This policy brief summarizes the paper: Pieretti, Pulina, Zanaj (2024), “Fiscal competition and two-way migration”, BCL working paper 183, Central Bank of Luxembourg. This policy brief should not be reported as representing the views of the BCL or the Eurosystem. The views expressed are those of the authors and may not be shared by other research staff or policymakers in the BCL or the Eurosystem.

We analyze migration patterns influenced by strategic public policies among competing jurisdictions, and offer insights into why less technologically advanced countries can attract skilled foreign workers, albeit not the utmost qualified. Our study focuses on economies with different technological advancements, each hosting a population of mobile individuals with varying skill levels. Governments aim to attract mobile workers by adjusting wage taxes and offering public investments that boost firm productivity. Our findings indicate that highly skilled workers tend to migrate to technologically advanced economies. Nevertheless, less developed economies can retain part of their skilled workers and attract foreign skilled workers through tax incentives or increased public investments. It follows the emergence of a bilateral migration pattern shaped by governments’ policy decisions. Moreover, we find that introducing heterogeneity in population size has minimal impact on these outcomes.

This paper introduces a game-theoretic framework to explore various migration patterns arising from the strategic decisions made by governments in attracting or retaining mobile workers. Existing empirical studies have predominantly focused on estimating bilateral migration flows based on characteristics of source and destination countries, often employing econometric analyses of aggregate data (e.g., Grogger and Hanson, 2011; Beine et al., 2016). While these studies underscore the impact of wage disparities on migration flows, they overlook the influence of country policies on migration patterns. In the realm of public economics literature, unilateral migration flows have been the primary focus (e.g., Gabszewicz et al., 2016; Kessing et al., 2020), with limited attention given to other patterns such as two-way migration, where a country serves as both sender and receiver of migrants. Despite recognizing economic disparities between countries as a major driver of migration, the literature has primarily examined unilateral flows from developing to developed countries, often emphasizing the role of public policies as migration triggers. However, no theoretical framework has been proposed to analyze different migration patterns, such as migration flows toward less technologically advanced countries.

To address these gaps, we propose a model in which different migration patterns result from strategic policy decisions of competing governments. Our framework considers two countries with mobile workers of varying skill levels that decide on taxes and infrastructure expenditures to maximize net revenues. By examining the interplay between public policies, firm productivity, and technology differences, our model provides some insights on migration patterns and their determinants.

Our key findings demonstrate that both technologically advanced and lagging countries can serve as origins and destinations in a two-way migration pattern under certain tax and expenditure levels. While highly skilled workers tend to migrate to technologically advanced countries, lagging countries can retain skilled workers and attract skilled foreign workers by adjusting tax rates and public expenditure. Additionally, our analysis reveals that optimal policy strategies of technologically lagging countries depend on the extent of technological gaps. This has implications for migration patterns and labor force composition. Finally, introducing heterogeneity in country size does not significantly alter these results.

Consider two countries, which differ in their technological advancements, each populated with a mix of workers of different skill levels. The skills are evenly spread over both countries and are common knowledge. In the basic scenario, we assume both countries have the same population size. However, differences in population size do not qualitatively affect the main results.

Each country collects taxes on labor income and invests in public infrastructure to help businesses thrive. These taxes and public expenditures are considered as tools to attract workers from abroad. Many businesses operate in each country and produce goods that are sold competitively. Labor productivity in each country, and consequently wage levels, depend on the degree of technology advancement, workers skills and public infrastructure expenditures.

Intuitively, a country with better technology tends to attract more skilled workers, because, other things equal, offers higher (gross) wages. Nevertheless, since net wage differentials also depend on infrastructure expenditures and labor taxes, technologically lagging countries can also retain and attract skilled workers.

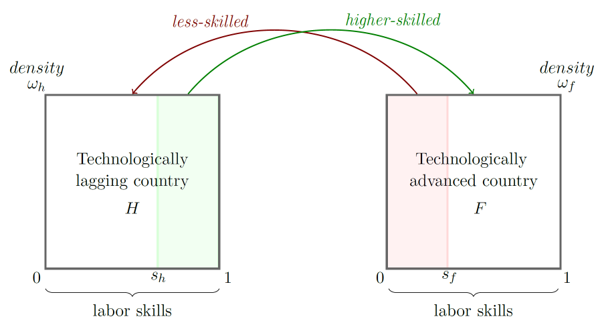

Workers in both countries decide whether to move abroad by comparing the wages they will earn after taxes and moving costs. For example, a worker in the technologically lagging country with a given skill level weighs the net wage (s)he would earn at home against what (s)he would earn abroad after considering a cost of moving. If, after considering moving costs, earnings are equal in both countries, the worker is indifferent between the two places. The level of skill required to be indifferent depends on the differences in taxes and public investments, as well as the moving costs and the technological gap. Knowing the position of this “indifferent” worker on the skill scale (see Տh in Figure 1) allows to characterize the migration flow from the lagging to the advanced country. In other words, there is a brain drain from the less advanced country to the technologically advanced country. This flow is driven by both the technological gap and the policies of the advanced country, which offers better conditions in terms of taxes or public investments.

