The views expressed in this brief are those of the authors and do not necessarily reflect the views of the Deutsche Bundesbank or the Eurosystem.

The ECB announced a new monetary policy strategy in July 2021. In contrast to the previous strategy of aiming at inflation close to, but below 2 %, it now pursues a symmetric 2% inflation target over the medium term. In addition, the ECB explicitly indicated some tolerance for above-target inflation to avoid low inflation from becoming entrenched. The main goal of this added clause was to lift private-sector inflation expectations in times when policy is constrained by the effective lower bound of interest rates. In this brief, we assess whether the new strategy had the intended effects. Using a representative survey of German individuals conducted just after the introduction of the new strategy, we find that respondents make little difference between the previous strategy of targeting inflation close to but below 2% and the new symmetric 2% inflation target. However, when informed about the ECB’s increased tolerance for inflation overshooting, they expect substantially higher inflation in the following years when current inflation is running below target.

In July 2021, the Governing Council of the European Central Bank (ECB) announced a new monetary policy strategy. While the ECB previously considered medium-term inflation of close to but below 2% in line with its primary objective, it now sees price stability as best maintained “…by aiming for a symmetric 2% inflation target over the medium term, with positive and negative deviations from the target being equally undesirable”. In addition, the ECB explicitly stated that it “…requires especially forceful or persistent monetary policy action to avoid negative deviations from the inflation target becoming entrenched”, adding that this “may also imply a transitory period in which inflation is moderately above target”.1 Hence, the possibility of making up for past misses by letting inflation temporarily overshoot the target after previously running below target for some time is now embedded in the ECB’s monetary strategy.

The main goal of this change is to lift private sector inflation expectations and thus lower real interest rates at times when policy is constrained by the effective lower bound. Given this novel strategic element, it is important to understand how private sector inflation expectations have responded to the new strategy. We assess this question using the Bundesbank Online Panel Households (BOP-HH). Specifically, we asked about 7,500 participants about their inflation expectations in the August and October 2021 survey waves, just after the new strategy had been released. To tease out whether specific aspects of the new strategy had the intended effects, we designed a randomized control trial (RCT).

This experiment was conducted in three stages. First, all participants were provided with some easy-to-process information about the previous “close to, but below 2%” as well as the new “symmetric around 2%” inflation target, without mentioning the embedded asymmetry. Second, all participants were asked to report their subjective probabilities that the inflation rate over the next two to three years would fall into certain intervals, assuming that the previous ECB strategy was still in place. We focused on this forecast horizon as it is commonly viewed as reflecting well the medium term referred to in policy announcements and coincides with the ECB’s projection horizon. Third, the participants were randomly split into groups which were provided with different snippets of information about the ECB strategy and assumptions about near term inflation. While some groups received a short text about the symmetric inflation target which did not explicitly mention the novel overshooting clause, others were given an unabridged explanation of the embedded overshooting mechanism in the new strategy.2

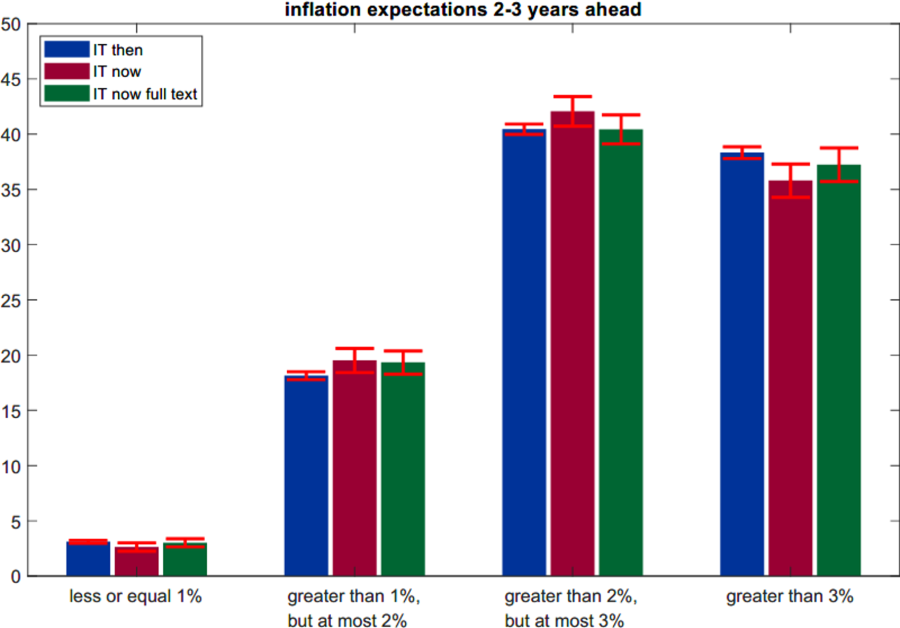

Figure 1 shows the distribution of expected medium-term inflation across participants from the October 2021 survey wave. The blue bars (labelled ‘IT then’) correspond to the average probabilities across all participants from Stage 2 of the experiment, that is assuming the previous strategy was still in place. The red (‘IT now’) and the green (‘IT now full text’) bars, in turn, refer to the inflation expectations from Stage 3 for the two groups that received information about the new strategy at different levels of detail.

