This Policy Brief is based on SNB Working Paper4/2024 “FX interventions as a form of unconventional monetary policy”

Abstract

In the aftermath of the Great Financial Crisis (GFC), when policy rates were very low, central banks from several advanced open economies have used FX interventions (FXI) in order to stimulate inflation. We present a quantitative DSGE model for Switzerland that allows us to study the effectiveness of FXI. The model implies that FXI are effective and long-lasting: FXI of approximately CHF 27 billion (5% of annual GDP) are necessary to prevent the Swiss franc from appreciating by 1.1%. The effect is stronger the longer the central bank can commit to keep its policy rate constant in response to the inflationary effect of the interventions. FXI can create significant additional leeway for monetary policy as indicated by a “shadow rate”, the policy rate required to keep inflation on its realised path without FXI. In Switzerland, this “shadow rate” was up to 1 pp below the realised policy rate.

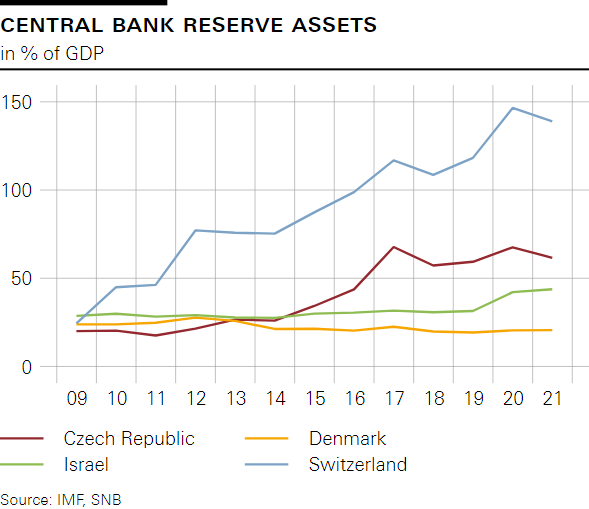

In the aftermath of the Great Financial Crisis (GFC), central banks in several advanced open economies used foreign exchange interventions (FXI) as an unconventional monetary policy tool to stimulate inflation and stabilize the economy. Figure 1 illustrates the substantial increase in reserve assets held by central banks in advanced open economies following the GFC.1 Notably, the Swiss National Bank’s (SNB) reserve assets peaked at almost 150% of GDP, highlighting the extensive use of FXI.

We utilise a quantitative dynamic stochastic general equilibrium (DSGE) model to evaluate the effectiveness of FXI in the context of Switzerland, where the SNB employed two unconventional monetary policy instruments to fulfill its mandate post-GFC: FXI and a negative policy rate.

Figure 1. Reserve assets/GDP of central banks from selected advanced open economies

A growing body of literature documented that FXI can be effective in absorbing different types of shocks and that FXI are welfare-enhancing.2 However, quantifying their impact is difficult due to endogeneity problems (Fratzscher et al., 2019, Menkhoff et al., 2021). Endogeneity problems are particularly pronounced if FX markets are “shallow” (Chen et al., 2024). Most quantitative DSGE studies therefore calibrate the impact of FXI (see e.g. Adrian et al., 2022a, Adrian et al., 2022b). We tackle these problems by focusing on Switzerland, a country where FX markets are deep, and by estimating the impact of FXI in a general equilibrium framework.

In addition, we contribute to the literature that estimates shadow rates. These studies frequently use a theory of the relationship between interest rates on government bonds of different maturities to quantify the effects of unconventional monetary policy measures (see Wu and Xia, 2016). This approach is not suitable for FXI, which mainly work via the exchange rate channel and not via lowering long-term interest rates. We employ our estimated DSGE model and extract the shadow rate through counterfactual experiments, similar to Sims and Wu (2020).

We find that FXI are effective and have long-lasting impacts, providing significant additional leeway for monetary policy. In the following we summarise the main findings of the paper.

