The views expressed here are those of the authors and do not necessarily reflect those of the European Central Bank, or the Bank of England.

Abstract

This policy brief explores the non-linearities associated with geopolitical risk (GPR) shocks. It shows that a large sudden increase in geopolitical tensions can significantly amplify the overall impact of such shocks on the whole economy through heightened economic uncertainty, which triggers precautionary savings behaviours. The findings suggest that traditional models, which typically assume a linear relationship, may instead underestimate the effects of larger shocks, overlooking the important role played by the uncertainty channel. Additionally, the study highlights that inflation responses to GPR shocks might be subdued due to the opposite effects on prices exerted by a reduced demand and the increase in uncertainty. However, when focusing specifically on the uncertainty component of these shocks, significant non-linearities also emerge and are responsible for a sharp increase in both oil prices and inflation.

Recent geopolitical events, such as Russia’s invasion of Ukraine, have demonstrated the critical importance of better understanding how geopolitical risk affects the economy. While existing literature acknowledges the substantial influence of geopolitical risk shocks on economic activity and inflation (Caldara and Iacoviello, 2022; Caldara et al., 2022) the precise extent of this impact remains unclear. For example, the magnitude of these shocks, serving as a proxy for their economic significance, could be a key factor in determining their effects. Minor shocks may have relatively inconsequential outcomes due to the localized nature of events and limited global repercussions, suggesting that economies may not significantly deviate from their steady state following such shocks. Conversely, larger shocks may induce significant non-linear effects, resulting in far-reaching economic consequences. While predominant approaches to geopolitical risk studies typically adhere to linear frameworks, the literature on uncertainty (Caggiano et al., 2015, 2017a, 2017b; Jackson et al., 2020; Chikhale, 2023), financial risk (Alessandri and Mumtaz, 2019; Candelon et al., 2021; Forni et al., 2023), and news shocks (Forni et al., 2024) advocates for exploring non-linearities and state-contingent effects for a more comprehensive understanding of shock transmission. Additionally, comprehending the transmission channels of these shocks remains challenging due to their heterogeneous structural nature. On one side, the literature suggests that geopolitical risk shocks can influence the economy through direct and tangible impacts, similar to those of disaster events, such as wars that impair infrastructure or industrial capacity (Barro and Ursúa, 2012). On the other, these shocks may also transmit via an increase in volatility and uncertainty,leading to precautionary saving behaviours that defer consumption and investment. In this policy brief, we explore the importance of accounting for the non-linearities associated with the magnitude of GPR shocks, and we analyse whether this approach could more clearly reveal the channels through which GPR shocks transmit to the economy.

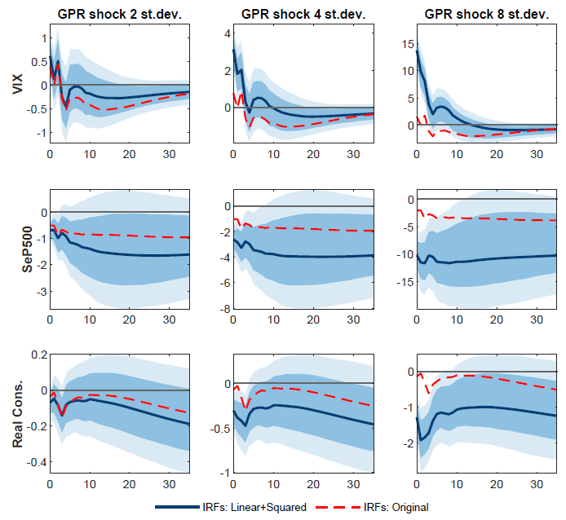

Our empirical analysis follows a two-step strategy. First, we estimate the linear impact of the shock using a simple Structural Vector Autoregression (SVAR) model. In the second step, we examine the non-linear impact of the estimated shock through a Vector Autoregression with Exogenous Variables (VARX), as outlined in Debortoli et al. (2020) and Forni et al. (2023). Figure1 illustrates the estimated impulse response functions (IRFs) of a GPR shock at varying magnitudes, with results from the first step shown by the red-dashed line and those from the second step by the blue solid line.

Our analysis demonstrates that incorporating non-linearities is essential for accurately assessing the impact of large GPR shocks on the economy. Neglecting these non-linearities results in a significant underestimation of the overall effects when the shock magnitude is substantial. Specifically, while smaller shocks tend to have limited and often temporary effects, larger shocks—those exceeding three standard deviations— exert a disproportionately large impact and trigger significant increases in economic uncertainty, a result that linear models fail to capture. This heightened uncertainty prompts precautionary saving behaviours, which, in turn, reduce consumption and slow down economic activity.