Figure 1: Distributions of medium-term (2-3Y) inflation expectations for different groups

Notes: Blue bars show the average subjective probabilities (ASP) of medium-term inflation from respondents assuming the previous ECB monetary policy strategy of close to but below 2% (treatment ‘IT then’) is still in place. Red bars show ASP collected from respondents assuming the new ECB monetary policy strategy with a symmetric 2% inflation target (treatment ‘IT now’), having received only abridged information about the strategy. Green bars represent the ASP for respondents who received the full text of the ECB statement (treatment ‘IT now full text’). A two-standard error band is plotted in red.

Roughly three-quarters of the probability mass is assigned to inflation rates above the ECB’s target of 2%. This is consistent with realized inflation at the time the survey was conducted. Comparing the blue (‘IT then’) to the red (‘IT now’) bars in Figure 1, it appears that respondents make little difference between the previous “close to but below 2%” strategy and the new “symmetric 2%” strategy. Even those respondents provided with the unabridged description of the new strategy (‘IT now full text’) reported very similar inflation expectations as the other groups. Hence, in October 2021, unconditionally, there was little discrepancy between inflation expectations formed under the previous and the new strategy, independent of the detail with which individuals learned about the new strategy.

A key novel element of the new ECB strategy was the clause that inflation might be tolerated to exceed 2% after prolonged periods of below-target inflation. This is in the spirit of “average inflation targeting” studied in the theoretical literature of which the Federal Reserve adopted a variant in 2020. The aim of such clauses is to use inflation expectations as an automatic stabilizer. Intuitively, when inflation is low and the nominal short rate at or near its effective lower bound, the central bank would like to see inflation expectations rise as agents factor in higher future inflation, leading to lower real interest rates.

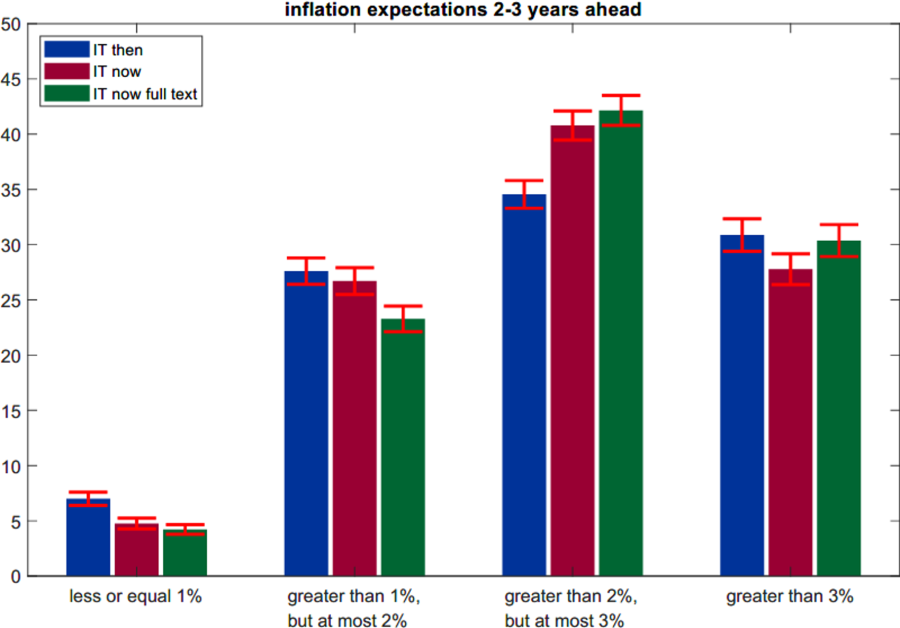

To assess whether this added clause had the intended effect, we next compare the reported expected inflation across groups of respondents who were given different assumptions about inflation over the next twelve months. We start by investigating reported inflation expectations when respondents were asked to assume that inflation would equal 1% in the coming year. Figure 2 plots the average probabilities for three groups of participants that were provided with this assumption, labelled ‘IT then 1%’ (blue bars), ‘IT now 1%’ (red), and ‘IT now full text 1%’ (green), respectively. Compared to Figure 1, respondents allocate considerably more probability mass to inflation outcomes between 1% and 2%. Most importantly, however, individuals who received information about the ‘forceful or persistent’ clause in the new ECB strategy consider it significantly more likely that medium-term inflation will be above target when the rate of price changes is currently below the target. Hence, households seem to understand the key difference between the previous and the new strategy in a low inflation environment.

