Views expressed are those of the authors and do not necessarily reflect official positions of De Nederlandsche Bank or the Eurosystem.

Corporate bond markets provide a vital source of funding, particularly for carbon intensive firms. As investors are increasingly concerned about climate change, a key question is whether investors take exposures to climate transition risk into consideration in their investment decisions. Our empirical study on global corporate bond markets suggests that investors are pricing climate transition risk. First, higher carbon emissions are associated with higher bond yield spreads. Second, investors value companies’ efforts to mitigate climate change by innovating in the green space as green innovation reduces the positive impact of higher carbon emissions on bond yield spreads. Third, our granular bond holdings data suggests that especially European investors reward carbon emission intensive companies that innovate to become more green. Overall, our findings show that investors care about whether companies are ‘fit’ for the green transition.

To reach net-zero emissions by 2050, the global productive system must decarbonize. Yet, current policies and actions are inadequate in addressing climate change, creating considerable uncertainty around the transition, and leaving businesses exposed to climate transition risk. Forward-looking, financial investors may anticipate climate transition risks and price this accordingly in financial markets.

As the price of capital serves as a signal of risk, and hence guides efforts to mitigate climate risk, investors may thus play a key role in promoting the green transition by redirecting capital towards green activities. In our paper – Boermans, Bun, and Van der Straten (2024) – we study whether investors in the corporate bond market take up this role in the period following the adoption of the Paris Agreement. Specifically, we assess whether corporate bond investors price climate transition risk, and whether they value companies’ efforts to mitigate climate change by innovating in the green space.

The literature studying the pricing of climate transition risk in financial markets has been growing rapidly over the past few years. First, the majority of research focuses on stock markets (Bolton and Kacperczyk, 2023) providing evidence of a carbon premium for stocks of firms with higher carbon emissions. Second, a more recent literature analyzes how carbon risk is accounted for in bank lending decisions (Altavilla et al., 2023), suggesting that firms with higher carbon emissions face higher loan rates. Third, corporate bond markets also provide a vital source of funding, especially so for carbon intensive firms. Arguably, bond markets provide a good setting to test the implications of climate transition risk for pricing in the bond market as tail risk has more direct implications for bond prices (Ilhan et al. (2021); Hoepner et al. (2018)), and polluting sectors rely to a larger extent on bond financing (Papoutsi et al., 2022). However, few studies so far analyze the pricing of climate transition risk for corporate bonds with two notable exceptions focusing on the relationship between carbon emissions and bond spreads (Seltzer et al., 2022; Broeders et al., 2024).

Our contribution to this literature is to assess whether investors value firm’s efforts to become more green within the pricing relationship, bringing a forward-looking approach to the center of the analysis. To study whether climate transition risk is priced in the corporate bond market, we combine global firm-level data on greenhouse emissions from Trucost Environmental with confidential bond-level holdings data from the ECB Security Holdings Statistics (SHS-S). We obtain data on various issuer – and bond characteristics at the security level, such as the yield to maturity, from the ECB Centralized Securities Database. As our main dependent variable, we determine the return in excess of the risk-free rate – henceforth bond spread – calculated as the bond yield to maturity minus the bond risk-free rate. For carbon intensity we measure the company’s environmental performance by considering Scope 1 and Scope 2 carbon emissions jointly relative to the companies’ revenue. Thus, our emission intensity variable measures CO2 emissions in tons of CO2 per million of US dollar. The sample consists of 9,313 unique bonds, issued by 1,496 unique companies from 57 countries over the period 2016-2021.

