References

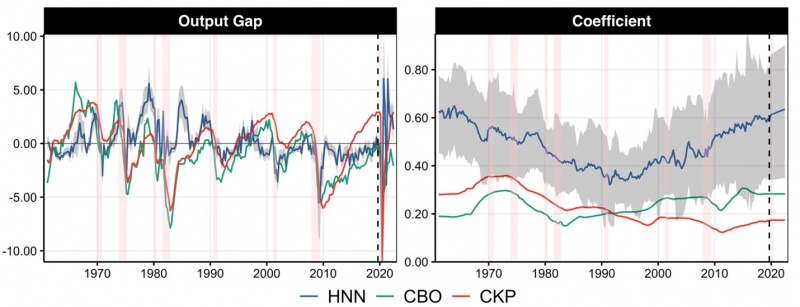

Goulet Coulombe, Philippe. “A Neural Phillips Curve and a Deep Output Gap.” Available at SSRN (2022).

Chan, Joshua CC, Gary Koop, and Simon M. Potter. “A bounded model of time variation in trend inflation, NAIRU and the Phillips curve.” Journal of Applied Econometrics 31.3 (2016): 551-565.

Borio, C. (2022). “Policy panel: Monetary policy, policy interaction and inflation in a post-pandemic world with severe geopolitical tensions”, speech at 35th SUERF Colloquium: The Return of Inflation? – Call for Papers, May 23rd 2022.

Crump, Richard K., et al. The Unemployment-Inflation Trade-off Revisited: The Phillips Curve in COVID Times. No. w29785. National Bureau of Economic Research, 2022.