This policy brief is based on “For whom the bill tolls: redistributive consequences of a monetary-fiscal stimulus”, ECB Working Paper Series, No. 2998. The views expressed are those of the authors and do not necessarily reflect those of the ECB.

Abstract

During the COVID-19 pandemic, governments in the euro area sharply increased spending while the European Central Bank eased financing conditions. We use this episode to assess how such a concerted monetary-fiscal stimulus redistributes welfare between various age cohorts. Our assessment involves not only the income side of household balance sheets (mainly direct effects of transfers) but also the more obscure financing side that, to a substantial degree, occurred via indirect effects (with a prominent role of the inflation tax). Using a quantitative life-cycle model, and assuming that the deficit was partly unfunded by future taxes, we document that young households benefited from the stimulus, while middle-aged and older agents mainly paid the bill. Crucially, most welfare redistribution was due to indirect effects related to macroeconomic adjustment that resulted from the stimulus. As a consequence, even though all age cohorts received significant fiscal transfers, the welfare of some actually decreased.

The COVID-19 pandemic triggered an unprecedented economic and social crisis. Starting in early 2020, economies worldwide faced simultaneous health and financial emergencies, nearly halting regular economic activity. In the euro area, the crisis exposed the limits of fiscal and monetary policy coordination, as well as vulnerabilities in public institutions and private households.

Strict lockdown measures led to a historic contraction in economic activity, with euro area GDP falling 6% in 2020, the sharpest decline on record. Unemployment increased, consumption plummeted, and industries such as tourism, hospitality, and retail faced severe disruptions as demand evaporated and supply chains were interrupted.

Governments responded with expansive fiscal stimulus packages totaling nearly 10% of pre-pandemic GDP, far exceeding measures taken during the 2008 financial crisis. These included cash transfers, wage subsidies, business support, and increased health spending.

The monetary response was equally critical. With interest rates near zero, the ECB launched the Pandemic Emergency Purchase Program (PEPP) in March 2020, designed to absorb up to €1.85 trillion in government and corporate bonds. The PEPP eased financing conditions for both public and private sectors, stabilizing financial markets and averting sovereign debt crises (Lane, 2022).

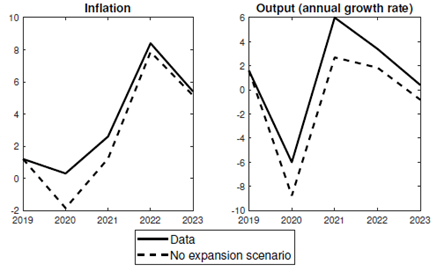

Naturally, the stimulus in Europe was not implemented in a vacuum. It responded to a sharp collapse in economic activity and deflationary pressures driven by global supply disruptions, social distancing measures, and heightened economic uncertainty. To give context to our further simulation results related to redistribution, it is worth starting with the aggregate macroeconomic situation in the eurozone. Figure 1 illustrates the trajectory of euro area inflation and GDP growth, alongside a counterfactual scenario without the monetary-fiscal stimulus, generated by our model. The package clearly prevented a deeper economic contraction and helped avert deflation.

Figure 1. Data and counterfactual scenario (w/o stimulus)

While the fiscal and monetary measures successfully stabilized the economy, they must have had significant redistributive effects across sectors, regions, and demographic groups. Redistribution occurred through multiple channels, including direct fiscal transfers, inflationary pressures, and changes in labor market dynamics. Using a calibrated life-cycle model, our study highlights disparities in the costs and benefits of stimulus measures across age cohorts.

To capture the complexity of the redistributive effects of the pandemic response, our study employed a quantitative life-cycle model, designed to simulate the behavior of households over time and assess the long-term implications of policy interventions. It incorporates data on household income, consumption, assets and liabilities, as well as macroeconomic factors such as inflation, interest rates and asset price movements.

The life-cycle model divides households into age cohorts to analyze how fiscal and monetary policies affect different generations. Younger households, for example, typically have higher debt levels, lower savings, and greater exposure to the labor market. In contrast, older households tend to hold significant nominal assets, such as cash and bonds, and rely more on fixed incomes, like pensions. These generational differences make age a critical determinant in assessing the distributional effects of economic policies.

The fiscal measures implemented during the pandemic were designed to address immediate economic challenges and prevent widespread hardship. Wage subsidies were a central component of these measures, allowing firms to retain employees even as revenues collapsed. Direct cash transfers to households provided immediate financial relief, while financial aid to businesses helped prevent a wave of bankruptcies. Governments also increased spending on public health systems, investing in hospitals, vaccines, and other critical infrastructure.

Monetary policy complemented these fiscal interventions. The ECB’s Pandemic Emergency Purchase Programme (PEPP) ensured governments could borrow at low interest rates while issuing record levels of debt. This analysis assumes that fiscal expansion was partly funded (around 60%) by future tax increases, with the remainder accommodated by a passive monetary policy stance, consistent with Leeper (1991). This ultra-expansionary policy mix not only financed necessary expenditures but also kept the economy afloat amid unprecedented disruption. However, it also triggered inflationary pressures, with inflation rising from 1.2% in February 2020 to 5.9% in February 2022, just before the Russian invasion of Ukraine further drove up energy and food prices.

For households, inflation had complex redistributive effects. On the one hand, inflation reduced the real value of nominal liabilities, such as mortgages, providing financial relief to younger, debt-laden households. On the other hand, it eroded the purchasing power of nominal assets, such as savings accounts and bonds, imposing significant costs on older, asset-rich households. By capturing these dynamics, the life-cycle model enables a nuanced analysis of how inflation reshaped the distribution of wealth and income during the pandemic.

