Disclaimer: this column does not necessarily reflect the view of the Bank of Italy or the European System of Central Banks.

We introduce a novel firm-level revenue-weighted geopolitical risk index by integrating the geographical distribution of corporate revenues with country-specific geopolitical risk. Our findings reveal a significant real-financial feedback loop: firms with greater exposure to geopolitical risk experience increased probability of default, reduced market valuations, higher financing costs and more volatile returns. The effects of heightened geopolitical risk also extends to the operative side as firms reduce their revenue-exposure in markets that become more risky. Finally, we highlight that data on the granular exposure of firms is key even when considering the effects of adverse aggregate shocks: a global fragmentation shock affects less severely firms whose revenues originate in safer markets.

In recent years, geoeconomic fragmentation – defined as significant geopolitical shifts that disrupt the rules-based international order and deteriorate international relations (Aiyar et al., 2023) – has been accelerating rapidly. Events such as Brexit, trade disputes between the United States and China, trade flow restrictions stemming from the COVID-19 pandemic, Russia’s invasion of Ukraine, and the ongoing Israeli-Palestinian conflict have all contributed to this trend.

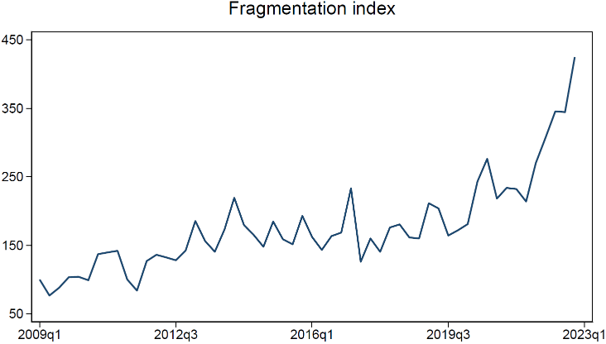

Figure 1: Dynamics of fragmentation index

Note: The fragmentation index (rescaled at 100 on 2009Q1) measures the frequency of earning call sentences that mention at least one of the following keywords: reshoring, onshoring, localization, nearshoring, regionalization, fragmentation, deglobalization. Data are obtained from NL analytics and are based on the methodology described in Hassan et al. (2019).

As a consequence, policy discussions have increasingly focused on how the benefits of decades of economic integration are now jeopardized by rising geopolitical tensions. So far, the analysis of the impacts of geoeconomic fragmentation has mainly focused on how the deterioration of international relations can affect international trade and highly interconnected global value chains (e.g., Campos et al., 2023; Attinasi et al., 2023). Concerns about geoeconomic fragmentation in commodity markets have intensified since the start of Russia’s invasion of Ukraine (e.g., IMF, 2023a; Emiliozzi et al., 2023). Conversely, the study of the financial impacts of geopolitical tensions has been more limited, with most analyses focusing on cross-border capital flows (especially foreign direct investment), asset prices, and investors’ risk aversion at the aggregate level (IMF, 2023b; Feng et al., 2023; Aiyar et al., 2024).

In a recent article (D’Orazio et al. 2024), we present evidence on the financial impacts of geoeconomic fragmentation from a firm-level perspective. Our study relies on a large sample of non-financial corporations included in the Eurostoxx 600 and the S&P500 equity indexes covering the period from 2010 to 2022.

We propose a novel firm-level measure of exposure to geopolitical risk by combining detailed information on the geographic distribution of corporate revenues with country-specific assessments of geopolitical risk to create a revenue-weighted geopolitical risk indicator.

Data on the geographical breakdown of corporate revenues, retrieved from explanatory notes to official financial statements, are used to specifically identify the locations where firms generate their revenues, thereby pinpointing the ultimate origin of firms’ business risks. Not surprisingly, the largest share of revenues originates from the geographical area where firms are listed: approximately 72% of revenues are generated in the US and Canada for S&P500 firms, compared to an average of 64% of revenues generated in Europe for Eurostoxx companies. In both regions, revenue generated in China hovers around 3%.

Data on country geopolitical risk relies on the yearly assessment of political risk developed by the International Country Risk Guide (ICRG). The political risk rating ranges from 0 to 100, with higher scores associated with lower risk levels. The global average risk score has been moderately declining over time (indicating an increase in geopolitical risk) and exhibits high variability across countries, with political risk scores ranging between approximately 30 and 90 points out of 100. Lower geopolitical risk scores are generally associated with advanced economies (Western countries, Japan, Australia, South Korea), while most emerging economies exhibit higher geopolitical risk.

We multiply the shares of firm revenues originating in each national market by the corresponding value of the country-specific ICRG index to obtain a revenue-weighted measure of firms’ exposure to geopolitical risk (Gprisk revenue-weighted).

