The views expressed in this paper are those of the authors and do not necessarily reflect those of the Bank of Greece.

Abstract

Food inflation has become a significant economic concern across the eurozone, including Greece. In 2023, food inflation in Greece and most euro area countries exceeded headline inflation by more than double. While headline inflation has shown signs of easing, food inflation remains more entrenched, declining at a much slower rate. This persistence places an especially heavy burden on lower-income groups, who allocate a greater share of their disposable income to food, thereby deepening household inequalities. An empirical model on food inflation persistence in Greece and the eurozone finds that headline inflation is as persistent as food inflation – contrary to public perceptions. Furthermore, there is evidence that food inflation persistence in Greece is higher than in the euro area only for the last sub-period (2021-2024), i.e. during the inflation crisis. The same finding holds both for unprocessed and processed food.

The rate at which food prices change, along with the factors driving it and its broader impacts, has long been a central focus in inflation research. Food inflation, the sustained increase in food prices over time, has become a significant economic concern across the Eurozone, including Greece. Examining this phenomenon has become even more pressing as, in 2023, food inflation in Greece and most euro area countries exceeded headline inflation by more than double. While headline inflation has shown signs of easing, food inflation remains more entrenched, declining at a much slower rate. This persistence places an especially heavy burden on lower-income groups, who allocate a greater share of their disposable income to food, thereby deepening household inequalities.

While inflation across various sectors affects consumer spending power and economic stability, food inflation has a particularly pervasive impact due to the essential nature of food consumption. Food inflation in the Eurozone has lingered due to factors such as rising production costs, supply chain disruptions, climate change, and geopolitical factors (Kuik et al., 2024).

Inflation persistence can be defined as the tendency of inflation to converge slowly towards the central bank’s inflation objective, following changes in the objective or various other shocks (Gadzinski and Orlandi, 2004). Its persistence in Greece and the broader Eurozone presents challenges to economic stability, social welfare, and policy making. The persistence of food inflation affects not only Greece but also the broader Eurozone, as it complicates the ECB’s monetary policy objectives. Although food inflation is only one part of the harmonised consumer price index (HICP) that the ECB monitors, its outsized impact on consumer welfare makes it an important component of the overall inflation picture.

As for inflation persistence consequences, the persistent food inflation reduces the purchasing power of households and this reduction disproportionately affects lower-income households, which allocate a larger share of their income to essential goods like food. Persistently high food inflation can thus worsen inequality and poverty rates, which are already high due to Greece’s economic struggles over the past decade. Second, food inflation persistence can lead to social discontent, particularly if wage growth does not keep pace with rising living costs. Persistently high food prices may drive social unrest and anti-government sentiment, adding political instability to the already fragile economic situation. Third, persistent food inflation demands greater government spending on social welfare programs and the governments may face pressure to increase subsidies, support low-income households, and mitigate the impact of high food prices, which may further strain public finances.

The main purpose of this paper is to provide a narrative of food inflation developments and investigate the persistence of food inflation in Greece compared to other countries in the euro area. In particular: In Section 2, the drivers of food inflation in Greece and eurozone are analysed. Section 3 presents the developments of food inflation in Greece, while in Section 4 a comparative analysis of food inflation in Greece compared with the euro area countries is provided. In Section 5, an empirical model on food inflation persistence in Greece and eurozone is estimated and some empirical results are provided. One of the most important findings of our analysis is that headline inflation is as persistent as food inflation contrarily to what is discussed in the public discourse. Furthermore, there is evidence that food inflation persistence in Greece is higher than in the euro area only for the last sub-period (2021-2024), i.e. during the inflationary crisis. The same finding holds both for unprocessed and processed food. Even though inflation persistence is high both in Greece and the Eurozone, food inflation has become more persistent in Greece. Finally, Section 6 summarizes the conclusions and provides some policy recommendations to address the persistence of food inflation.

