State-contingent debt instruments (SCDIs), such as GDP-linked bonds, have many theoretical benefits. For instance, they reduce interest payment burden in recessions and provide fiscal space when a shock hits the economy. But their use in practice is limited and we know very little about their empirical properties. This note takes a step towards filling this gap in the literature by examining GDP-linked warrants issued by Argentina, Greece, and Ukraine. The aim is to understand how SCDIs differ from plain vanilla bonds in terms of their pricing and volatility. The analysis reveals that the SCDI premium is high and persistent. It averages 12.5%, 4.25%, and 6.65% for Argentina, Greece, and Ukraine, respectively. The SCDI premium exhibits a procyclical pattern. In other words, it is lower when the economy is in a recession. Finally, the liquidity premium on SCDIs is higher and more volatile than those for plain vanilla bonds. A model in which investors fear ambiguity could explain these patterns.

State-contingent debt instruments (SCDIs) are widely considered an optimal way of linking a country’s debt service to its ability-to-pay, by making repayment obligations depend on the underlying state of the economy. They can then provide increased fiscal space and reduced interest payment burden in recessions, and reduce sovereign default probabilities. Elaborate theoretical depictions of the idea have been around for decades (e.g. Bailey 1983; Lessard and Williamson 1987; Shiller 1993, 2003; Borensztein and Mauro 2004). Interest in the instrument has been revived in the aftermath of both the eurozone crisis (e.g. Blanchard, Mauro, and Acalin 2016) and the COVID-19 crisis (Cohen et al., 2020).

Practice, however, lags theory. Examples of SCDIs go at least as far back as the 19th century: in 1863, Confederate States issued twenty-year bonds, convertible to warrants for cotton at a below-market price. Despite this early experimentation and the economic rationale for SCDIs, an overwhelming majority of sovereign debt is in the form of traditional, plain-vanilla bonds. When SCDIs are offered, often in the form of GDP-linked bonds, they carry high risk premia.

What accounts for this “non-contingency puzzle”? Several explanations have been put forward. Pricing difficulties and lack of liquidity reflecting the novelty and complexity of such instruments may make them too costly to be relevant quantitatively (Costa, Chamon, and Ricci 2008). Imperfect information leads to partial insurance while limited commitment adds incentive compatibility restrictions (Levy 2016). For instance, manipulation of the underlying data that determines the criteria for stipulated payments raises obstacles to issuance because of adverse selection and moral hazard (IMF 2017). Investor preferences for robustness could lead to unfavourable pricing of SCDIs (Roch and Roldan 2021). Surprisingly, however, there is relatively little work on the empirical properties of SCDIs to understand the relevance of these explanations in practice.

We provide a general framework to infer the path of SCDI risk premia and apply this framework to GDP-indexed warrants issued by Argentina, Greece, and Ukraine (Igan, Kim, and Levy 2022).

The framework involves developing a Monte Carlo asset pricing exercise to come up with a theoretical value for each GDP-linked bond. We then compare these to market prices to gauge the magnitude and evolution of any premia above and beyond what would be attributed to liquidity and default risks.

The choice of the SCDIs to empirically examine is guided by data availability. Building on IMF (2017) and Pina (2020), we first create a list of SCDIs from a historical point of view. We then gather information on the broad features (e.g. adjustment mechanism, issued in the context of debt restructuring or not; tradeable or not, etc.). SCDIs vary widely in their types and indexation details. Most are linked to GDP or a range of commodity prices, others stipulate payments to be conditional on the occurrence of a natural disaster. To maintain comparability across the cases we study, we narrow down our attention to those linked to GDP. In addition, given the differences between SCDIs issued as part of debt restructuring versus those issued during normal times, we constrain the sample to the former. Focusing further on the tradeable cases, we identify the individual securities using ISIN codes and collect detailed information from Bloomberg on their characteristics (currency denomination, jurisdiction, market price, etc.). We collect similar information on other securities issued by the same sovereign to compare their price dynamics.

This process leaves us with three cases to study: Argentina, Greece, and Ukraine.

