This policy brief is based on DNB Working Paper No 820, “Fiscal policy and inflation in the euro area”. The views expressed are those of the authors and not necessarily those of the institutions the authors are affiliated with.

Abstract

This policy brief challenges the prevailing narrative that recent inflation in the euro area is primarily driven by supply-side factors. Our analysis, based on a Bayesian Vector Autoregression (BVAR) model with sign restrictions, reveals that fiscal policy has played a significant and progressively increasing role in driving euro area inflation. By the end of 2022, expansionary fiscal policy shocks accounted for 18% of the overall inflation peak. The findings suggest that demand shocks, particularly those induced by fiscal policy, contributed more to inflation than previously acknowledged, underscoring the importance of an appropriate fiscal stance in supporting monetary policy to achieve price stability.

It is often said that the steep rise in euro area inflation observed in recent years has mostly been due to supply-side factors rather than demand-side factors. Indeed, the euro area, with its strong reliance on global supply chains and energy imports, has been particularly vulnerable to the global supply chain disruptions during and after the pandemic, and the energy crisis that was aggravated by the Russian invasion of Ukraine. Moreover, numerous empirical studies find that supply shocks explain the lion share of the recent inflationary surge in the euro area, while demand shocks played a more limited role (e.g., Finck and Tillmann, 2022, Banbura et al., 2023, Ascari et al., 2024a).

This dominant narrative implies a negligible role for fiscal policy in driving inflation in the euro area and stands in contrast to the prevailing account of the high inflation episode in the US. With its sizeable Coronavirus, Aid, Relief and Economic Security Act of 2020 ($2.2 trillion) and American Rescue Plan Act of 2021 ($1.9 trillion), the fiscal response to the pandemic crisis is often perceived to have been much more prominent and acute in the US than in the euro area. Consequently, fiscal-induced demand shocks are thought to have been more important drivers of the inflation surge in the US than in the euro area.1

In a recent paper (Ascari et al., 2024b), we challenge the prevailing narrative and show that fiscal policy had a major and progressively increasing impact on inflation in the euro area. Based on estimates from a Bayesian Vector Autoregression (BVAR) model with sign restrictions, we show that, by the end of 2022, expansionary fiscal policy shocks had raised HICP inflation by as much as 1.5 percentage points, thereby accounting for 18% of the overall inflation peak. Fiscal shocks explain an even larger share, 27%, of the overall increase in the growth rate of the GDP deflator during this period. Furthermore, using the model to quantify the relative contributions of other types of shocks to inflation, we find that the largest share (almost 60%) of the overall increase in inflation is accounted for by demand shocks rather than supply shocks (see Giannone and Primiceri, 2024, who reach a similar conclusion). Combined, our results underscore the importance of fiscal policy for inflation dynamics and imply that an appropriate fiscal stance can support monetary policy in achieving price stability.

We estimate the effects of fiscal policy shocks on inflation using a BVAR model with sign restrictions. This type of model has, in recent years, been frequently used to examine the relative contributions of demand and supply shocks to inflation (see e.g. di Giovanni et al., 2022, di Giovanni et al., 2023, Ferrante et al., 2023, Giannone and Primiceri, 2024, Shapiro, 2024). However, while much effort has been put into distinguishing between the contributions of different types of supply shocks, such as those related to energy price fluctuations (Banbura et al., 2023, López et al., 2024) and global value chain disruptions (see e.g. Finck and Tillmann, 2022, Ascari et al., 2024a), fewer studies distinguish between different types of demand shocks, particularly those stemming from fiscal policy. Our main contribution, therefore, is to isolate the contribution of fiscal policy shocks to inflation from those of other demand and supply shocks for the euro area. Identification of the fiscal shocks is achieved by restricting the signs of the responses to these shocks of the variables included in our model. These restrictions follow conventional economic theory. Specifically, we impose that an expansionary fiscal shock raises GDP growth, inflation and the primary deficit. The positive co-movement between output and primary deficit is unique to expansionary fiscal shocks. Favorable non-fiscal demand shocks that boost output and inflation, such as monetary policy or other non-policy shocks, reduce the primary deficit, as expansions are typically associated with an increase of the tax base and a reduction in transfers through automatic stabilizers. In addition to the fiscal shocks, we identify five other shocks: monetary policy shocks, non-policy related demand shocks, domestic and global supply shocks, and oil price shocks. We thus distinguish between three types of demand shocks and three types of supply shocks. The model is estimated using quarterly data for the euro area aggregate over the period 2002Q1 to 2023Q4.

