References

Bonam, D., Haan, J. de and B. Soederhuizen (2020), The effects of fiscal policy at the effective lower bound, Macroeconomic Dynamics (forthcoming).

Bofinger, P. and M. Ries (2017), Excess saving and low interest rates: theory and empirical evidence. CEPR Discussion Papers 12111, Centre for Economic Policy Research, London.

Brunnermeier, M.K. and Y. Koby (2018), The reversal interest rate. NBER Working Papers 25406, National Bureau of Economic Research, Cambridge MA.

Darracq Pariès, M., C. Kok and M. Rottner (2020), Reversal interest rate and macroprudential policy. ECB Working Paper 2487, European Central Bank, Frankfurt am Main.

Jarociński, M. and P. Karadi (2020), Deconstructing monetary policy surprises – the role of information shocks. American Economic Journal: Macroeconomics, 12(2), 1-43.

Palley, T.I. (2019), The fallacy of the natural rate of interest and zero lower bound economics: why negative interest rates may not remedy Keynesian unemployment. Review of Keynesian Economics, 7(2), 151-170.

Schnabel, I. (2021), Unconventional fiscal and monetary policy at the zero lower bound, Speech at the Third Annual Conference organized by the European Fiscal Board on “High Debt, Low Rates and Tail Events: Rules-Based Fiscal Frameworks under Stress”, Frankfurt am Main, 26 February 2021.

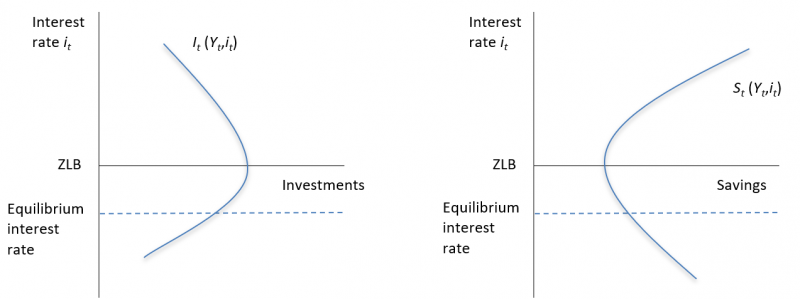

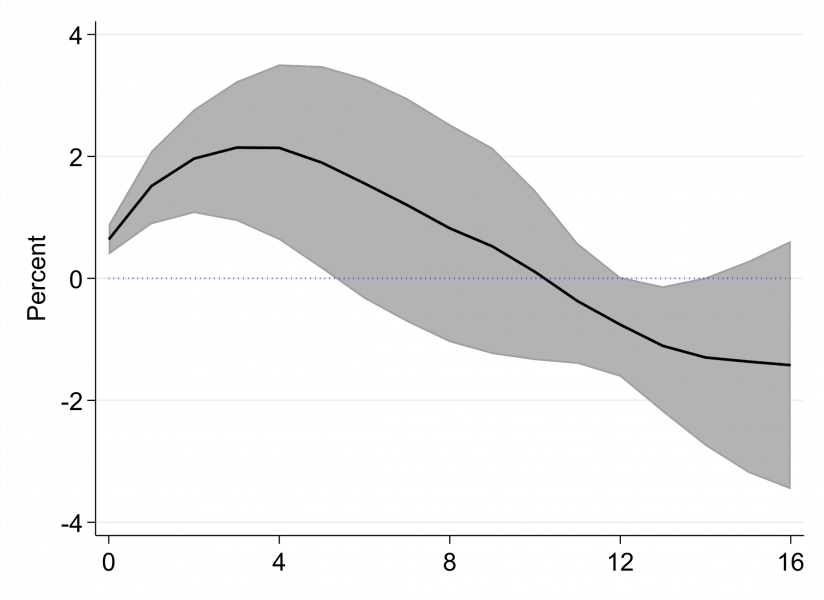

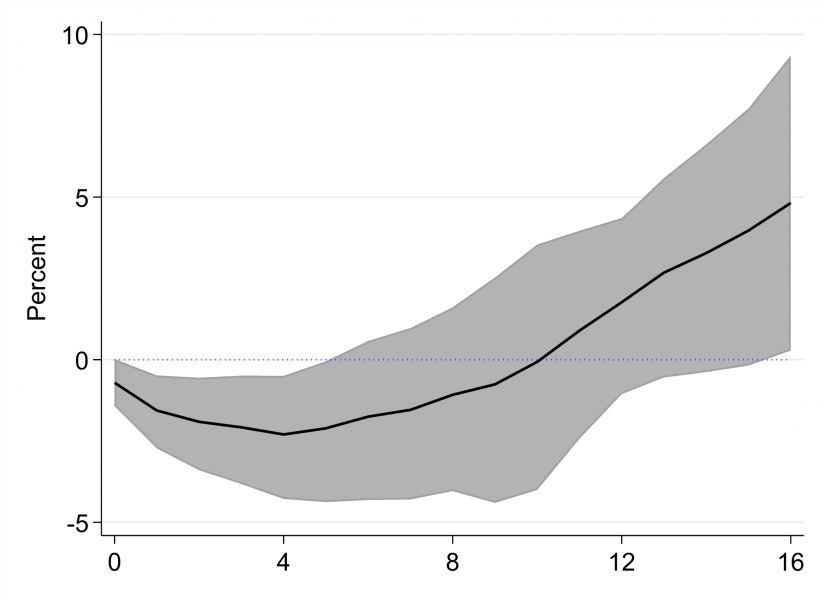

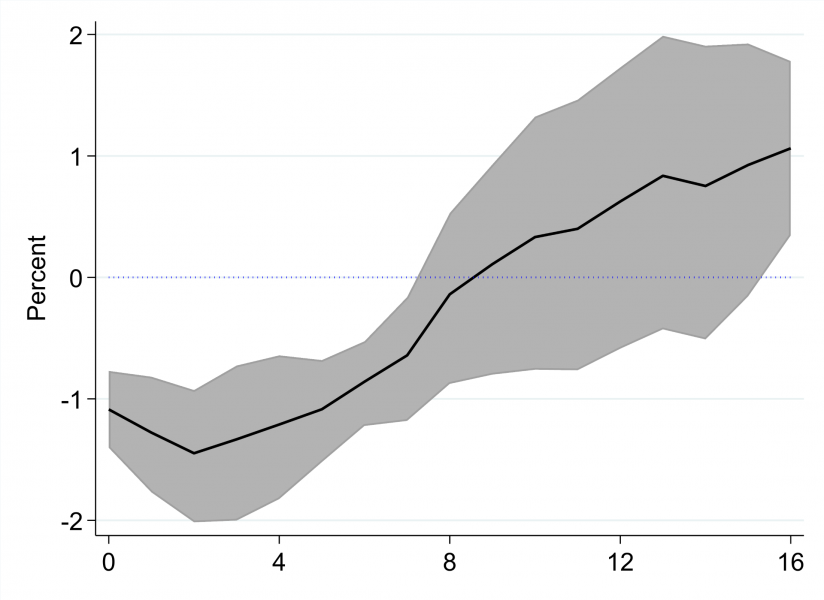

Van den End, J.W., P. Konietschke, A. Samarina and I. Stanga (2020), Macroeconomic reversal rate: evidence from a nonlinear IS-curve, DNB Working Paper 684, De Nederlandsche Bank, Amsterdam.