This policy brief is based on ECB Working Paper Series, No 3003. The policy brief was also written by Lucyna Górnicka when she was affiliated with the European Central Bank. The views expressed in this brief are those of the authors and do not necessarily reflect the position of the ECB.

Abstract

Monetary policy affects consumer prices through several channels, and the speed and magnitude of its effects can be heterogeneous across consumption categories. Understanding the heterogeneous pass-through of monetary policy to granular prices can inform aggregate analysis and provide key insights on monetary policy transmission. In our analysis of the impact of monetary policy on granular prices in the euro area, we find that about 33% of the core inflation basket is sensitive to monetary policy shocks. Items of discretionary nature, and those with larger role of credit in financing their purchase, tend to be more sensitive. Non-sensitive items are more frequently subject to administered prices and include non-discretionary items such as rents and medical services. Estimations over different samples show that the transmission of monetary policy shocks has been stronger following the recent sharp policy tightening in the euro area.

Monetary policy affects inflation through both direct and indirect channels. Interest rate changes affect prices directly when they alter households’ propensity to save and spend. More indirect channels, via the impact on growth and employment, can then feed through to household incomes and have an additional impact on consumption and prices.

Given the different propagation channels in the monetary transmission mechanism, sub-components of the inflation basket respond differently to monetary policy shocks, both in terms of the size and the speed. For instance, consumption items with high intertemporal elasticities of substitution, like costlier discretionary or durable goods, usually respond to shocks more quickly, while items that tend to have administered prices respond more slowly.

In our analysis, we identify which items of the euro area core inflation basket – the Harmonised Index of Consumer Prices that excludes food and energy (HICPX) to better capture medium-term inflationary pressures – tend to be most sensitive to changes in monetary policy and investigate the mechanisms that could explain the relative sensitivity of different items. This granular approach provides new insights on monetary policy transmission to consumer prices in the euro area and on the effects of the policy tightening in the most recent disinflation episode.

A challenge when trying to discern the effects of monetary policy shocks on inflation is that various subcomponents of the inflation basket tend to be influenced by different channels. For example, non-energy industrial goods inflation is strongly influenced by prices of internationally traded goods, while services inflation is more affected by domestic factors like labour market developments.

In Allayioti et a. (2024), we adopt a consistent approach that ‘lets the data speak’ and estimate 72 item-specific Bayesian vector autoregressive (BVAR) models between 1999 and 2023, one for each item in the core inflation basket. The specifications are identical in terms of number of lags, control variables, and account for deviations from normality and outliers. The identification strategy follows the internal instrument approach, using the monetary policy shock measure of Jarocinski and Karadi (2020), updated with the database of OIS surprises by Altavilla et al. (2019). Upon collecting the 72 impulse responses of individual consumption items to monetary policy shocks, each item is classified, according to its responsiveness to monetary policy shocks over a three-year horizon, as being either: (i) highly sensitive, (ii) moderately sensitive, and (iii) non-sensitive.1 In a nutshell, the classification captures the heterogeneity in price sensitivity to monetary policy across consumption items.

