A wide range of fiscal measures to support firms were introduced in many countries to counteract the imposed restrictions and the slowdown in demand during the pandemic. We investigate the impact of extensive public liquidity measures in Denmark on non-financial firms’ debt financing decisions during covid-19. The growth in credit from banks and mortgage banks to Danish firms has been modest during the pandemic, in fact many firms reduced their debt level in the initial phases. This was in particular the case for those with stronger pre-pandemic balance sheets. Liquidity measures such as deferred tax and VAT payments served as a substitute for more traditional debt funding sources during the pandemic. There are indications that firms that were weaker even before the pandemic have received a disproportionately high share of tax and VAT loans. These insights suggest that swiftly implemented liquidity measures to a large extent can contribute to alleviating liquidity issues in vulnerable firms, whereas they may also come with substantial costs and risks for the public sector.

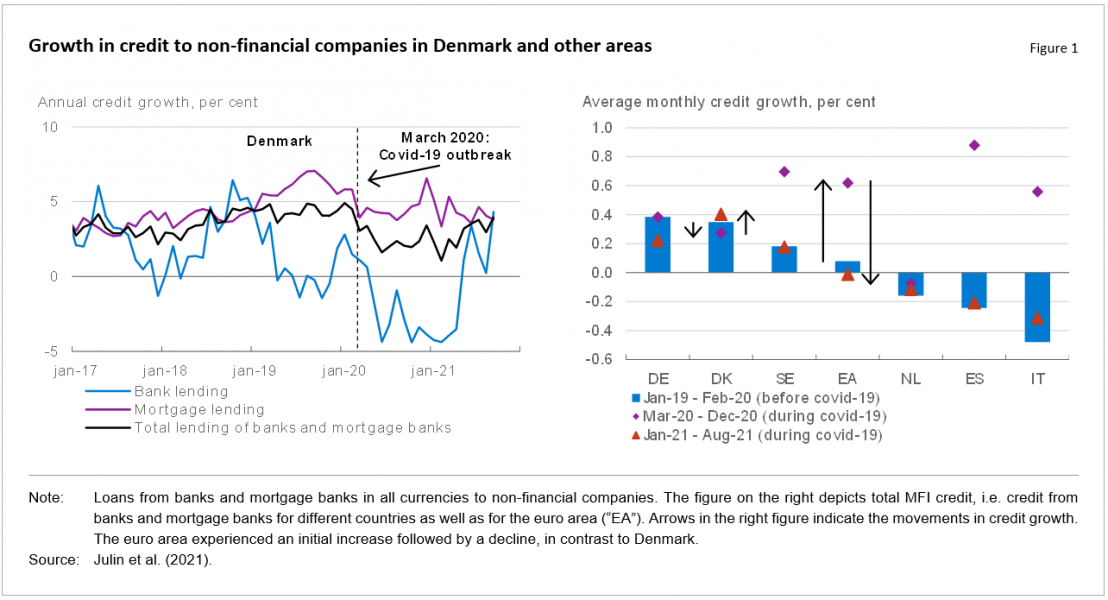

How did firms’ financing decisions respond to government support measures introduced during the covid-19 pandemic? This question is important both for assessing the short- and medium-term financing situation of firms and, more generally, for the design of future government support measures. A wide range of fiscal measures to support firms were introduced in many countries to counteract the imposed restrictions as well as the slowdown in demand during the pandemic (OECD, 2020). In a new paper (Julin et al., 2021), we study the impact of extensive public support measures in Denmark on non-financial firms’ debt financing decisions during the covid-19 crisis. Denmark was one of the countries that introduced large support packages in the form of liquidity measures, in particular when measured in terms of actual usage (rather than potential use) and in comparison to the size of the slowdown (measured ex post). Compensation schemes and government loan guarantees were used to a smaller extent in Denmark than in other countries (Jensen et al., 2020).1 At the same time, credit growth was low in Denmark compared to most European countries and to the pre-pandemic level, see Figure 1. Denmark is therefore an interesting country to study in order to learn more about the effects of public support measures on credit developments. In this policy brief, we focus on the results regarding the impact of liquidity measures on credit developments and firms’ financing situations.

Our analysis is based on the credit register compiled by Danmarks Nationalbank, the central bank of Denmark, merged with firm-level data on the use of public support measures from the Danish Tax Agency and the Danish Business Authority as well as balance sheet information from Bisnode.