Since food inflation in Greece remains in higher levels than headline inflation, the exploration of food inflation persistence is a topic of high interest. Although headline inflation is decelerating, food inflation seems to be more persistent and is falling at a significantly lower pace. Persistent food inflation implies wider inequalities among households as it causes a disproportionate burden on lower income households which spend a higher share of their income on food (Bragoudakis, 2018).

In general, strong inflation persistence is related to whether prices are sticky, remaining stable for long periods or continuously increase. Schwartzman (2023) distinguishes the sources of strong inflation persistence into intrinsic and extrinsic. One of the intrinsic sources is the competition among businesses in raising prices. Typically, businesses react similarly to changes in the economic environment, resulting in successive price increases, leading to high inflation persistence. Continuously rising prices also lead workers to demand higher wages, increasing the persistence of unit labour costs (Gali and Gertler, 1999), ultimately resulting in even higher prices of final goods.

Expectations about future inflation and the credibility of the central bank also play a significant role in shaping high inflation persistence. If the central bank lacks credibility regarding the long-term inflation target, businesses will expect a higher rate of inflation, directly resulting in higher price increases and high inflation persistence. Sequential or persistent supply shocks can also contribute to maintaining high inflation rates and thus greater persistence. For example, in the period following the pandemic and the supply disruptions caused, the faster recovery of demand compared to supply led to price increases. This period was followed by the war in Ukraine, resulting in a new supply shock due to rising prices of raw materials and fuels. The overall result was to reinforce the rise in prices and thus the persistence of inflation.

On the other hand, Schwartzman identifies two exogenous causes of high inflation persistence. The first concerns the fiscal policy pursued by a government. If fiscal policy is expansionary, then aggregate demand increases, consequently raising prices and inflationary pressures. Additionally, labor market conditions can lead to a persistent rise in prices. A labor market with high tightness creates upward pressure on wages, mainly due to insufficient labor supply, ultimately leading to high inflation for an extended period.

According to the Eurostat classification, food items are split into two main groups, i.e. unprocessed and processed food. Unprocessed food prices in Greece rallied in 2023 probably due to large increases in energy prices (especially oil and gas) and fertilisers (ECB, 2023). Further, an additional upward pressure on unprocessed food prices was caused by increases in wage costs, which were affected by wage increases especially in lower salary bands (Bank of Greece, 2024). As for processed food prices, the main determinants are producer prices and international commodity prices. As noted above, the war in Ukraine is estimated to have further pushed upwards international food prices, particularly the prices of wheat (Arndt et. al., 2023). Furthermore, the climate crisis and the associated extreme weather phenomena are estimated to cause significant supply disruptions, that initially appeared during the coronavirus pandemic (Vos et al., 2022). Since the climate crisis creates uncertainty about weather forecasts, food prices’ volatility may increase as well.

The term “Food” is used to denote all HICP food-relating items such as food products, non-alcoholic beverages, alcoholic beverages and tobacco, i.e., this term practically covers all items in the first two categories of the Harmonised Index of Consumer Prices (HICP), representing around 25% of the consumption basket in Greece. Food inflation varied in Greece from 1.3% in 2020 to 1.2% in 2021, 9.7% in 2022, 9.9% in 2023 and 3.9% in the first seven months of 2024. The corresponding average food inflation in the euro area stood at 2.3% in 2020, 1.5% in 2021, 9.0% in 2022, 10.9% in 2023 and 3.2% in the first seven months of 2024. In the previous decade (2010-2019), the average food inflation was 1.3% in Greece and 1.8% in the euro area.

Almost all food components surged in 2022 in Greece. Despite the fact that energy inflation started posting deflationary rates as of February 2023, food inflation further increased in 2023. At the same time, though, food inflation embarked on a solid downward path leading to significantly lower annual inflation rates in the first seven months of 2024.

