This policy brief is based on a working paper: Hodula, M., Janků, J., S. Malovaná and N. A. Ngo (2024): Geopolitical Risks and Their Impact on Global Macro-Financial Stability: Literature and Measurements. Czech National Bank Working Paper No. 8/2024. The views expressed are those of the authors and not necessarily those of the Czech National Bank.

Abstract

This policy brief summarizes the findings of Hodula et al. (2024), where we review the literature on how geopolitical risks (GPR) affect macro-financial stability. First, we demonstrate that GPR episodically increases economic and financial uncertainty, with significant spikes during major geopolitical events. We then identify two primary transmission channels: the financial channel, where uncertainty and heightened risk aversion drive shifts in investment portfolios and capital flows, and the real economy channel, which impacts global trade, supply chains, and commodities. Using data from the past two to three decades, we provide graphical analyses that confirm the findings in the literature, emphasizing the episodic nature of GPR’s impact. These insights underscore the need for policymakers to adopt flexible, event-specific strategies to mitigate the adverse effects of GPR on economic and financial systems.

In recent years, major central banks and international organizations have acknowledged the economic risks posed by increasing geopolitical tensions. These tensions have strained international relations and underscored the potential threats that geopolitical risks (GPR) pose to economic growth and financial stability. GPRs, arising from instability across various domains, have become more impactful due to global interconnectedness. For instance, the conflict in Ukraine has generated global uncertainty, disrupting commodity prices, causing significant supply chain issues, and affecting consumer sentiment and stock markets.

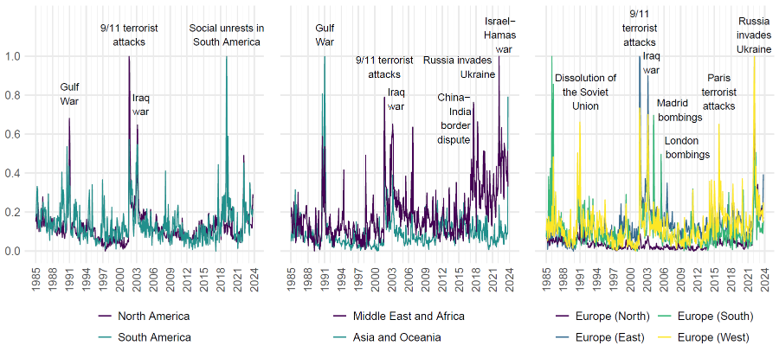

GPR shocks, often considered exogenous to the economic models typically used by central banks and policymakers, present a significant challenge due to their unpredictability and potential to trigger widespread economic disruption. These shocks can stem from various sources, including international conflicts, political instability, and global crises, making them particularly dangerous for policymakers responsible for safeguarding economic and financial stability (Figure 1). Unlike endogenous factors, which can be better predicted and potentially also managed through conventional monetary and fiscal policy tools, GPR shocks evade standard forecasting models, leaving economies vulnerable to sudden and severe impacts. In this context, it is crucial to understand how GPR influences the real economy and financial markets.

Figure 1. Geopolitical Risk Index by World Regions

Source: Caldara and Iacoviello (2022), own compilation.

Note: The country-specific GPR indexes reflect the automated text-search results from the electronic archives of newspaper articles. The resulting indexes capture the US perspective on risks posed by, or involving, the country in question. The data were normalized using min-max scaling.

In our paper, we provide an extensive review of the transmission channels through which geopolitical risks influence macro-financial stability. Initially, we compile and analyze existing measures of geopolitical tensions and uncertainty, focusing on their interrelationship. We then explore the broader effects of heightened uncertainty on the economy and financial sector, as documented in the literature. Although the literature is abundant, it is fragmented across multiple topics and lacks a cohesive conceptual framework.

