In late 2008, Iceland imposed capital controls in response to a severe financial crisis, these were maintained until 2017. We use this experience to conduct, what we believe is, the first microstructure study of the impact of controls on the functioning of the FX market by comparing the pre-, during and post- capital controls regimes. Some effects of controls are predictable (for example, a dramatic fall in market activity). More surprisingly perhaps trade volume did not recover after controls were removed. Our key result, however, is that the information content of trades fell dramatically during the capital controls period and did recover after controls were lifted with a significant rise in the role of FX trades in determining the exchange rate and in transmitting macro news (such as inflation news) into the FX rate. This occurred even though other features of the market, such as turnover, were largely unchanged.

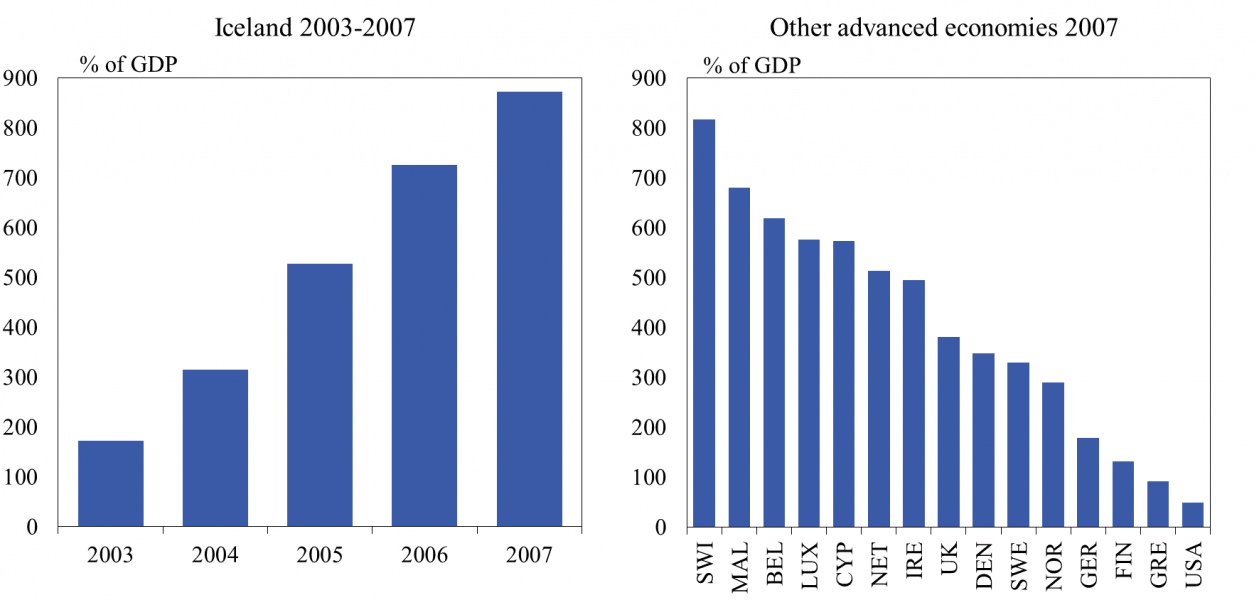

Iceland has a long history of currency volatility, having spent close to a quarter of its post-independence history in currency crisis of some form. The most recent crisis had its roots in the dramatic growth of three Icelandic commercial banks following the privatisation and deregulation of the banking industry in the early 2000’s as shown in Figure 1.

Figure 1: Banking system size

Within a week in the beginning of October 2008, the three large Icelandic commercial banks collapsed and the Icelandic króna had depreciated by almost 50% against the euro. A severe economic contraction followed, with output contracting by 15% from peak to trough and employment by close to 10%. To stem capital flight, on 28 November, as part of an IMF approved programme, legislation imposing comprehensive restrictions on outward capital movements was introduced which blocked all capital outflows, except those related to servicing pre-existing debt obligations and payments of interest income and dividends and payments related to international trade in goods and services. It took until 2016 to fully address most of the crisis legacies and begin the liberalisation process so by 14 March 2017 most remaining restrictions were finally removed, including restrictions on capital movements of private households and corporations.