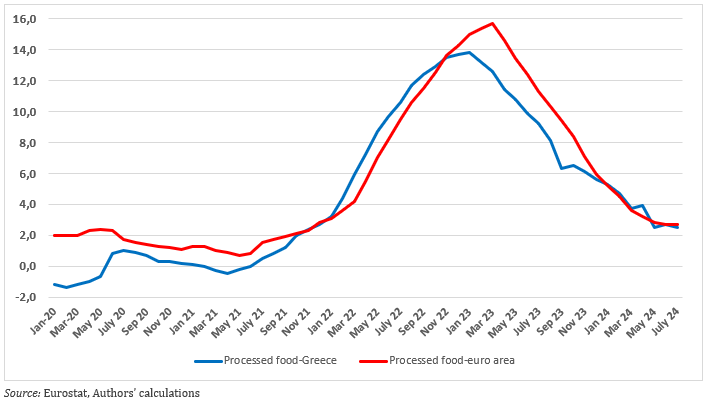

As regards Greece, a substantial part of the processed food component is imported and is thus subject to international price developments. The processed food inflation path shows minor fluctuations, and it generally is quite smooth. Processed food inflation embarked on an upward trajectory in July 2021, it peaked in January 2023 (13.8%) and has since then followed a downward course. As it is largely determined by imported food inflation, it is expected to remain on a disinflationary course in 2024.

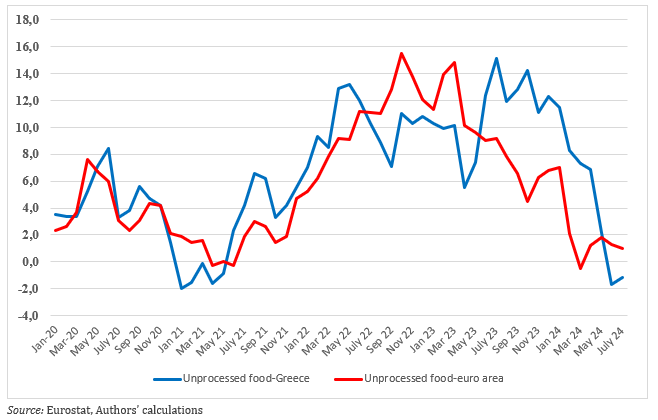

Unprocessed food, which consists of fresh meat, fish, fruit, vegetables and eggs, varies from processed food, as the former largely comprises domestically produced goods, particularly “fresh fruit” and “fresh vegetables”. In contrast with processed food inflation, unprocessed food inflation exhibits intense volatility, which is attributed to the volatile prices of fresh fruit and vegetables, which are heavily dependent on weather conditions. Unprocessed food inflation embarked on an upward trajectory in June 2021; within 2022 it peaked in May (13.2%), while within 2023, after fluctuating strongly for several months, it reached a peak in July (15.1%). During its disinflationary course in 2024 it declined to -1.7% in June 2024 and to -1.2% in July 2024.

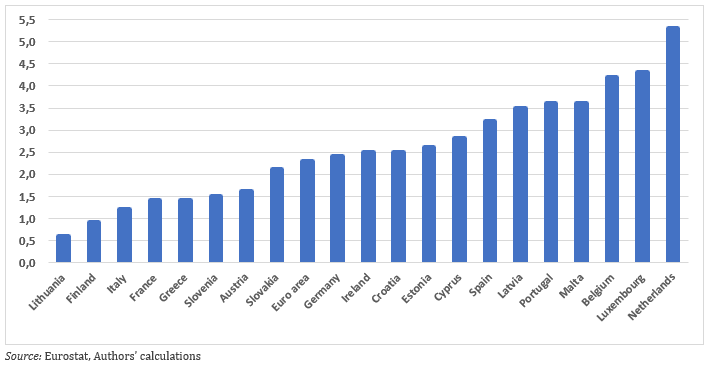

According to the data available for July 2024, food inflation in Greece (including alcoholic beverages and tobacco) dropped to 1.4%, from 4.8% in April and March, moving lower from the European averages (euro area: 2.3%; ΕU-27: 2.3%). Among the euro area countries (see Figure 1), the Netherlands (5.3%), Luxembourg (4.3%) and Belgium (4.2%) registered the highest food inflation levels, while Lithuania (0.6%), Finland (0.9%) and Italy (1.2%) registered the lowest.