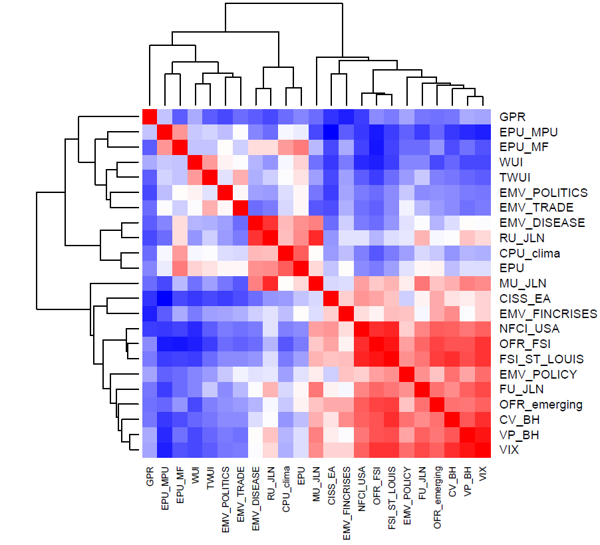

Geopolitical events and conflicts can have profound effects on global financial markets, leading to heightened uncertainty among investors, businesses, and policymakers. To investigate potential overlaps between the GPR index and existing uncertainty indexes, we conducted a cluster analysis, the results of which are depicted in a heat map in Figure 2. The first cluster (the top) contains the GPR index alongside uncertainty indexes related to trade disputes, politics, and migration policy uncertainty and fears. The second cluster (the middle) consists of general macroeconomic uncertainty indexes, such as the Economic Policy Uncertainty index (Baker et al., 2016) and the Real Uncertainty index (Ludvigson et al., 2021), along with two distinct uncertainty indexes related to climate and diseases. The third cluster (the bottom) includes various uncertainty indexes related to the financial sector, such as the VIX and the St. Louis Fed Financial Stress Index.

When examining the cross-correlation between the GPR indexes and the uncertainty indexes, we do not observe a consistent pattern over time. However, we find that GPR events tend to generate significant spikes in uncertainty across various categories, including the financial sector, the real economy, policy, and environmental and migration concerns, underscoring the episodic nature of GPR’s impact.

Figure 2. The Uncertainty Indexes Naturally Group into Three Clusters

Note: The heat map visually clusters the listed indexes. The intensity and shade of the color indicate the degree of similarity between the indexes. Red signifies a positive correlation, while blue denotes a negative correlation. Adjacent to the heat map, dendrograms use hierarchical clustering to group variables based on their correlation patterns. Variables positioned closer in the dendrogram exhibit more similar correlation behaviors. The clustering uses an agglomerative (bottom-up) approach, where each observation starts in its own cluster, and pairs of clusters are merged as one moves up the hierarchy. The distance between pairs of observations is calculated using Euclidean distance. For an explanation of the mnemonics, please refer to the full version of the paper (Hodula et al., 2024), Table 1.

Our research identifies two key transmission channels through which GPR affect macro-financial stability: the financial channel and the real economy channel. These channels describe how GPR-induced uncertainty propagates through financial markets and the broader economy, often amplifying the risks to both.

Financial Channel: Uncertainty Shocks, Capital Flows, and Market Volatility

GPR heighten uncertainty in financial markets, resulting in several destabilizing effects:

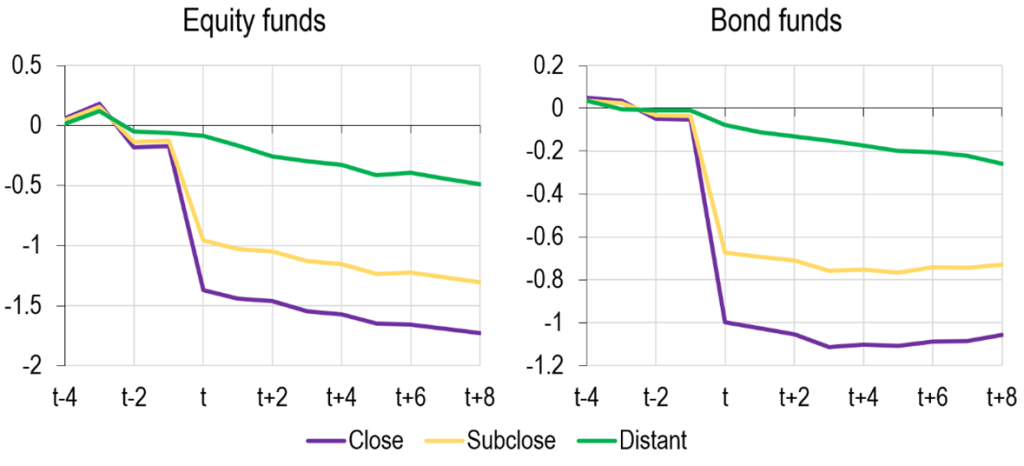

The mutual fund industry is particularly susceptible to GPR shocks, with investors withdrawing funds during periods of heightened risk. For example, Russia’s invasion of Ukraine in 2022 led to substantial outflows from mutual funds as risk aversion spiked across global markets. Notably, the decline was more pronounced in countries geographically closer to Ukraine (Figure 3).