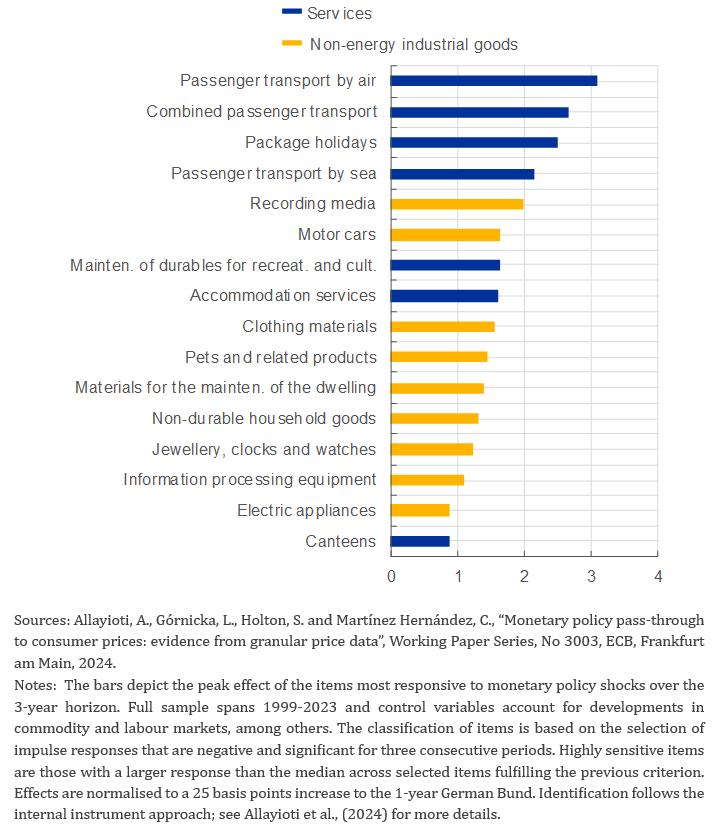

Items classified as either highly or moderately sensitive to monetary policy account for around 33% of the core inflation basket and are equally split among goods and services. Chart 1 shows the peak responses of items in the highly sensitive category, which consists of a mix of durable, semi-durable and non-durable goods, and services that are primarily related to recreation and transportation.2

Which theoretical mechanisms possibly drive the sensitivity of specific consumption items? We explore the relevance of discretionary spending, the credit channel, the presence of administered prices, and the frequency of price changes.3

Our findings suggest that core inflation items that are more discretionary in nature and tend to be more prevalent in consumption baskets of wealthier households (such as jewellery and recreation-related items like package holidays) and that rely more on credit (for example, motor cars) are more sensitive to monetary policy. Additionally, for the sensitive items, a higher frequency of price changes is associated with a larger and a statistically significant price effect from monetary policy shocks. In contrast, the non-sensitive category exhibits a substantial overlap with administered prices and includes, for example, goods and services related to health and postal services.

Chart 1. Peak effect of monetary policy on highly sensitive items

(max. cumulative percentage change)

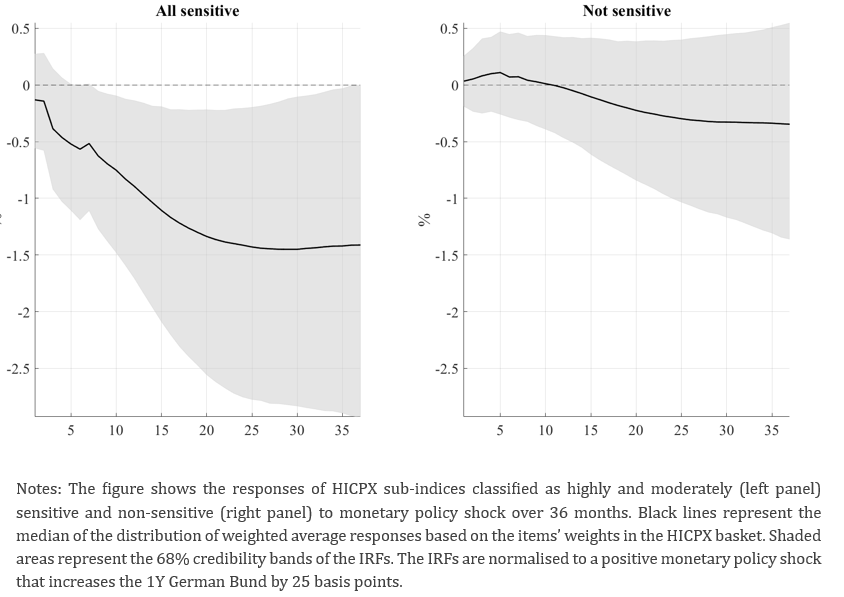

Using our granular results, we document the impact of monetary policy shocks on different sub-categories of the consumption basket. Aggregating the individual impulse responses of all items classified as either highly or moderately sensitive (shown in Chart 1), our analysis suggests that after around 25 months, a 25 basis points tightening shock lowers the cumulative price change by around 1.4 percentage points for the highly and moderately sensitive aggregate (Chart 2, lhs chart). For the remaining items, the effect initially exhibits a mild price puzzle, which is however not statistically significant, before the response enters a negative territory at around 10 months. The documented heterogeneity in the strength of the monetary policy pass-through reinforces the merits of examining the inflation process at a granular level, since the effects of monetary policy changes take time to fully materialise on aggregate inflation, with some channels usually blurred in the aggregate response.