Figure 1. Food inflation in the euro area countries

During the period January-July 2024, the processed food component in Greece (including alcoholic beverages and tobacco) was set at 3.6% on average, from 11.5% in the respective period of 2023 (see Figure 2). This index was fairly close to European averages in the first seven-month period of 2024, with the processed food index standing at 3.5% in the euro area and at 3.4% in the EU-27. Following Russia’s invasion of Ukraine in February 2022 and until July 2024, average processed food price increases in Greece were slightly smaller compared to corresponding EU figures (Greek average: 8.5%, euro area average: 9.0%; ΕU-27 average: 9.7%).

Figure 2. Processed food in Greece and the euro area, Jan.2020-July 2024

During the period January-July 2024, the unprocessed food component in Greece was set at 4.5% on average, from 10.1% compared to the respective period of 2023 (see Figure 3). This index was much above the European averages in the first seven-month period of 2024, with the unprocessed food index standing at 1.9% in the euro area and at 1.3% in the EU-27.

Following Russia’s invasion of Ukraine in February 2022 and until May 2023, the rise in unprocessed food prices had been stronger in the euro area and the EU compared to the respective Greek figures (Greece: 9.9%, euro area: 11.6%, EU-27: 13.1%). Since then, these prices decelerated faster in Europe than in Greece, although May 2024 registered a convergence of Greek and euro area prices.

Figure 3. Unprocessed food in Greece and the euro area, Jan.2020-July 2024

In terms of methodology, the measure of inflation persistence, i.e. the inflation persistence parameter, is the sum of autoregressive coefficients based on univariate estimations (see Gadzinski and Orlandi, (2004), Lünnemann and Mathä, (2004) and Levin and Piger, (2004)). High values of the inflation persistence parameter imply slower return of inflation to the long-term average and vice versa.

It should be noted that the model used in the present analysis is not a structural inflation model. Therefore, caution should be applied when interpreting estimation results. The above estimate is based on monthly data on headline and food inflation in Greece and the Eurozone in the period between January 1997 and June 2024. The estimation is rolled over 5-year (60-month) periods while other rolling windows have been tested without affecting the results presented below.

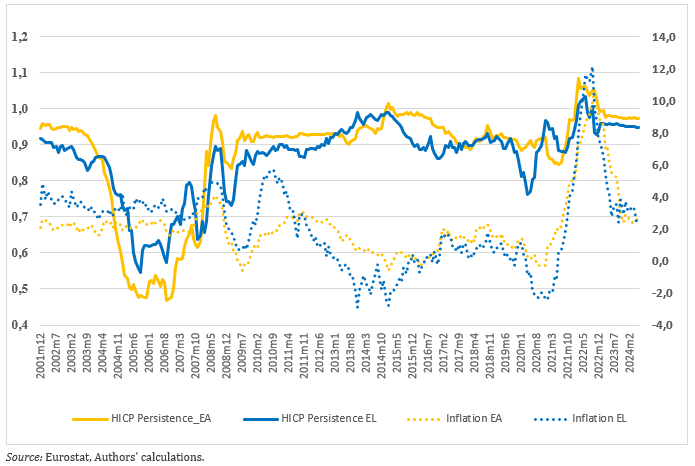

In Figure 4, headline inflation levels and estimated persistence coefficients are presented. According to our findings, Eurozone and Greece inflation rates fluctuated slightly up to 2008. Hence, persistence fell for both Eurozone and Greece to historically low levels. Since the onset of the financial crisis, inflation rates fell and consequently persistence coefficients increased as they were remaining in low levels. This means that inflation rates were expected to remain at low levels for a long time. This was almost the case up to the outbreak of the pandemic at early 2020, when inflation rates fell (more in Greece compared to the Eurozone) due to the restrictive measures applied against the coronavirus spread. Therefore, persistence coefficients slightly fell. While economies started to recover, inflation rates began to increase as the supply increase was larger than that of aggregate demand. Hence, prices, inflation and inflation persistence started to increase. The inflation in Greece increased more rapidly compared to the Eurozone, but headline inflation persistence was estimated to be higher in the latter.

