The views expressed here are those of the authors and do not necessarily represent those of the Banque de France or the Eurosystem.

Some weeks ago, the Banque de France published aggregate results of a new quarterly survey about firms’ inflation expectations (Bouche et al. 2022). Since Q4 2021, this survey has been collecting every quarter the opinion of 1,700 business leaders about their perception and expectation of aggregate inflation over a one-year horizon and a longer term horizon (3 to 5 years) Additionally the survey also collects information regarding wage growth expectations within the firm (one-year horizon). Overall, about 7,000 firms of all sizes and sectors (industry, construction, services) will be interviewed once within a year.

Setting up a new tool for monitoring firms’ inflations expectations is a double challenge (Candia 2022). The first challenge is related to the technical feasibility: conducting such a survey requires contacting a large sample of economic decision-makers who are available to respond. To this end, the survey on corporate inflation expectations is based on the usual contacts that the Banque de France branches establish with business leaders as part of the Monthly Business Survey (MBS). The second challenge consists in obtaining relevant information for monetary policy assessment. In particular, the survey asks firms’ managers about an aggregate nominal variable and collects quantitative information for a medium to long-term horizon whereas most business surveys ask for qualitative information about short-term evolutions of firms’ prices or activity.

Before launching the regular phase of the survey, we have conducted a pilot phase to design a questionnaire which should be rather easy to understand for firms’ leaders and which should also help us to collect relevant information. In Savignac et al. (2021) we report empirical evidence on firms’ inflation expectations based on this pilot phase and the main methodological lessons we draw for the design of the survey questionnaire. This pilot survey was conducted in two specific regions in France, Hauts-de-France (the northernmost region of France) and Provence-Alpes-Cote-d’Azur (a region in southeastern France bordering Italy and the Mediterranean Sea), over five different monthly waves: four waves between September-December 2020 and one wave in May 2021. Overall, the initial sample surveyed between September-December 2020 includes a little more than 1,000 firms of different sizes covering industry, services and construction. This sample was divided into four subsamples of similar composition in terms of regions, firms’ size and sectors, so that in each wave of 2020, a new set of firms (of about 250 firms each) was interviewed. In May 2021, 75% of firms from the initial sample were randomly selected and were interviewed again using a similar set up.

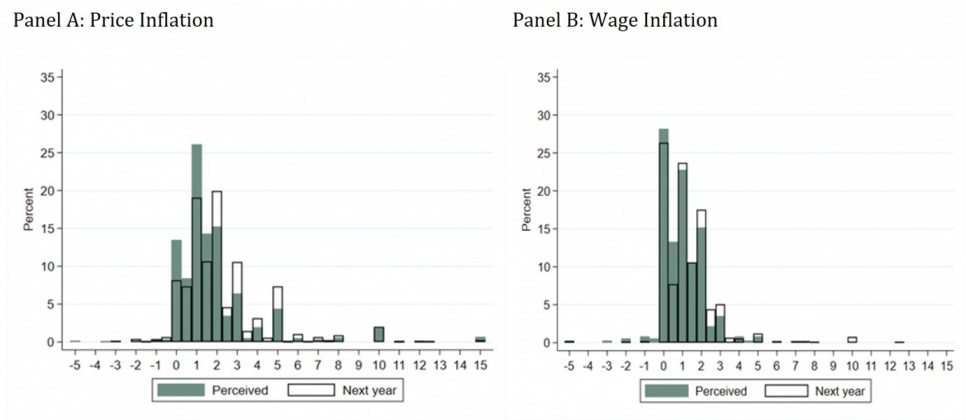

In the 2020 low-inflation environment, we find that French firms significantly overestimated the rate of inflation. Between September 2020 and May 2021, the average perceived inflation rate was 1.8% and the median 1.3% while actual inflation was between 0% at the end of 2020 and 1.4% in May 2021. The “overestimation bias” was much smaller for firms than the one observed for households. Based on the French Household Survey (CAMME, Insee), we find that the average perceived and expected inflation rates as reported by households over the same period were around 4 to 5%. Besides, we find that the distribution of firms’ expectations shows little dispersion (Figure 1). In particular, we find that the number of large rounding answers is much smaller for firms than the one typically found for households.

