The views presented in this paper are those of the authors alone and do not necessarily reflect those of the European Central Bank.

We empirically analyze the interaction of monetary policy with financial stability and the real economy in the euro area. For this, we apply a quantile vector autoregressive model and two alternative estimation approaches: simulation and local projections. Our specifications include monetary policy surprises, real GDP, inflation, financial vulnerabilities and systemic financial stress. We disentangle conventional and unconventional monetary policy by separating interest rate surprises into two factors that move the yield curve either at the short end or at the long end. Our results show that a build-up of financial vulnerabilities tends to be accompanied initially by subdued financial stress which resurges, however, over a medium-term horizon, harming economic growth. Tighter conventional monetary policy reduces inflationary pressures but increases the risk of financial stress. We find unconventional monetary policy to be similarly effective in reducing inflation, but with a lower adverse effect on growth and financial stress. Tighter unconventional monetary policy is also found to have a dampening effect on the build-up of financial vulnerabilities.

The interplay between monetary policy, financial conditions and the real economy has been a long-standing topic in macro-financial debates. Monetary policy transmits to the real economy by affecting financial conditions which themselves are taken into consideration in the conduct of monetary policy to stabilize inflation and the real economy. In this transmission process, monetary policy can promote financial stability during economic slowdowns by supporting the debt servicing capacity of economic and financial sectors. Conversely, tighter monetary policy during periods of exuberance aims to mitigate financial imbalances by implicitly counteracting frothy market conditions.

Expanding on the empirical quantile regression framework of Chavleishvili and Kremer (2021) to include monetary policy shocks, inflation and financial vulnerabilities, we examine the interaction of monetary policy with financial stability conditions and the real economy. In our analysis,1 we estimate impulse response functions of a quantile vector autoregressive model using a simulation approach following Ruzicka (2021b). These quantile methods capture potential asymmetries in the interactions between economic activity, financial stability variables and monetary policy across the entire distribution of the variables.

Our data consist of a set of aggregate euro area macro-financial and monetary policy variables, starting in the beginning of 2002 and running through the end of June 2019 at monthly frequency. Our baseline model input consists of real GDP growth and HICP inflation, the Composite Indicator of Systemic Stress (CISS) as a measure of financial stress (Hollo et al., 2012; Chavleishvili and Kremer, 2021) and the Systemic Risk Indicator (SRI, Lang et al., 2019) as a measure of financial vulnerabilities. Furthermore we incorporate one of two monetary policy shock series described further below.

