Using the Beveridge curve concept, we find that EU countries last experienced full employment in the 1970s, with the subsequent decades marked by elevated unemployment. After the COVID-19 crisis, only the Netherlands and the US have achieved full employment; and most EU member states still have considerable labour-market slack. Among other things, our analysis highlights how hysteresis, trade union density and right-wing government policies contribute to explaining labour-market slack (Gökten et al. 2024).

Policy makers closely monitor the labour market to assess whether it is slack, excessively tight, or operating at full employment – as this influences the direction of macroeconomic policies. In slack labour markets, job opportunities are limited and there is an abundance of available workers. Conversely, overly tight labour markets have numerous job openings, but a shortage of available workers. Although the level of unemployment that corresponds to full employment is non-observable, it is important to provide some sort of estimate, in order to inform macroeconomic policy making. In this sense, full employment estimates may also help shed light on historical labour-market developments.

Full employment is achieved when job supply matches demand – i.e. when the ratio of job vacancies to the number of unemployed people is equal to one, indicating that the number of job opportunities is in alignment with the number of job seekers. Michaillat and Saez (2021; 2022) introduce the concept of the ‘efficient’ unemployment rate, which is a geometric average of the current unemployment rate and job vacancy rate. This is what we refer to as the Beveridge (full-employment-consistent) rate of unemployment, or BECRU.1 In this framework, the economy attains full employment with a zero full-employment gap, calculated as the difference between actual unemployment and the BECRU. A zero gap signifies full employment, whereas a positive gap indicates labour-market slack, necessitating a reduction in unemployment in order to achieve full employment. Conversely, a negative gap suggests an excessively tight labour market.

We expanded our analysis by assembling a quarterly dataset that includes data for Germany, Austria, Sweden, Finland and the UK, in addition to the existing US dataset. This extended dataset covers the period from 1970 to 2022. Additionally, we constructed an extended quarterly dataset for 25 countries – including 23 of the 27 EU states,2 the UK and the US – focusing on the period from 2000 to 2022. This dataset allows us to examine deviations from full employment across a wider set of countries during this time frame.

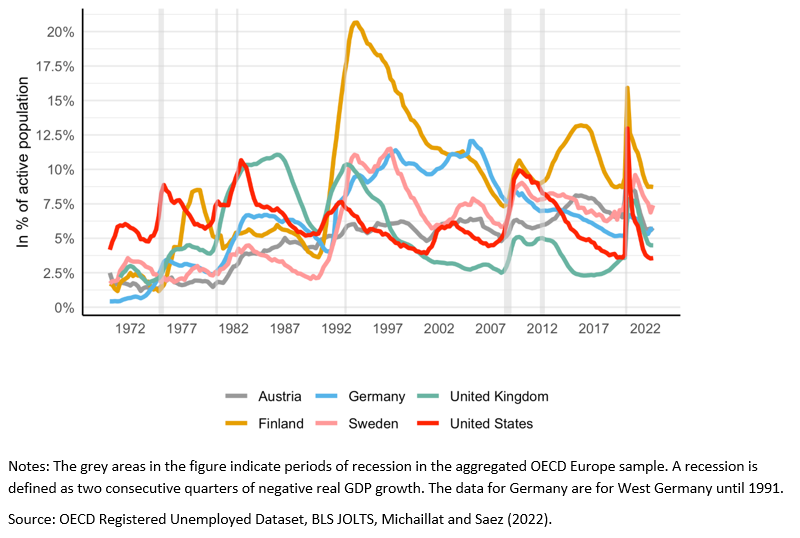

In the 1980s and 1990s, high unemployment in the European countries became a key policy challenge, as economic research struggled to explain the phenomenon (Bean, 1994; Ljungqvist and Sargent, 2008). The surge in unemployment rates in numerous European nations significantly exceeded levels observed in the US (see Figure 1). Today, only the US has unemployment rates that are lower than in the early 1970s, while the UK has experienced a slight increase from very low levels. By contrast, the EU member states, including Austria, Germany, Finland and Sweden, today have significantly higher unemployment rates than in the early 1970s. As in many other countries, their unemployment rates surged in the late 1970s; but notably, they have remained persistently high ever since. Yet the experience has not been uniform across Europe, as is illustrated in Figure 1.

