This policy brief is based on L. Chiṭu, M. Grothe, T. Schulze and I. Van Robays “Financial Shock Transmission to Heterogeneous Firms: the Earnings-Based Borrowing Constraint Channel”, ECB Working Paper, 2860. The views expressed in this brief are those of the authors and do not necessarily represent the views of the European Central Bank nor of the IMF, its Executive Board, or IMF management.

The US corporate sector has been recently faced with major simultaneous shocks: rapid monetary tightening and elevated global risk aversion after the pandemic outbreak and Russia’s invasion of Ukraine. In this policy brief, we first propose an integrated framework to identify monetary policy and global risk shocks jointly. We then tease out their transmission mechanisms to firms’ funding costs and default prospects through the lenses of the type of borrowing constraint that firms may face. Specifically, we contrast tighter funding conditions arising from traditional asset-based collateral constraints with the recently proposed earnings-based borrowing constraint hypothesis, differentiating firms across their leverage and earnings distributions, respectively. Our empirical evidence strongly supports the earnings-based borrowing constraint: global risk shocks have strong and heterogeneous effects on corporate funding costs which depend on firms’ position within the earnings distribution.

The corporate sector in the US has recently been faced with two large shocks stemming from the rapid tightening of monetary policy and heightened global risk aversion amid the pandemic, the Russian invasion of Ukraine and central bankers’ grappling with inflation. Disentangling these two types of shocks – monetary policy and global risk aversion shocks – is empirically challenging. These shocks may also transmit differentially to firms’ funding costs depending on the type of borrowing constraint binding firms, more specifically on whether firms are relatively more constrained by their balance sheet or by their income.

While firms’ borrowing constraints are typically analysed based on the value of physical assets that firms can pledge as collateral – a building block of the financial accelerator literature (e.g. Bernanke et al, 1996) – recent evidence suggests that borrowing constraints based on earnings have become an increasingly important determinant of firms’ access to financing, particularly among large US firms (Lian and Ma, 2021).1 This in turn may have implications for the transmission of adverse financial shocks. Financial acceleration through firms’ balance sheet may be dampened under the earnings-based borrowing constraint, as higher earnings can directly relax borrowing constraints when firms’ borrowing capacity is not directly tied to the liquidation value of physical assets. Conversely, firms with low earnings can become relatively more constrained when adverse financial shocks impact both their discounted stream of cash flows and overall funding costs in capital markets. Understanding how monetary and global risk shocks transmit to firms depending on the type of their borrowing constraint matters since shocks that tighten firms’ funding constraints can adversely affect real outcomes such as investment and production with important macroeconomic implications (Drechsel, 2023).

In a first step, we propose an identification strategy to separate global risk and monetary policy shocks using a Bayesian Vector Autoregression (BVAR) framework with US financial market variables and a combination of sign, narrative, and relative magnitude restrictions. This allows us to obtain both shocks from the same integrated model, while ensuring that global risk shocks are purged of any confounding effects of actions by the Federal Reserve on global risk appetite.

We focus on shocks that are important determinants of firms’ funding constraints by encompassing a set of key variables summarising how costly it is for corporations to finance themselves. For bank-based financing, short- and long-term interest rates matter, while for market-based financing, the cost of equity and corporate bond pricing are important determinants of the cost of funding. Fluctuations in the exchange rate can also matter.2 To capture the wider concept of financial conditions, we include five endogenous variables which are key indicators for funding costs for firms: the 3-month and the 10-year US government bond benchmark yields, the cyclically-adjusted price to earnings ratio as a measure of equity prices (CAPE), US corporate spreads, and the US nominal effective exchange rate.