We analyze the impact of this measure on several indicators of corporate financial performance, namely the Altman Z-score, which is an inverse proxy of firms’ default probability based on accounting variables, the price-to-earnings (P/E) ratio, and the Tobin’s Q ratio, which reflect investors’ assessment of firms’ profitability and market value. Finally, we also assess the impact of geoeconomic fragmentation on equity return volatility.

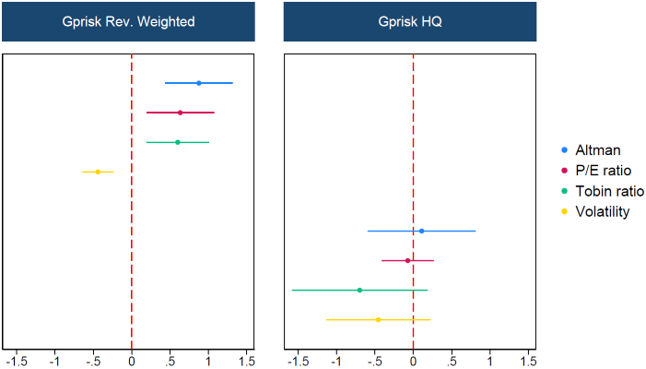

Firms’ revenue exposure to markets characterised by high geopolitical risk impacts corporate viability and this is also reflected in lower investors’ valuations. Figure 2 graphically presents our results, including, for comparative purposes, the effects of a naïve and less sophisticated measure of firm geopolitical risk based on firms’ headquarters (Gprisk HQ).

The two measures can imply very distinct assessments of corporate exposure to geopolitical risk. For instance, consider two firms headquartered in the US – one generating all revenues from the local market and another with half revenues from the US and half from China. The geopolitical risk based on the headquarters’ exposure is identical for both firms, amounting to 79, according to the ICRG scores in 2022. In contrast, the assessment based on revenue exposure is 79, for the former firm with no foreign revenues, but only 68 for the latter firm with more diversified revenues.

Figure 2: Impact of exposure to geopolitical risk on firms’ financial performance

Note: Gprisk revenue weighted (left panel) combines corporate revenue distribution with geopolitical risk across countries, Gprisk HQ (right panel) is based on geopolitical risk of firms’ headquarter.

In economic terms, the elasticity to a 1% increase in our revenue-weighted geopolitical risk measure, i.e. an improvement in terms of risk exposure, results in a roughly 0.9% increase in corporate viability (Z-score) a 0.6% increase for both the P/E ratio and the Tobin Q ratio, and a reduction in equity return volatility of around 0.5%. Conversely our estimates show that this relationship is muted when examining geopolitical risk based on firms’ headquarters.

These results should be interpreted as conservative estimates of the actual effect, as our revenue geographical breakdown pertains to revenues originating from the sale of final goods and services and does not account for other forms of cross-country linkages (e.g. intermediate output trades) arising from a firm exposure to sourcing from different countries.

As firms’ financial conditions react to heightened geopolitical risk, our next step is to investigate whether fluctuations in geopolitical risk are also linked to operational adjustments by firms with revenue exposure in the affected market, particularly concerning their adjustment of the share of revenues generated in that market.

We employ a regression model saturated with fixed-effects to shield the estimate of the impact of geopolitical risk from the influence of changes in macroeconomic conditions in the revenue market. This approach ensures effective control for variation at the year, firm, market of revenues, firm-market, firm-year, and market-year levels. We find that firms’ exposure to the market whose geopolitical risk increases by 1% results in a decrease of their revenue exposure to that country by more than 0.2 percentage points, all else equal. These results indicate that the consequences of geopolitical risk are not confined to the financial dimension but also extend to firms’ presence in the final revenue markets.

As a second exercise, we investigate whether aggregate geoeconomic shocks, such as increasing fragmentation, affect firms’ financial performances heterogeneously depending on their level of revenue-weighted geopolitical risk exposure. We identify aggregate global fragmentation shocks at the monthly frequency by exploiting the positive comovement in the GPR index (Caldara and Iacoviello, 2022) and the trade uncertainty index (Caldara et al., 2020) We employ a structural VAR identified by means of sign restrictions to disentangle a fragmentation shock as the fluctuation that moves the two variables in the same direction, as opposed to other fluctuations that may shift them in opposite directions.