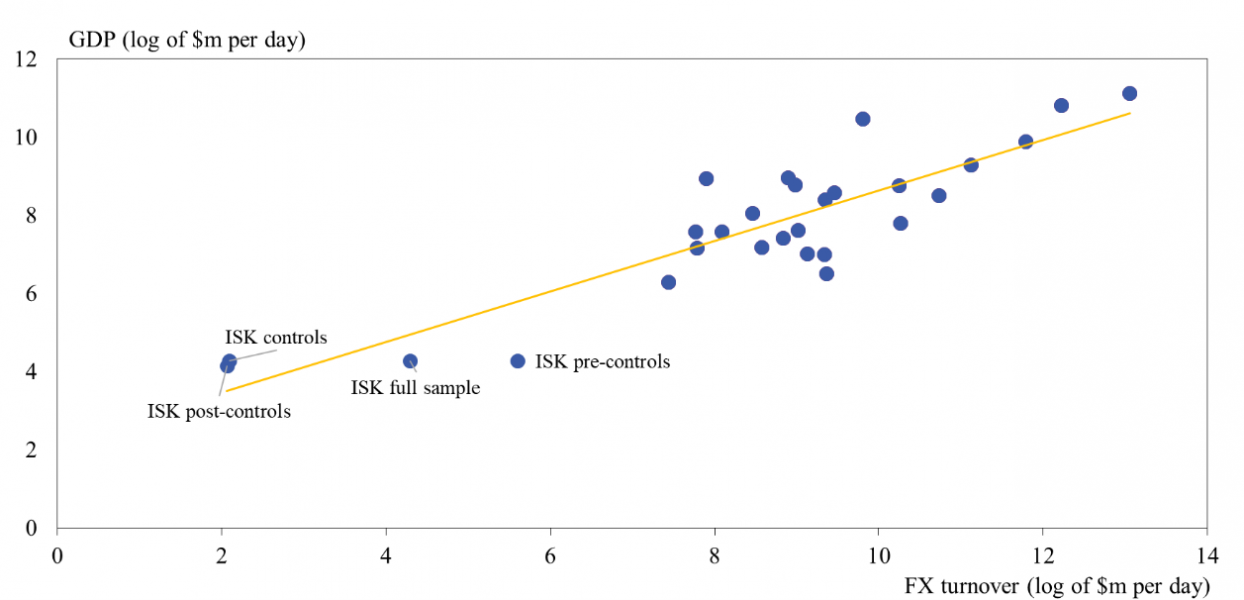

Given that Iceland is the smallest country in the world (in terms of population) with its own freely floating currency, the Icelandic FX market is necessarily small. However, as Figure 2 suggests, FX turnover as a share of GDP is not significantly out of line with other countries. The figure also shows the dramatic decline in turnover that followed the introduction of capital controls but that the lifting of controls did not have the same dramatic effect on turnover.

Figure 2: FX market inter-dealer turnover for the Krona (ISK) and 24 other currencies

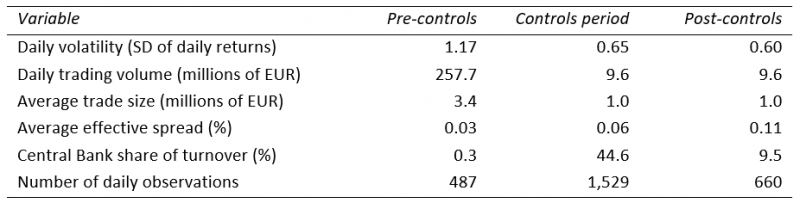

In our empirical analysis, we use daily data from 1 December 2006 (the start of the current market convention of quoting trades in euros) to 24 June 2020 collected by the trading desk of the Central Bank of Iceland from the three market makers. This gives us a total of 2,676 daily observations on the EURISK rate, trading volume and order flow (net trades over the day). Table 1 Gives some key statistics for our data. As the table shows, the key change between the pre-control period and the control period was a dramatic fall in turnover and volatility whilst the exit from controls only saw an increase in effective spreads and a reduction in the share of Central Bank trades.

