This policy brief is based on IMF Working Papers (WP/24/174). The views expressed are strictly ours and do not necessarily represent the views of the IMF, its Executive Board, or management.

Abstract

Since the pandemic, the combination of rising debt levels and higher interest rates has rekindled discussions on tensions between fiscal and monetary policies. Based on recent work to introduce a quantitative measure of such tensions, this brief discusses a new concept of “fiscal r-star,” which is the implied real interest rate that stabilizes fiscal dynamics. By computing the difference between monetary r-star and fiscal r-star—referred to as the “fiscal-monetary gap”— this brief shows that fiscal-monetary tensions in advanced economies have risen to historic highs not seen since World War II. Furthermore, larger fiscal-monetary gaps are found to be associated with a host of adverse macroeconomic outcomes, including rising debt and inflation levels, financial repression, and elevated risks of economic and financial crises. Given the tepid growth outlook, growth-enhancing reforms and fiscal consolidation, among other policy adjustments, may be needed to attenuate fiscal-monetary tensions over time.

Advanced economies face challenging fiscal outlooks characterized by rising debt levels and spending pressures. Deficits, which have been increasing since the global financial crisis (GFC), have led to a steep increase in public debt ratios, especially since the COVID-19 pandemic. At the same time, the post-pandemic surge in inflation led to significant tightening of monetary policy.

These developments have rekindled discussions on the implications of monetary policy for fiscal sustainability. Several authors, such as Gita Gopinath and Olivier Blanchard, noted that the possibility of higher-for-longer interest rates could have implications for fiscal sustainability in advanced economies. Others have argued that loose fiscal policy could complicate monetary policy by making it harder for central banks to achieve their inflation targets (see, for example, Bianchi and Melosi, 2022). In short, fiscal policy has implications for monetary policy and vice-versa.

In our recently published IMF Working Paper (Bolhuis et al., 2024), we introduced the concept of “fiscal r-star,” which is the implied real interest rate that would stabilize fiscal dynamics, to better frame these fiscal-monetary dynamics. We argue, through theoretical and empirical analyses, that fiscal r-star and its difference with monetary r-star (what we term the “fiscal-monetary gap”) are useful concepts for measuring fiscal-monetary tensions and that tensions appear to be subsequently associated with a host of adverse macroeconomic outcomes. Based on 140 years of data for 16 advanced economies, we show that fiscal-monetary tensions have risen to historic highs not seen since World War II, which has implications for policy.

Standard (e.g., New Keynesian) macroeconomic models assume that the fiscal authority adjusts primary balances (i.e., fiscal deficits and surpluses net of interest expense) to stabilize debt levels over time. In these frameworks, the trend growth rate and real interest rate on the existing debt stock are assumed to be exogenously determined. As we show in our paper, however, fiscal policy has become increasingly unresponsive to higher debt levels. Therefore, the primary balance may not always adjust to stabilize debt levels.

It is thus useful to treat the primary balance path as given and back out an implied real interest rate that would stabilize the debt level. This real interest rate is known as “fiscal r-star.” More formally, fiscal r-star is the real interest rate required to achieve a stable ratio of debt-to-GDP for a given debt stock and target debt level, inflation target, trend growth rate, and constant primary balance path. It can also be interpreted as the real discount rate required for the private sector to absorb the current stock of government debt.

Using standard macroeconomic frameworks, including the IS and Phillips Curves, it is possible to compare fiscal and monetary r-star and analyze how differences in these variables could impact debt accumulation and inflation. In so doing, fiscal r-star helps frame fiscal and monetary policy interactions, goals, and conflicts.

Our framework predicts that when monetary r-star is greater than fiscal r-star (i.e., when there is a positive “fiscal-monetary gap”), one of four outcomes (or a combination of them) should occur. First, when neither the fiscal nor monetary authority changes its stance, debt will grow. Second, if the monetary authority accommodates fiscal policy by lowering the monetary policy real interest rate for a given monetary r-star, inflation will rise above target. Third, a positive fiscal-monetary gap can also be closed by fiscal consolidation. Fourth, the fiscal authority can lower the spread between the real effective interest rate on government debt and the real monetary policy rate.#f1 This reduction can be achieved through several factors, such as financial repression (where there are a mix of official and unofficial taxes on savings to help drive down government borrowing costs) or through changing the mix of debt issuance, such as by lowering the term premia of the debt stock by issuing shorter maturity debt.

