This Policy Note is based on Natixis Special Report, August 2024 “Germany: a case of long-covid?”

Abstract

The German economy has been broadly stagnating over the last couple of years, with the level of economic activity now only slightly higher than before the pandemic. This is in stark contrast to other euro area countries, where real activity is now significantly higher than in pre-pandemic times. The inability of the German economy to reach escape velocity and to return to its old growth path reflects a combination of cyclical sluggishness in some sectors, less support from the fiscal side and structural changes that are affecting the German economy more than others. The structural headwinds – the rise of China as a direct competitor and a semi-permanent upward shift in energy costs – have made the pre-existing weak spots of the economy look more problematic than previously. Factors such as high wage costs and a high tax burden, which seemed acceptable in the pre-pandemic world, appear now more threating to the outlook of the German economy than in the “old world”. The continuing weakness of the industrial sector and corporate investment spending poses the risk of a self-re-enforcing downward adjustment. As industrial clusters shrink, productivity tends to decline as internal and external local economies of scale weaken. Whether this process has started now in earnest is hard to say. But what seems clear is that the nature of these challenges demands more than a piecemeal response from the government.

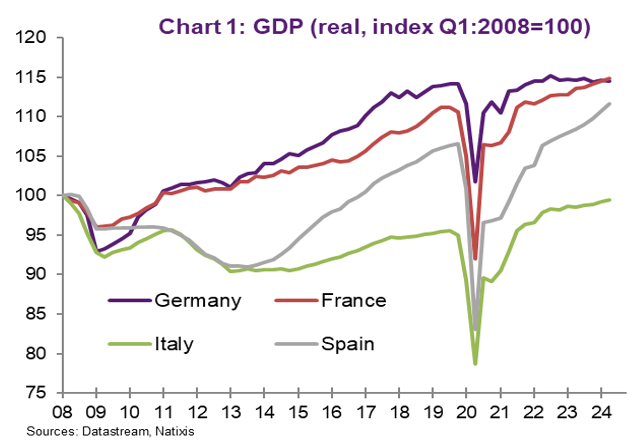

After a sharp rebound in activity during the second half of 2020 and 2021, following the immediate covid shock, the German economy has been broadly stagnating: German real GDP is only marginally higher now than before the pandemic. This is in sharp contrast to the other EMU4 countries where GDP now exceeds its pre-pandemic level significantly (France: +3.8%; Italy: +4.7%; Spain: +4.7%).

Before we delve deeper into the underlying factors behind this weakness, it is noteworthy that the growth divergence seen since the pandemic is to some extent more a catching up of the other countries when viewed from a longer time horizon as the German economy had been growing relatively strongly in the years prior to the pandemic (see Chart 1). Nevertheless, the lasting stagnation of the German economy is worrisome regardless of the relative performance and points to some deeper underlying problems.

