This policy brief is based on BoF Economics Review 8/2024 “Forecasting inflation: A comparison of the ECB’s short-term inflation projections and inflation-linked swaps”

Abstract

According to the efficient-market hypothesis, forecasts derived from efficient market prices should be unbeatable. However, numerous institutions, including the European Central Bank, regularly publish forecasts for future inflation that deviate from market expectations. We investigate the relative predictive accuracy of the ECB’s short-term inflation projections against predictions derived from the market prices of short-term inflation-linked swaps (fixings) in 2018-2023. Overall, our findings suggest that making use of the information in the market prices for fixings could potentially improve the accuracy of the ECB’s short-term inflation projections.

The European Central Bank’s (ECB) macroeconomic projections, published four times a year, play a central role in the ECB’s monetary policy making and communication. Included in the regular projections is the Narrow Inflation Projection Exercise (in short NIPE), which produces short-term euro area inflation forecasts over a horizon of 11 months. The NIPE forecasting errors have been substantial during the last years of high inflation.

In our recent publication, Anttonen & Laine (2024), we study whether the NIPE short-term inflation projections could be improved by making use of short-maturity inflation-linked swaps, also known as fixings. Given the efficiency of financial markets to process new information, market prices for inflation-linked swaps could very well provide the best attainable forecast for inflation. This could be the case especially in the short term, where timely processing of new information plays a significant role. Also, the role of (time-varying) inflation risk premia might be less important at short forecasting horizons (see, e.g., Buraschi & Jiltsov, 2005 and Chen, Liu & Cheng, 2010).

Thus, in principle, and according to the efficient-market hypothesis, efficient market prices should provide the best available forecast for inflation and no model should be able to improve it. However, market prices for fixings are not necessarily efficient, different risk premia might affect the market prices, and Eurosystem insiders (producers of the NIPE) might possess pieces of information unavailable to the market participants. Regardless, in our view, it would be a surprise if the NIPE could consistently beat the markets in the short-term and produce significantly more accurate predictions than those derived from fixings directly. For the NIPE to systematically beat fixings in predictive accuracy, either the informational advantage or the role of risk premia (or any other factor contributing to the deviation of prices from the true expectations) should be significant. According to our assessment, this seems not to be the case.

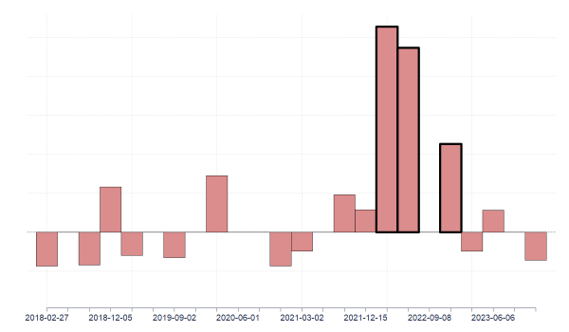

Most of the time the fixings and the NIPE seem to have performed about equally well (see Figure 1). However, there are some forecasting rounds during which swaps performed significantly better than the NIPE. NIPE, in turn, has never outperformed fixings by a significant margin.

Figure 1. Markets outperformed ECB’s NIPE inflation forecasts during recent 2022 inflation bout

Note: Differences in absolute prediction errors between the NIPE and swap implied forecasts on the NIPE cut-off dates for forecasting horizon of 3 months. Positive values indicate better accuracy of swap implied forecasts. Forecasting rounds of March 2022, June 2022, and December 2022 (top 3) are bolded. As the exact NIPE figures are confidential, differences under the threshold of certain absolute value are set to zero and the scale of the y-axis is not reported.

We conclude that by making use of the information in the associated inflation forward curve in forecasting short-term inflation, Eurosystem could have potential to improve its short-term inflation projections without any additional complexity to the NIPE process in the form of complex econometric methodology or expert judgement.

Per our analysis, the ability of the financial markets to process new information in practice without a delay is of extreme importance to the accuracy of short-term inflation forecasting. To this end, we argue that the policymakers should pay close attention to the market-based expectations of short-term inflation especially if they differ markedly from the NIPE projections. Overall, the long and winding processes involved in the production of the NIPE projections might not be well suited for the relatively short forecasting horizons considered, because of the unavoidable delays in the processing of latest information.

However, our analysis is not without its limitations. The sample available for the fixings is relatively short and it covers historically somewhat extraordinary periods. The first part of our sample (2018-2020) was highlighted by exceptionally stagnant inflation, whereas the latter part (2021-2023) was quite the opposite. Also, in the beginning of our sample the market for the euro area fixings was still developing and it is possible that the market has matured since. Hence, the beginning of our sample might not be representative of the future performance of fixings and our analysis might even underestimate the predictive power of the market prices of these instruments.

Anttonen, J. & Laine, O. -M. (2024). Forecasting inflation: A comparison of the ECB’s short-term inflation projections and inflation-linked swaps. BoF Economics Review, 2024/8.

Buraschi, A., & Jiltsov, A. (2005). Inflation risk premia and the expectations hypothesis. Journal of Financial Economics, 75(2), 429-490.

Chen, R. R., Liu, B., & Cheng, X. (2010). Pricing the term structure of inflation risk premia: Theory and evidence from TIPS. Journal of Empirical Finance, 17(4), 702-721.