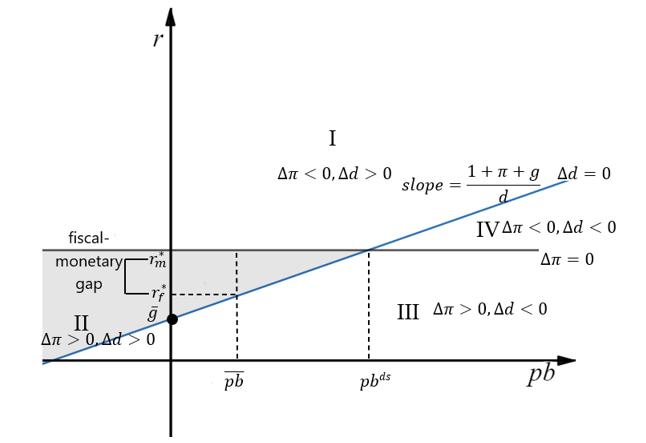

These dynamics can be expressed graphically (Figure 1). First, there is a balanced debt accumulation schedule (where the change in the debt ratio is zero), which is a positive function between real interest rates and the primary balance. This schedule can be thought of as the debt stabilizing real interest rate for a given level of the primary balance. The intuition of this curve is that as the real interest rate rises, the primary balance required to maintain an unchanged debt level goes up. The second, flat schedule follows from the theoretical treatment of the standard IS and Phillips curves and represents the exogenously given real interest rate at which inflation is stable (monetary r-star).

Figure 1. Phase Diagram of Fiscal-Monetary Dynamics

Source: Authors.

The phase diagram yields four areas, which give intuition about inflation and debt dynamics based on different real interest rate and primary balance combinations. Area I indicates combinations of the real interest rate and primary balance where inflation is falling while debt accumulation is positive. Area II shows combinations of the real interest rate and primary balance where both the debt ratio and inflation are growing. Area III shows combinations of the primary balance and real interest rate where inflation is rising while the debt ratio is falling. And finally, area IV indicates where both inflation and debt are falling.

Different monetary and fiscal r-star combinations can be applied to the phase diagram, which, combined with current levels of the primary balance, provide intuition for fiscal-monetary tensions. As is shown in Figure 1, for a given primary balance (p͞b), prevailing real interest rates would need to be equal to fiscal r-star to stabilize debt. If the monetary and fiscal authorities could indeed engineer an effective fiscal financing cost of such that the monetary policy rate is less than monetary r-star, then it should be expected that this primary balance level would lead to an increase in inflation but without an increase in the debt stock. If the real interest rate faced by the fiscal authority were greater than the given level of fiscal r-star, then debt would increase along with inflation (provided the monetary policy rate were less than monetary r-star), such that inflation and debt stocks would continue to rise. These challenges become more acute as the fiscal and monetary authorities move further to the left on the phase diagram where the locus of region II grows.

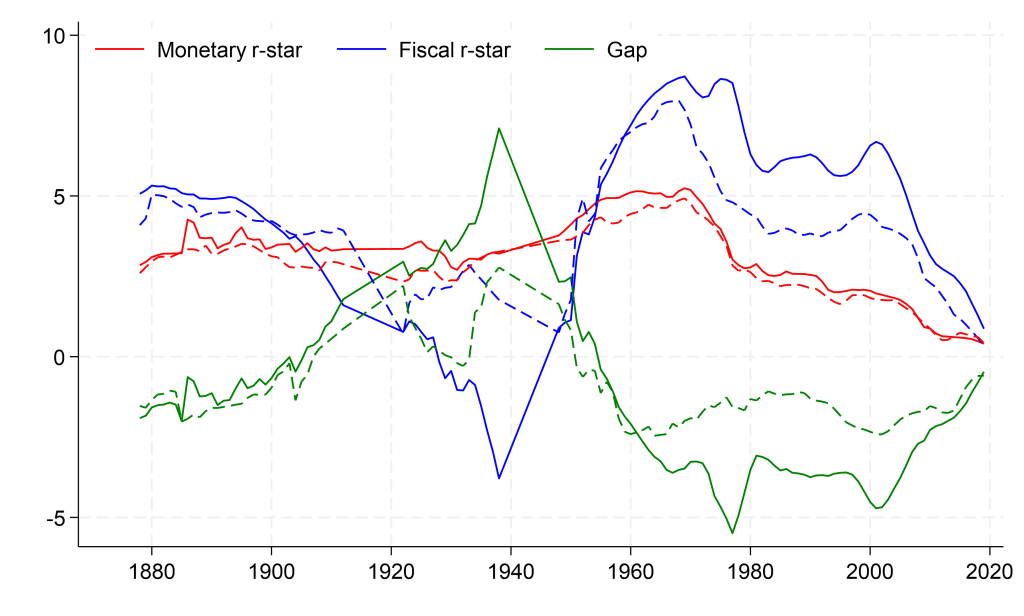

We then estimate fiscal r-star and the fiscal-monetary gap using data between 1878 and 2020 for 16 advanced economies. The estimation results of fiscal r-star and the fiscal-monetary gap are presented in Figure 2 and offer several insights. First, the fiscal-monetary gap peaked during World War II amid war-era fiscal strains. Second, the fiscal-monetary gap in 2020 is the highest measured since the early 1950s, when AEs were dealing with the significant debt overhang from World War II. The post-war boom and demobilization reduced the gap, which hit a historic low in the mid-1970s. Third, after historic lows in the 1970s, the gap remained low and relatively constant from the early 1980s through the mid-2000s, due primarily to the decline in monetary r-star after the early 1980s disinflation. Fourth, and most relevant to current policymaking, the fiscal-monetary gap has been on an upward trajectory since the mid-2000s, currently reaching highs not seen since World War II.#f2