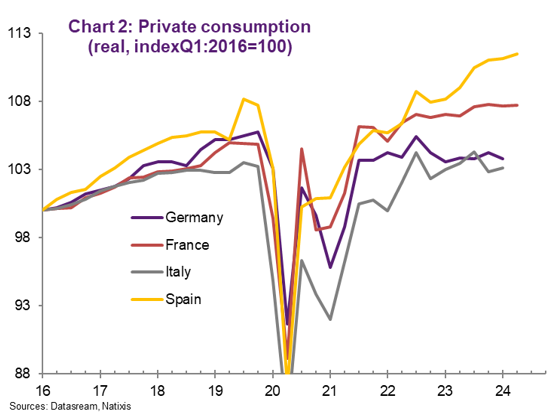

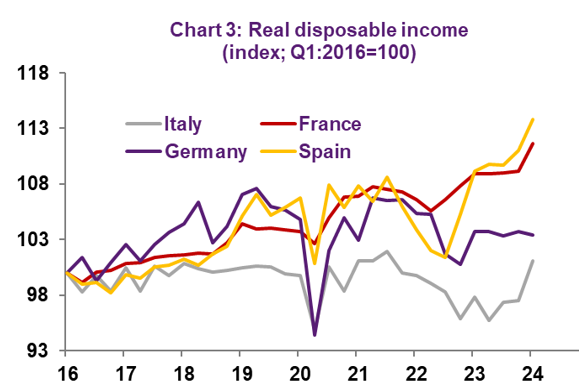

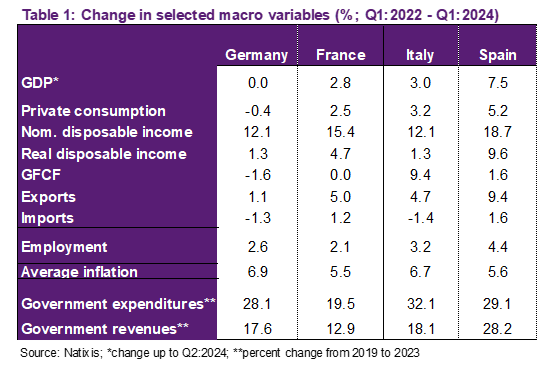

Consumer spending has been broadly flat over the last two and half years in Germany, while it was growing quite strongly in the other EMU4 economies (see Chart 2). The main reason behind this stagnation of private consumption is a similarly weak development of real disposable income (see Chart 3). Weak real income reflects weaker nominal income growth in Germany but also a higher average inflation (see Table 1 further below for the details). Another factor holding consumption back in Germany is an increase in private household savings: the savings rate rose from Q1:2022 to Q1:2024 by 0.9 percentage points, while it rose only 0.4 ppts in France and declined by 0.9 ppts in Italy).

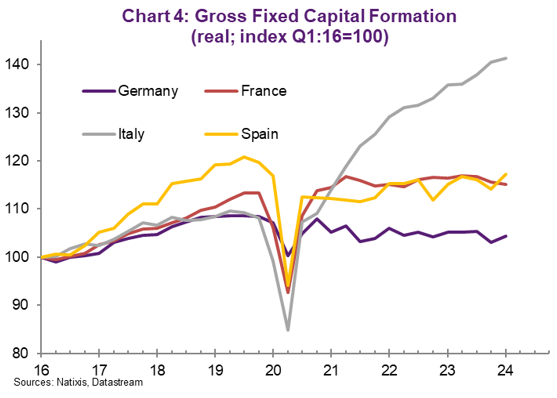

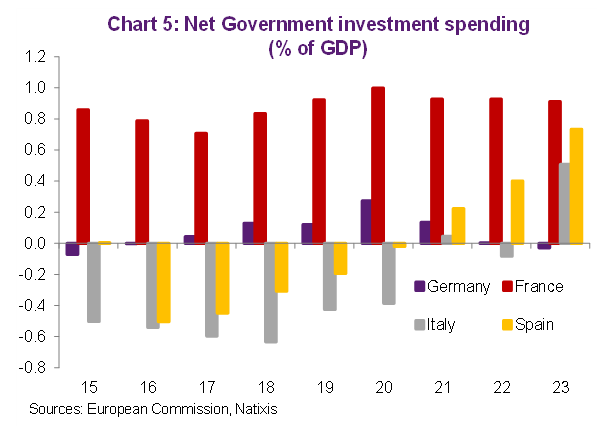

Total Gross Fixed Capital Formation has been (marginally) trending down in Germany over the last three years (see Chart 5). Again, investment spending has been developing more dynamically in the other three economies. Italy stands out in this respect as GFCF has surged by close to 10% since 2022. This predominately reflects the so-called “superbonus” tax incentive scheme and a (significant) correction is likely (for more on this see here). But even when discounting the Italian numbers as somewhat artificially inflated, it is clear that GFCF remained relatively weak in Germany.

The weakness in GFCF mostly reflects weak public and private investment spending. Net government investment spending has been broadly flat in Germany over the last three years while it has either been growing robustly or increased strongly over the last three years in the other EMU4 countries (see Chart 5). The combination of anemic public investment and weak housing construction activity can explain why overall construction investment is down by almost 5% since 2022.