Argentina issued GDP-linked warrants during the 2005 debt restructuring. These instruments are characterized by the three rules that stipulate repayment: (i) a level condition: actual real GDP must exceed baseline real GDP (the base case GDP, measured in 1993 pesos); (ii) a growth condition: growth in actual real GDP must exceed growth in baseline real GDP; (iii) a cap: the cumulative amount of past payments should not exceed 0.48 per unit of security (in its corresponding currency). Payment then equals a fraction of excess nominal GDP (equal to the excess of real GDP over the base case, multiplied by the GDP deflator of the current year), to be distributed among the units of notional GDP-linked securities (the fraction would have been 5% if participation in the debt exchange had been 100%; since participation was 76%, the fraction is 76% of 5%, i.e. 3.8%). Note that these conditions may not be satisfied in a given year but then met in the next, hence missed payments can be recovered.

Greece issued GDP-linked warrants in the process of the 2011-12 debt restructuring. These are again characterized by three rules: (i) a level condition: nominal GDP must exceed a base case nominal GDP specified to be a certain value from 2014 to 2020, then equal to the 2020 value; (ii) a growth condition: the real GDP growth rate must exceed the baseline growth rate; (iii) a cap: 1% of the nominal value of the original instrument. Payout then equals a notional amount that decreases each year multiplied by 1.5 times the difference between the real growth rate in that year and a baseline growth rate. Contrary to the Argentine warrants, missed payments in one year are not recovered in the next.

Ukraine issued GDP-linked warrants during the 2015 debt restructuring. These warrants feature the same three rules: (i) a level condition: nominal GDP must reach $125.4 billion (calculated using the average hryvnia/dollar rate), compared to about $82 billion at the time of issuance (albeit at a depressed exchange rate); (ii) a growth condition: the real GDP growth rate must exceed 3%; (iii) a cap: 1% of GDP, applicable from 2021 to 2025. Payments are calculated as 15% of nominal GDP times excess real GDP growth exceeding 3% if growth is between 3 and 4, plus 40% of nominal GDP times excess real GDP growth beyond 4% if growth is faster than 4.

We translate these narrative descriptions to payment formulas to derive the model-implied price of these instruments. We calibrate the parameters based on historical patterns and use GDP, inflation and exchange rate forecasts to calculate the price. In the final step, we decompose the premium – that is, the difference between the model-implied and the actual prices – into a liquidity premium, default premium and SCDI premium.