Figure 4. Headline inflation levels (right axis) and estimated persistence coefficients (left axis) in Greece and Eurozone, 2001m12 – 2024m06.

Since 2023 and as inflation rates began to deescalate, there are decreases in the estimated persistence coefficients. However, these coefficients have been stabilized in high levels (higher than 0.90). As a result, headline inflation is estimated to be persistent not only in Greece but also in the Eurozone despite its decreasing trend.

All in all, high persistence coefficients are estimated for headline inflation since 2007 except for the pandemic period. This finding means that headline inflation both in the Eurozone and Greece was stable either in low or high levels and any destabilization has been caused by external shocks like the pandemic or the war in Ukraine. As far as the comparison between Greece and Eurozone, inflation persistence was higher in Greece only before the onset of the financial crisis. Since then, inflation is more persistent in Eurozone than in Greece, but persistent coefficients remain high in both cases.

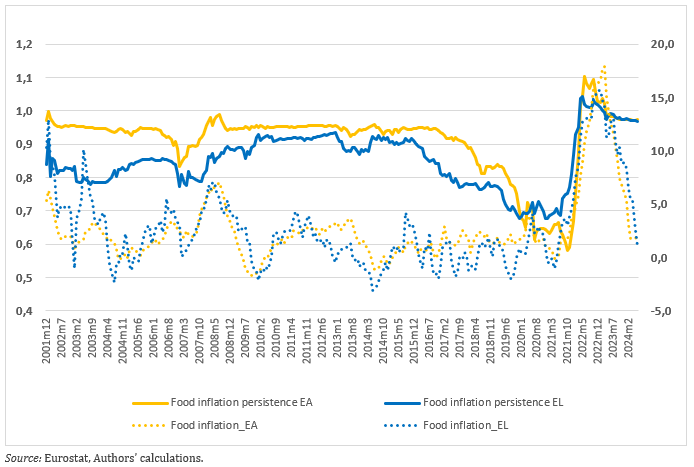

Food inflation is much more volatile than headline inflation both in the euro area and Greece as food inflation determinants are characterised by strong volatility. In early 2000s, food inflation in Greece started to decline and converged with that of the eurozone. Then, fluctuations of food inflation in Greece are very similar with those observed for the euro area. As far as food inflation persistence, food inflation was more persistent than headline inflation. This has been reversed since 2013 as headline inflation stabilized in low levels and the corresponding persistence was higher. Food inflation persistence remained lower up to 2021 when it increased dramatically and took temporarily values higher than 1, indicating that food inflation was at risk of embarking on a destabilising track, risking further increases in the future. This sharp increase can be attributed to the broad range of food inflation determinants as presented in the previous section. However, an overall finding is that food inflation persistence is not higher than headline inflation persistence contrary to what is discussed in the public discourse related to food prices (see Figure 5).

Food inflation determinants are characterised by strong volatility and, thus, lower persistence. However, during the 2021-2023 period, the faster recovery of demand after the pandemic and the war in Ukraine had a significant impact on these determinants. The cumulative impact of these factors possibly explains the increased estimated persistence of food inflation. Taking also into account the possible uncertainties related to climate change and the subsequent variability of food prices, and strong food inflation persistence, food inflation is not expected to significantly decline in the short-term.

Figure 5. Food inflation levels (right axis) and estimated persistence coefficients (left axis) in Greece and Eurozone, 2001m12 – 2024m06.