Table 1: Icelandic FX market by regime

A key question in FX market microstructure is how trading activity conveys information that helps determine prices and so in our study we use a structural VAR model to attempt to establish if capital controls change the role of trades in exchange rate determination. However, the fact that we only have daily data makes the task of identifying trade innovations more complicated. With higher frequency data, researchers normally assume that causality runs predominantly from trades to prices but this is untenable in our case. We therefore estimate a model of the relationship between trades and prices that explicitly allows for contemporaneous feedback effects from prices to trades (based on the approach of Daníelsson and Love, 2006) using the price of credit default swap (CDS) on Icelandic government bonds and the EURUSD exchange rate as instruments to identify trade innovations and the feedback effects. Our VAR analysis also allows for feedback effects between private dealers’ and Central Bank’s trades, adding another novel layer to the microstructure dynamics.

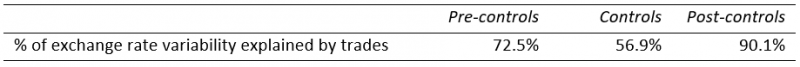

Table 2 shows the key result from estimating this model for our three sub-periods. It shows how the share of total exchange rate variability explained by trades (i.e. the information contained in order flow) fell to around 57% during the capital controls period. In comparison with the pre-controls period this fall is perhaps not surprising given the dramatic fall in the average number of trades once controls were imposed. Indeed, the price impact per trade actually rose between the pre-control and controls period. More surprising is the comparison with the post-controls period when the level of turnover and volatility was very similar to that in the controls period – the rise of the role of trades to 90% suggests a fundamental change in the trading process once controls were removed despite most other features of the market remaining unchanged.

Table 2: Role of trades in exchange rate determination

One potential explanation for why trades became less important once capital controls were introduced is that trading activity became less responsive to macro news once capital movements became restricted. This would be consistent with a key finding from the microstructure literature on exchange rate determination, which argues that order flow is an important channel through which macro news impacts the exchange rate.

To test whether the declining information content of trades in the capital controls era reflects reduced impact of macro news on trading activity, we look at the relationship between trades (in the form of order flow) and inflation surprises. This is the only macro variable for which surveys of market expectations are available for the whole sample period – but it should also be the single most important macro variable for an inflation-targeting central bank such as the Central Bank of Iceland.2