Figure 3. Evolution of Mutual Fund Flows around the Onset of the Ukraine War

Note: Annual growth rates of total fund assets with the pre-event mean subtracted from the time series. Close, subclose, and distance are country averages. Close includes: Estonia, Finland, Hungary, Lithuania, Latvia, Poland, Romania, and Slovakia. Subclose comprises the countries in the Close category and adds Austria, the Czech Republic, Germany, and Slovenia. Distant countries are Belgium, Cyprus, Spain, France, Greece, Ireland, Italy, Luxembourg, Malta, the Netherlands, and Portugal.

Real Economy Channel: Trade and Commodity Market Disruptions

In addition to financial market impacts, GPR also affects the real economy through disruptions to trade, supply chains, and commodity markets:

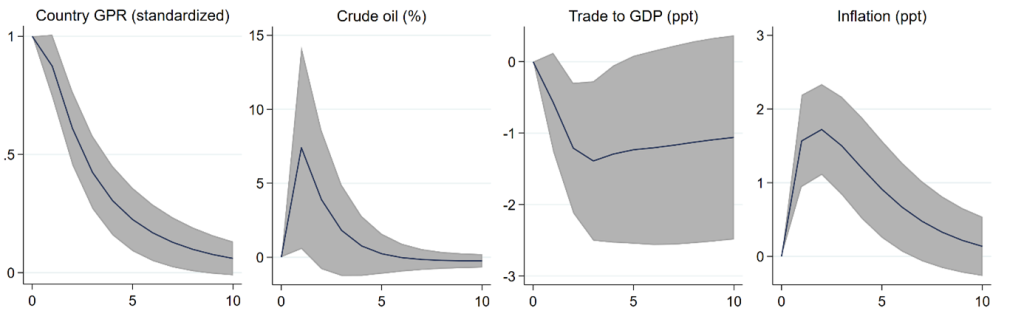

Rising commodity prices lead to increased inflation and affect output and income differently, depending on whether a country imports or exports commodities (De Gregorio, 2012). Figure 4 shows that a one-standard-deviation GPR shock induces inflationary pressures, peaking at nearly 1.5% within two years. The model suggests that geopolitical risk-induced inflation is accompanied by increases in crude oil prices and trade disruptions.

Figure 4. Effects of Geopolitical Risks on Inflation: Panel VAR from 1900 to 2020

Note: The figure presents impulse responses to a one-standard-deviation surge in country-specific geopolitical risk, as determined through a panel vector autoregression (PVAR) model. This model uses annual data from 1900 to 2020, based on the following Cholesky ordering of variables (with two lags set according to information criteria tests): country GPR (standardized), the log of crude oil prices (West Texas Intermediate), the trade-to-GDP ratio, and the inflation rate. Inflation data were winsorized at the top 2.5% to filter out hyperinflation periods. The solid lines in the figure represent the primary estimates, while the shaded regions show bootstrapped 90 percent confidence intervals. The data are sourced from Caldara & Iacoviello (2022), FRED, and the Jorda-Schularick-Taylor Macrohistory Database.

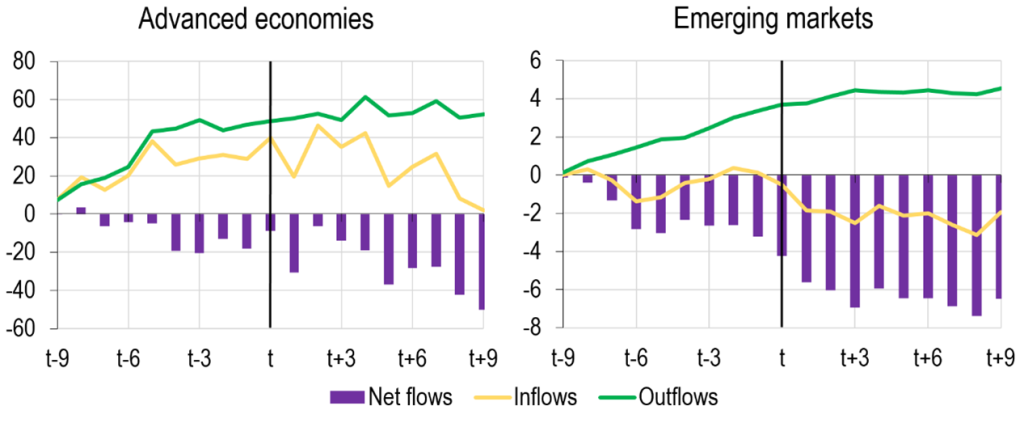

Our analysis also highlights the significant spillover effects of geopolitical risks on cross-border capital flows. Geopolitical tensions often lead to abrupt capital outflows, particularly from emerging markets, resulting in reduced access to external financing, currency depreciation, and financial stress. These spillovers exacerbate liquidity shortages and financial instability, especially in countries highly dependent on foreign capital inflows (Aguiar and Gopinath, 2005).

