Numerous negative external effects are associated with the transport of goods. Due to the lack of internalising them in transport prices, too many goods are transported over too long distances. Several approaches are taken to reduce external costs, such as bans, regulations, taxes, levies and tradable permits. In some areas, however, such interventions are impractical to implement or do not exist at all. At the EU level external costs associated with the transport of goods are only partially reflected in transport prices. Applying a quantitative model, the analysis investigates a scenario of a coordinated EU approach to internalise external transport costs of extra-EU trade activities. The results reveal a positive effect on real GDP and employment in the EU, provided that the revenues from these trade surcharges are recycled back into the economy. Policy options to achieve that transport prices reflect social costs are identified in the analysis.

The exchange of goods and services as well as the mobility of people is a basic prerequisite for the functioning of a market economy. At the same time, the related transport activities in international trade are often associated with considerable burdens and undesirable consequences for society and the environment. Currently, many costs are only partially reflected in transport prices and thus represent external costs. Already the construction of transport infrastructure negatively affects ecosystems and frequently destroys habitats. Depending on the type of transport, there are also technologically induced effects, such as emissions of disease-causing air pollutants, the emission of gases that have a harmful effect on the atmosphere, noise emissions and traffic accidents that harm people and wildlife. The social costs associated with these effects are not fully reflected in prices and thus are not taken into account and borne by the polluters themselves (Maibach et al., 2008). When true costs are higher than the costs in the markets, wrong production and consumption decisions are made because part of the costs are passed on to society. Incorrect price signals of some goods and services may also lower the demand for other goods.

Welfare losses resulting from inefficient resource allocation imply distortions of competition. When external costs of transport of internationally traded goods are not internalised, their provision is de facto subsidised. This may result in a competitive advantage over local or regional production when their external costs are (at least partly) internalised. Consequently, too many goods are transported over too long distances.

Quantifying the extent of external costs related to freight transport is complex. Besides several country‑specific studies (see e.g., Herry, 2016 for Austria; ARE, 2020 for Switzerland; Bieler and Sutter, 2019 for Germany) several studies commissioned by the EU (van Essen et al., 2019a; Korzhenevych et al., 2014; van Essen et al., 2011) attempt to find adequate and comparable methodologies to evaluate the externalities and assess the costs related to transport activities at the European level. The most recent EU study quantifies the external costs of the transport system in the 28 EU Member States at 647 billion €, with around 18% (119.1 billion €) attributable to freight transport and around 82% (527.9 billion €) to passenger transport. Despite the extensive literature assessing the external costs induced by transportation, the linkage to international goods trade is missing in the literature yet. Closing this gap is the subject of the present analysis.

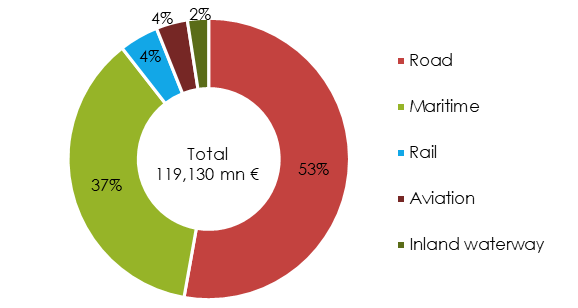

The main external cost categories examined by the European Commission’s recent Handbook of External Costs of Transport (van Essen et al., 2019a), include costs related to accidents, air pollution, climate change, noise, up- and downstream processes, habitat damage and congestion. In terms of overall costs, the analysis at the European level reveals that more than 50% of the total external costs of goods transport in the EU‑28 are due to road freight transport, while maritime freight transport is responsible for about 37% of the overall costs, as Figure 1 depicts. Rail freight transport as well as air freight transport and freight transport via inland waterways have a noticeably lower relevance, however, transport volume differs substantially across these individual modes of transport. Similarly, taking into account the freight transport volume (measured in tkm) attributes the highest average external costs to road freight transport, amounting to 34 €/1,000 tkm. In comparison, average external costs of rail freight transport are much lower at 13 €/1,000 tkm and are lowest for maritime transport at 7 €/1,000 tkm.

Figure 1: Modal share of total external costs for the EU‑28

Note: External costs of road refer to trucks > 3.5 t.

Source: WIFO calculations based on data from van Essen et al. (2019a) for 2016.