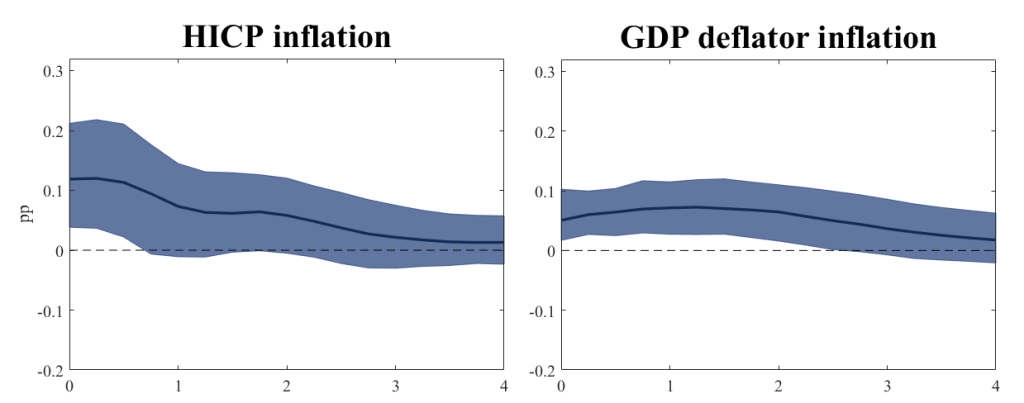

Figure 1. Responses of euro area inflation to an expansionary fiscal policy shock

Notes: Solid line (shaded areas) refers to the posterior median (16th-84th percentiles) of the estimated impulse response functions. Horizontal axis measures years.

An expansionary fiscal policy shock has a positive and persistent effect on inflation, as shown by the impulse response functions estimated by our BVAR model (Figure 1). While a positive response of inflation to the fiscal shock is imposed by our sign restrictions on impact, the response remains positive long after the initial impact of the fiscal shock. In fact, when we measure inflation by the growth rate of the HICP (left panel), the positive effect of the fiscal shock on inflation persists for almost 1 year. If, instead, we measure inflation by the growth rate of the GDP deflator (right panel), the positive inflation response is even more persistent and lasts for almost 3 years, most likely reflecting that fiscal policies are typically predominantly domestic in nature.

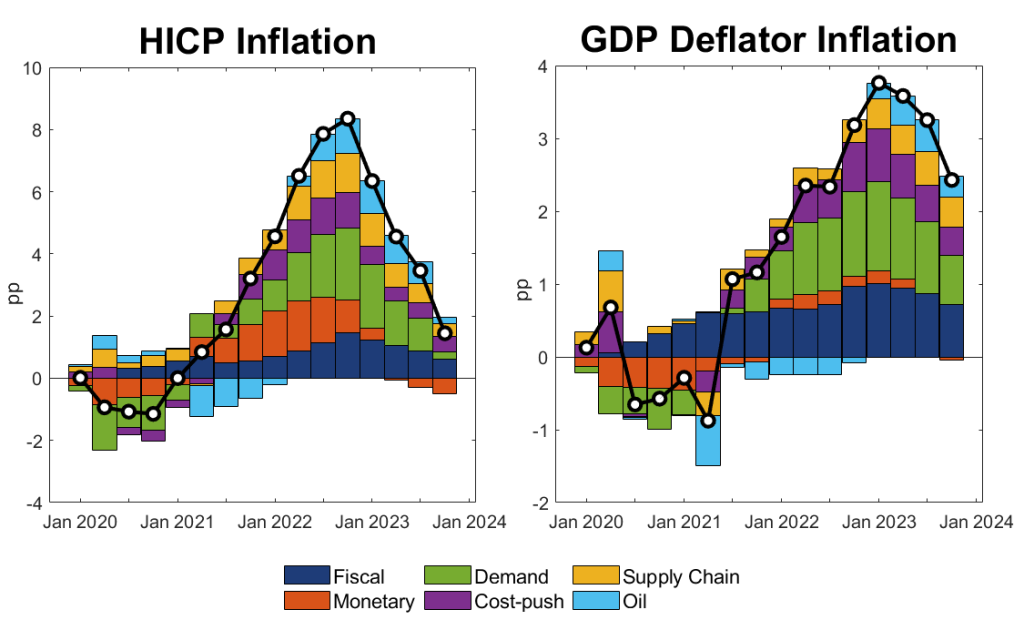

Figure 2. Sources of euro area inflation

Notes: Cumulative contribution of the different shocks after 2019Q4, filtering out initial conditions and pre-pandemic shocks.

