The opinions expressed in this paper are those of the author and do not necessarily reflect the views of the European Central Bank or of the Eurosystem.

This column studies the links between interbank liability and equity markets (financial exposure), and cross-border mergers and acquisitions (M&As) in the European banking sector, both at the micro and macro level. Using a binary logit model, the column first examines – at the micro level – how financial exposures between banks affect the probability of M&A. It finds that financial interlinkages significantly increase the chances of them taking place. Using a gravity model, the column then investigates – at the macro level – whether the micro results hold. Not only are financial links positively and significantly correlated with the number of M&As between countries, but they are also a better predictor than trade – traditionally used in the macro literature on M&A. Finally, a M&A compatibility index is built for each pair of EU countries.

The European banking sector is characterised by a wide range of interconnections. These are both legal, through branches and subsidiaries, and financial, through liabilities and equity (henceforth, exposures). This column highlights that the bilateral financial interlinkages favour consolidation between European banks, via cross-border mergers and acquisitions (M&As). To do that, it uses bank-level data for the period 2014-20 for all the European Union Member States plus the United Kingdom. The database contains 3,491 M&As (810 cross-border transactions) between 1999 and 2020 which could be match with banks balance sheet data, of which 385 took place in the period 2014-2020 (61 cross-border transactions) that could be matched with financial exposure data.

Important financial stability benefits may result from financial integration via M&A, and especially cross-border M&A, for example financial risk diversification and risk sharing. Understanding the links between cross-border financial linkages and cross-border M&As is therefore essential.

Documented in the literature, two waves of cross-border M&A transactions has been observed in the last twenty years: shortly after the creation of the euro, and in the years preceding the global financial crisis. After the global financial crisis, the cross-border M&As never reached their pre-crisis level. The period studied (2014-2020) is therefore a period with a relatively low number of cross-border M&As.

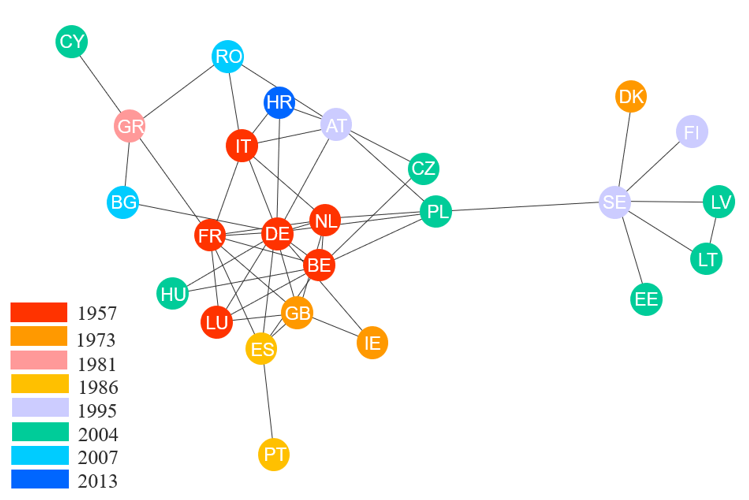

A cluster analysis by year of EU membership shows that the banking sectors of the six founding members of the EU are the most active in terms of cross-border M&As, Germany being in the centre of the network (Figure 1). This cannot only be the result of the banking regulation European laws, since this legislative trend only started in the years 1990s. The shape of the network presents striking similarities with the topography of the European Union, suggesting an important role of geography and culture as drivers of M&A transactions. This motivates the use of the gravity model in the analysis.

Figure 1: M&A network and cluster by year of EU membership (1999-2020, number)

Sources: Dealogic, SNL and Zephyr.

Note: Each dot represents a country, the colour represents the year of EU membership, each string represents the existence of at least one M&A transaction between 1999 and 2020 for each pair of countries. Only M&A with a final stake higher than 30% are counted. Only the edges for the 50 higher number of M&As are represented). The network has been created using the Fruchterman-Reingold layout. The Fruchterman-Reingold layout is a force-directed algorithm: it positions the nodes of a graph to minimise the number of edges crossing, in order the visualisation to be as aesthetic and reader-friendly as possible.