The findings reveal that uncertainty is the primary channel through which large GPR shocks impact the economy, highlighting the necessity of examining non-linearities. This is evident in the sharp rise of the VIX (a measure of market volatility), which coincides with a significant decline in equity prices and real consumption following large shocks. The increased uncertainty prompts consumers and investors to adopt a cautious stance, delaying spending decisions and further exacerbating the downturn in economic activity.

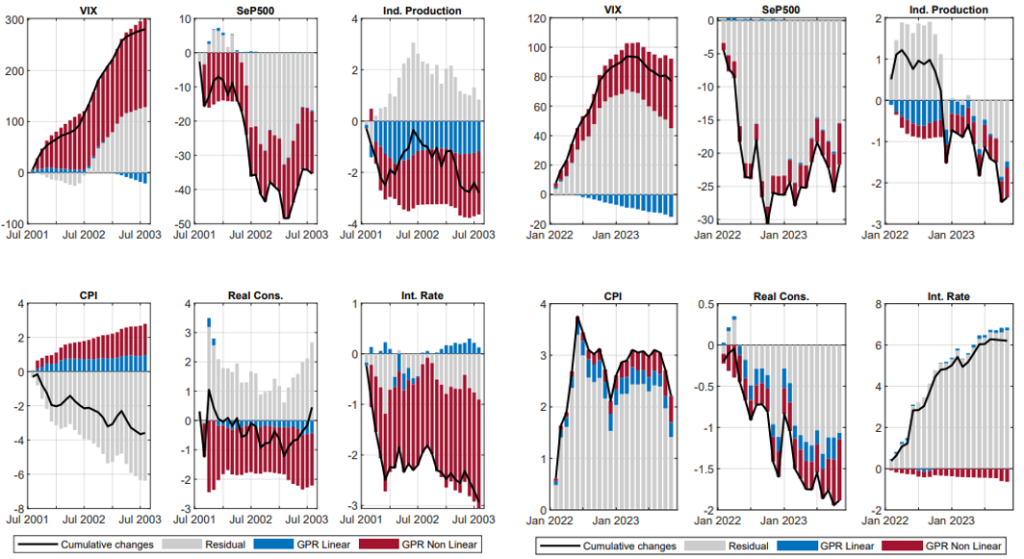

Our study offers a new perspective on the factors driving macroeconomic fluctuations associated with major geopolitical events, such as the 9/11 attacks and Russia’s invasion of Ukraine. As shown in Figure 2, our analysis demonstrates that largeGPR shocks have consistently driven economic volatility, particularly through the uncertainty channel. The findings emphasize that the economic impact of geopolitical events is highly dependent on the magnitude of the shock, with larger shocks resulting in more significant and long-lasting effects. Policymakers should be aware of these dynamics when developing strategies to mitigate the economic fallout from geopolitical risks.

Figure 1. Impulse Response Functions of the VARX summing the linear and the non-linear responses to a GPR shock

Notes: The solid blue line represents the point estimate of the non-linear SVAR responses, while the shaded bands the 68% and 90% confidence intervals estimated via bootstrap. The dashed red line shows the responses of the linear SVAR. Each column depicts a different standard deviation of the shock.

Figure 2. Historical decomposition of 9/11 (LHS panel) and Russia’s invasion of Ukraine (RHS panel)

Notes: Historical Decomposition over four different episodes. The black line depicts the cumulated sum of the log-changes, except for the Fed fund rate and the VIX index reported as the cumulated sum of the level. The blue bars show the contribution from the linear shock, the red bars the one from the non-linear shock. The grey bars are the residuals.