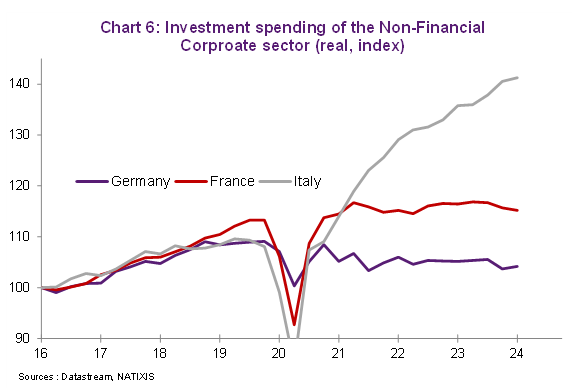

The picture looks similar with respect to corporate investment spending, which has again underperformed corporate investment spending in France and Italy (see Chart 6). We should mention that the relative weakness in real corporate investment spending reflects a much steeper rise in the deflator for GFCF. Corporate investment spending has actually grown a bit stronger in Germany than in France. Given the innate difficulties to deflate investment goods it may be possible that the divergence is actually smaller than shown in Chart 6. This would be also consistent with the fact the corporate profit growth – a main determinant for corporate investment spending – had been growing strongly in Germany.

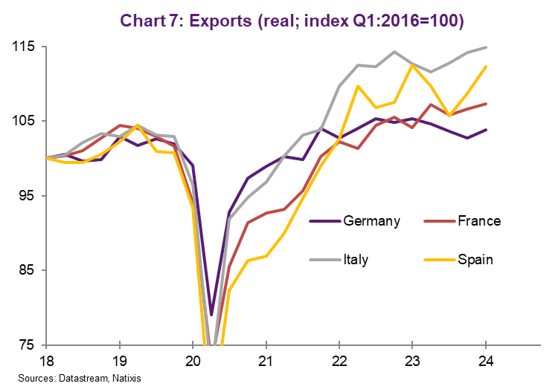

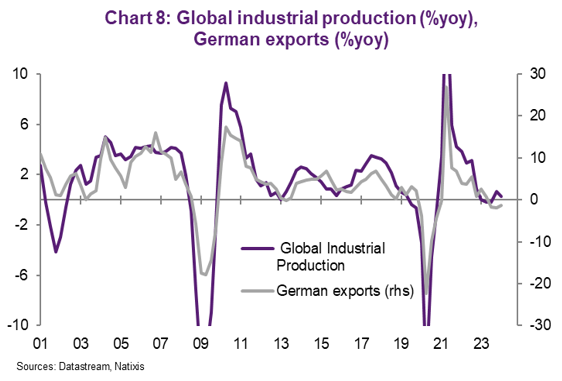

No pick-up in export growth. German export growth also underperformed growth in other countries (see Chart 7). Interestingly there is no obvious structural break in the German export performance. German export growth has been closely correlated with global industrial activity. The sluggishness seen in export growth is broadly consistent with the lackluster dynamics in global industrial activity (see Chart 8). This is not to say that all is well in the German export industry. Indeed, the aggregate numbers are blurring the picture somewhat and there are some fault lines developing, especially in the trade with China. We will take a closer look at this further below.

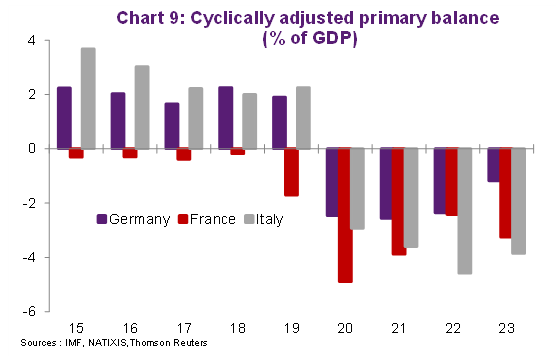

We already mentioned anemic government investment spending in Germany. But fiscal policy more generally – including government transfers – provided a much smaller growth impulse in Germany than in other countries. The cyclically adjusted deficit was much smaller in Germany throughout the pandemic and the following years. Put differently, the fiscal stance was less expansionary in Germany than either in France or Italy (see Chart 9).

Table 1 provides a summary of several macro variables for the EMU 4 countries. As discussed, the relative weakness of the German economy is visible “across the board” and cannot be attributed to just one or two areas.

While the temporary boost provided by an expansionary fiscal policy in the other countries will fade, leading to some convergence in growth performance, the growth outlook for the German economy remains fragile. The reason behind this fragility is several structural shocks that have hit (and continue to hit) the German economy. Though inherently difficult to quantify, there is little doubt that the impact of the combination of these shocks poses a considerable challenge. Moreover, these structural shocks have made it more difficult for the corporate sector to ignore existing disadvantages, such as a high tax burden and bureaucratic costs. We first discuss each of these structural shocks before we try to assess how lasting the growth damage might be.

