References

BHAS (2022). Agency for Statistics of Bosnia and Herzegovina. Available at: Statistics of BH

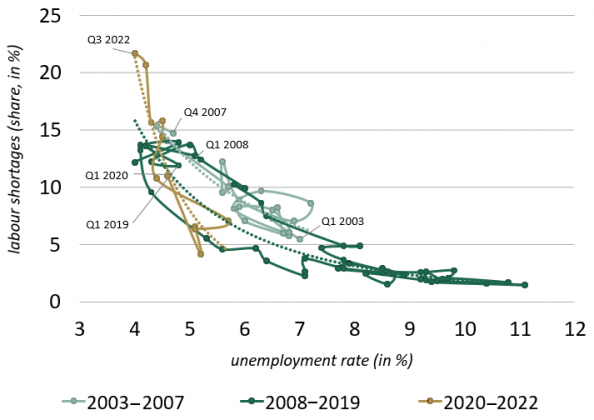

ECB (2019). The euro area labour market through the lens of the Beveridge curve. ECB Economic Bulletin, Paper No. 4/2019. Available at: The euro area labour market through the lens of the Beveridge curve

ESS (2023). Data on unemployed persons, foreign nationals, and surveys. Available at: ESS

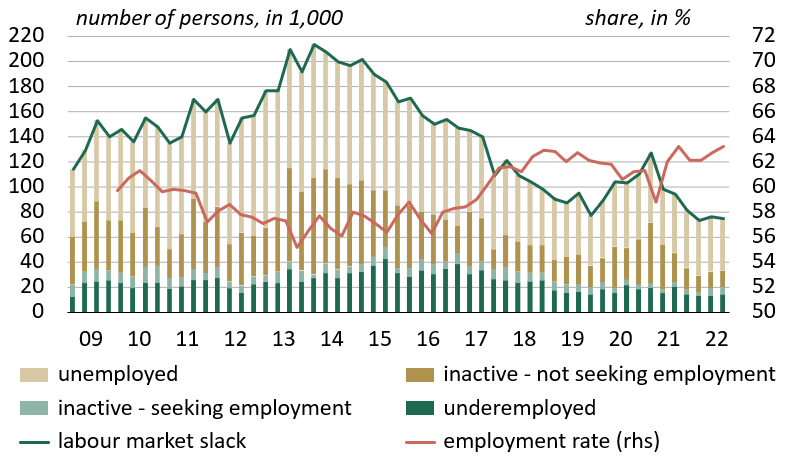

European Commission (2022a). Slack & Tightness: Making Sense of Post COVID-19 Labour Market Developments in the EU. Discussion Paper, Paper No. 178. Available at: EC Discussion Paper 178

European Commission (2022b). Slack vs. tightness in euro area labour markets: growing mismatch after COVID-19? Published in: Quarterly Report on the Euro Area (QREA), Vol. 21, No. 2. Available at: Quarterly Report on the Euro Area (QREA), Vol. 21, No. 2 (2022)

European Commission (2022c). A closer look at labour shortages across the EU. Published in: Technical Paper 059. Available at: European Business Cycle Indicators – A closer look at labour shortages across the EU

EUROSTAT (2023). Database. Available at: Database – Eurostat

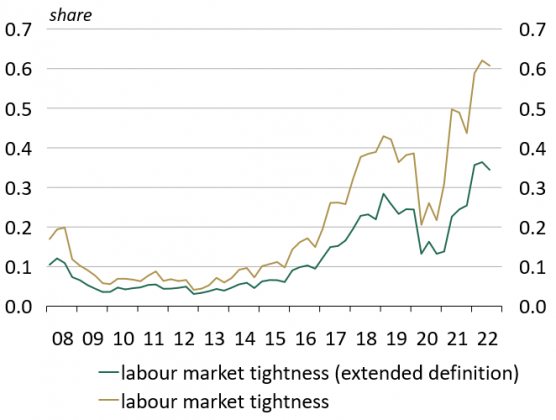

IMF (2022). Labor Market Tightness in Advanced Economies. IMF Staff Discussion Notes, Paper No. 2022/001. Available at: IMF_Labour market tightness

OECD (2022a). OECD Employment Outlook 2022. Available at: OECD Employment Outlook 2022

OECD (2022b). OECD Reviews of Pension Systems: Slovenia. Available at: OECD Reviews of Pension Systems: Slovenia

OECD (2020). Labour market institutions for an ageing labour force in Slovenia. OECD Economics Department Working Papers, Paper No. 1648. Available at: OECD Working Paper No. 1648

SORS (2023): Database. Available at: Database – SiStat

UMAR (2023). Kakšen je obseg razpoložljivih kapacitet na trgu dela? Kratke analize. Available at: UMAR (2023)

World Bank (2023). Data for Bosnia and Herzegovina. Available at: World Bank – BiH