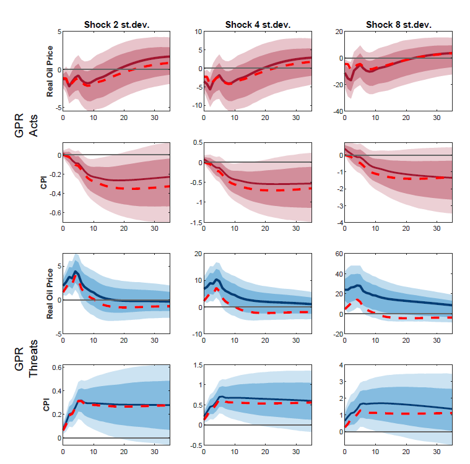

The research also distinguishes between the economic impacts of geopolitical “Acts” (e.g., wars) and “Threats” (e.g., the anticipation of conflict), a distinction already proposed by Caldara and Iacoviello (2022). Acts typically lead to reduced demand and lower inflation due to the direct impact on economic activity. In contrast, Threats often result in increased inflation,driven by speculative behaviour and uncertainty, especially in commodity markets like oil. This observation suggests that threat shocks may resemble uncertainty shocks, prompting speculative demand for oil as markets anticipate potential future disruptions in oil supply, consistent with findings in the literature on oil prices (Kilian and Murphy, 2014; Juvenal and Petrella, 2015; Cross et al., 2022). Overall, as shown in Figure 3, we find that the two shocks have opposite effects on prices, which may explain the relatively muted response of CPI to a generic geopolitical risk shock. Regarding non-linearities, we do not observe evidence of non-linearities for both real oil prices and CPI following a GPRA shock. The responses of the two variables increase linearly with the magnitude of the shock, as evidenced by the proximity of the solid line to the dashed line. However, the scenario differs for responses following a GPRT shock, with real oil prices exhibiting significant non-linearities as the shock magnitude increases. This aligns with our earlier interpretation: as the shock’s size increases, uncertainty around the event amplifies, thereby intensifying the overall impact on real oil prices. This effect partially translates to inflation, with CPI exhibiting some non-linearities, albeit limited.

Figure 3. Effects of Geopolitical Acts vs. Threats on Inflation

Notes: The solid line represents the point estimate of the two-step VARX, with the respective 68% and 90% confidence intervals. The dashed red line shows the point estimate of the first step SVAR. Each column depicts a different standard deviation of the shock. The rows show the response of real oil price and CPI to a GPRA and GPRT shock respectively.

Our investigation underscores the importance of accounting for both linear and non-linear components when evaluating the effects of geopolitical risk shocks. For smaller shocks, the choice between a linear or non-linear model may be inconsequential, but as the size of the shock increases, significant non-linearities emerge, and uncertainty escalates, greatly amplifying the shock’s impact on the economy through precautionary behaviours. Furthermore, our analysis of the subcomponents of GPR shocks reveals that threats shocks, similar to uncertainty shocks, trigger speculative demand for oil as markets anticipate potential future disruptions, driving oil prices and CPI upward, while acts shocks induce significant negative price reactions, much like negative demand shocks.

Alessandri, P., Mumtaz, H., 2019. Financial regimes and uncertainty shocks. Journal of Monetary Economics 101, 31–46.

Barro, R.J., Ursua, J.F., 2012. Rare Macroeconomic Disasters. Annual Review of Economics 4, 83–109.

Caggiano, G., Castelnuovo, E., Colombo, V., Nodari, G., 2015. Estimating Fiscal Multipliers: News From A Non-linear World. Economic Jour-nal 0, 746–776.

Caggiano, G., Castelnuovo, E., Figueres, J.M., 2017a. Economic policy uncertainty and unemployment in the United States: A nonlinear ap-proach. Economics Letters 151, 31–34.

Caggiano, G., Castelnuovo, E., Pellegrino, G., 2017b. Estimating the real effects of uncertainty shocks at the Zero Lower Bound. European Economic Review 100, 257–272.

Caldara, D., Conlisk, S., Iacoviello, M., Penn, M., 2022. The Effect of the War in Ukraine on Global Activity and Inflation.

Caldara, D., Iacoviello, M., 2022. Measuring Geopolitical Risk. American Economic Review 112, 1194–1225.

Candelon, B., Ferrara, L., Joets, M., 2021. Global financial interconnectedness: a non-linear assessment of the uncertainty channel. Applied Economics 53, 2865–2887.

Chikhale, N., 2023. The effects of uncertainty shocks: Implications of wealth inequality. European Economic Review 154.

Cross, J.L., Nguyen, B.H., Tran, T.D., 2022. The role of precautionary and speculative demand in the global market for crude oil. Journal of Applied Econometrics 37, 882–895.

Debortoli, D., Forni, M., Gambetti, L., Sala, L., 2020. Asymmetric Effects of Monetary Policy Easing and Tightening. Working Papers 1205. Barcelona School of Economics.

Forni, M., Gambetti, L., Maffei-Faccioli, N., Sala, L., 2023. Nonlinear transmission of financial shocks: Some new evidence. Journal of Money, Credit and Banking n/a.

Jackson, L.E., Kliesen, K.L., Owyang, M.T., 2020. The nonlinear effects of uncertainty shocks. Studies in Nonlinear Dynamics & Econometrics 24, 1–19.

Juvenal, L., Petrella, I., 2015. Speculation in the Oil Market. Journal of Applied Econometrics 30, 621–649.

Kilian, L., Murphy, D.P., 2014. The Role Of Inventories And Speculative Trading In The Global Market For Crude Oil. Journal of Applied Econometrics 29, 454–478.