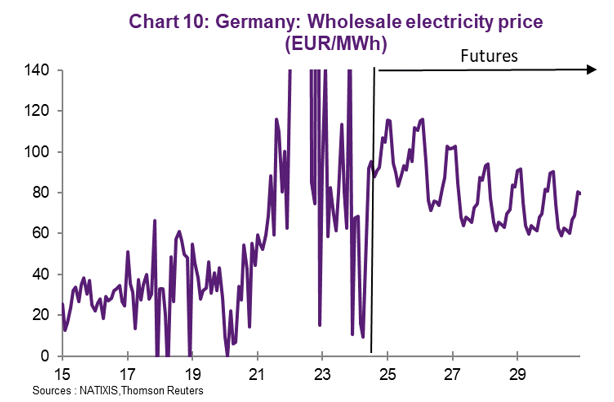

Energy shock and uncertainty related to Green Transition. The costs of energy, especially natural gas, have seen a lasting upward shift in Germany on the back of the loss of Russian gas, but also the shift towards renewables (and the shutting down of the remaining nuclear plants).1 Future markets indicate that electricity prices in Germany will be at least twice as high as prior to the pandemic in the coming years (see Chart 102). To what extent the energy intensive parts of the economy can adjust to this new regime of permanent higher energy prices remains to be seen. While there is clearly a path that would allow the energy industry to recover, activity remains low for now.3

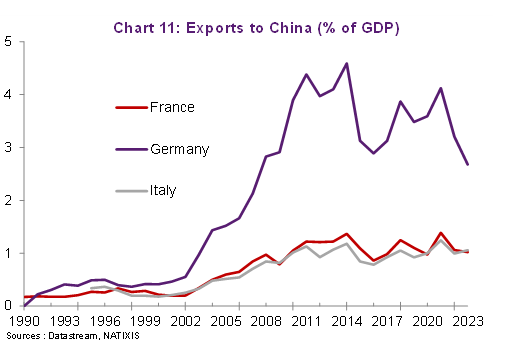

The China shock. Trade with China has been a boon for Germany and exports to China accounted for up to around 4% of GDP at their peak (see Chart 11). There has been, however, a clear moderation in the size of German exports to China over the last couple of years.

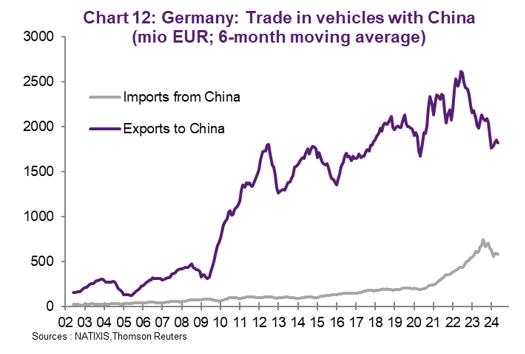

The trade with China has also steadily become more imbalanced as China moved up the value-chain. German car exports to China, for example, are declining while Chinese car exports to Germany are rising fast (see Chart 12). At the same time, the deficit in other sectors, such as “electrical machinery” is rising quickly since the pandemic (see Chart 13).

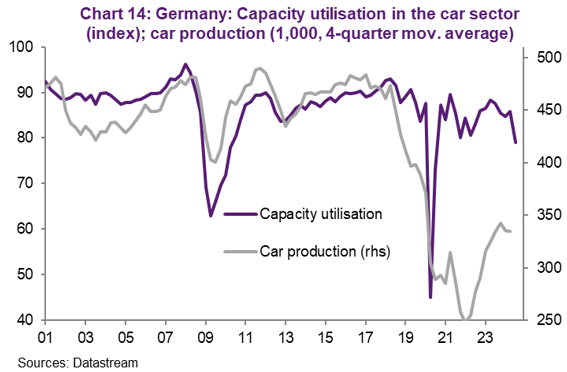

The transition to EVs. The shift from combustion engine to electric vehicles is a major structural shift for the German car industry. Car production remains very low, underlining the difficulties of the transition. The fact that German car companies are reporting at the same time a rather high capacity utilization shows that the upside growth potential for the car industry remains limited for now (see Chart 14).