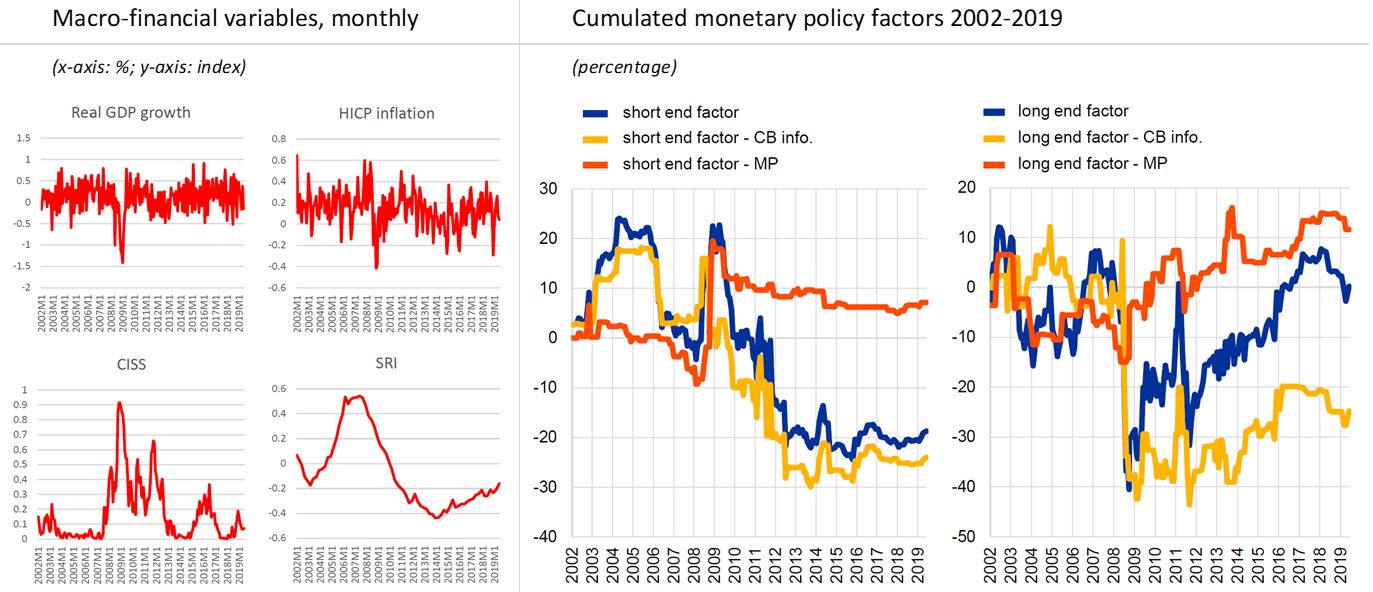

Figure 1 plots the macro-financial variables used in our estimation on the left-hand side. We intentionally represent financial stability aspects in our models with two distinct variables. This differentiation allows us to distinguish between short-term financial stress which can trigger instability and medium-term vulnerabilities which make the financial system more susceptible to destabilizing triggers. We approximate monthly GDP by interpolating a quarterly GDP series with a monthly index of industrial production for the euro area.

Figure 1: Model input: macro-financial variables and monetary policy factors

Notes: LHS: Monthly data 2002M1-2019M6. Variables are displayed as they enter our models: real GDP and HICP in first differences of logs (in %), CISS and SRI in levels. RHS: The figure shows cumulated factors before and after identification with BBB-rated NFC bond spreads in basis points.

Financial vulnerabilities evolve more slowly and more gradually than the other variables in our models, reflecting the longer duration of financial cycles compared to economic cycles. These vulnerabilities can also be controlled by a range of financial stability instruments, including microprudential and macroprudential measures. Due to their negligible contemporaneous interactions, we can interpret SRI changes as exogenous shocks. Thus we treat the SRI as the third policy tool, in addition to conventional and unconventional monetary policy.

Similar to financial conditions, the monetary policy stance is not fully captured by the short-term policy interest rate alone, especially considering central bank purchases of longer-term securities and the use of forward guidance. While monetary policy rates primarily impact short-term market rates, forward guidance affects interest rates further into the future, and purchases of medium- to long-term securities affect interest rates over longer maturities.

In our empirical macro-financial estimation framework, we incorporate monetary policy effects using monetary policy surprises in risk-free interest rates between one month and ten years over a narrow time window (covering the press release and the subsequent press conference) around the communication of ECB monetary policy decisions contained in the “Euro Area Monetary Policy Event-Study Database” developed and regularly updated by Altavilla et al. (2019). From these surprises, we estimate a short- and long-term factor of interest rate surprises and identify monetary policy shocks following Gürkaynak et al. (2005), Jarocínski and Karadi (2020) and Giuzio et al. (2021). The approach separates surprises related to conventional monetary policy (short-term rates) from those related to unconventional monetary policy (longer-term maturities). The resulting factors are displayed on the right-hand side of Figure 1.