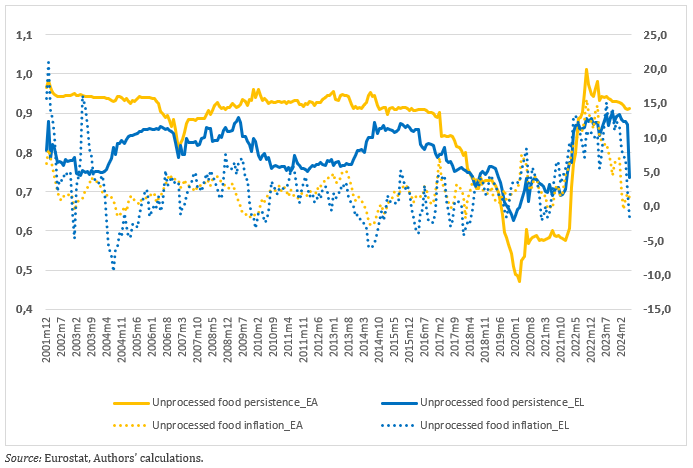

A critical question behind the findings above is what is the source of high food inflation: unprocessed food or processed food? As discussed above, ‘food’ includes unprocessed and processed food. Firstly, the results of the persistence analysis for the unprocessed food are presented (see Figure 6). Unprocessed food prices and, thus unprocessed food inflation, are much more volatile than those of processed food. The reason behind that is the higher volatility of fresh fruits and vegetables’ prices which are strongly related to weather conditions and extreme weather phenomena. Unprocessed food inflation presents higher volatility both upwards and downwards in Greece than in the euro area. Thus, unprocessed food inflation in the euro area was more persistent as shown in Figure 6.

Figure 6. Unprocessed food inflation levels (right axis) and estimated persistence coefficients (left axis) in Greece and Eurozone, 2001m12 – 2024m06.

This persistence in the euro area collapsed near 0.5 in early 2020 as prices started to decrease due to the pandemic shock, while the corresponding drop in Greece was much smaller probably as supply shock was not as strong as in the euro area. But as inflation started to increase estimated persistence coefficients increased as well, while a very interesting finding was that persistence in the euro area exceeded that in Greece in early 2022.

According to the latest available data, the persistence coefficient for the euro area is estimated around 0.9 with a slight downward trend. This estimation indicates that unprocessed food inflation in the Eurozone is expected to decline at a slow pace in the next months. This finding is probably linked to the uncertainties caused by weather conditions leading to sticky high prices. On the contrary, persistence is estimated to decline more dramatically in Greece. This finding is probably linked to higher volatility of unprocessed food prices in Greece.

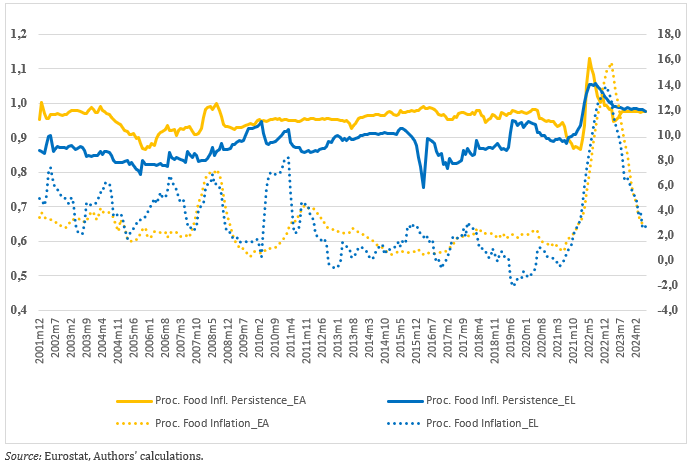

On the other hand, processed food inflation followed a different path. Both in Greece and the Eurozone, processed food inflation is estimated to be more persistent than that of unprocessed food over time (See Figure 7). Up to 2021, when the inflationary crisis started, processed food inflation was more persistent in the Eurozone than in Greece. Since then, this has reversed and processed food inflation is estimated to be slightly more persistent in Greece. A spike in inflation persistence is observed also for processed food during the inflationary crisis of 2021. This spike might be attributed to the successive shocks as described above. These shocks dramatically increased energy and food commodities’ prices leading inflation to unprecedented levels. Since energy and food commodities are the main inputs, prices for processed food increased as well.

Figure 7. Processed food inflation levels (right axis) and estimated persistence coefficients (left axis) in Greece and Eurozone, 2001m12 – 2024m06.