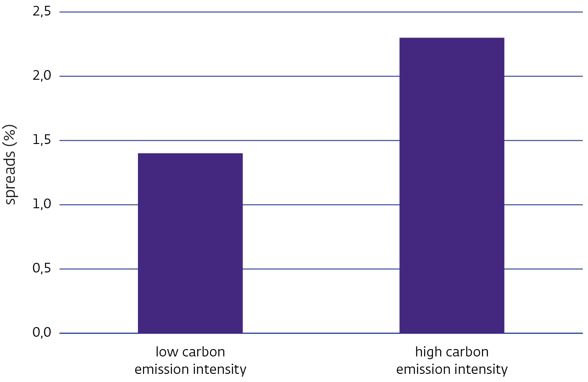

Our results suggest that higher carbon emission intensity is associated with higher bond spreads. Specifically, we find that a one standard deviation increase in emission intensity raises the bond yield spread with 48.3 basis points. To further illustrate this, Figure 1 depicts the difference in mean predicted bond yield between the lowest and highest quartile of the emission intensity distribution, which highlights that the mean predicted yield spread is higher for bond issuers with a higher emission intensity. This indicates that investors perceive firms with a higher emission intensity as more risky. Importantly, this effect cannot be explained by bond credit risk, neither by whether a bond has a green bond label or other factors accounting for in the underlying regression analysis. Hence, our findings underscoring the crucial role of carbon emissions in determining the cost of capital.

Figure 1: The mean predicted spread for bonds issued by firms with an emission intensity in the lowest quartile of the distribution of emission intensity, and by firms with an emission intensity in the highest quartile of the distribution.

The green transition requires the majority of companies to change their business models to ensure their compatibility with climate goals going forward. This raises the question whether financial investors value firm’s efforts to become green by innovating in the green space. To assess whether green innovation affects the pricing relationship, we augment our dataset with firm-level data on (green) patents, obtained from Orbis Intellectual Property. We identify all patents registered by a given company within our sample, resulting in a total of 19,406,540 patents associated with 1,236 unique companies.

As we are particularly interested in the green patents owned by these companies, we utilize the Cooperative Patent Classification (CPC) codes to identify which patents are green and which are not. Specifically, we follow Haščič and Migotto (2015) and consider the entire class on Climate Change Mitigation and Adaptation (Y02) as green patents. This results in 222,091 green patents, which are held by 384 unique companies. To account for differences in the extent to which companies engage in patenting activities, we consider the green patent ratio, which is the amount of patents related to green technologies relative to the total amount of patents of a given company (Bolton et al., 2023).

Our findings show that the ‘carbon’ risk premium is lower when an emission intensive company engages in green innovation. Specifically, we find that a one standard deviation increase in the green patent ratio reduces the yield spread of a bond issued by a company with a mean emission intensity by 11.7 basis points. This indicates that investors reward carbon emission intensive companies that make efforts to become more green. Importantly, the result is robust against controlling for bond credit risk, and the effect does not become stronger as credit risk rises. Moreover, the relationship remains significant when we consider absolute emissions (rather than emission intensity) in the pricing relationship, and when we adopt a stricter classification of green patents. Specifically, we find comparable results when we solely consider patents in the Y02E subclass, which considers technologies to reduce greenhouse gasses related to energy generation, transmission, or distribution as green patents, see Acemoglu et al. (2023).

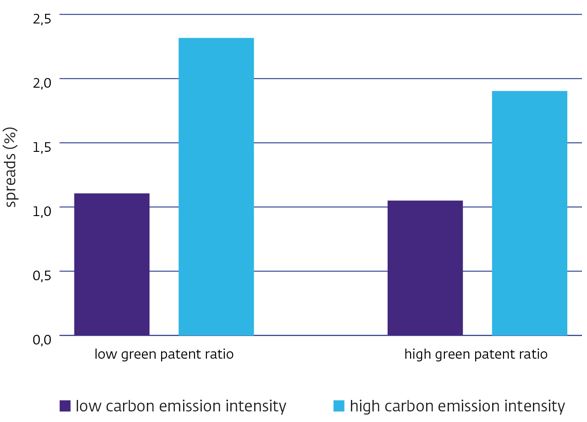

Figure 2: The mean predicted spread for bonds issued by firms with a below median green patent ratio and of firms with an above median green patent ratio. We again calculate the mean predicted spread separately for firms with an emission intensity in the lowest quartile of the distribution of emission intensity, and by firms with an emission intensity in the highest quartile of the distribution.