Figure 1. Unemployment rates in selected Western countries, 1970-2022

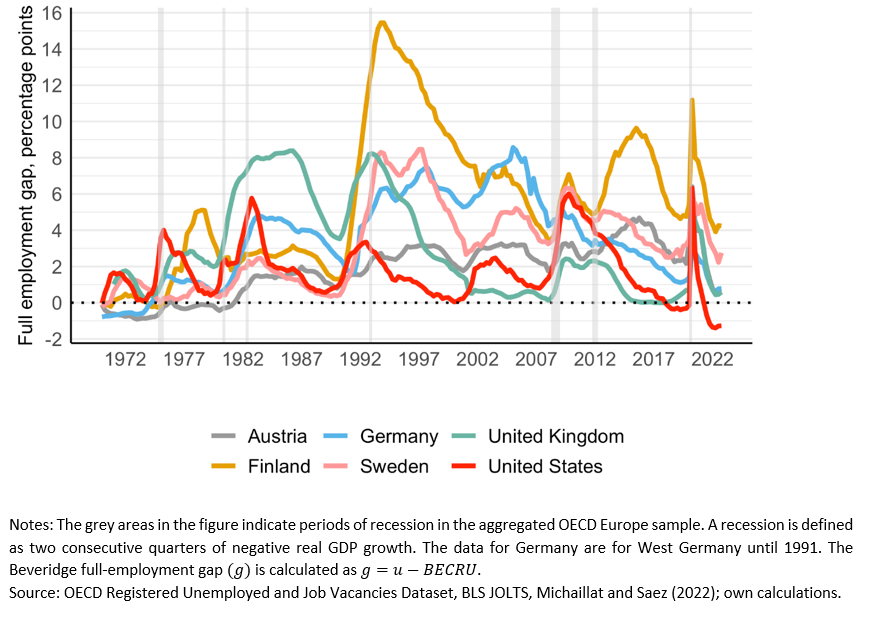

The European unemployment problem of the 1980s and 1990s is evident from the expanding gaps in full employment: in the 1970s, Germany, Austria, Sweden and Finland consistently maintained a BECRU rate of below 2.5%. All four countries witnessed full-employment episodes during that decade, with Beveridge full-employment gaps dipping below zero. This era reflected high efficiency in matching job opportunities for firms and workers.3

However, as the late 1980s and 1990s wore on, these countries witnessed a rise in the BECRU, reflected particularly in the outward shift of the Beveridge curve. This shift, marked by increased unemployment and higher vacancy rates, indicated a decline in matching efficiency. Unlike the US, which saw its full-employment gap peak in the early 1980s and approach zero in the late 1990s, Germany, Austria, Sweden and Finland faced widening full-employment gaps during this period. By the end of 1999, the UK had reduced its full-employment gap to below 2 percentage points, while Finland, Germany, Sweden and Austria recorded full employment gaps of 9, 6, 4.7 and 2.2 percentage points, respectively (see Figure 2). It is crucial to note that, unlike the typical pattern of the gap widening during an economic downturn and narrowing during periods of growth, the latter four countries in the 1980s and 1990s exhibited a unique pattern, where the full-employment gap did not return to the level seen at the end of the previous business cycle.

The US and the UK witnessed very different BECRU patterns over time: notably, the BECRU was higher in the US than in the European countries during the 1970s and 1980s, but it decreased in the 1990s and remained consistently below the BECRU of selected European countries (except for in the aftermath of the global financial crisis). This decline in the BECRU coincided with an inward shift of the US Beveridge curve, signalling improved matching efficiency. The UK’s experience falls between the US and the European patterns, starting with a lower BECRU in the 1970s. After an increase in the 1980s and an outward shift in the UK Beveridge curve, the BECRU stabilised and even decreased slightly in the 1990s and 2010s, coinciding with an inward shift in the curve.

The COVID-19 pandemic significantly affected full-employment gaps. Initially, in 2020, the full-employment gaps increased on account of reduced job vacancies, increased unemployment and deteriorating matching efficiency. However, as the recovery got under way, the labour markets in all six of the countries considered tightened substantially, resulting in a notable decrease in the full-employment gap. However, the US stood out as the only nation to achieve full employment, with the Beveridge full-employment gap entering negative territory. It is essential to note that even before the pandemic, the US labour market had already been excessively tight during the preceding economic upswing.

Figure 2. Beveridge full-employment gap for selected Western countries, 1970-2022

We also explore the predictors of full-employment gaps, including labour-market institutions, macroeconomic elements, political forces and structural factors. The hysteresis effect highlights the persistent nature of the full-employment gap. Our results suggest that elevated unemployment rates can persist even after the initial causes have diminished – for instance, when skills that will be required for jobs that emerge in the recovery phase are lost over time. Our results highlight structural unemployment (i.e. structural mismatch in the labour market, whereby the skills of job applicants do not match the requirements of advertised job vacancies) as a driver of contemporary wider full-employment gaps, supporting the notion that hysteresis may explain the prolonged high unemployment rates observed in Europe since the 1980s.

The impact of trade unions on unemployment is complex, and possibly widens the full-employment gap via insider-outsider dynamics. Traditionally, high unemployment rates are often attributed to inflexible labour-market institutions, such as trade unions. However, the impact of trade unions is far more complex and depends on factors like wage flexibility and labour demand. For instance, a decline in labour union influence may reduce the priority given to full-employment policies. Conversely, powerful trade unions that advocate for higher wages and benefits for their insider members may inadvertently damage the interests of outsiders, such as the unemployed or non-union members. This latter phenomenon – often referred to as the insider-outsider theory (Lindbeck and Snower, 2001) – can contribute to a widening of the full-employment gap. Our findings indicate that labour-market institutions correlate positively and significantly with full-employment gaps. This finding is in line with the insider-outsider theory.

