In recent years there has been greater recognition that, in a world where financial institutions and markets are highly interconnected, differences in national macroprudential policies can be an important source of international spillovers. Through cross-border regulatory arbitrage, these differences may lead to large swings in capital flows, which in turn may magnify the transmission of financial shocks across regions and exacerbate financial risks in recipient countries. In a recent contribution, we used a quantitative two-region (core and periphery) model with global banks to a) characterize the cross-border leakages that may occur when regulators in the core tighten their macroprudential stance in response to an expansionary monetary shock in that region; and b) evaluate the potential benefits of coordinating countercyclical capital buffers (consistent with Basel III’s Principle of reciprocity) in the presence of regulatory arbitrage. Our key finding is that if regulators set policies on the basis of a financial stability mandate, and if cross-border regulatory leakages are strong, Basel III’s reciprocity principle may perform better for all parties than acting independently. Yet, the gains for the world economy tend to be relatively modest.

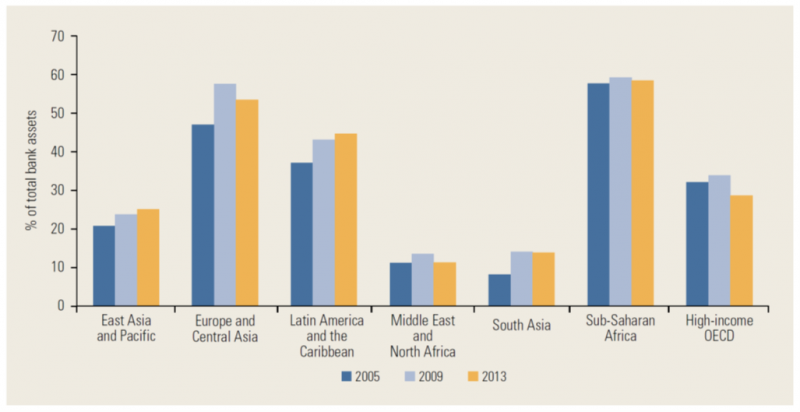

In recent years there has been greater recognition that, in a world where financial institutions and markets are highly interconnected, differences in national macroprudential policies can be an important source of international spillovers. Through cross-border regulatory arbitrage, these differences may lead to large swings in capital flows, which in turn may magnify the transmission of financial shocks across regions and exacerbate financial risks in recipient countries. Particularly important in that context has been the role of global banks, which importance in the world economy has increased significantly over the past three decades. Despite the Global financial crisis, the share of bank assets held by foreign banks remains high in many regions, including high-income OECD countries, Latin America and the Caribbean, and Sub-Saharan Africa (Figure 1).

Figure 1. Share of Total Bank Assets Held by Foreign Banks, by Region, 2005-2013

Source: World Bank (2018, p. 8).

The role of global banks in the transmission of financial shocks has also become more significant in recent years. In response to a tightening of capital requirements at home, for instance, domestic banks with a regional or global presence may respond by increasing lending abroad, through direct loans to either foreign-country borrowers or their foreign affiliates.1 This brief elaborates on the channels through which the increase in lending occurs, its impact on recipient countries, and whether coordinated policy responses can be beneficial to all.

A number of studies have provided evidence that banks with a global outreach often engage in regulatory arbitrage, by transferring funds to (or, in some cases, from) markets with weaker regulations – creating, in effect, an international credit channel.2 In turn, the increased lending induced by cross-border regulatory arbitrage may contribute to a credit boom or asset price pressures in recipient countries.3

Whether a counterbalancing macroprudential response by regulators in those countries is also called for to mitigate financial risks depends on the stage of their financial cycles, that is, whether countries are already experiencing sustained credit growth increasing spreads, or asset price pressures. At the same time, aggregate fluctuations and policy responses in recipient countries may generate significant spillback effects, through both trade and financial channels, which in turn may hamper the achievement of the initial objectives set out by regulators in source countries. The implication is that when global financial institutions can evade policy actions taken by regulators in their jurisdiction, financial cycles are not well synchronized across economies, and externalities in the form of reverse spillovers are potentially significant, macroprudential policies that are optimal at the national level may be sub-optimal from the perspective of the world economy. By implication, if policy decisions can magnify risks for all parties when taken independently, ex ante coordination may provide benefits for all and possibly improve global welfare.