The survey also measures firms’ expectations about firm-level wage growth. The average perceived and expected wage growth are about 1% whereas the actual aggregate base wage growth is about 1.6% in France over the period. Compared to inflation expectations, we find the distribution of firms’ wage expectations is more asymmetric around 0 but also more condensed: almost all answers range from 0% to 2% between September 2020 and May 2021, Figure 1).

Figure 1: Distribution of Perceived and Expected Wage and Price Inflation (2020- 2021)

Notes: The figure plots the distribution of responses for perceived and expected one-year ahead inflation (Panel A) and wage inflation (Panel B) pooled across all available waves of the pilot survey and questionnaire formulations.

A unique characteristic of the pilot survey is that the interviewers enquire about the position of the respondent within the firm. We find that the respondent who are CEOs or Financial Officer tend to have lower inflation perceptions than other respondents, suggesting that they are more informed about inflation. Such a difference depending on the job of the respondent also applies to one-year ahead inflation and is true even after for controlling for firm characteristics. Using household data (CAMME survey conducted by Insee within the harmonized European Commission Framework, cf. Andrade et al., 2022), we further investigate why firms’ managers report lower inflation expectations and perceptions than other households. Even when we control for several individual characteristics (age, gender, income, education), we find that individuals with higher managerial role within a firm report a smaller inflation perception or expectation. Hence, evidence from this alternative source of data confirms the result that the position of the respondent within the firm matters for inflation perceptions and expectations.

Another key question for the measurement of firms’ inflation expectation is how sensitive are responses to the formulation of the questions. We find only limited sensitivity of reported expectations to whether questions refer to inflation or “prices in general”, in contrast to what is typically found for households (de Bruin et al. 2012). Referring to “prices in general” in the formulation of questions leads to a slightly higher average perception of recent inflation but has no statistically significant effect on expectations about future inflation relative to equivalent questions asking about inflation. In contrast, when questions about future inflation first include information about recent inflation rates, we find that this has large negative effects on firms’ expectations. Consistent with Bartiloro et al. (2019) and Coibion, Gorodnichenko and Ropele (2020), when firms are provided with information about recent inflation, they move their reported forecasts of future inflation in the direction of the provided information, leading to a strong reduction in the dispersion of forecasts and a movement in the mean towards the provided signal. We also find that this information has a rather short-lived effect since firms receiving this information in December 2020 have similar inflation expectations as untreated firms by May 2021. The powerful effect of even simple information about recent inflation on reported expectations implies that questions about inflation expectations should not include additional information about recent inflation if they are meant to solicit firms’ unbiased prior beliefs about future inflation.

Since wages are the largest component of costs for most companies, one might expect that opinions of business leader about future inflation are related to expected wage increases. We find however there is only little correlation between price and wage expectations of firms: firms that expect higher aggregate wage growth do not display a much higher expectation of price inflation than those who expect lower aggregate wage growth. Moreover, we find that firms do not link revisions in inflation with revisions in wage growth expectations across the years 2020 and 2021. Overall, this suggests that firms, on average, do not view wage changes as a primary determinant of price inflation at the aggregate level when inflation is low.