However, the lagging country can also be attractive for skilled workers from the advanced country. Indeed, in the technologically advanced country, there may be a worker Տf who is indifferent between staying and moving to the less advanced country. If the lagging country is able to provide a policy advantage in terms of taxes or public investments that is higher than the moving cost, less skilled workers will move from the advanced to the less advanced country (see red shaded area in Figure 1). The intuition is that less skilled workers have less to gain from the technological advance at home and are therefore easier to attract with appropriate policy instruments. This can explain migration flows towards technologically lagging countries.

Finally, it can be proven that a necessary condition for the occurrence of two-way migration is that the technologically lagging country has a sufficiently large policy advantage(Δh > 0), i.e., lower taxes or more infrastructure than its rival.

Figure 1: A model of bilateral migration

Source: Visual representation of Proposition 1 from Pieretti, Pulina, Zanaj (2024).

It follows that migration does not solely depend on exogenous technological differences but can also be influenced by endogenous policy choices. If a technologically lagging country implements policies that give it an advantage, it can keep part of its workers from leaving. Moreover, if this advantage is large enough to compensate for moving costs, it can even attract less skilled workers of the other country. This will result in two-way migration.

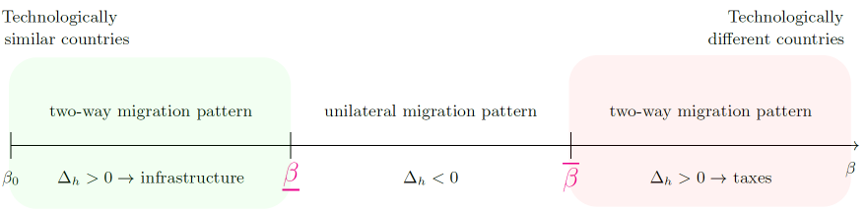

Governments decide on taxes and expenditure in a game-theoretic setting anticipating possible migration flows discussed above, in an attempt to maximize their net revenues. In this context, it can be demonstrated that the magnitude of the technological gap determines the best policy the lagging country has to choose. This can result in a two-way migration pattern (see Figure 2). Differences in taxes and public input expenditures across countries can be positive or negative according to the technological gap. Each country can be the one offering lower taxes or higher public inputs.

When the technological gap is small (Figure 2, green shaded area), the technologically lagging country tends to invest more in public input but imposes higher taxes compared to the other country.

On the contrary, in scenarios where the technological gap is large (Figure 2, red shaded area), the lagging country opts for lower taxes, but provides less public input. Therefore, in any equilibrium involving a two-way migration pattern, the lagging country will have a policy advantage in either labor taxation or public investment, but not both simultaneously.

The underlying intuition can be explained as follows. A significant technological gap reduces the intensity of tax competition, allowing the less advanced country to lower taxes without triggering too much of a response from its rival. However, to remain appealing to highly skilled workers, the advanced country compensates for higher taxes by offering more public investment. Conversely, when the technological gap is small, intense tax competition prompts the less advanced country to focus on boosting public investment, while the advanced country lowers taxes to offset the lower level of public spending.

Figure 2: Migration patterns and technological gap

Source: Visual representation of Proposition 2 from Pieretti, Pulina, Zanaj (2024).

Beine, Michel, Bertoli, Simone, & Fernandez-Huertas Moraga, Jesus. 2016. A Practitioners’ Guide to Gravity Models of International Migration. The World Economy, 39(4), 496–512.

Gabszewicz, Jean, Tarola, Ornella, & Zanaj, Skerdilajda. 2016. Migration, wages and income taxes. International Tax and Public Finance, 23(3), 434–453.

Grogger, Jeffrey, & Hanson, Gordon H. 2011. Income maximization and the selection and sorting of international migrants. Journal of Development Economics, 95(1), 42–57.

Kessing, Sebastian G., Lipatov, Vilen, & Zoubek, J. Malte. 2020. Optimal taxation under regional inequality. European Economic Review, 126(C).

Pieretti, Patrice, Giuseppe, Pulina, & Skerdilajda, Zanaj. 2024. Fiscal competition and two-way migration. BCL working papers 183. Central Bank of Luxembourg.