Figure 2: Distributions of medium-term (2-3Y) inflation expectations, assuming current inflation at 1%

Notes: Blue bars show the average subjective probabilities (ASP) of medium-term inflation from respondents assuming the previous ECB monetary policy strategy of close to but below 2% (treatment ‘IT then’) is still in place. Red bars show ASP collected from respondents assuming the new ECB monetary policy strategy of symmetric 2% (treatment ‘IT now’), having received only abridged information about the strategy. Green bars represent the ASP for respondents who received the full text of the ECB statement (treatment ‘IT now full text’). A two-standard error band is shown in red.

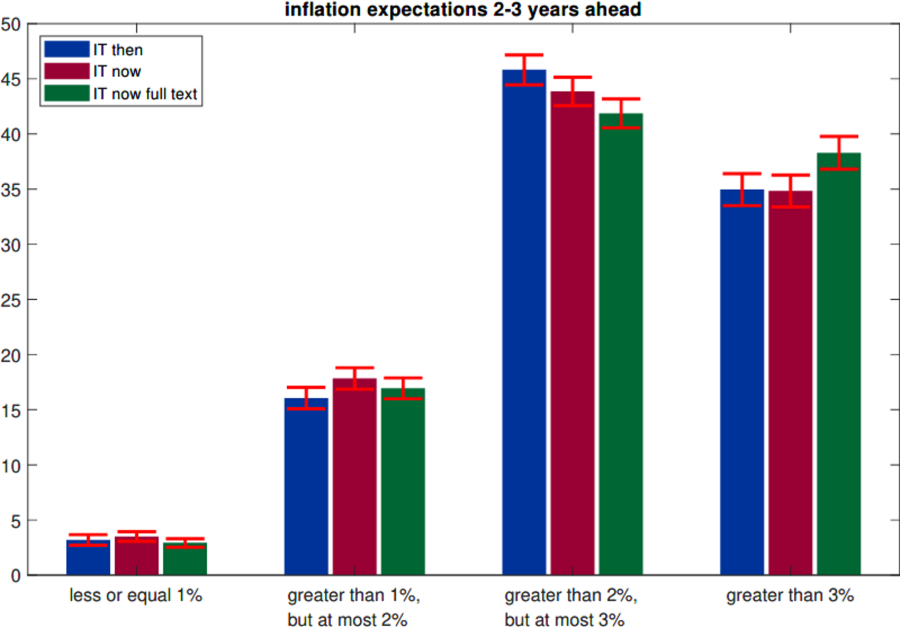

Of note, while emphasizing that the inflation target is symmetric around 2%, the new ECB strategy does not contain a clause implying a tolerance for below-target inflation following periods of price growth above 2%. To assess if households appreciate this implicit asymmetry, we also asked three groups of randomly selected participants to assume that inflation would equal 3% over the next twelve months, while again giving them different pieces of information about the ECB strategy. Figure 3 shows that when asked to form expectations in an above-target inflation environment, households do not perceive the previous and the new strategy differently. Respondents in all three treatment arms assign about equal mass to inflation outcomes below the 2% target. The same holds true for inflation outcomes above the target, although respondents who have been provided the full text attribute somewhat more mass to inflation outcomes above 3%. This could indicate that households perceive a reduced urgency of the central bank to bring inflation back to the target under the full new strategy.

Figure 3: Distributions of medium-term (2-3Y) inflation expectations, assuming current inflation at 3%

Notes: Blue bars show the average subjective probabilities (ASP) of medium-term inflation from respondents assuming the previous ECB monetary policy strategy of close to but below 2% (treatment IT then) is still in place. Red bars show ASP collected from respondents assuming the new ECB monetary policy strategy of symmetric 2% (treatment IT now), having received only abridged information about the strategy. Green bars represent the ASP for respondents who received the full text of the ECB statement (IT now full text) A two-standard error band is plotted in red.

A more thorough regression analysis summarized in Hoffmann et al. (2023) confirms these significant differences controlling for a host of socio-economic factors. They also show that individuals who are more educated, have some trust in the ECB or report having prior knowledge about the new strategy adjust their inflation expectations most strongly.

In summary, our survey evidence suggests that households make little difference between the previous strategy of keeping inflation rates close to but below 2% and the new strategy of targeting inflation rates symmetrically around 2%. Yet, they interpret the forceful and persistent clause of the new strategy as asymmetric. They expect inflation to overshoot after a period of below-target inflation, but do not expect an undershooting of inflation following above-target inflation.

Hoffmann, M., Mönch, E., Pavlova, L. and Schultefrankenfeld, G. (2023), „Forceful or persistent: How the ECB’s new inflation target affects households’ inflation expectations“, Bundesbank Discussion Paper 27/2023.

See the ECB’s press release of 8 July 2021 on the occasion of the introduction of the new monetary policy strategy available at https://www.ecb.europa.eu/press/pr/date/2021/html/ecb.pr210708~dc78cc4b0d.en.html.

For a complete outline of our experiment and the full set of questions, we refer to Hoffmann et al. (2023).