Several studies have looked at the drivers of financial integration, mostly using a macro gravity model, which explains trade and financial flows through geographical factors (distance, GDP, language, religion, etc.). Di Giovanni (2005) and Gulamhussen et al. (2016) apply the gravity equation to cross-border M&As in the banking sector. This analysis complements the existing macro M&A literature by adding cross-border financial interlinkages. It shows that the number of M&As between a pair of countries increases with the intensity of the financial links shared between their banks. Indeed, there is a positive and significant effect of financial exposure on M&As: 1% more liabilities and equities between country i and j increases the number of M&As between the two countries by 1.4%, while having a common border increases it by 17%. Results remain significant when adding lags to the financial linkages variable, reducing the possibility of reverse causality. Di Giovanni (2005) and Gulamhussen et al. (2016) find that distance is significantly negatively correlated with the number of M&As between two countries. However, once financial exposure is taken into account, distance does not play a role anymore. Although distance and financial exposures are correlated, financial exposures appear to be a better predictor of M&As than distance. Trade is also not significant when controlling for financial exposure and distance, implying that financial links are a better predictor than trade – traditionally used in the macro literature on M&A.

Another part of the literature looks at the micro drivers of M&A, using a logit to measure how the different variables affect the probability of M&A. This literature concentrates on the probability of a bank being an acquiror or a target in a merger/acquisition, depending on its particular characteristics. This analysis goes further by using a bilateral variable – the importance (in value) of the financial linkages between a pair of banks – to estimate the probability of M&A activity between them. It appears that the probability of M&A activity between two banks increases with the scale of their financial interlinkages. 1% increase in exposure between two banks increases the probability of a M&A transaction by between 0.6% and 2.4%. However, reverse causality cannot be completely ruled out despite the inclusion of lags on the financial interlinkages.

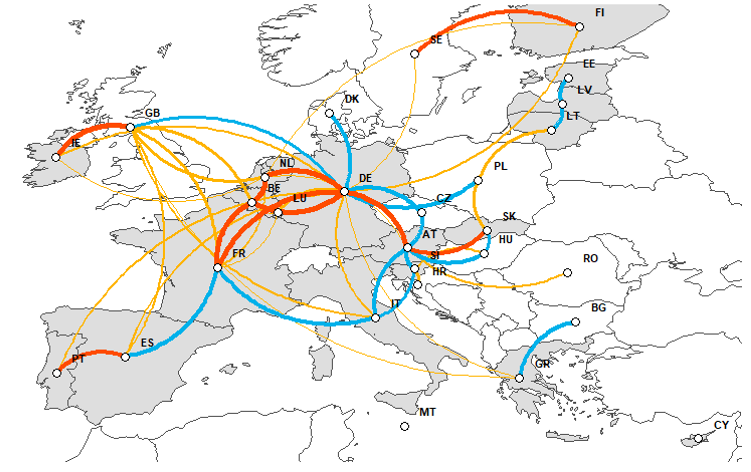

Figure 2 shows a graphical representation of M&A compatibility, calculated using the coefficients of the gravity analysis. The M&A compatibility index is higher for the core countries (Belgium, Germany, France, Luxembourg and the Netherlands) than for the other countries. In addition, geographical proximity and historical links tend to persist: Spain-Portugal, Ireland-United Kingdom, Finland-Sweden and Austria-Slovakia have a very high compatibility for bank M&A. In the long term, the banking activities within each block might be more correlated than outside the blocks. The banking systems in Cyprus and Malta are highly integrated internationally, displaying strong links with non-EU parties, and therefore exhibiting a relatively low compatibility with other EU Member States on the measure used in this analysis (these two countries are the only ones that do not appear in the top 50 highest connections, as calculated by the index). Furthermore, this study concentrates on the period 2014-2020 and therefore does not fully capture past interconnectedness, for example between Cyprus and Greece, which was affected by the financial crisis.