The potential benefits of coordinated action are indeed one of the rationales underlying Basel III’s principle of reciprocity, which applies to countercyclical capital buffers (see Basel Committee on Banking Supervision (2011)). Designed to overcome the problems associated with global banks bypassing national regulations on capital requirements, the principle stipulates that when the countercyclical capital buffer embedded in Basel III is activated in any given country, all countries are expected to apply the same buffer on exposures to that country from banks in their jurisdiction.4 In the same vein, automatic reciprocation of countercyclical capital buffers is required in the European Union since 2016. In effect, the fundamental rationale for reciprocity is that greater coordination of macroprudential policies across countries may help to maintain, or promote, global financial stability.

Given the importance of this issue from a policy perspective, in a recent contribution (Agénor et al. (2022)) we have developed a quantitative analysis aimed at modeling cross-border regulatory leakages and at quantifying the gains from international macroprudential coordination, in the form of reciprocal activation of countercyclical instruments. To do so we develop a two-region (core and periphery) model with imperfect financial integration and global banking to shed light on two issues. First, we characterize the cross-border leakages when regulators in the core region tighten their macroprudential stance in response to an expansionary monetary shock in that region. Second, we evaluate the potential benefits of macroprudential policy coordination and reciprocity agreements (pertaining to countercyclical capital buffers, consistent with Basel III’s Principle alluded to earlier) in the presence of regulatory arbitrage.

Specifically, dwelling on previous work by Agénor et al. (2019), the framework assumes that banks in the periphery are all considered to be affiliates set up by a global bank located in the core, and loans between them occur through an internal capital market. In addition, banks in both regions are subject to a risk-sensitive capital regulatory regime. Outward leakages in macroprudential policies are defined as a situation where, in response to changes in countercyclical capital requirements in the core, which affect lending there, the global bank shifts lending from its jurisdiction to lending to its affiliates abroad. Regulatory arbitrage therefore contributes to financial spillovers (and potential spillbacks) across jurisdictions. A key novelty of our analysis also is to treat reciprocity – a regime which, as described earlier, involves partial cooperation – as an independent policy regime, whose performance can be compared with the standard cases of (full) cooperation and independent policymaking.

To discuss the issues outlined earlier, the model is parameterized for two groups of countries, corresponding to the core and periphery, respectively: major advanced economies (MAEs) and systemically-important middle-income countries (SMICs). As defined in Agénor and Pereira da Silva (2022), MAEs consist of the United States, the euro area, and Japan, whereas SMICs consist of Brazil, China, India, Indonesia, Mexico, Russia, South Africa, and Turkey. This classification is based in part on the results of a study by the International Monetary Fund (2016), in which these groups of countries were identified as those that have exerted the largest financial spillovers and spillbacks from and to each other in recent years.

First, our analysis considered an expansionary monetary policy in the core – a key driver of the global financial cycle, as documented, for instance, by Miranda-Agrippino and Rey (2020) – to illustrate how lending costs, countercyclical capital buffers (which respond to credit fluctuations), and regulatory arbitrage affect cross-border bank capital flows. Following that shock, a countercyclical response in capital requirements induces the global bank to engage in regulatory arbitrage. The magnitude of the resulting cross-border capital flows is shown to depend on the degree of economies of scope in lending by the global bank. Thus, the model provides a structural interpretation of the empirical evidence on the growing importance of regulatory arbitrage. At the same time, because the equilibrium of the world economy is solved for both regions simultaneously, simulations of the model help also to capture the spillback effects associated with fluctuations in the periphery – making it therefore particular suitable to study the potential benefits of cooperative regimes, in terms of either reciprocity (partial coordination) or (full) coordination.

From that perspective, the analysis finds that when regulators set policies on the basis of a financial stability mandate, and these policies are evaluated in terms of household welfare, reciprocity may perform better than independent policymaking for all parties if cross-border regulatory leakages are strong. Yet, the gains for the world economy tend to be relatively modest. Thus, despite being narrowly defined, reciprocity agreements may face significant obstacles in practice, in the absence of adequate incentives (penalties or side-payment mechanisms) to ensure voluntary participation. Our results may also help to explain why, as discussed in more detail in Agénor and Pereira da Silva (2022), reciprocity has been only rarely invoked in the real world.