Effectiveness of FXI

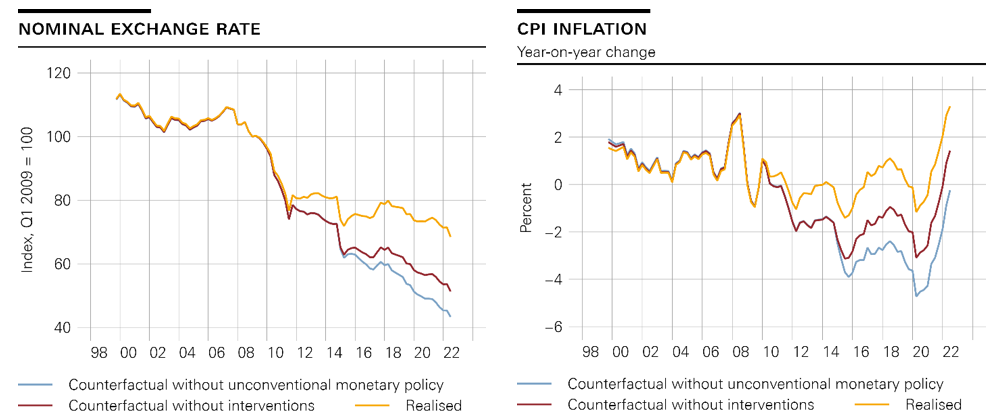

The model indicates that FXI amounting to approximately CHF 27 billion (5% of annual GDP) can prevent the Swiss franc from appreciating by 1.1%. The effect of FXI is stronger if the central bank can commit to maintaining a constant policy rate in response to the inflationary impact of the interventions. In Figure 2 we present the realized paths of the Swiss franc exchange rate and CPI inflation (yellow lines) from Q4 1999 until Q3 2022 together with their hypothetical paths in two scenarios: (i) if the SNB had not intervened in the FX market since the GFC (red line) and (ii) if it had not used any unconventional monetary policy instruments, FXI and negative policy rate (blue line).

The absence of FXI would have led to a 17 percent stronger appreciation of the Swiss franc since the GFC (left panel), leading to downward pressure on import prices. As a consequence, Swiss inflation would have been negative from mid-2010 until 2022 (right panel).

Hence, we conclude that FXI were crucial in stabilizing inflation around the range of 0-2% that the SNB equates with price stability. The negative policy rate further reinforced the effects of FXI.

Figure 2. Swiss franc exchange rate and CPI inflation without FXI and without unconventional monetary policy

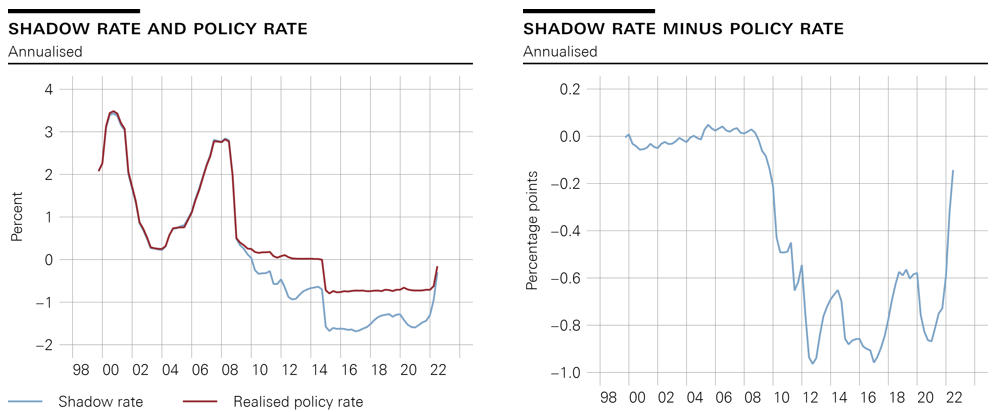

We also compute a “shadow rate” for Switzerland—the policy rate required to keep inflation on its realized path in the absence of FXI. The left panel of Figure 3 shows the shadow rate in comparison to the observed policy rate. The right panel plots the difference between the two rates. The shadow rate was found to be up to 1 pp below the actual policy rate, approaching −1.5% from 2015 to mid-2022.