Data from the credit register reveal that credit growth was negative for the majority of firms during 2020. As could be expected, two groups of firms had higher credit growth than other firms: Those that were most adversely exposed to the pandemic, and those that experienced a positive demand shock during the pandemic. In addition, large firms that already before the pandemic had high leverage and smaller firms with low liquidity had a higher credit growth than other firms (also when controlling for the size of the shock to value added at the firm level). The fact that more vulnerable firms had higher credit growth than other firms could indicate that the crisis amplified pre-crisis weaknesses.2

Following the outbreak of the pandemic, the Danish government introduced a number of measures to relieve firms’ immediate financing needs resulting from the lockdowns and reduced demand. The most comprehensive measure undertaken (in terms of ex-post usage) was to extend deadlines for payment of VAT, taxes and labour market contribution tax paid by firms on behalf of their employees by up to seven months for all firms. The total liquidity made available through these deferrals amount to DKK 333 billion (EUR 44 billion, or 14 per cent of Danish GDP). Since the first deferrals in March 2020, the accumulated liquidity boost at any point in time has varied considerably, with a maximum of almost DKK 150 billion (EUR 20 billion) in June 2020.

While deadlines were extended for all firms, variation in e.g. firm size, labour intensity and product prices across firms give rise to variations in the amount of tax and VAT for which deadlines were extended for each firm. We find a clear negative relationship between this amount of extra liquidity and credit growth at the firm level, also when controlling for factors such as firms’ pre-pandemic balance sheet indicators and the size of the shock to value added during covid. This implies that the introduction of liquidity measures contributed to a strong reduction in firms’ immediate credit demand during the pandemic and thereby served as a substitute for more traditional funding sources.

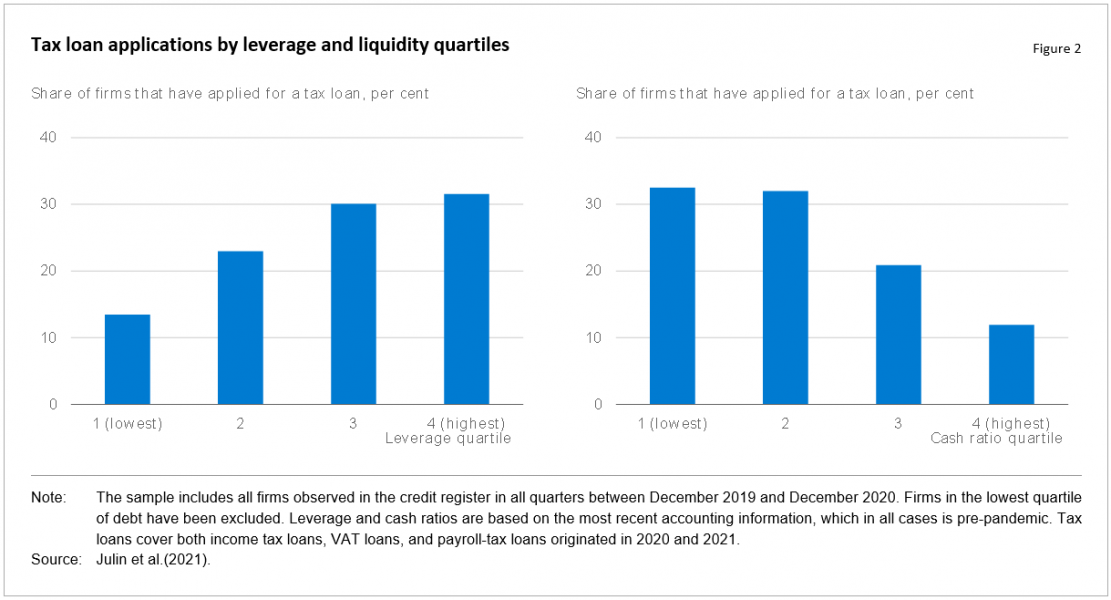

In 2021, deadlines for tax payments were generally not postponed further, but instead a public lending scheme in the form of tax and VAT loans was introduced for all firms satisfying some rather basic criteria.3 Data on the usage of these tax and VAT loan schemes show that firms with low liquidity or high leverage, as well as firms that were already in default on an existing bank or mortgage loan were more likely to apply for a tax loan (see Figure 2).4

The deferral of taxes and the tax and VAT loan schemes were made available for all firms that were about to pay taxes. In that sense, this measure was broadly scoped and not specifically targeted at firms adversely affected by the pandemic; unlike compensation schemes such as wage compensation, that were also implemented in Denmark. On the one hand, this facilitated a swift implementation, which to a very large extent contributed to alleviating liquidity issues in vulnerable firms. In addition to this direct liquidity effect, the deferrals may have contributed to maintaining lending capacity in some banks at the peak of the crisis, since the deferrals worked as a substitute for borrowing from banks for many firms. Thus, as a result of fewer firms demanding bank credit it may have been easier for firms negatively affected by the pandemic to obtain a bank loan at the peak of the crisis compared to a situation with no public liquidity measures.