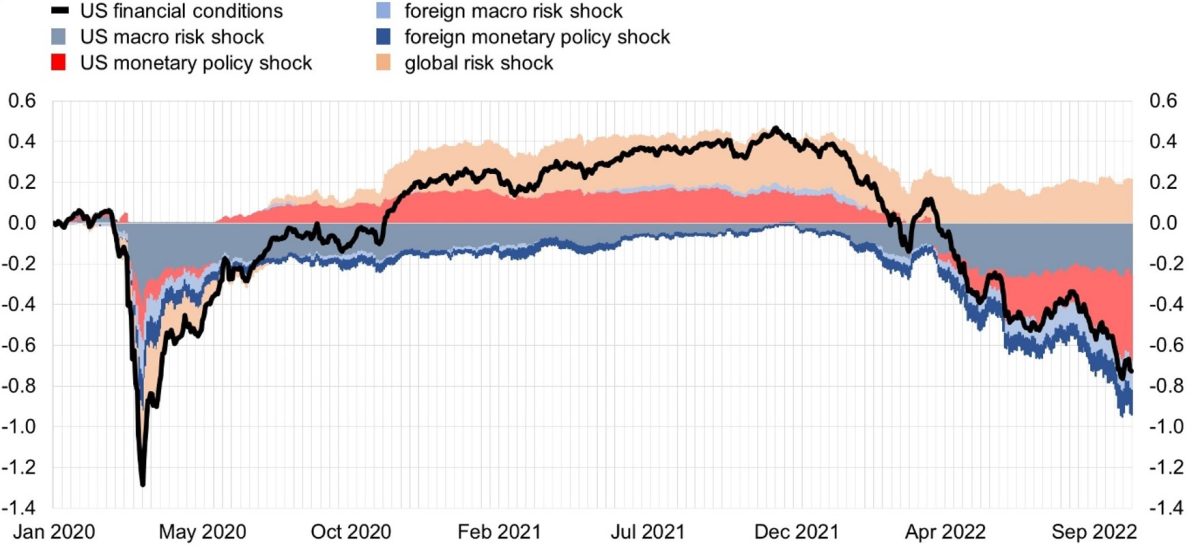

We exploit co-movements in this set of asset prices to identify five different structural shocks to financing conditions. We focus on US monetary policy and global risk shocks, while simultaneously identifying other important driving factors behind financial conditions to ensure that our shocks of interest are disentangled from these.3 The BVAR model is estimated at daily frequency to capture higher frequency changes in the perception of markets of the monetary policy stance of the Fed and global risk sentiment. As an illustration, Figure 1 shows the drivers of US financial conditions since the COVID-19. It suggests that shocks to the monetary policy stance and global risk sentiment are key drivers of financial conditions for US firms.

Figure 1: Model-based drivers of US financial conditions since the COVID-19 pandemic

Notes: This figure shows accumulated contributions of the identified BVAR shocks to the US financial conditions index (FCI). An increase (decrease) in the FCI indicates a loosening (tightening) of financial conditions. The FCI index is constructed as an equally weighted average of the historical decomposition of the individual variables in the BVAR.

Using a rich firm- and bond-level data sample of large S&P500 US corporates at weekly frequency over the period 2000-2021 and panel local projections, we analyse how firms’ funding costs, as captured by their bond spreads and equity prices, as well as their default probabilities respond to the identified monetary policy and global risk shocks along three dimensions of firm heterogeneity: leverage, earnings, and interest coverage ratios. We do so to link the transmission of these shocks to canonical asset-based collateral constraints versus earnings-based borrowing constraints.

We conjecture that, in case of a prevalence of earnings-based borrowing constraints, the responses of firms’ funding costs to financial shocks would be more muted for the tails of firms in the leverage distribution, but more pronounced for the tails of firms in the earnings distribution, and vice versa for the asset-based collateral constraints. We also consider firms’ earnings-to-interest, i.e. interest coverage ratio (ICR), which can be seen as a hybrid indicator bridging the earnings-based and the collateral-based borrowing constraints (Greenwald, 2019; Drechsel, 2022). We interact the two shocks of interest with indicator variables for these tail firms in a panel local projections approach (Jordà, 2005).4

We also zoom into the reaction of the pricing components of corporate bonds. We decompose bond spreads into an expected default risk component, capturing firm fundamentals, and an excess bond premium (EBP) component, a proxy for investor risk sentiment, following Gilchrist and Zakrajšek (2012). As an additional insight, we also assess via which of these two components the transmission of shocks is stronger.