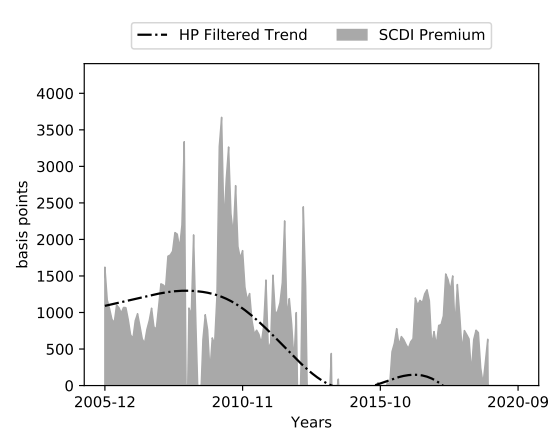

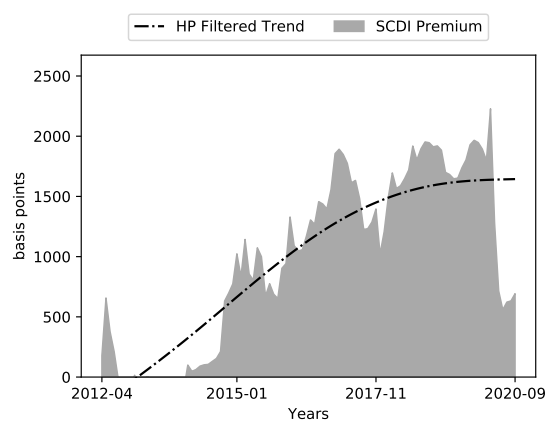

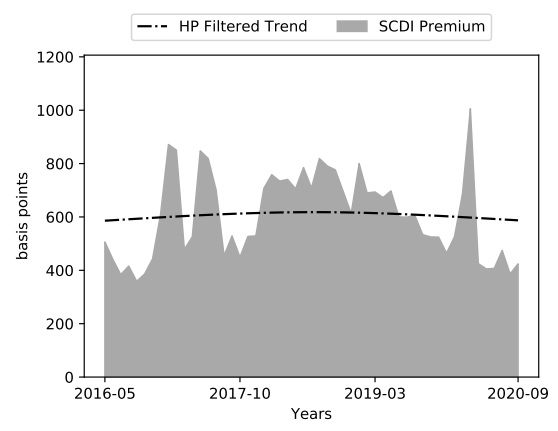

SCDI premium: High and persistent

The SCDI premium is high, persistent and shows no sign of a downward secular trend for most of our sample period (Figure 1). For instance, the first two-year averages of the SCDI premium are 9.36%, -0.21%, and 6.12%, while the averages over the next three years are 15.78%, 8.70%, and 7.18% for Argentina, Greece and Ukraine, respectively. A sizable premium exists in the market even after a reasonable timeframe has passed since the issuance of each security.

Figure 1: SCDI premium

![]()

|

|

|

Sources: Bloomberg, IMF World Economic Outlook, Consensus Economics, authors’ calculations.

Notes: This figure plots the SCDI premia for (US dollar-denominated) Argentinian GDP-linked warrant (Panel A), Greek GDP-linked warrant (Panel B), and Ukrainian GDP-linked warrant (Panel C) on a monthly frequency. The black dotted line indicates the trend component extracted through HP filter.

This finding is in contrast with early research such as Costa, Chamon, and Ricci (2008), which documents a substantial decline in the SCDI premium (around 600 basis points) during the first two years after the issuance of Argentinian GDP-linked warrants. If so, a sizable portion of the SCDI premium could be attributed to “novelty premium,” which arises from unfamiliarity with these new assets or the absence of liquidation markets. The premium is likely to decay over time, according to this view, as market participants become more used to trading the new assets. What we highlight here is that, in hindsight, this observation reflects only a short-term aberration. The estimated SCDI premium trends downward for the first two years in Argentina, which echoes the early result of Costa, Chamon, and Ricci (2008). Extending the sample period, our result shows that the trend is reversed in year 2 and, rather, there is a steady increase in the SCDI premium during the first five years if we rule out the cyclical components of the monthly time-series. In the case of Greece and Ukraine, our estimation results do not show any sign of a downward trend. These results imply that a large portion of the SCDI premium can be potentially attributed to a permanent feature of a GDP-linked warrant.

Procyclicality of the SCDI premium explains issuance in bad times

A large literature in empirical asset pricing has documented that risk premia of stock, bond and currency returns tend to increase in economic downturns (see, among others, Fama and French 1989, Campbell and Cochrane 1999, Lustig, Roussanov, and Verdelhan 2014). One may expect the SCDI premium to be countercyclical in the same manner, implying that the premium tends to rise in recessions. The premium is said to be procyclical when it tends to drop in recessions.

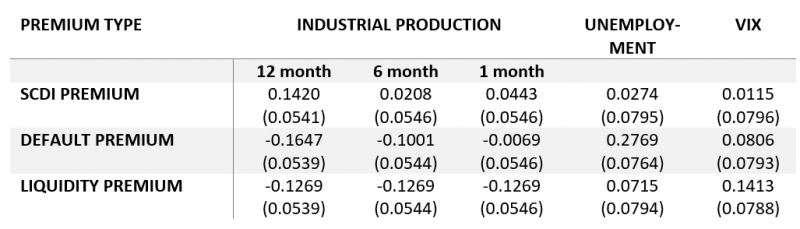

The SCDI premium has been less countercyclical than the default premium of the plain-vanilla government bonds in various dimensions (Table 1). While the default premium (proxied by the CDS spread of a 5-year government bond) exhibits negative correlation with growth in industrial production, the SCDI premium displays positive correlation. While both are positively correlated with unemployment, the correlation coefficient is much lower for the SCDI premium than for the default premium. In the global context, the SCDI premium shows a positive correlation with the VIX but this is again much weaker than the one the default premium or the liquidity premium (proxied by the bid-ask spread) has with the VIX. One illustrative example, besides the general pattern, is that the SCDI premia dropped substantially at the onset of the COVID-19 crisis (Figure 1), whereas the default premium rose. This lower premium in bad times is consistent with the issuance of SCDIs in the context of sovereign debt restructurings.

