Even though the Fed does not have an explicit financial stability objective extending beyond its supervisory responsibilities, the public speeches of Fed officials, during the period 1997 to 2013, reveal that a higher speaking time or a higher negative tone on Financial Stability topics correlate with a more accommodative monetary policy stance. In contrast, communication on Housing topics correlates with a tighter policy stance. These results are mainly driven by the information in speeches of regional Fed presidents.

The Federal Reserve does not have an explicit financial stability objective that extends beyond its supervisory responsibilities. Nonetheless, a narrow interpretation of the dual mandate, i.e. ignoring any interactions between monetary policy and financial stability risks does not seem credible (see Kashyap and Siegert, 2020). Indeed, even in the absence of an institutionalised communication strategy, Federal Open Market Committee (FOMC) members do express their views on financial stability risks and policy consequences through informal public remarks.

In a recent study, we assess what Fed speeches reveal about financial stability concerns and whether there is a systematic relationship between higher proportion of time devoted to this topic and the Fed’s monetary policy decisions (Istrefi, Odendahl and Sestieri, 2021). We focused on speeches because they give the speaker discretion over the content, and, to some extent, reflect debates and opinions expressed in FOMC meetings that have guided policy (Bernanke, 2015).

We analysed the main topics covered in Fed speeches and computed speeches’ topic shares, which we label “topic proportions”. To extract this information from speeches we employ textual analysis techniques, such as a topic model based on a latent Dirichlet allocation, commonly used to extract information from text data. We looked at around 3,850 public speeches given during the period 1997-2018 by Fed officials, i.e. the Chair of the Federal Reserve, the other members of the Board of Governors and the presidents of the 12 Federal Reserve Banks (FRB).

Chart 1. Main topics covered in Fed speeches

Source: Istrefi, Odendahl, Sestieri (2021). The chart shows the proportion of six topics extracted from the Fed speeches for the period 1997 to 2018. The topic proportions displayed are annual averages.

We identify 12 main topics covered in these speeches; for instance, Economy and Monetary Policy and several related to finance, such as Financial Conditions, Financial Stability, Supervision and Regulation and Housing. Chart 1 shows the evolution of the topic proportions of Fed speeches at an annual frequency. We observe that, while Fed officials speak predominantly about issues related to the Economy and Monetary Policy (about 40-50%), in the period around the global financial crisis they dedicated a higher proportion of speaking time to Financial Stability and other financial-related topics. Financial Stability, the topic at the center of our analysis, relates mainly to communication about excessive behaviour in financial markets or vulnerabilities in the financial system that are likely to have major impacts on the economy.

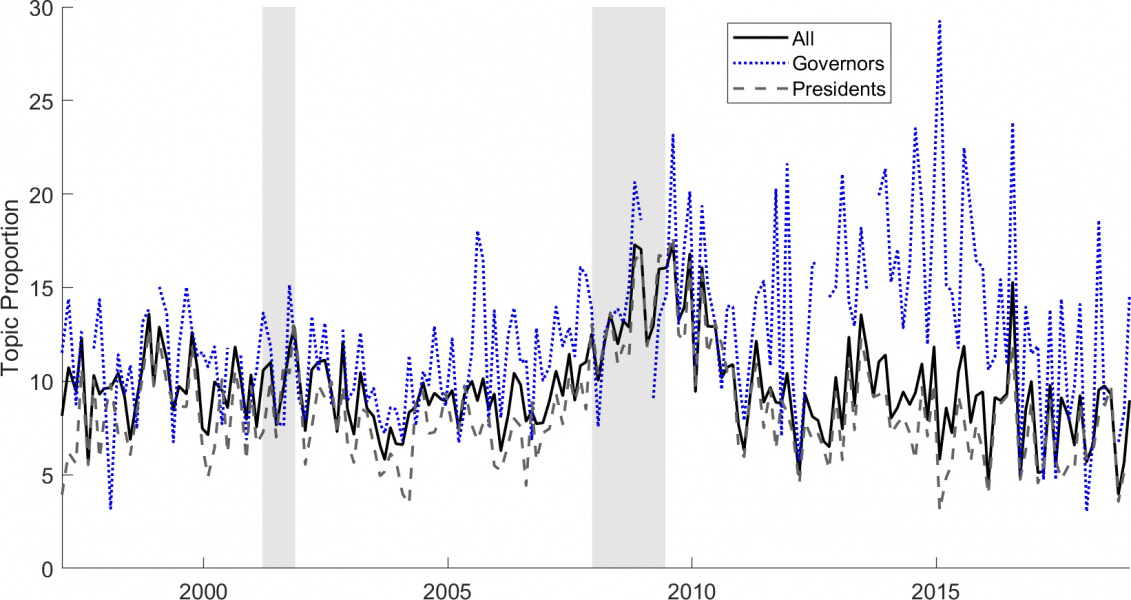

While members of the Board of Governors and FRB presidents cover similar topics in their speeches, the relative topic share differs between those speakers. For instance, Governors devote, on average, a higher proportion of their speeches to Financial Stability than FRB presidents do, especially after the global financial crisis (GFC). However, during the GFC, FRB presidents also significantly increased their speaking time on this topic (see Chart 2). A similar pattern is observed for other financial-related topics, such as Supervision and Regulation.