On the other hand, the tax deferrals and tax and VAT loan schemes also provided interest-free liquidity for firms that were not adversely affected by the pandemic but already suffered from financial problems prior to the pandemic. Consequently, the government on behalf of the taxpayers ran a calculated, uncompensated credit risk with increased exposure to losses. In addition to the credit risk, there is also a risk that the public support that was available also to unfit firms could increase the prevalence of zombie firms in the coming years. This could lead to economic inefficiencies due to a less dynamic allocation of resources across firms.5 Arguably, the risk of more zombies may be considered a second-order concern in such an exceptional crisis, where the lockdowns and the support measures were temporary and hence only hampered business dynamics temporarily. Still, in the case continued public support measures are needed, it is worth considering whether such measures should be more targeted.

Our findings can be useful for the design of potential future support measures. However, at this stage we are only able to assess the short-term responses and short-term effects of policies, and we have focused on the implications for credit developments. An assessment of medium-term outcomes of the type considered here as well as outcomes such as firm exit, zombie lending and labour market effects could be fruitful avenues for future research and could serve as the basis for a more complete evaluation of the fiscal support measures introduced during the pandemic.

Andersen, Svend, Paul Lassenius Kramp and Andreas Kuchler (2019), Low prevalence of zombie firms in Denmark, Danmarks Nationalbank Analysis, no. 29/2019.

Bess, Mikkel, Andreas Kuchler and Morten Werner (2020), The covid-19 crisis reduces Danish growth potential, Danmarks Nationalbank Economic Memo, no. 9/2020.

Brülhart, Marius, Rafael Lalive, Tobias Lehmann and Michael Siegenthaler (2020), COVID-19 financial support to small businesses in Switzerland: evaluation and outlook, Swiss Journal of Economics and Statistics, Vol. 156, article no. 15.

Buchheim, Lukas, Jonas Dovern, Carla Krolage and Sebastian Link (2020), Firm-Level Expectations and Behavior in Response to the COVID-19 Crisis, CESifo Working Paper, no. 8304.

Julin, Ida Rommedahl, Andreas Kuchler and Alexander Meldgaard Otte (2021), Firm financing and public support measures during the pandemic, Danmarks Nationalbank Working Paper, no. 184.

Jensen, Carina Moselund, Rasmus Mose Jensen, Nastasija Loncar and Alexander Meldgaard Otte (2020), Lower borrowing needs in Danish corporations compared to European during covid-19, Danmarks Nationalbank Analysis, no. 20/2020.

OECD (2020), COVID-19 Government Financing Support Programmes for Businesses, OECD Paris.

The potential costs of the compensation and liquidity measures were not known at the time they were implemented. Compensation schemes were generally expected to have higher costs than liquidity measures, in part because wage and fixed cost compensation were not to be repaid.

Similarly, evidence from Germany shows that firms, which appeared weak before the crisis, were hit harder by the pandemic, and, on top of the initial impact, expected more difficulties for their businesses going forward (Buchheim et al., 2020).

The tax and VAT loans were issued in amounts corresponding to one or more instalments of income tax (paid by firms on behalf of their employees) and VAT. Firms were not subject to a traditional assessment of their creditworthiness by the government. However, they had to satisfy a few criteria in order to be eligible for the tax and VAT loans. Firstly, during the last three years the firm should have reported its tax information to the tax authority in a sufficient manner. Secondly, the owner or the management must not have been indicted for tax fraud within the last 10 years. Thirdly, firms could not get a tax or VAT loan if they were already in default on their tax payments, being liquidated or the like. Lastly, in the case where the firm already had an outstanding debt with the government, the liquidity originating from the tax and VAT loans would automatically pay down that debt of the firm first.

This is in line with evidence from Switzerland, where more indebted firms have also been found to be more likely to take corona-related loans provided by the government (Brülhart et al., 2020).

The share of these firms, so-called zombie firms, has generally been low in Denmark in the years leading up to the pandemic (Andersen et al., 2019). Dynamic allocation of resources across firms is normally an important driver of productivity growth in Denmark (Bess et al, 2020).