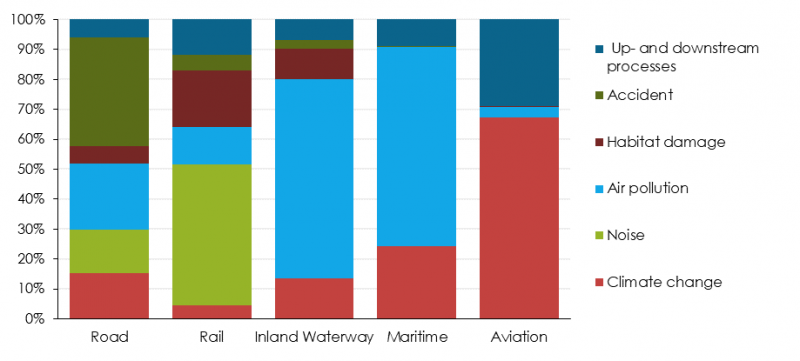

Clearly, as Figure 2 shows, the relevance and overall impact of individual external cost categories vary substantially across transport modes. While costs related to accidents are particularly important for road freight transport, two thirds of the total external costs in maritime freight transport in the EU-28 result from air pollution, followed by the costs of climate change with 24%. In contrast, more than two thirds of total costs of air freight arise from climate change and this cost share is many times higher than for other modes of transport. As this analysis shows, the negative environmental impacts vary significantly across the type of externality and mode of transport. Thus, the specific causes must be known in order to implement appropriate instruments for internalisation.

Figure 2: Share of cost categories per mode of transport in total external costs for the EU‑28

Note: External costs of road refer to trucks > 3.5 t. Maritime transport refers to 35 selected ports in the EU. Air transport refers to 33 international airports.

Source: WIFO calculations based on data from van Essen et al. (2019a) for 2016.

3.1 Current state of internalisation of external transport costs

Despite increasing interest in internalisation at the European policy level, relatively little is known to what extent infrastructure and external costs of transport are internalised by (monetary) disincentives. Recent studies by van Essen et al. (2019a, 2019b) assessing the current state of internalisation for various transport modes in the EU conclude that the overall degree of cost internalisation is very low, although the EU transport system collects 370 billion € in taxes and charges. In general, internalisation is achieved with various policy measures, including market-based instruments (e.g. charges, taxes and tradable permits) and regulatory instruments (e.g. vehicle emission and safety standards, traffic restrictions) that vary by mode of transport and administrative level (EU, national, regional and local area) and partly also benefit from national tax exemptions. However, EU legislation and harmonisation with regard to the internalisation of externalities in the transport system are not evident and are often entirely in the responsibility of individual Member States. Determining the degree of cost coverage for each type of transport and country shows that only about 45% of the costs are internalised in European road freight transport. Austria, as a transit country with higher external costs as well as special tax exemptions and reliefs, with an external cost coverage ratio of 36% is below the EU average. Similar cost coverage figures were found for other transport modes. Hence, negative environmental impacts and overall external cost coverage vary significantly across Member States and transport modes.

3.2 Internalisation of external costs of extra-EU trade activities

The failure to implement “true costs” implies distortions of international competitiveness. The purpose of internalising external costs is not to redirect flows of goods or to favour domestic producers, but to adequately price goods and reduce production and consumption that is associated with high social costs. Hence, adjustments in production and consumption decisions are accompanied by macroeconomic effects.

In this analysis a quantitative model with a multi-regional input-output model is used to investigate two scenarios of an internalisation of external costs of extra-EU trade activities: (i) an EU-wide internalisation versus (ii) a unilateral intervention by a small country (Austria). For this purpose, the non-internalised external costs recorded in the economic literature were added as a mark-up to the prices of internationally traded goods by (i) the EU and (ii) Austria.

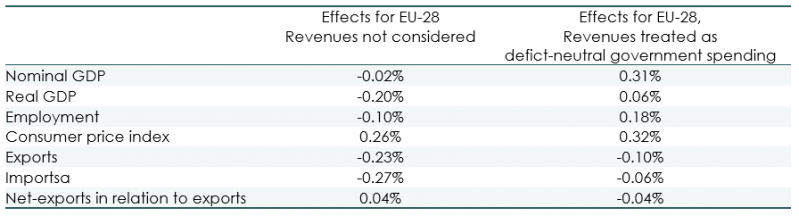

Overall, the results of the model simulation show that steps to internalise external costs implemented only by a small country like Austria have an immediate impact on the domestic economy, but hardly induce any effects on international markets. When import and export prices of the EU are adjusted, trade flows are redirected and shifts in production and consumption patterns take place. As Table 1 shows, a coordinated EU approach towards reducing external transport costs in extra-EU trade is associated with a slight increase in real GDP, employment and prices in the EU, provided that the revenues from these trade surcharges are recycled back into the economy as additional (but deficit-neutral) government spending. Due to the expansionary effect (increase of consumption and investment in addition to government spending) the trade balance turns (slightly) negative. Given that extra-EU trade links are much smaller than those within the EU (extra-EU trade accounts for 35.9% of total EU trade), the estimated effects are, not surprisingly, relatively small. However, total simulated export and import surcharges add up to about 33 billion € at the EU level, corresponding to 0.2% of EU‑GDP in 2016. In contrast, a unilateral approach by Austria leads to moderate overall effects for Austria, while changes at the EU level are hardly visible at all.