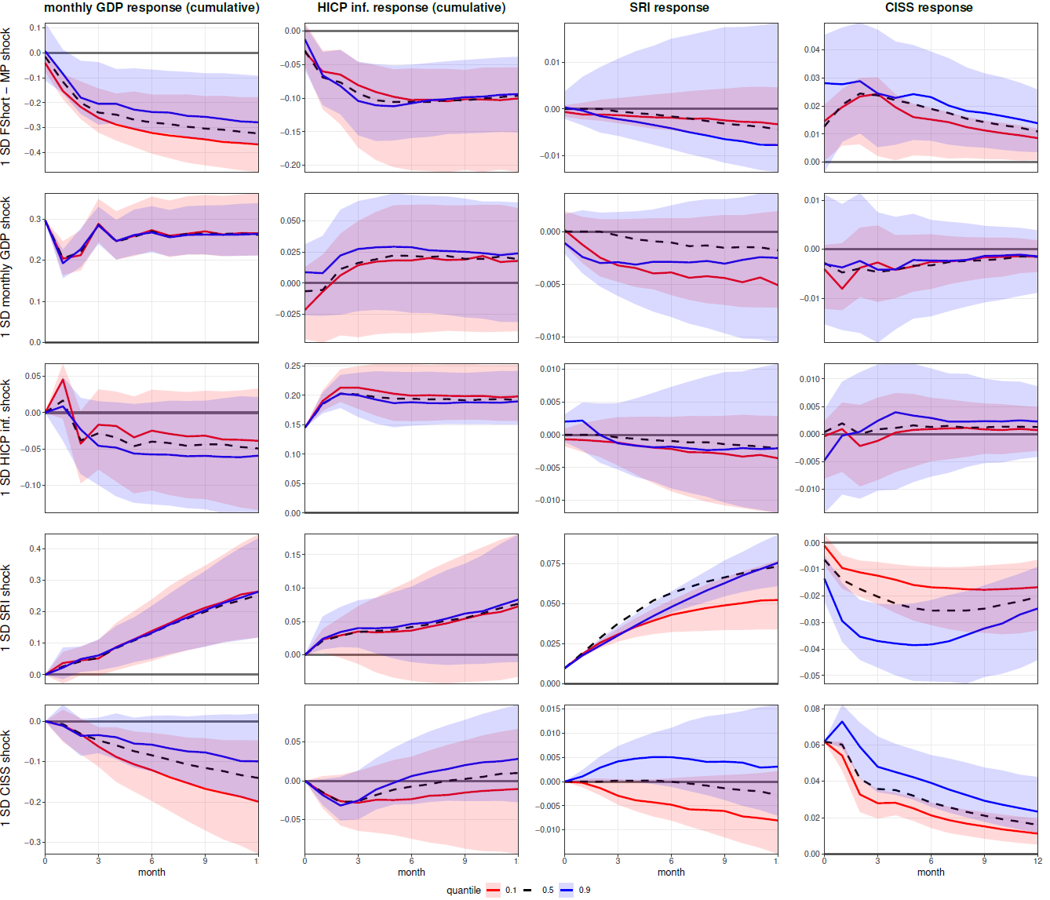

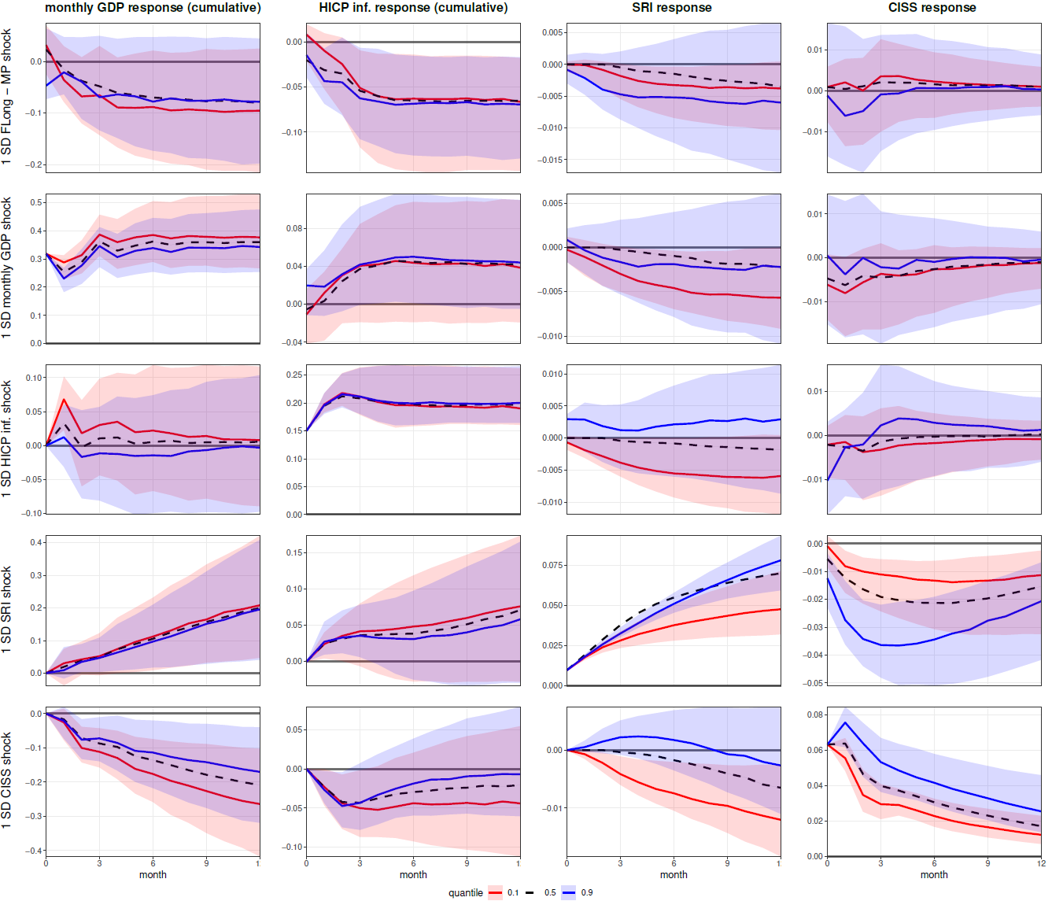

Our results show that surging financial stress significantly affects economic growth in the short term, especially at the lower tail of the GDP distribution, in line with earlier findings such as Adrian et al. (2018). We also find that financial stress surges over the medium term while a build-up of financial vulnerabilities initially tends to be accompanied by subdued financial stress – i.e. below-average financial market volatility, risk-pricing and excess returns. This suggests that periods of calm in financial markets during the early stages of financial expansion can lead to severe repercussions later on. Finally, and as illustrated in Figure 2, the estimation indicates that tightening conventional monetary policy, identified as surprises in shorter-term interest rates, reduces inflationary pressures at the cost of slower real GDP growth and increasing financial stress. On the other hand, tightening unconventional monetary policy, as shown in Figure 3 and identified as surprises in longer-term interest rates, is found to be similarly effective in reducing inflation, but with a smaller impact on growth and financial stress, while financial vulnerabilities mildly recede. This suggests that both conventional and unconventional monetary policies could, at times, play complementary roles in stabilizing the economy and the financial system.

Our empirical results also allow for a quantitative assessment of monetary policy by using counterfactual scenarios to explore the policy trade-offs involved in maintaining price stability. A first counterfactual traces out the effects of monetary policy on Growth-at-Risk (GaR; the 10th percentile of the forecasted GDP growth distribution one year ahead) with price stability set to the objective of 2% annual inflation. Especially during the global financial crisis, policymakers faced a trade-off: either tighten monetary policy to stabilize inflation forecasts at 2% or loosen policy to prevent a deterioration in Growth-at-Risk. Our analysis suggest that exploring alternative policy measures could offer additional beneficial ways to stabilize the real economy effectively.

Figure 2: Impulse responses of monetary policy tightening shock on short-term rates

Notes: Five-variable specification with response of monetary policy shock variable excluded. Confidence bands are at 90% and are excluded for the median response. Estimated by simulation (QVAR model).

Figure 3: Impulse responses of monetary policy tightening shock on long-term rates

Notes: Five-variable specification with response of monetary policy shock variable excluded. Confidence bands are at 90% and are excluded for the median response. Estimated by simulation (QVAR model).