Figure 2: M&A network and cluster by year of EU membership (2014-20, index)

Note: the index is calculated using the coefficients of the gravity analysis, averaged over the years 2014-20. Links represent the 50 highest values of the index. The values from 1 to 10 are shown in red, values between 11 and 25 in blue and those between 26 to 50 in yellow. The thickness of the links indicates the value of the index. The euro area is in grey.

However, there is a low unconditional correlation between the number of M&A transactions and the compatibility index: the actual frequency of cross-border mergers involving some country pairs seems to lie significantly below model-implied potential. Indeed, despite a very high theoretical compatibility, some pairs of countries experience a low number of cross-border M&A transactions; this is for example the case of the pair Germany-Austria. This suggests that factors not captured by the compatibility index, such as the prominence of cooperative and savings banks in a given country, may impede M&A activity, in spite of the strong financial linkages already existing between countries involved.

Overall, both in the micro and macro analysis, existing financial linkages between banks or countries increase the probability of a M&A transaction occurring. At the micro level, the stronger financial linkages are between banks, the higher the probability is that they will undertake a merger/acquisition. At the macro level, the more countries share financial linkages, the higher is the number of M&As between them (controlling for geographical factors). M&As tend to create ownership links between banks that were already sharing strong financial links. These results however have to be taken with caution: despite the inclusion of lags on the financial linkages variable, reverse causality cannot be completely ruled out.

Anderson, J. and van Wincoop, E. (2003), “Gravity with gravitas: a solution to the border puzzle”, American Economic Review, Vol.93, No. 1, pp. 170–92.

Beccalli, E. and Frantz, P., (2013), “The determinants of mergers and acquisitions in banking”, Journal of Financial Services Research, Vol. 43, No. 3, pp. 265-291.

Bijsterbosch, M., Deghi, A. and Lo Duca, M. (2019), “Bank M&A in Europe: Drivers and Obstacles”, ECB, Frankfurt am Main, mimeo.

Cerutti, E. and Zhou, H. (2017), “The global banking network in the aftermath of the crisis: Is there evidence of deglobalization?”, IMF Working Paper, No. 232.

Covi G., Ziya Gorpe, M. and Kok, C. (2021), “CoMap: Mapping Contagion in the Euro Area Banking Sector”, Journal of Financial Stability, Vol. 53, Issue C.

Di Giovanni J. (2005), “What drives capital flows? The case of cross-border M&A activity and financial deepening”, Journal of International Economics, Vol. 65, pp. 127-149.

ECB (2005), “Consolidation and diversification in the euro area banking sector”, Monthly Bulletin, ECB, Frankfurt am Main, May, pp. 79–87.

Focarelli D., Panetta F. and Salleo C. (2002), “Why do banks merge?”, Journal of Money, Credit and Banking, Vol. 34, No. 4, pp. 1047-1066.

Gulamhussen, M., Hennart, J. and Pinheiro C. (2016), “What drives cross-border M&As in commercial banking?”, Journal of Banking and Finance, Vol. 72, pp. S6-S18.

Hannan, T. and Pilloff, S. (2009), “Acquisition targets and motives in the banking industry”, Journal of Money, Credit and Banking, Vol. 41, No. 6, pp. 1167-1187.

Head, K. and Mayer, T. (2014), “Gravity Equations: Toolkit, Cookbook, Workhorse”, Handbook of International Economics, Vol. 4.

Hernando I., Nieto, M. and Wall, L. (2009), “Determinants of domestic and cross-border bank acquisitions in the European Union”, Journal of Banking & Finance, Vol. 33, No. 6, pp. 1022-1032.

Lebastard, L. (2022), “Financial exposure and bank mergers – Micro and macro evidence from the EU”, ECB Working Paper Series, No. 2724