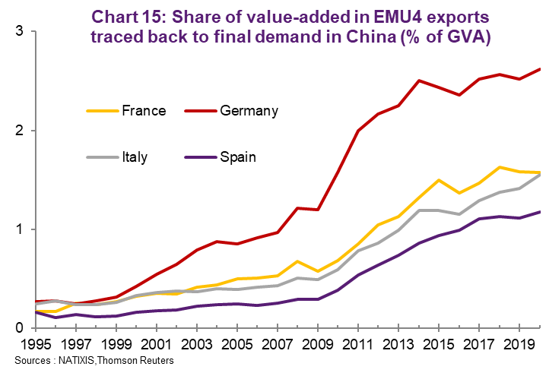

Unlike many other advanced economies, Germany was able to sustain the size of its manufacturing sector during the last two decades and globalization has generally helped to retain manufacturing jobs. The rise of China as a competitor, however, may change this picture. We will try in this section to get a rough idea how damaging the decline in trade with China could be. Chart 15 shows the value-added in EMU4 exports that can be (with the help of Input-Output tables) traced back to final demand in China. For Germany, the value-added is close to 3%, roughly twice the value for France and Italy.5

To get an idea how much a further loss of competitiveness of German exporters could affect trade with China we revert back to simulations we have done somewhere else. In these simulations we estimated what the growth effect of a 10% increase in tariffs on exports to China would be. Our estimate not only took into account the value of exports to China but also the value added of the producer of intermediate goods that go into the final product. According to our estimate such a tariff would lead to a decline in German GDP between 0.25% to 0.7%.

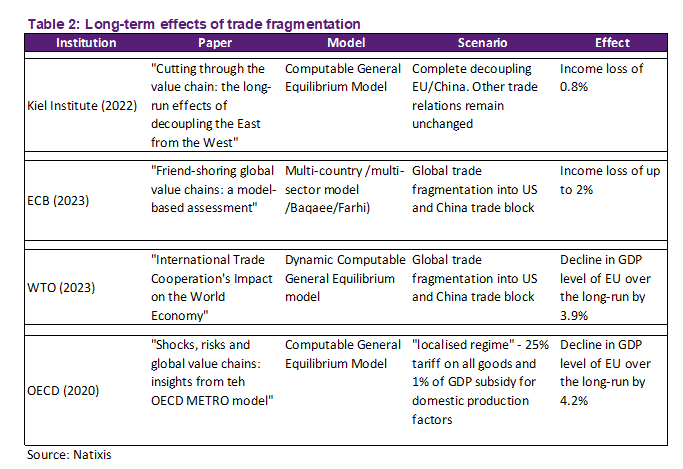

To be sure, such simulations give only a vague idea about the order of magnitude of the growth impact of a further deterioration in trade with China. For one, it only shows the impact of exports to China. It does not reflect the fact that Chinese companies have become now a direct competitor in many fields, implying higher imports from China and stronger direct competition in third markets. How strong this competition will be, will also depend on tariffs Chinese exporters face (in the EU but also elsewhere). It seems likely that in response to the overcapacity built in China many advanced economies will limit their direct trade exposure to China. It therefore seems likely that the ultimate impact of the China shock will be some kind of fragmentation of global trade into different blocks. Table 2 provides an overview of different studies that have tried to assess the economic effect of different fragmentation scenarios. Depending on which scenario is chosen, the output effect is significant.

In sum, when viewed from the perspective of a German exporter, the outlook looks unflattering: either there will be increased competition from Chinese companies (many of which backed by some form of government funding) or a fragmented world and dis-entanglement from China. Consequently, under most scenarios export growth will be, potentially a lot, less dynamic than in the past. To put this into perspective: net trade has on average provided 0.2 percentage points to quarterly growth since 2000 with the average GDP growth being 0.3%.

The changed global environment and the lasting rise in energy costs pose a genuine challenge for the German industrial sector and thus the whole economy.6 For assessing the seriousness of the challenge it is necessary to take into account potential self-reenforcing downward dynamics that can set in, once a sector or industrial cluster loses a certain critical size. It is economies of scale that can trigger these self-reenforcing dynamics. The production of goods display economies of scale if average costs decline as output increases. The more is produced from a good the cheaper it becomes to produce it. Economies of scale can be differentiated as local/national or international depending on whether the different stages of production need to be in close proximity or not in order for the economies of scale to occur. A cluster of specialized companies located in the same region (Silicon Valley) is an example of national, external economies of scale.