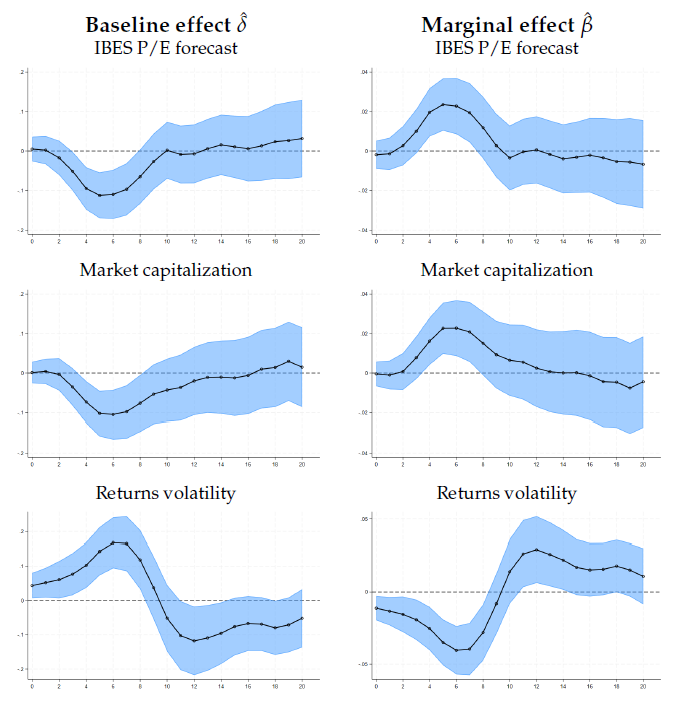

Next, we include the median fragmentation shocks in a set of panel local projection exercises performed using firm-level market proxies available at higher frequency (IBES P/E forecast, market capitalization, and volatility of equity returns). Our results (Figure 3) show both the baseline effect of a fragmentation shock (left column) and the marginal effect (right columns) obtained by interacting the fragmentation shock with our geopolitical risk index, gprisk revenue weighted. We find that global shocks to geoeconomic integration are detrimental for firms in terms of expected earnings, market capitalization, and volatility of returns. Crucially, firms with safer revenue-weighted risk exposure are less affected by fragmentation shocks, as the marginal response to the interaction terms mitigates the baseline effect.

Figure 3: Impact of exposure to geopolitical risk on firms’ financial performance

Note: Local projection estimates: impact of fragmentation shocks on firms’ financial performances. Point estimate and 90% confidence bands.

We introduce a novel revenue-weighted geopolitical risk index at the firm level and observe that geopolitical risk substantially affects firms’ default probability, market valuations, and return volatility. However, the effects of geopolitical risk are not confined to the financial dimension, as we document that firms reduce their revenue exposure in markets that become riskier.

We also highlight that granular exposure of firms is crucial when considering the effects of adverse aggregate geopolitical shocks: a global fragmentation shock affects firms less severely when their revenues originate in safer markets. This emphasizes the importance of accessing accurate microdata to precisely measure the real-financial interdependencies of geoeconomic fragmentation (Borin et al., 2023).

As global tensions continue unabated, the financial consequences of fragmentation for firms may intensify, amplifying macro-financial turbulence. This could manifest in cross-border effects, including capital shifts away from exposed countries, reduced asset valuations, and heightened market volatility.

Aiyar, S, and Ilyina, (2023), “Geo-economic fragmentation and the world economy”, VoxEU.org, 27 March.

Aiyar, S., Malacrino, D., and Presbitero, A.F. (2024), “Investing in friends: The role of geopolitical alignment in fdi flows”, European Journal of Political Economy.

Attinasi, M. G., Boeckelmann, L., and Meunier, B., (2023) “The economic costs of supply chain decoupling”, ECB Working Paper.

Borin, A., Cariola, G., Gentili, E., Linarello, A., Mancini, M., Padellini, T., Panon, L., and Sette, E. (2023) “Inputs in geopolitical distress: A risk assessment based on micro data”, Bank of Italy Occasional paper.

Caldara, D. and M. Iacoviello (2022): “Measuring geopolitical risk,” American Economic Review, 112, 1194–1225.

Caldara, D., M. Iacoviello, P. Molligo, A. Prestipino, and A. Raffo (2020): “The economic effects of trade policy uncertainty,” Journal of Monetary Economics.

Campos, R. G., Estefanía-Flores, J., Furceri, D., Timini J., (2023): “Geopolitical fragmentation and trade”, VoxEU.org, 31 July.

D’Orazio, A., Fabrizio F., and A. Gazzani (2024), “Geoeconomic fragmentation and firms’ financial performance”, SSRN Working paper.

Emiliozzi, S., Fabrizio F., and Gazzani A., (2024), “The European Energy Crisis and the Consequences for the Global Natural Gas Market”, VoxEU.org, 11 January.

Feng, C., Han, L., Vigne, S. and Xu, Y. (2023), “Geopolitical risk and the dynamics of international capital flows,” Journal of International Financial Markets, Institutions and Money.

Hassan, T. A., Hollander, S., Van Lent, L., and Tahoun A. (2019): “Firm-level political risk: Measurement and effects,” The Quarterly Journal of Economics.

IMF (2023a): “Fragmentation and Commodity Markets: Vulnerabilities and Risks”, World Economic Outlook, October.

IMF (2023b): “Geopolitics and Financial Fragmentation: Implications for Macro-Financial Stability”, Global Financial Stability Report, April.