Table 1: Long-term effects on GDP, employment and consumer price index of an internalisation of external transport costs

Source: WIFO calculations with ADAGIO.

The policy experiment analysed in the model cannot be implemented in practice as international trade agreements do not provide the legal basis for such a scenario. Notwithstanding this finding, there are policy options available to internalise the external costs of transport activities, at least to some extent. In order to achieve this, information on the extent of the external costs, the mode of transport and the type of externality is an essential prerequisite.

The concrete starting points and policy recommendations to establish “truth in transport costs” in international trade are currently still limited and will require additional European initiatives. Depending on the decision-making level, various options are available.

International environmental and trade agreements are currently only intertwined in a few cases, such as trade in endangered species or ozone-depleting chemicals. Recently signed or currently negotiated trade promoting agreements integrate the issue of “sustainability”, however external costs of transport have been neglected so far. In future trade agreements and in supplements to existing treaties, external transport costs should be handled explicitly.

At the European level, the Green Deal is the main driver towards achieving a rapid and complete (though stepwise) internalisation of external climate costs in the entire transport sector. While the EU defines the appropriate framework for action, it is up to the Member States to take fitting measures within this scope. Since road and rail transport are part of the effort sharing, the responsibility for fine-tuning falls primarily on the national states. The recently published “Fit‑for‑55‑package” by the European Commission contains several proposals strengthening the role of carbon pricing and polluter-pays principle in international transport activities and comprises the following initiatives:

For international aviation, the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA), aims to stabilise CO2 emissions at 2020 levels by requiring airlines to offset the growth of their emissions after 20202.

At the national level, there are several options for the internalisation of external costs. A look at the Austrian greenhouse gas balance shows that previous approaches to effectively curb transport-related emissions have had little effect. The elimination of the preferential tax treatment of diesel fuels is a first step frequently mentioned in the literature. In addition to placing a higher burden on transport modes that are associated with external damages, more climate-friendly ones can be promoted even more strongly. In the area of public procurement, there are also options for action. For this to work, however, a reliable certification system is a prerequisite. Private certification labels, for example, are one way of influencing the behaviour of stakeholders (both companies and consumers), not through prices but through the information provided.

ARE, Bundesamt fu r Raumentwicklung. (2020). Externe Kosten und Nutzen des Verkehrs in der Schweiz. Strassen-, Schienen-, Luft- und Schiffsverkehr 2017. Zürich/Bern.

Bieler, C., & Sutter, D. (2019). Externe Kosten des Verkehrs in Deutschland. Straßen-, Schienen-, Luft- Und Binnenschiffverkehr 2017. Schlussbericht. Zürich.

Christen, E., Meinhart, B., Sinabell, F., & Streicher, G. (2021). Transportkostenwahrheit im internationalen Handel. FIW Research Reports, 03. https://blog.fiw.ac.at/fiw-research-report-transportkostenwahrheit/

Herry, M. (2016). Berechnung beihilfefähiger Kosten für den Schienenverkehr 2016 – Endbericht. Studie im Auftrag des Bundesministeriums fu r Verkehr, Innovation und Technologie, Wien.

Korzhenevych, A., Dehnen, N., Bröcker, J., Holtkamp, M., Meier, H., Gibson, G., Varma, A., & Cox, V. (2014). Update of the handbook on external costs of transport. Report for the European Commission: DG MOVE.

Maibach, M., Schreyer, C., Sutter, D., van Essen, H. P., Boon, B. H., Smokers, R., Schroten, A., Doll, C., Pawlowska, B., & Bak, M. (2008). Handbook on estimation of external costs in the transport sector. CE Delft.

van Essen, H., Schroten, A., Otten, M., Sutter, D., Schreyer, C., Zandonella, R., Maibach, M., & Doll, C. (2011). External costs of transport in Europe. Update Study for 2008. CE Delft.

van Essen, H., van Wijngaarden, L., Schroten, A., Sutter, D., Bieler, C., Maffii, S., Brambilla, M., Fiorello, D., Fermi, F., & Parolin, R. (2019a). Handbook on the External Costs of Transport. Version 2019. CE Delft.

van Essen, H., Schroten, A., Scholten, P., van Wijngaarden, L., Brambilla, M., Gatto, M., Maffii, S., Trosky, F., Kramer, H., Monden, R., Bertschmann, D., Killer, M., Greinus, A., Lambla, V., El Beyrouty, K., Amaral, S., Nokes, T., & Coulon, A. (2019 b). Transport taxes and charges in Europe. An overview study of economic internalisation measures applied in Europe. European Commission Directorate-General for Mobility and Transport.

https://ec.europa.eu/clima/policies/transport/aviation_en (accessed September 26, 2021).