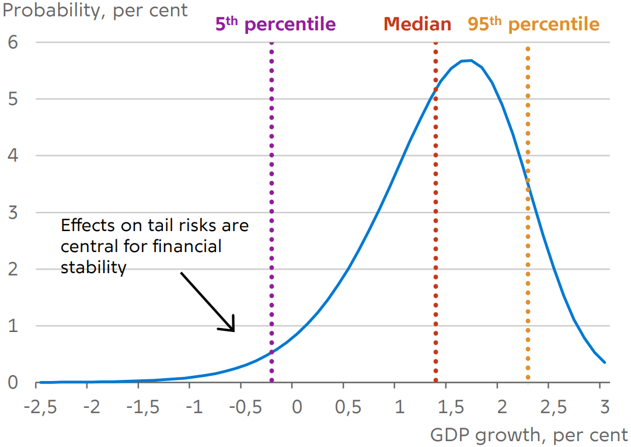

Chart 1: Growth-at-risk offers a metric for measuring and communicating the policy goals of macroprudential policy

We use a quantile regression model to estimate the impact of cyclical systemic risks (SRI) and macroprudential policy (capital-based measures and borrower-based measures) on the growth distribution of GDP over a horizon of eight quarters. The results of the model suggest that increasing cyclical systemic risk has historically had a significant negative impact on both the tail (5th percentile) and the median of the growth distribution at an 8-quarter horizon.

It is important to recognise that the model does not imply causality, but rather reflects correlations between the different variables, thereby describing past co-movements. The results should therefore be interpreted with caution.1 Nonetheless, the estimates suggest that an increase in systemic risks indicates a lower median and lower tail growth while the impact is somewhat more limited on the upper tail. That is, most likely it will lower growth – both in the most likely outcome and in the event of a crisis – but it will not have much of an impact on the strength of a strong expansion.

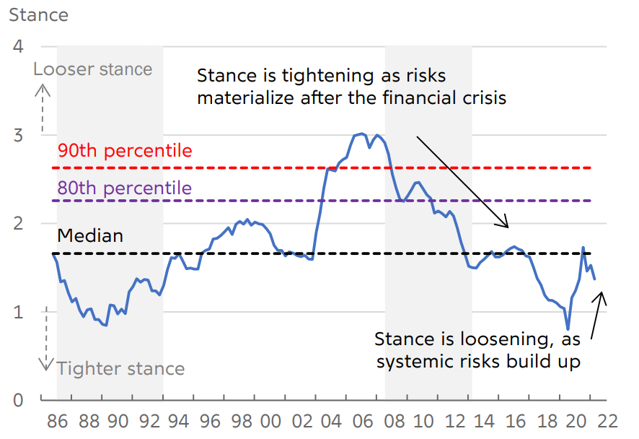

Chart 2: Predicted GDP growth distribution (Stance reflects distance between median and tail)

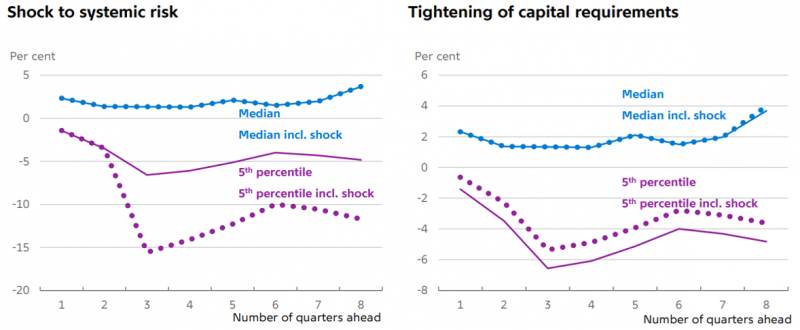

Chart 3: Systemic risks decrease tail growth while tightening capital requirements increase tail growth

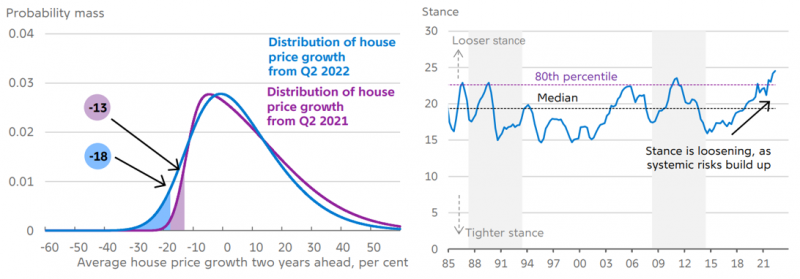

Chart 4: Systemic risks decrease tail growth while tightening capital requirements increase tail growth

Also, the method employs aggregate macroeconomic data at a quarterly basis providing relatively small samples. While 40 years of quarterly GDP growth data is a reasonably long time-series sample, it also means that only 8 of the observations are below the 5th percentile.

ESRB (2021), Report of the Expert Group on Macroprudential Stance – Phase II (implementation) (europa.eu).

A selective approach to determining the evaluation window is rather common in the literature of early warning indicators. The choice is motivated by the fact that policymakers would typically seek to address risks well ahead of a crisis in order to avoid extreme outcomes.

See, for example, Hartmann, P., “Real estate markets and macroprudential policy in Europe”, Working Paper Series, No 1796, ECB, 2015.

Grinderslev et al. (2017), Financial Cycles: What are They and What Do They Look Like in Denmark? Danmarks Nationalbank, Working Paper series No 115.