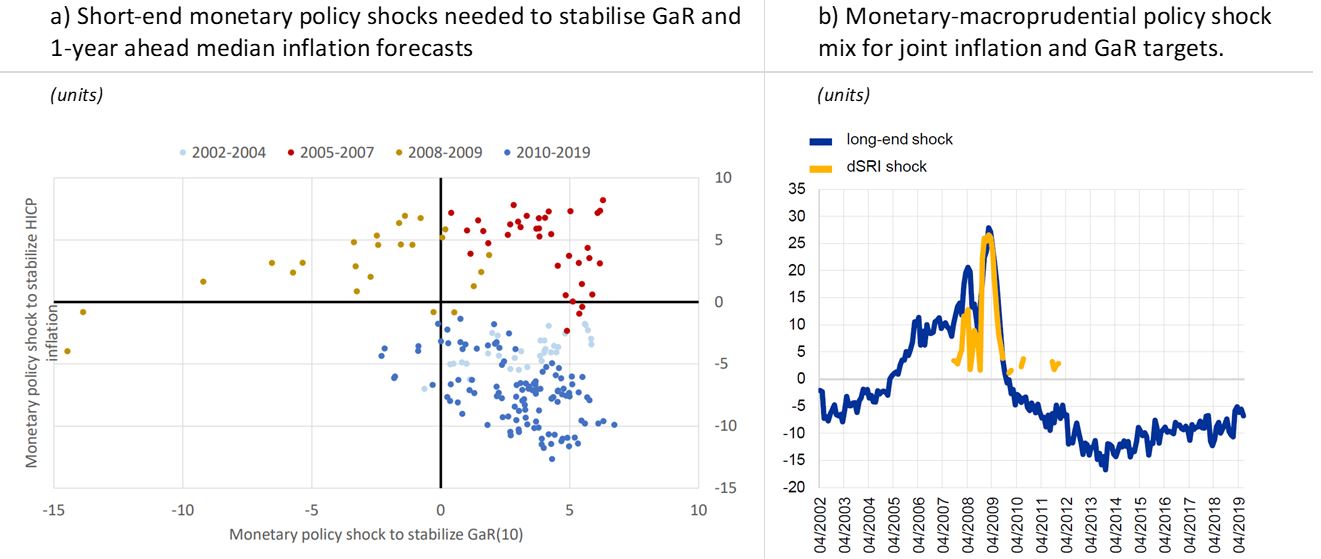

Figure 4a illustrates how our estimation results could inform a monetary and macroprudential policy mix to enhance stabilization over the sample period. We assume policy objectives of a 2% median inflation forecast one year ahead and stabilization of GaR at its sample average of -1.08%. Given the relative efficiencies, the policymaker uses a mix of monetary policy (long-end interest rate factor) and macroprudential policy (SRI). The GaR objective is non-symmetric, implying that the policymaker aims to prevent GaR from falling below the value of -1.08% while otherwise prioritising inflation. The policymaker thus provides a hedge against crisis outcomes. We compute the needed counterfactual policies based on the cumulated impulse response functions and find that relatively large monetary policy shocks would have been needed to bring inflation forecasts back to their target over the period from 2005 until the first half of 2009 as depicted in Figure 4b. However, our analysis suggests that a more relaxed monetary policy would have been appropriate during both the earlier and later stages of the sample period.

Figure 4: Monetary policy-financial stability versus monetary-macroprudential policy trade-off

Notes: LHS: The monetary policy changes required to stabilize median HICP inflation and the 10th percentile of GDP growth are in standard deviations of the monetary policy innovations. Positive values imply a required tightening and negative values a required loosening of short-term rates. RHS: his panel shows long-end and SRI shocks (in standard deviations) required to simultaneously achieve a 2% one-year ahead HICP inflation forecast while ensuring GaR above its sample average of -1.08%. Positive shocks indicate tightening for monetary policy but loosening for macroprudential policy.

Last, we find that looser macroprudential policy would have been needed starting in September 2007 and throughout the Global Financial Crisis until September 2009 and again on a few occasions during the euro area debt crisis to maintain GaR above its historical value. Forecasts implied by these policy counterfactuals show that they would have been effective in meeting combined inflation and growth targets, while limiting financial stress.