Chart 2. Monetary policy pass-through to sensitive vs non- sensitive HICPX items

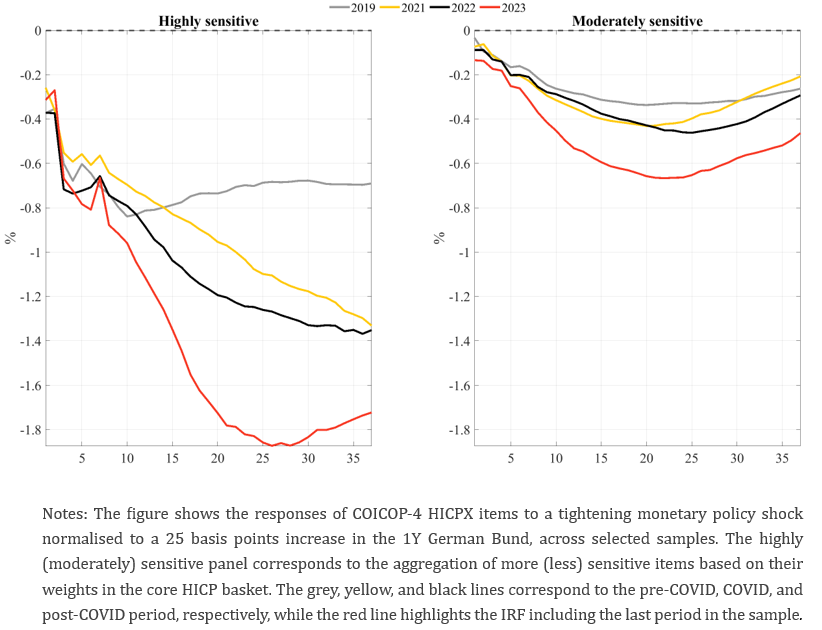

To explore the presence of time-varying dynamics in monetary policy pass-through to euro area core inflation, we estimate the item-specific BVARs over different sub-samples via an expanding window approach. For illustrative purposes, Chart 3 focuses on the separate responses of the highly (lhs chart) and moderately (rhs chart) sensitive core inflation subcategories over selected subsamples: a) the pre-COVID period, b) pre-COVID period and pandemic years, and c) full sample until September 2023. Impulse responses in Chart 3 show that the transmission of monetary policy shocks to the sensitive items has become stronger in recent years, i.e., following the historically exceptional tightening in the euro area. Focusing on the highly sensitive core inflation aggregate, when the most recent years are included in the sample, a 25 basis points tightening shock lowers the cumulative price change by around 1.8 percentage points after 25 months. In contrast, the cumulative response of the earlier samples over the same horizon is less than 1.4 percentage points.4 The steep and decisive shift in the policy stance in response to the surge in inflation has most likely been an important contributing factor to the stronger response of consumer prices to monetary policy in the most recent tightening cycle, with potential non-linear effects linked to it. For example, the globally aligned policy response to the recent surge in inflation may have amplified the impact of monetary policy (Auclert et al. (2023)). Alternative hypotheses link the amplified tightening impulse responses with channels operating through bank and firm balance sheets.5

Chart 3. Monetary policy pass-through to core inflation over time

The analysis presented in this policy brief highlights the merits of examining the inflation process at a granular level. This can serve as a complement to the study of aggregate responses to monetary policy, since the effects of monetary policy changes on aggregate inflation take time to fully materialise, with some channels blurred in the aggregate response. The granular analysis can help pin down various transmission channels and study their importance. Importantly, understanding the evolution of granular price data can be helpful in assessing the transmission of monetary policy in real time, particularly in an environment characterised by numerous policy-relevant drivers and shifting dynamics.