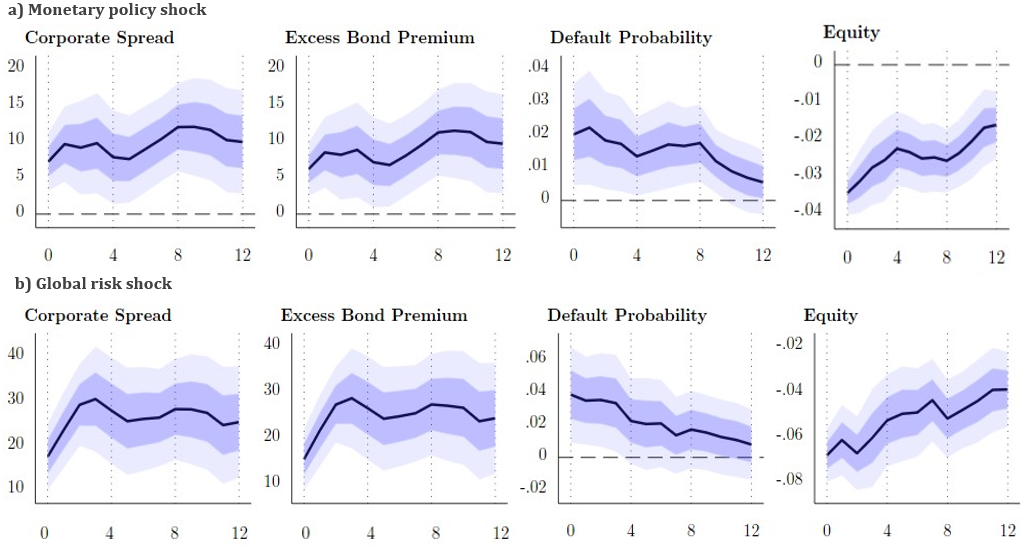

We find that monetary tightening leads to a significant initial jump in corporate spreads by 7 basis points in the same week, which transmits evenly across the S&P 500 firm distribution by leverage and by earnings. Most of this reaction is driven by the response of the excess bond premium component to the shock, which accounts for around 6 basis points of the increase in spreads. Unexpected monetary tightening raises firms’ probability of default on average only by about 0.02 percentage points and with little statistical significance. Equity prices drop significantly: a 10 basis point equivalent increase in US yields leads on average to a fall in a firm’s equity price by 3.5 percent. Overall, the results are in line with a typical reaction of asset prices to an unexpected monetary contraction.

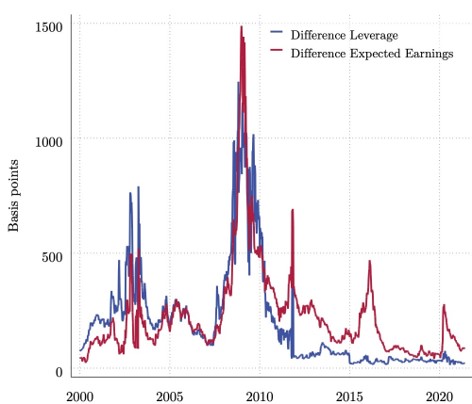

We obtain a similar adverse effect on corporate funding costs for the global risk shock but the transmission of this shock is heterogenous across the firm distribution. A sudden spike in global risk aversion triggers a sharp rise in spreads, with the brunt of the spread reaction again being driven by the excess-bond premium component. The responses are about twice as large in magnitude compared to the monetary policy shock. A global risk shock capturing flight-to-safety phenomena, equivalent to a 10 basis point unexpected decrease in US Treasury yields, pushes up a firm’s credit spread by an additional 12 basis points and depresses its equity price by additional 3.6 percentage points on average relative to a monetary policy shock. Importantly, the global risk shock has significant knock-on effects for firms with low earnings (and low interest coverage), while it does not significantly impact firms with high leverage relative to the median firm. Firms with low earnings pay an extra 15 basis points in terms of the spread on their bond financing in response to heightened global risk and face higher spreads more generally (Figure 2). This suggests that firms that are particularly constrained by their earnings, rather than by their balance sheet, face a significant rise in borrowing costs. A global risk shock thus further tightens their earnings-based borrowing constraint by lowering the value of the discounted stream of their cash flows.

Finally, we also assess the persistence of the impact of the identified shocks on funding costs and default probabilities across the sample of firms5, using panel local projections following Jordà (2005). We find persistent effects for both monetary policy and global risk shocks, with stronger impact for the latter and, in particular, for corporate bond financing (Figure 3). Corporate funding costs are thus hit by both shocks and stay high for longer, likely bearing significant real consequences down the line.

Figure 2: Difference in (option-adjusted) corporate spreads between the tail of weakest firms and the median firm computed based on leverage and expected earnings

Note: This figure shows the difference between the average option-adjusted spread (OAS) for the bottom 5th pct. and the 50th pct. (median) of firms computed based on the distribution of firms across leverage (blue) and expected earnings (red). Leverage is measured as the debt-to-equity ratio. Expected earnings are based on earnings per share projected 12 months forward. The tail of weakest firms is the top 95th percentile for leverage and the bottom 5th percentile for expected earnings.