Table 1: Contemporaneous Correlations

Sources: Bloomberg, IMF World Economic Outlook, Consensus Economics, authors’ calculations.

Notes: This table displays contemporaneous correlations between the three premia of a GDP-linked warrant and economic indicators such as industrial production, unemployment rate, and CBOE volatility index (VIX). We use changes in industrial production over 12-month, 6-month and 1-month horizons. For the rest of variables, we simply detrend the values using HP filter.

Table 1 shows that the liquidity premium on SCDIs is quite countercyclical, that is, it is much more expensive to trade these instruments in recessions. A related question is how this premium compares to the one on plain-vanilla bonds. Due to data limitation, we only examine the cases of Greece and Ukraine. The mean values of the SCDI liquidity premia are 210.42 bps and 18.43 bps whereas the liquidity premia of the traditional 10-year government bonds are 40.97 bps and 11.40 bps for Greece and Ukraine, respectively. During our sample period, the liquidity premium in GDP-linked warrant markets tends to be higher and fluctuates more widely than the liquidity premium in plain-vanilla government bond markets.

The empirical exercise shows patterns that cannot be generated in an asset pricing model with standard preferences, but a model with robust preferences can. Specifically, we develop a model where global investors price financial securities issued by a small open economy government, but they are concerned about ambiguity in the future path of economic variables.

The key intuition here is as follows. Investors with robust preferences are concerned that the probabilistic model they use to forecast the growth rate of a small open economy is potentially wrong. So, they exaggerate the likelihood of a bad state to prepare themselves for losses. This distortion makes the investors require a higher premium when a small deviation from the investors’ baseline forecast can change the coupon size widely in the next period – as it happens to be the case with a SCDI. In the case of a plain-vanilla bond, payment volatility increases when the economy enters a recession due to higher default risk. In the case of a GDP-linked warrant, volatility surges when the current GDP growth rate is in the vicinity of its payment threshold. The premium on the GDP warrant therefore moves procyclically relative to the default premium on the plain-vanilla bond. Essentially, the payment structure of a GDP warrant is more sensitive to the types of probability distortions that lenders fear during an economic expansion, so a heavier discount is applied.

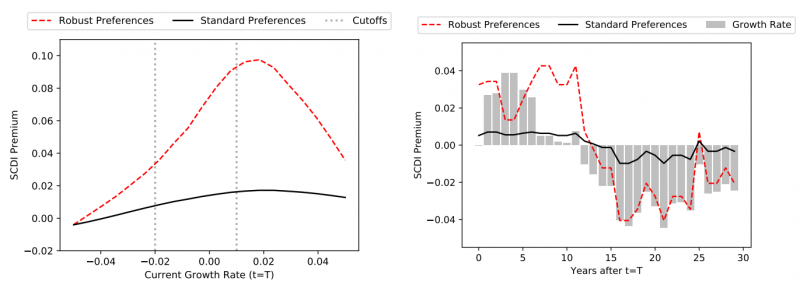

Such a distortion of subjective probability is non-existent under the standard expected utility model. So the SCDI premium is small and barely responds to business cycles (Figure 2, Panel A). In this sense, robust preferences work as extra risk aversion, raising the premium across all states of the economy (captured in the current GDP growth rate). But the increase is not uniform. The premium is highest when the growth rate is close to the payment threshold of the SCDI. Further, the premium is increased more acutely during good times, when investors face some uncertainty about how much the GDP-linked warrant will pay in the next period while the coupon payment on the plain-vanilla bond is known and assured (Figure 2, Panel B). A positive contemporaneous correlation with the growth rate is more pronounced under the robust preference setup. This observation is also noteworthy because investor risk aversion in the standard model creates risk premia, but is unlikely to generate procyclicality (on the contrary, as shown in Lizarazo (2013), it generates more countercyclicality of premia).

