The views expressed in this policy brief are those of the authors and do not necessarily reflect the position of the respective institutions.

Abstract

This brief examines the critical role of policy in unlocking climate finance through fintech innovations. As the urgency of climate change intensifies, mobilizing capital for sustainable development becomes paramount. Climate fintech offers unique opportunities to enhance transparency, mitigate risks, and facilitate access to investments. However, realizing its potential requires a cohesive regulatory framework that prioritizes sustainability and fosters private sector engagement. Key challenges, such as the lack of standardized data and inadequate digital infrastructure, must be addressed through collaboration among governments and financial institutions. By promoting innovative financing models, policymakers can create an enabling environment for climate fintech, driving sustainable investment and effectively addressing the challenges posed by climate change.

Recently, we co-authored an IMF Staff Climate Note titled “Fintech Applications for Boosting Climate Finance”. As the world grapples with the urgent realities of climate change, innovative financial solutions are necessary to mobilize the vast sums of capital required for sustainable development. Climate fintech, characterized by the integration of technology and finance, is uniquely positioned to bridge the investment gap that has long hindered climate initiatives.

Climate fintech encompasses a broad spectrum of applications that facilitate access to climate-related investments. By leveraging technology, fintech enhances transparency, mitigates risks, and offers flexible financial solutions tailored to the nuances of environmental projects. For instance, innovative platforms can streamline the process of trading carbon credits, ensuring that both investors and project developers can engage more effectively. The potential of fintech to transform climate finance is substantial; however, realizing this potential requires thoughtful policy interventions.

A comprehensive regulatory framework is crucial in fostering an environment where climate fintech can thrive. Policymakers must prioritize sustainability in their agendas, establishing guidelines that incentivize private sector engagement in climate-related investments. This includes creating standards for climate data reporting, ensuring that stakeholders can make informed decisions based on reliable information. Moreover, regulations must support innovation by allowing for the exploration of new financial products, such as green bonds and impact investments, which have gained traction in recent years.

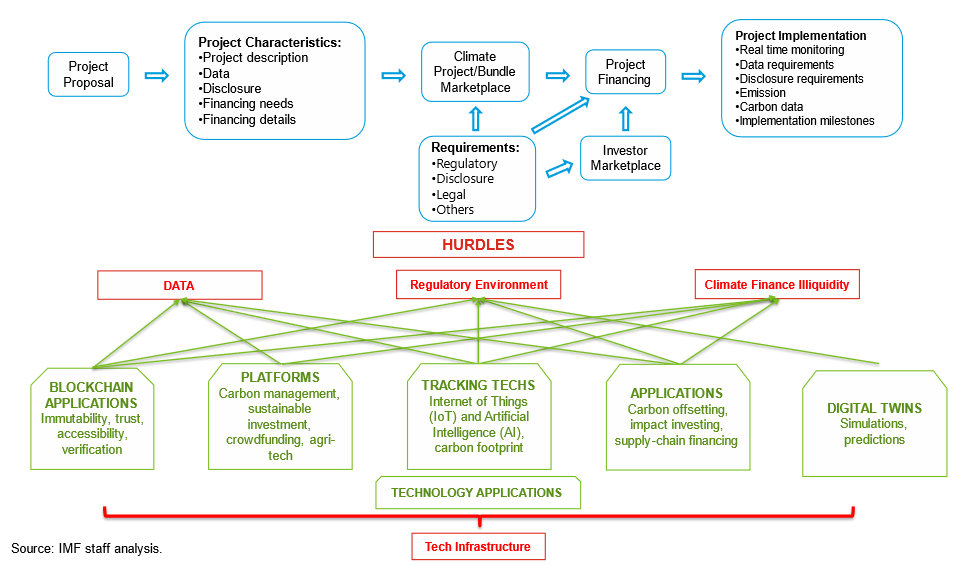

Despite the promising outlook for climate fintech, several barriers continue to impede its growth (Figure 1). One of the most significant challenges is the lack of standardized data, which complicates investment assessments and risk analyses. Policymakers should promote the use of blockchain and advanced analytics to enhance data transparency and reliability. Additionally, improving digital infrastructure, particularly in low-income countries, will be vital in ensuring equitable access to fintech solutions. Collaborations between governments, the private sector, and international financial institutions can help facilitate this infrastructure development, creating a more inclusive financial ecosystem.

Furthermore, addressing market liquidity is essential for expanding the reach of climate fintech. Innovative financing models, such as crowdfunding and peer-to-peer lending, can democratize access to climate finance, allowing small investors to contribute to large projects. Policymakers should encourage these models through incentives and support mechanisms, thereby increasing the pool of available capital for sustainable initiatives.

Looking ahead, the role of fintech in climate finance will only grow in importance. As we continue to navigate the complexities of climate change, it is imperative that policymakers remain proactive in creating an enabling environment for fintech innovations. By fostering collaboration among a diverse array of stakeholders and developing robust regulatory frameworks, the full potential of climate fintech can be unlocked to drive sustainable development and address the pressing challenges posed by climate change.

In conclusion, the intersection of climate finance and fintech presents a unique opportunity to reshape the future of sustainable investment. By prioritizing policy initiatives that support innovation, transparency, and inclusivity, policymakers can ensure that the financial resources necessary for combating climate change are mobilized effectively and efficiently. The role of policy in facilitating this transformation cannot be overstated.

Figure 1. Climate Investment Life Cycle