Figure 3: Cumulative responses of asset pricing variables to identified shocks

Notes: This figure presents the impulse responses of a set of asset pricing variables to a monetary policy shock and a global risk shock, obtained from estimating our model over a 12-week horizon h = 12 over the sample period from 01/2000-12/2021. The shocks are calibrated to a 10 basis point increase (panel (a)) and decrease (panel (b)) in the 10-year US Treasury yield. The excess bond premium and fitted corporate spread are obtained from a decomposition of corporate spreads following the methodology of Gilchrist and Zakrajšek (2012) which is estimated over the period 01/2000-12/2021. Shaded areas denote 95% and 68% confidence bands.

We find that both monetary policy and global risk shocks significantly tighten US firms’ funding costs with persistent effects in particular on borrowing costs in the bond market. Global risk shocks have strong and heterogeneous effects on corporate funding costs of large US firms which depend on firms’ position within the earnings distribution, rather than their position within their leverage distribution. We interpret these results through the lenses of the recently proposed earnings-based borrowing constraint which appears to be more binding than the canonical asset-based collateral constraint especially when it comes to large S&P 500 US firms.

Adrian, T., & Liang, N. (2018). Monetary policy, financial conditions, and financial stability. International Journal of Central Banking, 14 (1).

Ahmed, R. (2023). Flights-to-safety and macroeconomic adjustment in emerging markets: The role of us monetary policy. Journal of International Money and Finance, 133, 102827.

Arrigoni, S., Bobasu, A., & Venditti, F. (2022). Measuring financial conditions using equal weights combination. IMF Economic Review, 1–30.

Brave, S., & Butters, R. A. (2018). Diagnosing the financial system: Financial conditions and financial stress. 29th issue (June 2012) of the International Journal of Central Banking.

Bernanke, B. S., Gertler, M., & Gilchrist, S. (1996). The financial accelerator and the flight to quality. The Review of Economics and Statistics, 78(1), 1-15.

Drechsel, T. (2023). Earnings-based borrowing constraints and macroeconomic fluctuations. American Economic Journal: Macroeconomics, 15(2), 1-34.

Georgiadis, G., Müller, G. J., & Schumann, B. (2021). Global risk and the dollar (ECB Working Paper Series No. 2628). European Central Bank.

Gilchrist, S., & Zakrajšek, E. (2012). Credit spreads and business cycle fluctuations. American economic review, 102(4), 1692-1720.

Greenwald, D. (2019). Firm debt covenants and the macroeconomy: The interest coverage channel.

Jordà, Ò. (2005). Estimation and inference of impulse responses by local projections. American Economic Review, 95 (1), 161–182.

Lian, C., & Ma, Y. (2021). Anatomy of corporate borrowing constraints. The Quarterly Journal of Economics, 136(1), 229-291.

Earnings-based borrowing constraints have been found to be more prevalent than traditional asset-based collateral constraints particularly among large US firms. Lian and Ma (2021) show that for large US non-financial firms only 20% of debt by value is collateralized by physical assets, whereas 80% is based predominantly on cash flows from firms’ operations, with implications for firms’ access to finance.

There are numerous studies proposing various measures of these so-called ‘financial conditions’ which differ in coverage and setup (Arrigoni et. al, 2022, Brave and Butters, 2018), given their central role in monitoring the transmission of monetary policy and risks to financial stability (e.g. Adrian and Liang, 2018).

More specifically, we identify a tightening US monetary policy shock as driving up US yields while depressing equity prices and appreciating the exchange rate. The global risk shock captures flight-to-safety dynamics that occurs when global investors rotate into safe assets amid heightened global risk aversion. This in turn causes risk asset prices to fall, demand for safe US dollar-denominated assets to rise and the US dollar to appreciate (Ahmed, 2023; Georgiadis et al., 2021). A third type of identified shocks are US macroeconomic risk shocks, with a positive shift in macro risk sentiment identified as supporting long-term yields, equity prices and the US dollar, while compressing corporate spreads. To better separate domestic from foreign shocks, US macro risk shocks are assumed to have a stronger effect on US equity prices than foreign macro risk shocks. Finally, a foreign monetary policy and macro risk shock are identified by assuming similar co-movements between yields and equity prices as their domestic shock counterparts, but with an opposite effect on the exchange rate, as the shock comes from abroad.

In our benchmark analysis, we dynamically sort “weak/strong” firms into the top and bottom 20 percentiles of the firm distribution according to their leverage ratio, their ICR, and their expected earnings per share.

We also analyze the persistence of the shock impact for the subsamples of tail firms (by leverage and earnings). We however note the lack of statistical power given the small sample size of firms in the tails of the distribution.