These differences appear to reflect the Federal Reserve’s institutional design and the specific roles of these two groups. For instance, Governors and all the FRB presidents participate in deliberations and decisions on US monetary policy (the latter group is subject to a rotation of voting rights). Unsurprisingly, a large part of their speeches focuses on Economy and Monetary Policy. In addition, the Board of Governors writes regulations and creates supervisory policy for the Federal Reserve System. As part of their duties, Governors are assigned to several Board Committees, among them the Committee on Financial Stability and the Committee on Supervision and Regulation. This job “specialisation” of Governors could explain why in terms of public communication, they have more specialised speeches and therefore a higher average proportion of them in financial-related topics. The significant difference in intensity of speeches on financial stability between Governors and FRB presidents during the years 2012-2016 corresponds to a period of implementation of new US banking and supervisory regulation.

Chart 2. Financial Stability topic proportion by type of speaker, 1997 to 2018

Source: Istrefi, Odendahl, Sestieri (2021). The chart shows the Financial Stability topic proportion at a FOMC meeting frequency by type of speaker: the Board members (Governors), the FRB presidents (Presidents) and both groups together (All). US recession periods are marked in grey.

To shed light on this question, we incorporate our speech-based indicator of financial stability into a standard central bank reaction function. We regress the policy rate on the Fed’s forecasts of inflation and the output gap (a forward-looking Taylor rule), and on our financial stability speech-indicator. The policy rate is measured by the Fed Funds Rate (FFR) for the pre-Zero Lower Bound period (up to November 2008), and by the Shadow Rate (Wu and Xia, 2016) for the period after, to take into account the Fed’s unconventional monetary policy. Results show that the proportion of financial stability communication prior to FOMC meetings is a relevant predictor for FFR changes, in particular for the period before the GFC. In other words, the intensity of speeches on financial stability provides additional information beyond what is captured by the Fed’s internal forecasts of output and inflation. All other things being equal, an increase in the Financial Stability topic proportion is associated with a lower FFR, meaning an easing of monetary policy. This result is robust to different specifications of the Taylor rule and to the inclusion of standard financial indicators based on market data, such as the VIX, or the inclusion of additional topics.

We observe similar results for the Supervision and Regulation and the Financial Condition topics. However, for these two latter topics and unlike Financial Stability, an alternative text-based indicator that measures the degree of negative tone in speeches matters more than the intensity indicator. When looking at the Housing topic we find a positive relationship between the topic’s intensity and the policy rate.

These findings suggest that the Fed has rather acted to “clean” the damages than to “lean” against financial imbalances, internalising the negative impact of financial stability risks to the economy by setting a more accommodative monetary policy stance (see also Friedrich et al., 2019). Interestingly, we uncover a “leaning” stance when considering housing market concerns. This attitude was observed at a time where effective macroprudential tools in the United States were lacking, especially before the GFC (see Dudley, 2015).

The Taylor-rule coefficient associated with the financial stability speech-indicator have the same sign for speeches of the Fed Chair, the Governors and the FRB presidents. However, we find that the FRB presidents’ speeches contain a stronger signal for the likely direction of monetary policy. This result is not driven by speeches of New York Fed presidents, despite of the central role of the New York Fed in the US financial system. While there might be other factors that matter, the fact that FRB presidents have less specialised positions than Governors, are more numerous and flexible in choosing the topics of their speeches, could rationalize this result. Hence, even though FRB presidents are often criticised for cacophony by the financial press and market participants (e.g., see Olson and Wessels, 2016), our analysis suggests that their communication provides useful information for policy decisions according to a standard monetary policy reaction function, i.e. there is a policy signal in their public remarks.

Dudley, William C. (2015) “Is the active use of macroprudential tools institutionally realistic “, Panel remarks, 59th Economic Conference of the Federal Reserve Bank of Boston

Friedrich, Christian, Kristina Hess and Rose Cunningham (2019): “Monetary policy and financial stability: cross-country evidence”, Journal of Money, Credit and Banking, 51(2-3):403–453

Istrefi, Klodiana, Florens Odendahl and Giulia Sestieri (2021): “Fed communication on financial stability concerns and monetary policy decisions: revelations from speeches”, Banco de España Documentos de Trabajo No. 2110 and Banque de France Working Paper No. 779.

Kashyap, Anil K. and Caspar Siegert (2020): “Financial stability considerations and monetary policy?”, International Journal of Central Banking, 16(1):231–266

Olson, Peter and David Wessel (2016): “Federal Reserve communications: Survey results”, Hutchins Center on Fiscal and Monetary Policy at Brookings Paper, November 2016

Wu, Jing C. and Fan D. Xia (2016): “Measuring the macroeconomic impact of monetary policy at the zero lower bound. Journal of Money, Credit and Banking”, 48(2-3):253–291.

A similar version of this article was first published in Banque de France‘s Eco Notepad as blog post n°193.