We determine the mean predicted yield spread for bonds issued by firms with a below median green patent ratio, and an above patent ratio, and plot this against the emission intensity of the issuing firm in Figure 2. This panel highlights that the mean predicted yield spreads for emission intensive issuers with an above mean green patent ratio is lower than that of emission intensive issuers with a below mean green patent ratio and this difference is both statistically and economically significant. Hence, our results reveal that the pricing of the joint effect of emission intensity and the green patent ratio is concentrated among bonds issued by firms with an above median emission intensity and above median green patent ratio. We further show in our paper that the effect of climate risk – which is a long-term risk – on bond yield spreads is larger for bonds with a higher residual maturity. This underscores that investors care about whether companies are ‘fit’ for the green transition, rather than whether they are currently considered as ‘green’ or ‘brown’. Moreover, it indicates that investors aim to direct capital there where it is most needed to foster the green transition.

Investors may aim to direct capital there where it is most needed, but the question remains whether green innovation improves corporate environmental performance. Hence, to interpret our findings, we assess whether green patenting is associated with a decline in future emissions, see also (Bolton et al., 2023). The effect of green innovation on environmental performance is sensitive to the choice of both the explanatory (green patent ratio vs the number of green patents) and the outcome (emission intensity vs absolute emissions) variables. Additionally, the effects are heterogeneous across industries. Hence, it remains unclear from our results whether green innovation improves environmental performance and thus whether investors indeed ‘fund the fittest’. This suggests some need for caution among investors when accommodating emission intensive companies by charging a lower climate risk premium once they innovate in the green space.

Given the broader efforts within the European Union to promote sustainable finance, we assess whether European corporate bond investors are more inclined to price climate transition risk than other investors. Using SHS-S with bond-level portfolio holdings information, we determine the total holdings of European investors in a given period relative to the total amount outstanding. We find that a standard deviation increase in the share of EU-holders reduces the yield spread of company with a mean emission intensity and mean green patent ratio by 5.6 basis points. As the portfolio of European investors is largely tilted towards European firms, we verify that the effects are comparable when we only consider bonds issued by European companies.

Investors in global bond markets are pricing climate transition risk, taking into consideration the firm’s carbon intensity and a forward-looking measure on green patenting activities. However, our study highlights that the relationship between green innovation and corporate environmental performance remains elusive. Hence, it is not clear whether investors funding firms with high carbon emissions that are concurrently innovating to become more green is in fact a sustainable strategy to mitigate climate change.

Acemoglu, D., P. Aghion, L. Barrage, and D. Hémous (2023): “Climate change, directed innovation, and energy transition: The long-run consequences of the shale gas revolution,” NBER Working Paper No. 31657.

Altavilla, C., M. Boucinha, M. Pagano, and A. Polo (2023): “Climate Risk, Bank Lending and Monetary Policy,” CEPR Discussion Paper No. 18541.

Boermans, M., M. Bun, and Y. Van der Straten (2024): “Funding the Fittest? Pricing of Climate Transition Risk in the Corporate Bond Market,” DNB Working Paper No.797.

Bolton, P. and M. Kacperczyk (2023): “Global pricing of carbon-transition risk,” The Journal of Finance, 78, 3677–3754.

Bolton, P., M. T. Kacperczyk, and M. Wiedemann (2023): “The CO2 Question: Technical Progress and the Climate Crisis,” Available at SSRN 4212567.

Broeders, D., M. de Jonge, and D. Rijsbergen (2024): “The European Carbon Bond Premium,”DNB working paper No. 798.

Haščič, I. and M. Migotto (2015): “Measuring environmental innovation using patent data,” OECD Environment Working Paper No. 89.

Hoepner, A. G., I. Oikonomou, Z. Sautner, L. T. Starks, and X. Zhou (2018): “ESG shareholder engagement and downside risk,” Review of Finance, Forthcoming, AFA, 23–77.

Ilhan, E., Z. Sautner, and G. Vilkov (2021): “Carbon tail risk,” The Review of Financial Studies, 34,1540–1571.

Papoutsi, M., M. Piazessi, and M. Schneider (2022): “How unconventional is green monetary policy,” ECB Working Paper.

Seltzer, L. H., L. Starks, and Q. Zhu (2022): “Climate regulatory risk and corporate bonds,” NBER Working Paper No. 2999.