Allayioti, A., Gόrnicka, L., Holton, S., & Martínez Hernández, C. (2024). Monetary policy pass-through to consumer prices: evidence from granular price data, ECB Working Paper No.3003

Altavilla, C., Brugnolini, L., Gürkaynak, R. S., Motto, R., & Ragusa, G. (2019). Measuring euro area monetary policy. Journal of Monetary Economics, 108, 162-179.

Alvarez, F., Ferrara, A., Gautier, E., Le Bihan, H., & Lippi, F. (2024). Empirical investigation of a sufficient statistic for monetary shocks. Review of Economic Studies, rdae082.

Auclert, A., Monnery, H., Rognlie, M., and Straub, L. (2023). Managing an Energy Shock: Fiscal and Monetary Policy. NBER Working Papers 31543, National Bureau of Economic Research, Inc

Bernanke, B. S., & Gertler, M. (1995). Inside the black box: the credit channel of monetary policy transmission. Journal of Economic perspectives, 9(4), 27-48.

Chernis, T., & Luu, C. (2018). Disaggregating Household Sensitivity to Monetary Policy by Expenditure Category (No. 2018-32). Bank of Canada.

Corsello, F., and Neri, S. (2025). “Catch me if you can”: fast-movers and late-comers in euro area inflation.

Dedola, L., Henkel, L., Höynck, C., Osbat, C., & Santoro, S. (2024). What does new micro price evidence tell us about inflation dynamics and monetary policy transmission? ECB Economic Bulletin Articles, 3.

Altissimo, F., Ehrmann, M., & Smets, F. (2006). Inflation persistence and price-setting behaviour in the euro area-a summary of the ipn evidence. ECB Occasional paper, (46).

Gautier, E., Conflitti, C., Faber, R. P., Fabo, B., Fadejeva, L., Jouvanceau, V., … & Zimmer, H. (2024). New facts on consumer price rigidity in the euro area. American Economic Journal: Macroeconomics, 16(4), 386-431.

Hong, G. H., Klepacz, M., Pasten, E., & Schoenle, R. (2023). The real effects of monetary shocks: Evidence from micro pricing moments. Journal of Monetary Economics, 139, 1-20.

Jarociński, M., & Karadi, P. (2020). Deconstructing monetary policy surprises—the role of information shocks. American Economic Journal: Macroeconomics, 12(2), 1-43.

Mankiw, N. G. (1985). Consumer Durables and the Real Interest Rate. The Review of Economics and Statistics, 353-362.

Parker, J. A. (1999). The reaction of household consumption to predictable changes in social security taxes. American Economic Review, 89(4), 959-973.

Tobin, J. (1983). Monetary policy: rules, targets, and shocks. Journal of Money, Credit and Banking, 15(4), 506-518.

Zlobins, A. (2025). Monetary policy transmission in the euro area: is this time different? Chapter I: Lags and Strength. Latvijas Banka Working paper 1/2025.

A similar classification for consumption, prices and earnings in the United States is conducted by Andreolli, M., Rickard, N. and Surico, P., “Non-Essential Business-Cycles”, NBER Working Paper, 2024.

Notable items that are being classified as non-sensitive include, among others, rent, medical and dental-related services, and insurance linked to health and transport. Some of these items have been also classified as ‘late movers’ in recent work, see for example, “The heterogeneous developments of the components of euro area core inflation”, Economic Bulletin, No. 4, Banca d’Italia, October 2023 and Corsello, F., and Neri S., “Catch me if you can”: fast-movers and late-comers in euro area inflation”, SUERF Policy Brief, No. 1070 (2025).

For the link between monetary policy and discretionary spending (via inter-temporal substitution) see Mankiw (1985), Parker (1999), Chernis and Luu (2018); the credit channel see Bernanke and Gertler (1995); administered prices see Tobin (1983) and Ehrmann et al. (2006); the frequency of price changes see Hong et al. (2023), and Alvarez et al. (2024), and Dedola et al. (2024).

Recent work by Zlobins (2025) also finds that the transmission of policy to inflation has been stronger following the historically exceptional tightening in the euro area.

See, e.g., Lane, Philip, 2024, “The analytics of the monetary policy tightening cycle”, 2nd May 2024, guest lecture at Stanford Graduate School of Business.