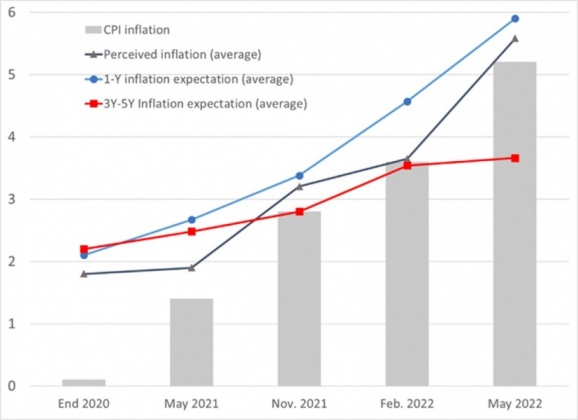

Looking at answers of the same firms during the pilot phase (2020-2021) but also during the nationwide phase (2021-2022), we document three main stylized facts on how firms’ inflation expectations have recently moved with the rise in inflation (Figure 2). First, average inflation perception of firms are highly correlated with actual inflation rates whereas the perception bias tends to decrease when inflation is higher in 2022. Second, the average one-year inflation expectation has been above the average perceived inflation rate since 2020, suggesting that firms do not expect that inflation will slow over a short horizon. Third, the average expected inflation rate three to five years ahead has also increased from 2.2% in 2020 to about 3.5% in May 2022. However, the rise of long-term inflation expectations is much smaller than the one observed for inflation perceptions or short-term expectations.

Figure 2: Inflation and firms’ inflation expectations

Notes: Sample restricted on the two regions covered by the pilot. Sources: Banque de France Inflation Expectation Survey (Pilot and Survey); Insee for CPI inflation.

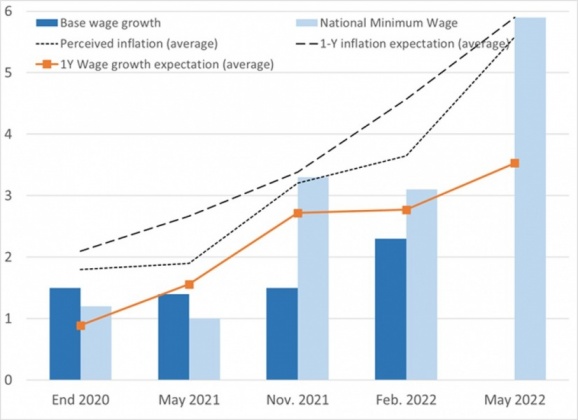

Finally, we find that firms’ expectations about base wage growth within the firms also react to aggregate inflation, but less compared with one-year inflation expectations (Figure 3). The average base wage growth is expected to be 3.5% in May 2022 whereas the actual inflation was higher than 5%, suggesting limited immediate second-round effects.

Figure 3: Firms’ wage growth expectations

Notes: Sample restricted on the two regions covered by the pilot. Sources: Banque de France Inflation Expectation Survey (Pilot and Survey); Insee for CPI inflation.

Andrade P., O. Coibion, E. Gautier, Y. Gorodnichenko (2022) “No Firm is an island? How industry conditions shape firms’ aggregate expectations” Journal of Monetary Economics (Carnegie-Rochester Conference) Volume 125, Pages 40-56.

Bartiloro L., Bottone M., Rosolia A (2019) “What does the heterogeneity of inflation expectations of Italian firms tell us?” International Journal of Central Banking, 15(5):175–205.

P. Bouche, J. Demuynck, E. Gautier and F. Savignac (2022) What are business leaders’ inflation expectations? Blog Banque de France n°275

W. Bruine de Bruin, W. van der Klaauw, J. S. Downs, B. Fischhoff, G. Topa and O. Armantier (2012) “The Effect of Question Wording on Reported Expectations and Perceptions of Inflation”, Journal of Economic Psychology, August 2012, Vol. 33 (4), 749-57.

Candia B., Coibion O. and Gorodnichenko O. (2022) “The Macroeconomic Expectations of Firms”, NBER Working Paper 30042.

Coibion O., Gorodnichenko Y., and Ropele T. (2020) “Inflation Expectations and Firm Decisions: New Causal Evidence” Quarterly Journal of Economics 135, 165-219.

F. Savignac, E. Gautier, Y. Gorodnichenko, O. Coibion, (2022) Firms’ Inflation Expectations: New Evidence from France, NBER Working Paper 29376.