This Policy Brief is based on “The Economic Cost of the Carbon Tax”, Working Paper 156, Amundi Asset Management S.A.S. The opinions expressed in this research are those of the authors and are not meant to represent the opinions or official positions of Amundi Asset Management.

The choice of the optimal environmental policy is an important question in the current climate change context. While the carbon tax was the preferred policy of economists in the 1970s and 1980s, governments have implemented both quantity-based policies, such as emissions trading schemes, and price-based policies, such as fossil fuel taxes and renewable energy subsidies. The implementation of a general carbon tax on greenhouse gas emissions is currently not very common, and a low carbon price is generally retained. However, with the development of the EU Carbon Border Adjustment Mechanism, the Fit for 55 package and the need to achieve a low-carbon economy by 2050 if we are to keep the temperature anomaly below 1.5°C, the issue of carbon taxes is back on the agenda and the old debate of price vs. quantity regulation is reopened.

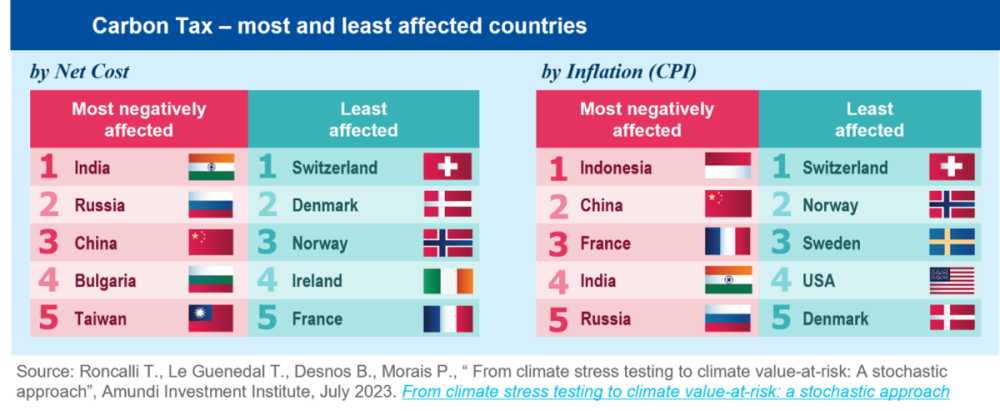

The primary objective of a tax is to reduce greenhouse gas emissions, particularly carbon emissions. By putting a price on carbon, the tax provides a financial incentive for businesses and individuals to adopt cleaner technologies, improve energy efficiency and switch to alternative low-carbon products. We estimate that a global carbon tax of $100 per tonne of CO2 emitted would, in total, be the equivalent of 5.01% of global GDP. However, this cost would be partially offset by a 2.83% increase in government tax revenues, leading to a net economic cost of 2.18% (of global GDP). The region most affected would be Emerging Markets, starting with India, followed by Russia, China, Bulgaria and Taiwan. We also note that the introduction of a $100 carbon tax could lead to an inflation shock, as the carbon tax would be passed from the producer to the rest of the supply chain: +4.08% for the producer price index and +3.53% in terms of the consumer price index.

Governments would earn revenue directly equivalent to the cost of the carbon tax, but the net economic cost is the indirect cost that results from passing the tax down the supply chain to the consumer. The amount passed on depends on factors, such as the market structure (e.g. monopolistic, competitive) and the price elasticities (i.e. sensitivities) of supply and demand. For example, economists assume that the pass-through rate for energy products is close to 100%, meaning that a carbon tax will generally be borne by end consumers because the demand for energy products is highly inelastic. In the above example, the net cost of 2.18% of global GDP was the amount passed through but within the 5.01% total figure, 0.93% was paid by the producers and 4.08% by the supply chain and consumers. This meant that only 20% of the carbon tax was borne by the producers.

‘A carbon tax would have a significant impact on growth and inflation, with Emerging Markets particularly affected.’

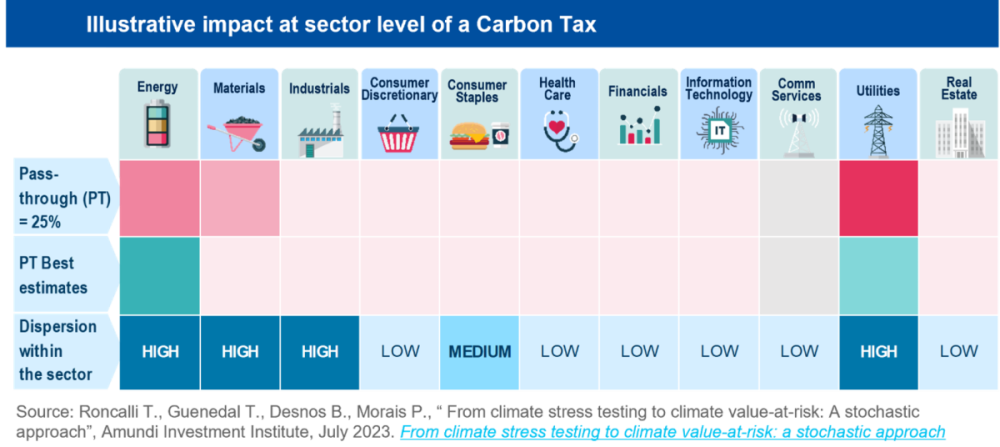

There are big differences between sectors, depending on the impact of the tax on each sector’s cost of supply and downstream supply chain. A sector near the top of its global value chain receives few costs from its suppliers.

Hence, it can pass on more costs than it receives. Conversely, if a sector is at the bottom of its global value chain, it receives a high number of costs from its suppliers due to a snowball effect. Thus, it can only pass on fewer costs than it receives. Our analysis finds (see chart) that when the pass-through rate is low (25% or less), the energy and utilities sectors are most affected. However, a realistic assumption (best estimates) for a high pass-through rate, given their positions at the top of their global value chains, finds that their earnings could be boosted by a carbon tax. In contrast, the consumer discretionary and consumer staples sectors would see their earnings notably reduced given their high dependency on other sectors. It is important to analyse the upstream and downstream supply chains in depth to understand how a carbon tax affects sectors differently.

The impact of a carbon tax not only varies across sectors, but also exhibits a wide dispersion of its effect within sectors. In particular, the tax effect appears relatively homogeneous within the communication services, financials, health care, technology and real estate sectors, while there is a higher dispersion among materials and industrials companies.

A carbon tax is aimed at changing demand in order to change supply. However, if demand is almost inelastic, a tax may only result in an inflationary shock and a net economic cost to society. To be effective, it must be accompanied by green electricity supply policies aimed at growing the number of green power projects as well as offering subsidies to the utility sector to encourage investment. Also, it would be necessary for taxation to be coordinated across countries. Thus, a regional carbon tax at the European Union level would be an option. Our research showed that such a tax would result in more than 95% of the costs falling on the countries within the Union, while the impact outside it would be relatively small. A Carbon Border Adjustment Mechanism to prohibit production from moving to countries outside the Union with lower carbon prices has been set up. Importantly, a carbon tax can have a social impact with low-income households potentially more affected than high-income ones (see Amundi’s research). Therefore, the redistribution of government revenues from carbon taxation between green investment and social aid must be addressed to ensure carbon taxation is effective.