Investment does not reduce full-employment gaps, and there is no trade-off between full-employment gaps and inflation. Our investigation into the relationship between macroeconomic factors (such as investment and inflation) and full-employment gaps challenges the conventional wisdom of a negative relationship between unemployment and inflation (Phillips curve). Quite the reverse: we find a positive and statistically significant coefficient for inflation, indicating that full-employment gaps and inflation tend to go hand in hand. Additionally, our results contradict the theoretical expectation that employment gaps should narrow as investment grows: we observe no significant association between investment and full-employment gaps.

Left-leaning governments tend to seek to reduce full-employment gaps, especially in social-democratic welfare states. Utilising a left-right orientation variable based on government inclination, we find that more left-leaning governments are associated with a reduction in full-employment gaps; this underscores the greater priority that they assign to full-employment policies, compared to right-leaning administrations. In addition, our analysis – which takes account of various confounding factors – reveals differences between social-democratic and liberal welfare states, with the former displaying smaller full-employment gaps on average. However, these disparities are less pronounced compared to conservative welfare regimes.4

Strengthened demand, aided by active population and total factor productivity (TFP) growth, reduces full-employment gaps, while economic globalisation plays a less influential role. In our analysis of structural factors – economic globalisation, TFP growth and population dynamics – in relation to full-employment gap, we consistently find that increased TFP growth is associated with a reduction in the gap. Despite the significance of economic globalisation in fostering international competition and job offshoring, our analysis does not reveal any substantial link with full-employment gaps. Conversely, higher active population growth is significantly associated with smaller full-employment gaps, probably because it contributes to economic growth and higher demand for goods and services (and despite the fact that it also increases job competition).

Focusing on the relation of the European unemployment problem and our Beveridgean measure of full employment gaps, we extend the previous benchmark model by including interaction terms of our European countries with the full employment gap measure. The results confirm the observations of the European unemployment problem: an increase in the lagged full employment gap of the EU block correlates with a significantly stronger increase of the full employment gap than in the US.

Our analysis highlights ongoing challenges in achieving full employment across EU member states since the 1970s. According to our measure, the Netherlands is the only EU member state that has attained full employment since the COVID-19 crisis. In addition, our estimates based on the Beveridge full-employment concept challenge traditional estimates, emphasising the euro area’s current significantly larger labour-market slack than in the US. This suggests that macroeconomic policy could do more to close existing full employment gaps.

Arts, W. and J. Gelissen (2002), ‘Three worlds of welfare capitalism or more? A state-of-the- art report’, Journal of European Social Policy, 12(2), pp. 137-158.

Bean, C. (1994), ‘European unemployment: A retrospective’, European Economic Review, 38(3-4), pp. 523-534.

Beveridge, W. (1944), Full Employment in a Free Society, Allen & Unwin, London.

Dao, M., Dizioli, A., Jackson, C., Gourinchas, P., Leigh, D. (2023): Unconventional fiscal policy in times of high inflation, Paper presented at the ECB Forum on central banking, June 2023.

Gökten, M., Heimberger,P., Lichtenberger, A. (2024): How far from full employment? The European unemployment problem revisited, European Economic Review, 164(4), 104725.

Lindbeck, A. and D.J. Snower (2001), ‘Insiders versus outsiders’, Journal of Economic Perspectives, 15(1), pp. 165-188.

Ljungqvist, L. and T.J. Sargent (2008), ‘Two questions about European unemployment’, Econometrica, 76(1), pp. 1-29.

Michaillat, P. and E. Saez (2021), ‘Beveridgean unemployment gap’, Journal of Public Economics Plus, 2, 100009.

Michaillat, P. and E. Saez (2022), ‘u*=√ uv’, National Bureau of Economic Research Working Paper No. 30211.

The Beveridge full-employment-consistent rate of unemployment (BECRU) is calculated as: √uv, where u stands for the unemployment rate (number of unemployed divided by the active population) and stands for the job vacancy rate (number of unfilled vacancies divided by the active population).

Denmark was omitted due to insufficient data availability, and Croatia, Czechia and Luxembourg were for data comparability, as Eurostat’s vacancy data for these countries is based on administrative data rather than survey data.

Matching efficiency represents the market’s ability to effectively match individuals with appropriate job opportunities.

The classification of countries into welfare state types is based on the typology introduced by Arts and Gelissen (2002). According to their framework, there are three distinct models of welfare states: conservative, liberal and social-democratic. In accordance with this typology, our analysis categorises Austria and Germany as conservative welfare states, reflecting their alignment with conservative economic policies that prioritise fiscal discipline or price stability over full employment. The United States and the United Kingdom are designated as liberal welfare states, indicative of a tendency toward individualism and less emphasis on social contributions. Similarly, Sweden and Finland are classified as social-democratic welfare states, in line with their dedication to policies that promote full employment.