Figure 2. Historical Estimates of Fiscal R-Star and the Fiscal-Monetary Gap

Note: Dashed lines represent medians of samples, while solid lines represent unweighted means.

Source: Jorda et al. (2017) and authors’ calculations.

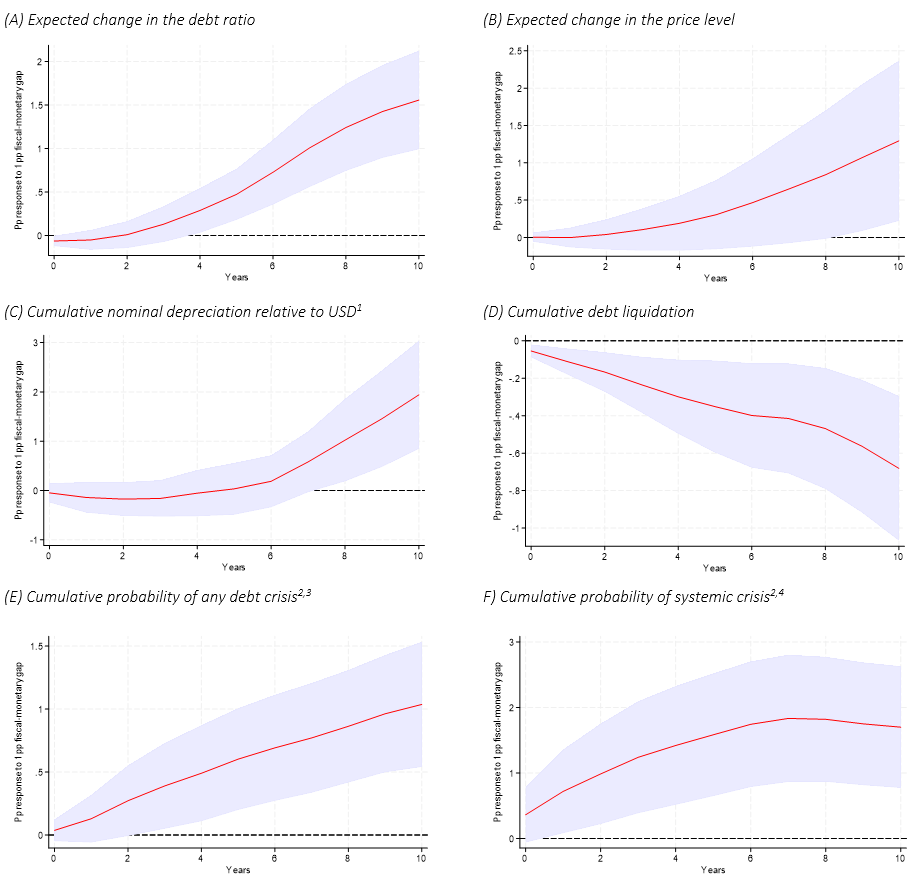

We also investigated the relationships between fiscal r-star and the fiscal-monetary gap and selected macroeconomic outcomes. Our empirical strategy exploits variation in the fiscal-monetary gap across time and countries and links this variation to subsequent changes in macroeconomic outcomes, asset prices, and the probability of different types of crises. The main results in the form of cumulative impulse responses are presented in Figure 3. We find that a rise in the fiscal-monetary gap is associated with a rising debt ratio, higher price level, weaker exchange rates, and fiscal consolidation. A higher fiscal-monetary gap also predicts liquidation of government debt, which is a symptom of financial repression.#f3

These results are consistent with asset price-related impulse responses. A higher fiscal-monetary gap is associated with lower returns on bonds and cash, which is consistent with the results regarding the greater propensity to engage in debt liquidation. An increase in the fiscal-monetary gap tends to be associated with a greater probability of economic crises as well.

Figure 3. Shocks to the Fiscal-Monetary Gap and Selected Macroeconomic Indicators

1 USA not included in sample. Units expressed in foreign currency units per 1 unit USD.

2 Expected difference in cumulative probability of crisis within time window due to a 1 p.p. increase in the fiscal-monetary gap.