The framework also allows us to examine the sensitivity of the shadow rate to the persistence of the policy rate. If the persistence of the policy rate increases, as was the case, for example, during the lower bound episode following the GFC, the shadow rate increases in absolute terms (i.e. it becomes less negative). On the one hand, the effectiveness of the FXI increases as the policy rate becomes more persistent. On the other hand, changes in the policy rate also become more powerful when the policy rate is more persistent. It turns out that the latter effect dominates and the shadow rate needed to offset FXI becomes less negative.

Figure 3: Shadow policy rate for Switzerland

Our paper underscores the importance and effectiveness of FXI as a tool for unconventional monetary policy in advanced open economies. The findings suggest that FXI, when combined with a committed policy rate, can significantly enhance the central bank’s ability to stabilize inflation and support economic growth.

Adrian, Tobias, Christopher J. Erceg, Marcin Kolasa, and Pawel Zabczyk, Managing Monetary Tradeoffs in Vulnerable Open Economies,Economies,” CEPR Discussion Papers 16972 , C.E.P.R. January 2022.

Adrian, Tobias, Vitor Gaspar, and Francis Vitek, A Medium Medium-Scale DSGE Model for the Integrated Policy Framework, Framework,” IMF Working Papers 2022/015 , International Monetary Fund January

Alla, Zineddine, Raphael A. Espinoza, and Atish R. Ghosh, FX Intervention in the New Keynesian Model, Model,” Journal of Money, Credit and Banking, October 2020, 52 (7), 17551755–1791.

Benes, Jaromir, Andrew Berg, Rafael Portillo, and David Vavra, Modeling Sterilized Interventions and Balance Sheet Effects of Monetary Policy in a New Keynesian Framework, Framework,” Open Economies Review, February 2015, 26 (1), 8181–10.

Chen, Kaili, Marcin Kolasa, Jesper Lindé, Hou Wang, Pawel Zabczyk and Jianping Zhou, Market Frictions in Emerging Market Economies: A Macroeconomic Assessment ”, CEPR Discussion Papers No. 19086 . CEPR

Fratzscher, Marcel, Oliver Gloede, Lukas Menkhoff, Lucio Sarno, and Tobias Stöhr, When Is Foreign Exchange Intervention Effective? Evidence from 33 Countries, Countries,” American Economic Journal: Macroeconomics, January 2019, 11 (1), 132132–156.

Malovana, Simona, Foreign Exchange Interventions at the Zero Lower Bound in the Czech Economy: A DSGE Approach, Approach,” Working Papers IES 2015/13 , Charles University Prague, Faculty of Social Sciences, Institute of Economic Studies May 2015.

Menkhoff, Lukas, Malte Rieth, and Tobias Stohr, The Dynamic Impact of FX Interventions on Financial Markets, Markets,” The Review of Economics and Statistics, December 2021, 103 (5), 939939–953.

Sims, Eric and Cynthia Wu, Are QE and Conventional Monetary Policy Substitutable?, Substitutable?,” International Journal of Central Banking, February 2020, 16 (1), 195195–230.

Wu, Jing Cynthia and Fan Dora Xia, Measuring the Macroeconomic Impact of Monetary Policy at the Zero Lower Bound, Bound,” Journal of Money, Credit and Banking, March 2016, 48 (2 2-3), 253253–291.

After conducting FXI in 2011 and at the beginning of 2015, the National Bank of Demark reduced its foreign asset holdings to stabilise its foreign reserves at 20% of GDP.

See e.g. Benes et al. (2015), Liu and Spiegel (2015), Malovana (2015), Alla et al. (2020) and Montoro and Ortiz (2023).