Following the pandemic, the contribution of fiscal policy to inflation has been sizeable and steadily increasing until the end of 2022, and only slowly receded thereafter. Figure 2 shows the estimated contributions of the six shocks to euro area inflation when the latter is measured using the HICP (left panel) or GDP deflator (right panel). We find that fiscal policy contributed positively to inflation in 2020, likely reflecting the impact of support measures taken to counteract the adverse effects of the pandemic crisis. In 2021 and 2022, as the economy recovered from the pandemic and entered

the energy crisis, the fiscal contribution to inflation steadily rose and, by the end of 2022, fiscal shocks accounted for around 1/5th of the overall inflation peak. In 2023, the contribution of fiscal policy to inflation slowly receded. However, most of the disinflation during that period was achieved through a reduction in the contributions from other shocks, most notably global supply and oil price shocks, but also contractionary monetary policy shocks.

Both the size and persistent nature of fiscal policy’s inflationary effects during the post-pandemic era in the euro area can be explained by two critical and unprecedented events. First, expansionary fiscal policies were facilitated by the activation of the Stability and Growth Pact’s (SGP) general escape clause in 2020. This clause, which allows for budgetary restrictions imposed by the SGP to be suspended during severe economic downturns, was extended until 2023, well after the economy had started its recovery. Second, the European Commission adopted in 2020 a large economic recovery package, called Next Generation EU (€ 750 billion), which was to be disbursed to euro area member states gradually over the period 2021-2026. Both events allowed for a sizable and prolonged fiscal expansion in the euro area, bringing the euro area narrative of the inflation episode closer to that of the US. In addition, supply shortages in both product and labor markets, along with an increase in the frequency of price changes, may have steepened the euro area Phillips curve during the high inflation period, thereby amplifying the inflationary effects of expansionary fiscal policies (while muting the effects on GDP).

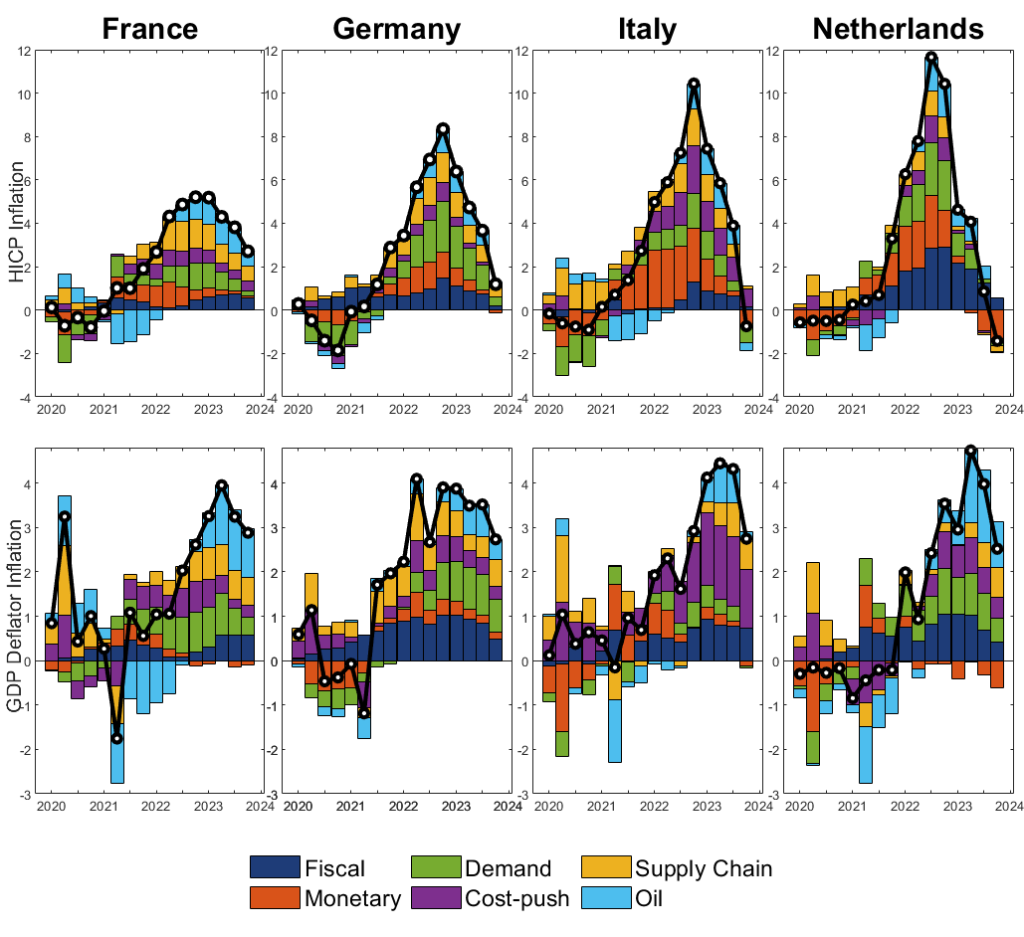

Figure 3. Sources of inflation in selected euro area countries

Notes: Cumulative contribution of the different shocks after 2019Q4, filtering out initial conditions and pre-pandemic shocks.