Our empirical analysis quantitatively assessed monetary policy trade-offs. One such trade-off involves two different policy goals and is captured by interactions between macro variables, such as inflation and GDP growth, and financial stability as measured by financial stress and vulnerabilities. A second trade-off is of intertemporal nature and differentiates between the potential impact of monetary policy on short-term financial stress relative to changes to financial vulnerabilities in the medium run. Our specifications consider not only short-term interest rates as a policy tool, but also changes in longer-term rates, so as to capture effects from forward guidance and asset purchases of medium- to long-term securities. To identify monetary policy shocks, our empirical strategy considers surprises in risk-free interest rates in a narrow time window around the communication of ECB monetary policy decisions and further separates between information and monetary policy shocks.

We find that surging financial stress has a strong short-term impact on the lower tail of the GDP distribution. In turn, a build-up of financial vulnerabilities tends to be followed by subdued financial stress initially, but vulnerabilities rise again over the medium term. Furthermore, tightening conventional monetary policy reduces inflationary pressures (and real GDP growth) at the cost of increasing financial stress. Changes in the long-term interest rates induced by unconventional monetary policy, on the other hand, are equally effective in bringing down inflation but have a relatively smaller adverse impact on growth and financial stress while financial vulnerabilities mildly recede.

Our quantitative assessment of monetary policy using counterfactuals sheds light on monetary policy trade-offs. During the Global Financial Crisis, monetary policy would have had to either tighten to stabilize inflation forecasts at 2% or loosen to prevent Growth-at-Risk to deteriorate. Our analysis thus indicates the potentially beneficial use of an additional policy and we show how macroprudential tools – through their impact on financial vulnerabilities – can be deployed effectively in a complementary way to stabilize the financial system and macro economy.

Adrian, T., F. Grinberg, N. Liang, and S. Malik (2018). The term structure of growth-at-risk. IMF Working paper 18/180. International Monetary Fund.

Altavilla, C., L. Brugnolini, R. S. G ̈urkaynak, R. Motto, and G. Ragusa (2019). Measuring euro area monetary policy. Journal of Monetary Economics 108, 162–179.

Bochmann, P., Dieckelmann, D., Fahr, S., & Ruzicka, J. (2023). Financial stability considerations in the conduct of monetary policy. ECB Working Paper, No. 2870. European Central Bank.

Chavleishvili, S. and M. Kremer (2021). Measuring Systemic Financial Stress and its Impact on the Macroeconomy. SSRN Working Paper.

Giuzio, M., C. Kaufmann, E. Ryan, and L. Cappiello (2021). Investment funds, risk-taking, and monetary policy in the euro area. ECB Working Paper, No. 2605. European Central Bank.

Gürkaynak, R. S., B. Sack, and E. T. Swanson (2005). Do actions speak louder than words? The response of asset prices to monetary policy actions and statements. International Journal of Central Banking 1, 55–93.

Hollo, D., M. Kremer, and M. Lo Duca (2012). CISS – a composite indicator of systemic stress in the financial system. ECB Working Paper, No. 1426. European Central Bank.

Jarocínski, M. and P. Karadi (2020). Deconstructing Monetary Policy Surprises: The Role of Information Shocks. American Economic Journal: Macroeconomics 12, 1–43

Lang, J. H., C. Izzo, S. Fahr, and J. Ruzicka (2019). Anticipating the bust: a new cyclical systemic risk indicator to assess the likelihood and severity of financial crises. ECB Occasional Paper, No. 219. European Central Bank.

Ruzicka, J. (2021a). Quantile local projections: Identification, smooth estimation, and inference. mimeo, Universidad Carlos III de Madrid.

Ruzicka, J. (2021b). Quantile structural vector autoregression. mimeo, Universidad Carlos III de Madrid.

This analysis is based on Bochmann et al. (2023) to which the interested reader may refer for further details on data, methodology and robustness. In the paper, we also use a second estimation technique, using local projections as in Ruzicka (2021a), and show that both yield the same qualitative results.