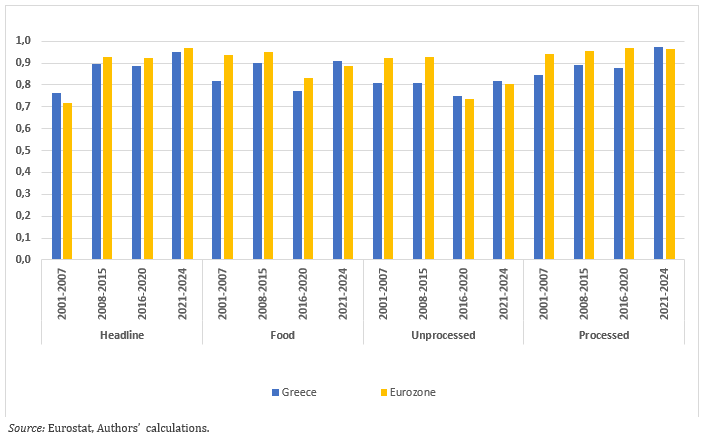

One of the most important findings of our analysis is that headline inflation is as persistent as food inflation contrarily to what is discussed in the public discourse. However, persistence levels in Greece have increased since the onset of the inflationary crisis started in 2021. Separating the 2001-2024 period under analysis into four sub-periods (as shown in Figure 8), we obtain that inflation persistence is higher in the Eurozone in all categories and in almost all sub-periods. However, we observe that food inflation persistence in Greece is higher than in the euro area only for the last sub-period (2021-2024), i.e. during the inflationary crisis. The same finding holds both for unprocessed and processed food. Even though inflation persistence is high both in Greece and the Eurozone, food inflation has become more persistent in Greece.

As discussed previously, there are plenty of factors that affect food prices, like energy, wheat and other raw materials, fertilisers, climate change etc. Contemporaneous negative shocks in these factors will increase inflation persistence and affect the speed of decline in the future. A possible explanation for the finding above is that food markets in Greece are more sensitive to the aforementioned factors. Hence, it is expected that food inflation in Greece will decline at a slower pace than in the Eurozone.

Figure 8. Average estimated persistence coefficients in Greece and Eurozone, 2001 – 2024.

Food inflation and its persistence are a subject of much research as food inflation grew strongly in 2022 and showed remarkable persistence in 2023 despite the decline in energy prices and the deceleration that recorded in the first months of 2024. These developments arose an important question related to the pace of food inflation deceleration and this question is linked to inflation persistence.

In this paper, we study food inflation persistence in Greece, comparing with the Eurozone and focusing on both food components, i.e. processed and unprocessed food. After a long period of low inflation rates, both Greece and the Eurozone experienced an inflationary crisis in the aftermath of the coronavirus pandemic. In the context of the present analysis, it is found that high inflation rates were recorded both in Greece and the Eurozone. Headline inflation was estimated to be persistent not only in Greece but also in the Eurozone, while the persistence coefficient is estimated to be higher in the latter.

Focusing on food items, food inflation reached unprecedented levels in Greece and the Eurozone as well. However, food inflation started to decline since 2023 but it remains higher than headline inflation. The cumulative impact of food price determinants is estimated to lead into high food inflation persistence. However, food inflation persistence is not higher than that of headline inflation. These results indicate that food inflation should not be expected to decelerate rapidly despite the last months’ developments. But the same finding is also obtained for headline inflation.

Unprocessed food prices are more volatile and hence the respective inflation persistence is estimated to be lower than that of processed food. However, unprocessed food inflation persistence is higher in the Eurozone than in Greece. On the other hand, persistence of processed food inflation in Greece is slightly higher than in the Eurozone.

To sum up, high inflation persistence is not an exclusively Greek case as headline inflation is also persistent in the Eurozone. The same finding holds also for food items. Significant discrepancies between processed and unprocessed food are estimated although high persistence coefficients are obtained. Hence, we can conclude that inflation rates are expected to decelerate at a slow pace in the next months and the same is expected to happen for food items.