For instance, during the Russia-Ukraine conflict, emerging markets experienced substantial capital flow retrenchment, leading to severe disruptions in local financial markets. These spillover effects underscore the importance of monitoring cross-border capital flows as a key mechanism through which geopolitical risks propagate financial instability (Figure 5).

Figure 5. Cross-Border Equity Flows Around the Start of the War in Ukraine (t=2022Feb)

Note: The figure shows the evolution of monthly equity cross-border cumulative flows in a sample of advanced and emerging market economies. Inflows represent the money flowing in or out of the domestic country from foreign investors. Outflows represent the money flowing in or out of foreign countries from domestic investors. Net flows are calculated as inflows minus outflows, where a positive value indicates net inflows into the domestic country. The data are sourced from the OECD Monthly Capital Flow Dataset.

In our review, we investigated how geopolitical risks affect macro-financial stability, focusing on their impact on financial markets and the broader economy. Although the literature on this topic is abundant, it remains fragmented across multiple areas and lacks a cohesive conceptual framework, as geopolitical risk is a relatively new source of uncertainty in academic research. We highlight the episodic nature of GPR shocks and identify the transmission channels through which they can impact macro-financial conditions.

By recognizing the episodic nature of these impacts, policymakers and financial institutions can better prepare for sudden spikes in uncertainty, thereby fostering more resilient economic and financial systems. Future research should focus more on the spillover effects and feedback loops of geopolitical risks across regions, and the role of asymmetries and nonlinearities in their transmission. Additionally, a unified theoretical framework is needed to better understand both the direct and indirect channels of geopolitical risk propagation, as well as the varying intensities and durations of these effects across different economies and markets. Furthermore, exploring the effectiveness of various policy measures under different geopolitical scenarios could offer valuable insights into mitigating the systemic impacts of such shocks.

In this paper, we mainly emphasize the importance of unexpected episodic spikes in GPR, but GPRs can also manifest over the medium- to long-term through complex interactions with other factors, such as cybersecurity threats, energy market dependencies, or technological competition. Understanding this broader spectrum of risks is another important area for future research.

Adrian, T., R. K. Crump, and E. Vogt (2019): “Nonlinearity and Flight-to-Safety in the Risk-Return Trade-Off for Stocks and Bonds.” The Journal of Finance, 74(4):1931–1973.

Aguiar, M. and G. Gopinath (2005): “Fire-Sale Foreign Direct Investment and Liquidity Crises.” Review of Economics and Statistics, 87(3):439–452.

Alcalá, F. and A. Ciccone (2004): “Trade and Productivity.” The Quarterly Journal of Economics, 119(2):613–646.

Baker, S. R., N. Bloom, and S. J. Davis (2016): “Measuring Economic Policy Uncertainty.” The Quarterly Journal of Economics, 131(4):1593–1636.

Buch, C. M., M. Buchholz, and L. Tonzer (2015): “Uncertainty, Bank Lending, and Bank-Level Heterogeneity.” IMF Economic Review, 63(4):919–954.

Caldara, D. and M. Iacoviello (2022): “Measuring Geopolitical Risk.” American Economic Review, 112(4):1194–1225.

Christiano, L. J., R. Motto, and M. Rostagno (2014): “Risk Shocks.” American Economic Review, 104(1):27–65.

De Gregorio, J. (2012): “Commodity Prices, Monetary Policy, and Inflation.” IMF Economic Review, 60(4):600–633.

Gilchrist, S., J. W. Sim, and E. Zakrajšek (2014): “Uncertainty, Financial Frictions, and Investment Dynamics.” NBER Working Paper 20038, National Bureau of Economic Research.

Hodula, M., J. Janků., S. Malovaná, and N. A. Ngo (2024): “Geopolitical Risks and Their Impact on Global Macro-Financial Stability: Literature and Measurements.” CNB Working Paper No. 8/2024, Czech National Bank.

Ludvigson, S. C., S. Ma, and S. Ng (2021): “Uncertainty and Business Cycles: Exogenous Impulse or Endogenous Response?” American Economic Journal: Macroeconomics, 13(4): 369–410.