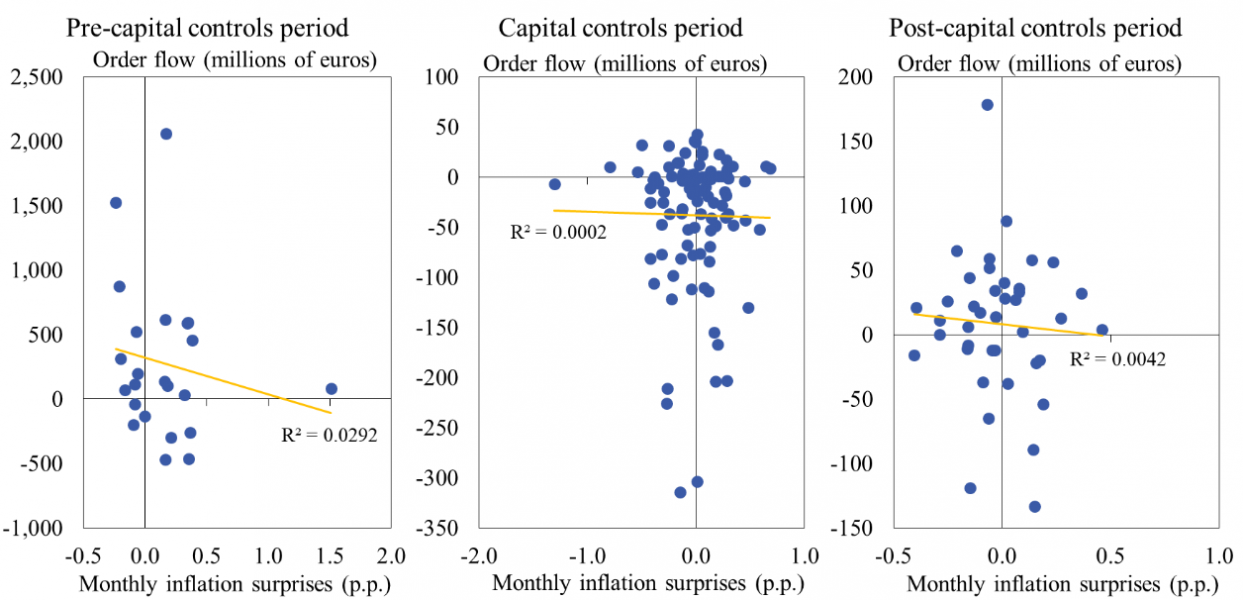

Figure 3 shows scatter plots of inflation surprises and monthly order flow over the three sub-samples. The scatter plots display a negative relationship between inflation surprises and trades, suggesting that higher-than-expected inflation triggers net selling of euros (the usual result for inflation targeting countries). Macro news appear to explain about 3% of the total variation in trades in the pre-capital controls period. This is similar to what Rime, Sarno and Sojli (2010) find for the USDJPY exchange rate but somewhat lower than for the EURUSD and GBPUSD rates – probably reflecting the much broader set of measures of macro news they use.

Figure 3: Order flow and inflation surprises over the three sub-samples

However, the relationship between inflation surprises and order flow appears to weaken considerably once capital controls are introduced in late 2008, with R2 falling to just 0.02%, before rising again once the capital controls are abolished in 2017. This tentatively suggests that an important reason for the decline in the information content of order flow during the capital controls period was that FX market traders reacted less to macro surprises than they did before (and after).

As the first empirical paper to analyse capital controls from a microstructure perspective, we focus on a standard microstructure question – the information content of trades. However, even with this somewhat limited question we find some strong results, particularly when comparing the capital controls and post-capital control periods which – in terms of trading activity – look rather similar. The dramatic rise in both the information content of trades and the link between macro news and trading once controls are removed, even though total trading volume was unchanged, indicate that the capital controls regime had fundamental effects on information transmission.

Overall, we hope that this first tentative step into the empirical microstructure of capital controls will be the beginning of a new approach as so many questions concerning capital controls that have traditionally been analysed at a macro level could, arguably, be illuminated by the microstructure perspective. These range from the mechanics of sudden stops and pecuniary externalities that are the problem capital controls are designed to solve to a detailed analysis of all the different measures (including greater central bank involvement in the FX market) that come under the broad heading of capital controls to establish the role of each.

Breedon, F., T. G. Pétursson, and P. Vitale (2021). The currency that came in from the cold: Capital controls and the information content of order flow. Central Bank of Iceland Working Paper 2021/86.

Daníelsson, J. and R. Love (2006). Feedback trading. International Journal of Finance and Economics, 11, 35-53.

Rime, D., L. Sarno and E. Sojli (2010). Exchange rate forecasting, order flow and macroeconomic information. Journal of International Economics, 80, 72-88.

This note is based on the research paper Breedon, Pétursson, and Vitale (2021). The views expressed are those of the authors and do not have to reflect those of the Central Bank of Iceland.

We get similar results for other macro variables (using an ARMA model to create a market expectation).