To address the persistence of food inflation, coordinated policy measures are essential across the Eurozone. First, the euro area countries should aim to strengthen the resilience of food supply chains. This might involve diversifying trade partners, investing in local production, and enhancing transportation and storage infrastructure to minimize disruptions and ensure a steady supply of essential goods. Second, targeted social support programs, such as cash transfers, food subsidies, and other welfare programs, could provide support to vulnerable households (Headey and Martin, 2016). Third, investing in sustainable agricultural practices can help counteract the effects of climate change on food production. For example, euro area countries and especially Greece could benefit from EU funding for sustainable agricultural practices that improve productivity while reducing the vulnerability of food production to climate variability. Finally, given that food inflation is a Eurozone-wide phenomenon, coordinated fiscal and monetary policies are essential. Thus, well-coordinated macroeconomic policies in euro-area economies are essential for stabilizing food inflation (Sami and Makun, 2024). The ECB could explore measures specifically aimed at managing food inflation without compromising growth (Bhattacharya and Jain, 2020). Furthermore, governments of euro area countries can consider collective funding mechanisms to support the agricultural sector and vulnerable populations.

Arndt, C., Χ. Diao, P. Dorosh, K. Pauw and Thurlow, J., 2023. The Ukraine war and rising commodity prices: Implications for developing countries, Global Food Security, 36, 100680.

Bank of Greece, 2024. Evaluation of the applicable statutory minimum wage and daily wage, 19 February 2024 (in Greek).

Bhattacharya R., and Richa Jain R., 2020. Can monetary policy stabilise food inflation? Evidence from advanced and emerging economies, Economic Modelling Volume 89, July 2020, pp 122-141.

Bragoudakis, Z., 2018. Are price adjustments asymmetric in basic food categories? The case of the Greek food market, Bank of Greece, Economic Bulletin, 47.

ECB, 2023. Broad Macroeconomic Projection Exercise, June 2023.

Gadzinski, G. and Fabrice O., 2004. Inflation persistence in the European Union, the euro area, and the United States, Working Paper Series 414, European Central Bank.

Galı, J., and Gertler, M., 1999. Inflation dynamics: A structural econometric analysis. Journal of monetary Economics, 44(2), 195-222.

Headey, D., and Martin, W., 2016. The Impact of Food Prices on Poverty and Food Security. Annual Review of Resource Economics 8 (1), 329-51.

Kuik, F., Lis E., Joan Paredes, and Ieva Rubene, I., 2024. What were the drivers of euro area food price inflation over the last two years?, ECB Economic Bulletin, Issue 2/2024.

Levin, A.T., Piger, J., 2004, “Is Inflation Persistence Intrinsic in Industrial Economies?”, ECB

Working Paper, 334.

Lewis, M., Herron, L.M., Chatfield, M.D., Tan, R.C., Dale, A., Nash, S. and Lee, A.J., 2023. Healthy food prices increased more than the prices of unhealthy options during the COVID-19 pandemic and concurrent challenges to the food system, International Journal of Environmental Research and Public Health, 20(4), 3146.

Lünnemann, P. and Mathä, Τ.Υ., 2004. How persistent is disaggregate inflation? An analysis across EU15 countries and HICP sub-indices, European Central Bank, Working Paper Series, No. 415.

Sami, J., and Keshmeer Makun, K., 2024. Food Inflation and Monetary Policy in Emerging Economies, Journal of Asian Economics.

Schwartzman, F., 2023. Untangling Persistent Inflation: Understanding the Factors at Work, Federal Reserve Bank of Richmond, Economic Brief, September 2023, No. 23-31.

Vos, R., Glauber, J.W., Hernández, M.A. and Laborde Debucquet, D., 2022. COVID-19 and food inflation scares, IN McDermott, J. and J. Swinnen (eds), COVID-19 & Global Food Security: Two years later, International Food Policy Research Institute, USA, pp. 64-72.