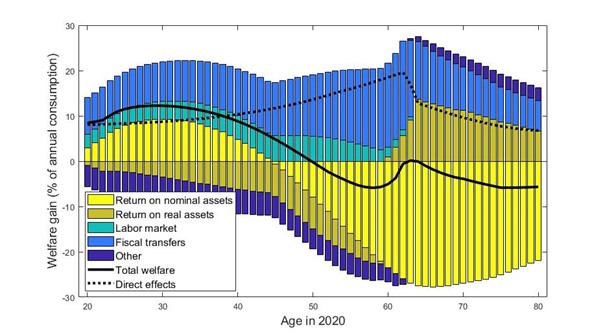

During the crisis, fiscal authorities in the euro area implemented a broad range of transfers targeting firms, workers, retirees, and vulnerable individuals, regardless of age. As shown in Figure 2, these direct transfers had a positive welfare effect across all age cohorts (dotted line), with older individuals receiving slightly larger direct benefits. However, these direct effects only tell part of the story. Once – in the language of Kaplan et al. (2018) – indirect effects, such as inflation and macroeconomic adjustments, are included, the redistributive picture changes dramatically (solid line).

Our simulations show that the redistributive effects of the pandemic stimulus were far from uniform. Younger households—particularly those under the age of 40—emerged as the primary beneficiaries of the pandemic response. Despite their relatively low wealth, younger cohorts gained disproportionately from several mechanisms embedded in the fiscal and monetary policy mix.

One of the most significant drivers of redistribution was inflation. Rising prices reduced the real value of nominal liabilities, such as mortgages, effectively lowering the debt burden for younger households. For instance, a young family with a mortgage would find that the real value of monthly payments declined as inflation increased, offering substantial financial relief. Moreover, younger households were less likely to hold significant nominal assets, such as savings or bonds, which lose value during periods of inflation.

Figure 2. Welfare effects of the pandemic stimulus – decomposition by income channels

The labor market recovery also played a key role in supporting younger cohorts. Wage subsidies and employment-support programs enabled younger workers to retain jobs during the economic downturn, positioning them to benefit. In contrast, older households—particularly those over the age of 50—faced significant challenges. These households typically hold a substantial share of their wealth in nominal assets, such as savings accounts, bonds, and pensions. Inflation reduced the purchasing power of these assets, leading to considerable welfare losses. Although targeted transfers, such as increased pensions, provided some relief, these measures were insufficient to fully offset the erosion caused by rising prices.

The COVID-19 pandemic has revealed the intricacies of fiscal and monetary policy in addressing economic shocks of unprecedented scale. While the immediate goal of the pandemic response was to stabilize the economy, the long-term effects have exposed key trade-offs and challenges for policymakers. Chief among these are the redistributive consequences of inflation, asset price dynamics, and labor market recovery, all of which reshaped the economic landscape in the euro area.

The pandemic response revealed how inflation serves as both a stabilizing force and a redistributive mechanism. On one hand, inflation facilitated the reduction of public and private debt burdens, creating fiscal space for ambitious government interventions without immediate tax increases. For governments, this inflationary environment delayed solvency concerns while enabling critical spending programs.

On the other hand, inflation acted as a hidden tax on savers, disproportionately affecting older households who depend heavily on nominal assets for financial security. In contrast, younger households, burdened with nominal liabilities, reaped significant benefits from inflation’s debt-eroding effects.

The literature suggests that the redistributive effects of fiscal policy depend on how it is funded, the monetary policy response, and public expectations regarding the monetary-fiscal mix (Leeper and Leith, 2016; Hall and Sargent, 2022; Galí, 2020). To explore these dynamics, we also examine two counterfactual scenarios:

The COVID-19 pandemic tested the limits of fiscal and monetary policy in the euro area, prompting an unprecedented response to an unprecedented crisis. While these measures succeeded in stabilizing the economy and averting a deeper recession, they also reshaped the distribution of wealth and income across generations. Younger households emerged as the primary beneficiaries of the pandemic response, gaining from inflation-induced debt relief and labor market recovery. In contrast, older households faced significant losses due to the erosion of nominal savings and reduced purchasing power.

These findings underscore the importance of understanding the redistributive dynamics of economic policy. The aggregate and redistributive effects of the pandemic stimulus may not necessarily be representative for other fiscal expansions, especially those conducted in normal times. However, we do believe that properly accounting for the indirect effects of such programs is key to identifying their winners and losers. As our analysis clearly shows, the outcome of such an evaluation can be very different from what one would expect just by looking at direct income flows.

Brzoza-Brzezina, Michał, Julia Jabłońska, Marcin Kolasa, and Krzysztof Makarski (2024). For whom the bill tolls: redistributive consequences of a monetary-fiscal stimulus. ECB Working Paper No. 2998.

Gali, Jordi (2020) ‘The effects of a money-financed fiscal stimulus.’ Journal of Monetary Economics 115(C): 1–19

Hall, George J, and Thomas J Sargent (2022) ‘Three world wars: Fiscal–monetary consequences.’ Proceedings of the National Academy of Sciences 119(18): e2200349119

Lane, Phillip (2022) ‘Monetary policy during the pandemic: the role of the PEPP.’ Speech at the International Macroeconomics Chair Banque de France – Paris School of Economics, European Central Bank

Leeper, Eric M. (1991) ‘Equilibria under ’active’ and ’passive’ monetary and fiscal policies.’ Journal of Monetary Economics 27(1): 129–147

Leeper, E.M., and C. Leith (2016) ‘Chapter 30 – Understanding Inflation as a Joint Monetary – Fiscal Phenomenon.’ vol. 2 of Handbook of Macroeconomics (Elsevier): 2305–2415

Kaplan, Greg, Benjamin Moll, and Giovanni L. Violante (2018) ‘Monetary Policy According to HANK.’ American Economic Review 108(3): 697–743.