3 Debt crisis if either in domestic or external default according to data by Carmen Reinhart.

4 Definitions from same dataset. A systemic crisis is defined following Caprio et al. (2005), who characterize modern systemic crises as “those episodes where there are bank runs, a significant share of non-performing assets, bank liquidations, and large-scale policy intervention to support banks” (Reinhart and Rogoff, 2014).

Source: Authors’ calculations

Fiscal r-star and the fiscal-monetary gap being at historic levels today could present difficult policy tradeoffs. What are the implications, and what can be done?

Tighter fiscal policy can raise fiscal r-star and reduce tensions. However, achieving lasting consolidation may be hampered by political economy constraints. Specifically, many advanced economies may lack the sociopolitical consensus necessary to undertake a sustained consolidation effort barring an acute fiscal crisis.

Policymakers could be tempted to pressure central banks to accommodate additional fiscal spending and abandon their inflation targets given elevated tensions. Therefore, continued efforts to safeguard central bank independence could be needed. In fact, preserving central bank independence may even have fiscal dividends amid elevated tensions: by anchoring inflation expectations and preserving credibility, prudent monetary policy can contribute to reducing the long-term inflation risk premia on government debt.

Fiscal authorities may pursue financial repression to reduce the effective cost of government debt. However, such an approach could have adverse consequences for savers and financial institutions and could disrupt credit to the private sector, hampering growth.

Going forward, the extent of fiscal-monetary tensions will likely depend, in part, on the speed of fiscal adjustment and trajectory of monetary r-star. The impact of fiscal-monetary tensions could also depend on the global demand and supply for safe assets.

Overall, the path of both fiscal r-star and monetary r-star is uncertain. In such an environment, and when faced with tectonic macroeconomic shifts such as geoeconomic fragmentation, the climate transition, aging societies, and artificial intelligence, prudent risk management would dictate that the risk of acting too soon to curb tensions is far outweighed by the risks of inaction. Policymakers should keep these lessons in mind as they navigate policy using fiscal and monetary r-stars.

Alvarez, F., M. Beraja, M. Gonzalez-Rozada, P. A. Neumeyer (2018). From Hyperinflation to Stable Prices: Argentina’s

Bianchi, Francesco and Leonardo Melosi. 2022. “Inflation as a fiscal limit,” Federal Reserve Bank of Chicago Working Paper, No. 2022-37.

Caprio, Gerard, Daniela Klingebiel, Luc Laeven, and Guillermo Noguera (2005), “Banking Crisis Database”, In “Systemic Financial Crises: Containment and Resolution”, edited by Patrick Honohan and Luc Laeven, 307– 40. Cambridge: Cambridge University Press.

Blanchard, Olivier. 2023. “If markets are right about long real rates, public debt ratios will increase for some time. We must make sure that they do not explode”. Washington, DC: Peterson Institute for International Economics.

Bolhuis, Marijn A., Jakree Koosakul, and Neil Shenai. 2024. “Fiscal R-Star: Fiscal-Monetary Tensions and Implications for Policy”, IMF Working Paper 24/174.

Caprio, Gerard, Daniela Klingebiel, Luc Laeven, and Guillermo Noguera (2005), “Banking Crisis Database”, In “Systemic Financial Crises: Containment and Resolution”, edited by Patrick Honohan and Luc Laeven, 307– 40. Cambridge: Cambridge University Press.

Gopinath, Gita. 2023. “Gita Gopinath’s Introductory Remarks for the Conference ‘Fiscal Policy in an Era of High Debt’”, Washington, DC.

Jordà, Òscar, Moritz Schularick, and Alan M. Taylor. 2017. “Macrofinancial History and the New Business Cycle Facts”, in NBER Macroeconomics Annual 2016, volume 31, edited by Martin Eichenbaum and Jonathan A. Parker. Chicago: University of Chicago Press.

Reinhart, Carmen M. and M. Belen Sbrancia. 2015. “The Liquidation of Government Debt” IMF Working Papers no. 15/7.

Reinhart, Carmen M., and Kenneth S. Rogoff. 2014. “Recovery from financial crises: Evidence from 100 episodes”, American Economic Review, 104(5), 50-55.

For simplicity, we assume in subsequent sections that the real effective interest rate on government debt equals the real policy rate. In the presence of a positive wedge between the two (due to, inter-alia, liquidity or term premia) the captured fiscal-monetary gap would be higher. This assumption implies that the fiscal-monetary gap is likely a lower bound for fiscal-monetary tensions.

The sample period was extended based on a more up to date dataset (the IMF’s World Economic Outlook database) to show that tensions continued to rise between 2021 and 2023.

Debt liquidation can be thought of as the change in the debt ratio that results from the real interest rate being below monetary r-star and inflation being above target (Reinhart & Sbrancia, 2015).