During the period 2008-13, the Italian economy suffered a severe double-dip recession. One of the consequences of the decline in economic activity was the sharp rise in default rates, particularly in the real estate sector. Default rates were high among construction and real estate firms. Households’ financial conditions were overall sound, but default rates reached their historical peak also for mortgage loans. As a result, many real estate properties were foreclosed to settle the debtors’ debts, and many of these properties were dwellings.

In Italy, the stock of foreclosed homes has not been very large in absolute terms and compared to other countries. However, the sale of foreclosed residential properties deserves attention for two reasons. First, in a forced sale ‒ like that of a foreclosed property ‒ the transaction price may be well below market values. This is relevant for the determination of the recovery rate of a non-performing loan. Second, the stock of foreclosed homes may be vast compared to the housing market’s trading volumes. Due to the illiquidity of the housing market, foreclosures may have a significant impact on market outcomes. These issues are also relevant in the current juncture, as the economic recession caused by the COVID-19 epidemic may lead to a new wave of mortgage defaults and foreclosures.

In Loberto (2021), I investigate whether this empirical evidence holds in Italy. The Italian case is quite interesting for two reasons. First, mortgage loans to households are recourse (the lender can go after all the borrower’s assets until he gets a full repayment of the loan). This softens the feedback effect from house prices on foreclosures. Second, the inefficiencies of the foreclosure process may cause limited spillovers of foreclosures on the market for non-foreclosed properties. In Italy, until recently, the purchase of foreclosed houses — that occurs through auctions managed by the courts — was for many reasons very complicated. For example, until 2015, the buyer had to pay the price offered in a single installment, with no mortgage loan access. However, this situation has changed since 2015, when legislative reforms aimed to simplify the sale of foreclosed properties entered into force.

My analysis has the following goals. First, I estimate the foreclosure discount in Italy. Second, I investigate whether home sellers’ price-setting strategies are affected by the competition of nearby foreclosure listings. Finally, I estimate the spillovers of foreclosures on the prices of non-foreclosed nearby houses.

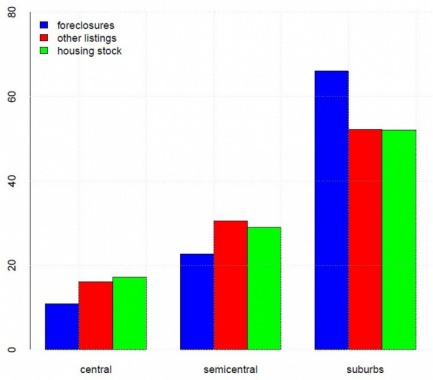

This analysis is based on a large dataset of listings published on Immobiliare.it — the largest online website for real estate services in Italy — between the second half of 2016 and December 2018, including both foreclosed and non-foreclosed dwellings. The dataset covers about one hundred main cities, representing nearly one-third of the Italian population and house sales. Overall, I observe the listing history of about 750 thousand dwellings. For each home, I know the timing of entry into the market and delisting (i.e., when the property exits from the market), a large set of physical characteristics, the location (Figure 1), the time series of the asking prices, and the timing of price revisions.

Figure 1: Distribution of foreclosed homes, other listings and housing stock inside the cities (percentage points).

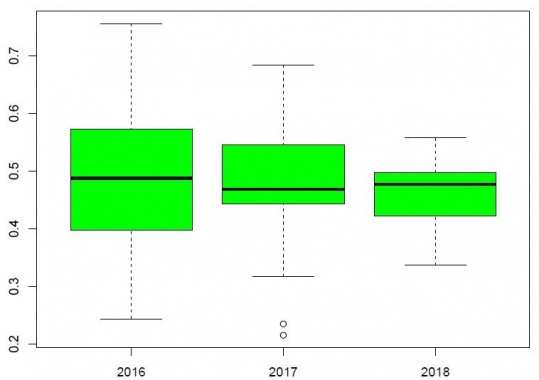

I estimate that the foreclosure discount is approximately between 42 and 56 percent. The discount is heterogeneous across cities and varies with the characteristics and the geographical position of the property (Figure 2). It is higher for smaller dwellings and those in suburban neighborhoods.

Figure 2: Distribution of the foreclosure discount across cities.

Such a high discount would suggest that the market for foreclosures is isolated from other segments of the housing market. Segmentation would imply limited spillovers from foreclosures to the housing market. However, this is not the case. Following the approach proposed by Anenberg and Kung (2014), I show that the listing of a foreclosed dwelling increases nearby home sellers’ propensity to revise downward their asking price. This effect is local. The increase in the probability of a downward price revision is statistically significant and economically relevant up to a distance of 150 meters from the foreclosed house. Then it gradually decreases, becoming very small at 400 meters. This is consistent with the hypothesis that home sellers consider foreclosed houses as competitors. Because of the considerable foreclosure discount, sellers react by lowering their prices.

Finally, I estimate the causal effect of foreclosures on non-foreclosed homes’ prices, following the approach used by Campbell et al. (2011) and Anenberg and Kung (2014). This methodology allows controlling for the endogeneity of foreclosures and housing prices and common shocks that may affect both variables. I find that the impact of foreclosures on nearby house listing prices is negative and significant. The final listing price of dwellings distant less than 150 meters from a foreclosed home is lower by 1.1 percent, an estimate very similar to those obtained for the US by Campbell et al. (2011) and Anenberg and Kung (2014). This estimate is a good approximation of the impact on sale prices because listing and sale prices show a very similar trend in the period examined.

Campbell, John Y., Stefano Giglio, and Parag Pathak, 2011, “Forced sales and house prices.” American Economic Review 101.5: 2108-31.

Cohen, Jeffrey P., Cletus C. Coughlin and Vincent W. Yao, 2016, “Sales of Distressed Residential Property: What Have We Learned from Recent Research?,” Review, Federal Reserve Bank of St. Louis, vol. 98(3), pages 159-188.

Loberto, Michele, 2021, “Foreclosures and house prices,” Temi di discussione (Economic working papers) 1325.