Figure 2: SCDI premia with standard vs robust preferences

![]()

Notes: Panel A displays the SCDI premia in a simulation of the model. The black (red) solid line indicates the SCDI premium when investors have standard (robust) preferences. The gray dotted lines represent the default cut-off for the plain-vanilla bond and the payment cut-off for the SCDI, respectively. Panel B displays an illustrative trajectory of the (demeaned) SCDI premia under standard and robust preferences. The shaded bars plot a randomly generated trajectory of the growth process.

A model where investors fear ambiguity can explain the high, persistent premia on GDP-linked bonds and why they tend to be issued during times of sovereign distress. GDP-linked warrants that have more kinks on their payment structure tend to have a higher SCDI premium especially when kinks are located on a more probable region of the state. Choosing appropriate payment thresholds, or perhaps avoiding discrete payment thresholds altogether, could lower the SCDI premium. Also, countries may want to market SCDIs to particular classes of investors, i.e. those that are less averse to ambiguity (say, because they hold a well-diversified portfolio of SCDIs issued by heterogeneous countries).

An important venue for future research is the role of country characteristics. The discount rate applied to SCDIs may be larger for countries with less credible institutions or a poor track record in sovereign debt markets. By the same token, a country may start with a countercyclical SCDI premium and graduate to a procyclical one as it gains institutional credibility and reputation over time, thus ultimately reaping the theoretical benefits of a SCDI. As more countries consider issuing GDP-linked warrants, a more fruitful discussion on cross-country characteristics would become feasible.

Basco, S. 2016. Switching Bubbles. European Economic Review, 87: 236265.

Bailey, N. (1983): “A safety net for foreign lending,” Business Week, January.

Blanchard, O., P. Mauro, and J. Acalin (2016): “The Case for Growth-Indexed Bonds in Advanced Economies Today,” Peterson Institute for International Economics Policy Brief No. 19.

Borensztein, E., and P. Mauro (2004): “GDP-indexed bonds,” Economic Policy, pp. 165–216.

Campbell, J. Y., and J. H. Cochrane (1999): “By force of habit: A consumption-based explanation of aggregate stock market behavior,” Journal of Political Economy, 107(2), 205–251.

Cohen, C., S. M. A. Abbas, M. Anthony, T. Best, P. Breuer, H. Miao, A. Myrvoda, and E. Togo (2020): “The Role of State-Contingent Debt Instruments in Sovereign Debt Restructurings,” IMF Staff Discussion Note No. 20/06.

Costa, A., M. D. Chamon, and L. A. Ricci (2008): “Is There a Novelty Premium on New Financial Instruments? The Argentine Experience with GDP-Indexed Warrants,” IMF Working Paper No. 08/109.

Fama, E. F., and K. R. French (1989): “Business conditions and expected returns on stocks and bonds,” Journal of Financial Economics, 25(1), 23–49.

Igan, D., T. Kim, and A. Levy (2022): “The premia on state-contingent sovereign debt instruments,” BIS Working Paper No. 988.

IMF (2017): “State-Contingent Debt Instruments for Sovereigns,” IMF Policy Paper.

Lessard, D. R., and J. Williamson (1987): Capital Flight and Third World Debt, Washington, DC: Institute for International Economics.

Levy, A. (2016): “The claim is bond, GDP-indexed bond,” Master Thesis, Paris School of Economics, UC Berkeley, Ecole Normale Superieure.

Lizarazo, S. (2013): “Default risk and risk-averse international investors,” Journal of International Economics, 89(2), 317–330.

Lustig, H., N. Roussanov, and A. Verdelhan (2014): “Countercyclical currency risk premia,” Journal of Financial Economics, 111(3), 527–553.

Pina, G. (2020): “State-Contingent Sovereign Bonds: A new database,” Mimeo.

Roch, F., and F. Roldan (2021): “Uncertainty Premia, Sovereign Default Risk, and State-Contingent Debt,” IMF Working Paper No. 21/076.

Shiller, R. J. (1993): Macro markets: Creating institutions for managing society’s largest economic risks, Clarendon: Oxford University Press.

Shiller, R. J. (2003): “The Invention of Inflation-Indexed Bonds in Early America,” NBER Working Paper No. 10183.

The views expressed here are those of the authors and do not necessarily represent the views of the IMF, its Executive Board, or IMF management, or those of the BIS.