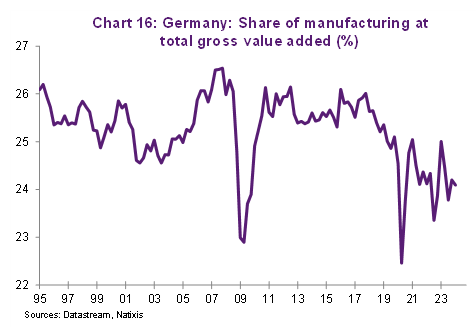

National external economies of scale have important implications when assessing the competitiveness of a country.7 Economies of scale raise the economic entry barriers to an industry and the position that a country reaches as a producer does not break down over night. Differences in wage costs can be sustained through the positive effects of economies of scale on productivity. Past estimates have shown sizeable effects of economies of scale.8 According to these estimates a doubling in the size of the German motor vehicle industry in terms of capital and workforce would lead, all else equal, to an increase in productivity by 20%. But economies of scale can work in both directions: when the size of an industry declines as companies stop to invest, the decline and competitive pressure rises disproportionally. Thus, a crucial question for the outlook of the German manufacturing sector is whether the current shocks will lead to an erosion of the economies of scale as corporate investment fails to keep industrial clusters intact? After being broadly stable for three decades, the share of manufacturing in the economy has started to decline since 2018 (see Chart 16).

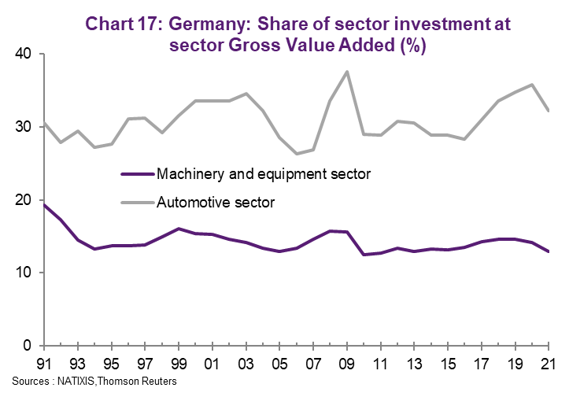

At the same time, investment spending in two key industrial sectors, machinery equipment and automotive, have been holding up well until 2021 (latest data available). Overall, there is so far no clear evidence that investment weakness has been exceptional and outside the usual cyclical bounds. But this is by no means a guarantee that downward dynamics may gain additional momentum that would eventually endanger existing industrial clusters in a more significant way.

The last time the German economy was in need of a significant adjustment of its production structure was at the beginning of the 2000s. Several factors made a general re-orientation of the economy necessary at that time. For one, the unification boom had triggered a surge in wage costs in the early 90’s, eroding the competitiveness of the manufacturing sector. It was only a matter of time before that loss of competitiveness needed to be addressed. EU enlargement in 2004 and globalization in general exacerbated the competitive pressure on the manufacturing sector during the early parts of the 2000s further. Moreover, Germany entered monetary union in 1999 at too high a conversion rate of Deutsch Mark into Euro, adding yet further competitive pressure. Finally, the dismantling of the so-called Germany Inc (cross-shareholdings of banks and insurances that governed the German corporate sector) and a rising influence of capital markets forced a fundamental re-orientation of German corporates. Thus, we think that the beginning of the 2000s represents a rough template for the coming adjustment and how it will impact growth of the German economy.

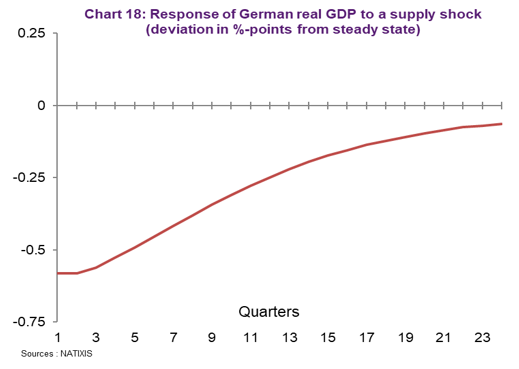

With this in mind, we built a so-called SVAR model of the German economy to better understand the dynamic response of the German economy to a negative supply shock.9 We define a negative supply shock as a shock that will reduce output, wages and raise prices as the capacity of the economy is adversely impacted by the shock. We can use this model to estimate how big the “supply shock” around the early 2000s – when the aforementioned structural changes cumulated – was and then use this shock to see how the economy would respond if it were to be hit again by such a supply shock. Chart 18 shows the result of this simulation. According to this simulation GDP would decline, all else equal, by around 2% in the first year on the back of such a shock. Furthermore, it would take about four years until the effect of the shock had broadly faded.