Fiscal policy had a non-negligible and gradually increasing positive effect on inflation in individual euro area countries as well. This is shown in Figure 3, where we present the results from our BVAR model when estimated on data from four large euro area countries: Germany, France, Italy and the Netherlands. A country-level analysis is useful, as aggregate data might mask substantial heterogeneities across countries that stem from differences in, for example, how countries were impacted by the pandemic and energy crises, the size of their respective fiscal responses to these crises, and the structure of their product and labor markets. Nevertheless, our results show that fiscal policy had a positive and persistent effect on inflation in all four countries that we consider. There are, however, some differences in the magnitudes of the inflationary effects of fiscal policy across countries. While the fiscal contributions to inflation in Germany and the Netherlands are similar to that in the euro area as a whole, they are somewhat smaller in France and Italy. In France, the primary deficit did not increase as much following the pandemic as it did in the other countries. This may have been because the primary deficit was already relatively high before the pandemic, thereby constraining fiscal policy in expanding further. However, it may also have been due to households being relatively less affected by the (energy) crisis in France than in other countries (see Amores et al., 2024), thus calling for a more modest fiscal response. In any case, the more limited fiscal impulse in France might explain why the contribution of fiscal policy to inflation had been relatively small. In Italy, labor market slack was relatively more pronounced than in the rest of the euro area, with the unemployment rate reaching 9.5% in 2021 (compared to the euro area average of 7.8%). Therefore, the Phillips curve may have been much flatter in Italy at the time of the fiscal impulse, causing fiscal shocks to have had a more modest effect on inflation than in the rest of the euro area (and a stronger effect on GDP).

Our findings show that fiscal policy had a sizeable and persistent positive effect on inflation in the euro area during the post-pandemic period. These findings therefore challenge the dominant view that euro area inflation was primarily driven by supply-side factors, whilst assigning a negligible role to fiscal policy. Policymakers should not ignore the potentially significant inflationary impact of fiscal measures and, instead, take note of the importance of the fiscal stance for achieving and maintaining price stability. Moreover, an assessment of the structural differences between countries is crucial to better understand why the fiscal impact on inflation may vary across the euro area.

Amores, A., Basso, H., Bischl, J., De Agostini, P., De Poli, S., Dicarlo, E., Flevotomou, M., Freier, M., Maier, S., García-Miralles, E., Pidkuyko, M., Ricci, M., and Riscado, S. (2024). Inflation, fiscal policy, and inequality: The impact of the post-pandemic price surge and fiscal measures on European households. Review of Income and Wealth, 71(1).

Ascari, G., Bonam, D., and Smadu, A. (2024a). Global supply chain pressures, inflation, and implications for monetary policy. Journal of International Money and Finance, 142(103029).

Ascari, G., Bonam, D., Mori, L. and Smadu, S. (2024b). Fiscal policy and inflation in the euro area. DNB Working Paper No 820.

Banbura, M., Bobeica, E., and Hernández, C. M. (2023). What drives core inflation? The role of supply shocks. ECB Working Paper No. 2023/2875.

di Giovanni, J., Kalemli-Özcan, Ş., Silva, A., and Yıldırım, M. (2022). Global supply chain pressures, international trade, and inflation. NBER Working Paper No. 30240.

di Giovanni, J., Kalemli-Özcan, Ş., Silva, A. and Yıldırım, M. (2023). Quantifying the inflationary impact of fiscal stimulus under supply constraints. In AEA Papers and Proceedings, 113: 76-80.

Ferrante, F., Graves, S., and Iacoviello, M. (2023). The inflationary effects of sectoral reallocation. Journal of Monetary Economics, 140: S64-S81.

Finck, D., and Tillmann, P. (2022). The macroeconomic effects of global supply chain disruptions. BOFIT Discussion Paper No. 14/2022.

Giannone, D. and Primiceri, G. (2024). The drivers of post-pandemic inflation. In Conference Proceedings: Monetary Policy in an era of transformation, ECB Forum on Central Banking.

López, L., Odendahl, F., Párraga, S., and Silgado-Gómez, E. (2024). The pass-through to inflation of gas price shocks. ECB Working Paper No. 2024/2968.

Shapiro, A. (2024). Decomposing supply‐ and demand‐driven inflation. Journal of Money, Credit and Banking.

See, e.g. page 2-3 in Tenreyro, S., Monetary policy in the face of large shocks, 9 June 2023 Speech, Bank of England, and reference therein, or Giles, C., When inflation models go wrong, Financial Times, July 9, 2024.