While simulations based on past episodes are necessarily crude, they nevertheless give a rough idea about the order of magnitude. Moreover, given the persistence of supply shocks as shown in Chart 18 it can help explain the lasting underperformance of the German economy.

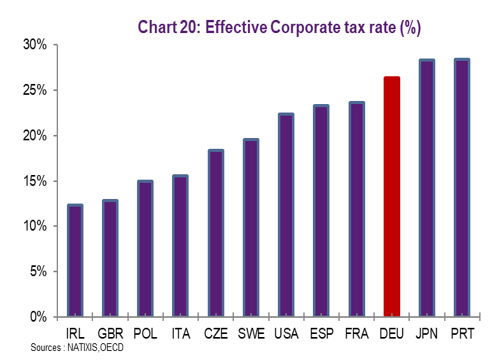

To weather the current challenges, the German capital stock needs to be upgraded. This implies more investment from the government and the corporate sector. The growth of public investment spending will be limited for the time being owing to the so-called constitutional debt brake. While it is true that a prioritization of government spending (spending cuts in other areas) could lead to more public investment spending, the political realities are such that this is unlikely to happen.10 With respect to corporate investment spending, it remains the case that wage costs in Germany are very high (see Chart 19), as is the tax burden (see Chart 20).

In addition, costs associated to red tape have risen strongly and excessive bureaucratic regulations remain among the major complaints of German companies (see Chart 21). Given the limited fiscal space, there is not much the government can do immediately to address a high tax burden or high wage costs (a significant part of the wages paid are contributions to the social security system). This would leave reducing red tape as the obvious instrument to improve Germany’s attractiveness as a place to do business. While compelling in theory, many governments have tried (including the current one) and little has happened on a net basis to reduce the overall costs of bureaucracy.

It is the multitude of shocks that are compounding the risks for the German economy at this point. Unlike in previous episodes, it is not simply price competitiveness that needs to be regained. Changes in technology as well as in the economic and geopolitical environment make it much more difficult to know what is necessary to recalibrate the economy to embark again on a sustainable growth path. This demands an attentive economic policy that is willing to act in an unorthodox way if needed. Unfortunately, the steady infighting in the ruling coalition in Berlin makes this unlikely. Moreover, the continuing relative strength of the labour market reduces the immediate pressure to act. While we still expect some cyclical improvement in the coming quarters as real income should grow more forcefully, the upside is clearly limited and we forecast growth of only around 1% for the German economy in 2025 after zero growth this year.

While the Levelized Costs of Energy have plunged for renewables, building up the infrastructure to for deal with the innate volatility of renewables is proving quite costly.

Given the volatility of electricity generation by renewables the development of storage capacity will be a crucial determinant of the medium-term outlook for electricity prices. Storage capacity has been now rising quite strongly, though difficult to say at this point how long this momentum will last. For more see here.

See Scheider. C. “Aus der Gaskrise zu einer anpassungsfähigen klimaneutralen Grundstoffindustrie“ Ifo Schnelldienst (2023).

See Dauth et al “Trade and Manufacturing Jobs in Germany, AER; (2017).

Data from Input-Output tables are only published, unfortunately, with a significant lag.

It is important to note in this respect that 9%-11.5% of valued added in the services sector can be traced back to demand from the industry. See Hüther Ifo Schnelldienst 3/2023.

For a detailed analysis see Gomory and Baumol “Global Trade and Conflicting National Interests” (2000).

See Henriksen et al “Economies of scale in European manufacturing revisited” (2001).

Our model is based on „Technology shocks and robust sign restrictions in a euro area SVAR”; Peersman, Straub (2004).

It is true that public investment at the level of the federal government is increasing. However, it is on the local level that investment spending has been very weak. Addressing the funding problems of local governments would demand a significant overhaul of the current system.