In several dimensions, the quantitative analysis presented in Agénor et al. (2022) can be viewed as preliminary. A key assumption of the framework developed in that paper is that all banks in the periphery are foreign affiliates. This helps to simplify significantly the analysis and made it easier to understand the channels through which (outward) regulatory arbitrage is transmitted across countries. However, as a result one cannot capture the substitution effects that may occur between domestic and foreign lenders within the periphery, and their indirect impact on cross-border bank capital flows induced by regulatory changes occurring in the core.

A framework with both domestic and foreign banks operating in the periphery would also be necessary to assess another type of cross-border leakages, the possibility that tighter regulation on domestic banks in the periphery may induce foreign branches (which are not subject to local prudential rules) to extend more credit to local borrowers, thereby hampering the achievement of the policy’s intended goal. There is evidence that this type of (inward) leakages have been quite significant as well (Buch and Goldberg (2017)).

Such extensions mean that the gain from reciprocity could be even more significant than currently estimated. Indeed, it is possible that the results in Agénor et al. (2022) provide only a lower bound on the potential benefits (in terms of financial stability) that a broad application of regulatory reciprocity may generate for the world economy.

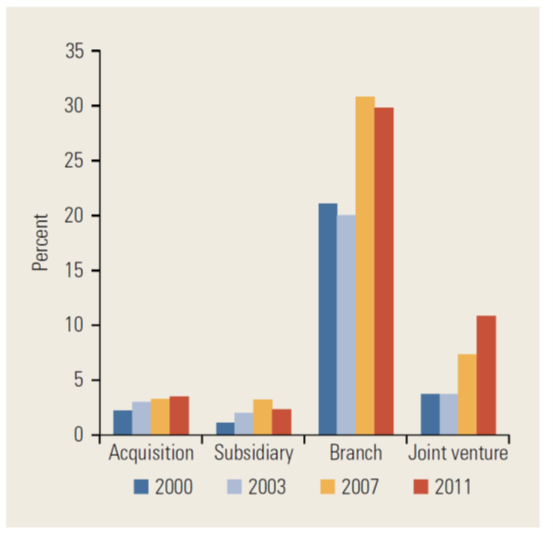

At the same time, it should also be noted that, in practice, to mitigate the risk that an increase in credit by foreign banks may substitute for a contraction in loans by domestic banks, a growing number of recipient countries have opted to restrict entry by foreign banks in the form of branches, which obviates the need to invoke reciprocity with the jurisdiction where the parent bank is registered. Indeed, as shown in Figure 2, since the global financial crisis over a third of developing countries have placed restrictions on creating branches.

Figure 2. Share of Developing countries with Restrictions on Foreign Bank Entry through Alternative Modes

Note: Based on data for 78 developing countries, in response to Banking Regulation and Supervision Surveys conducted in the 2003, 2007, and 2011. Source: World Bank (2018, p. 10).

Finally, as documented by Aldasoro et al. (2022), during the past decade subsidiaries – which tend to behave more like local banks in the sense that they focus more on domestic currency and retail business – have reduced their share in total assets held by foreign banking offices, in favour of branches, which are more tailored to providing international services, such as the clearing of foreign-currency transactions. Branches’ asset growth has also been more responsive than subsidiaries’ to financial and economic conditions outside host jurisdictions. This shift may therefore create financial stability risks. A framework that accounts for these two types of banks would help to shed light on how these risks could materialize and whether coordinating regulatory policy responses could benefit all parties.

Agénor, Pierre-Richard, Timothy Jackson, and Luiz Pereira da Silva, “Global Banking, Financial Spillovers, and Macroprudential Policy Coordination,” Working Paper No. 764, Bank for International Settlements (January 2019).

––––, “Cross-Border Regulatory Spillovers and Macroprudential Policy Coordination,” Working Paper No. 1007, Bank for International Settlements (March 2022).

Agénor, Pierre-Richard, and Luiz Pereira da Silva, “Financial Spillovers, Spillbacks, and the Scope for International Macroprudential Policy Coordination,” International Economics and Economic Policy, 19 (February 2022), 79-127.

Aldasoro, Iñaki, John Caparusso, and Yingyuan Chen, “Global Banks’ Local Presence: A New Lens,” BIS Quarterly Review, March 2022, 31-43.

Avdjiev, Stefan, Bryan Hardy, Patrick McGuire, and Goetz von Peter, “Home Sweet Host: Prudential and Monetary Policy Spillovers through Global Banks,” Working Paper No. 853, Bank for International Settlements (April 2020).

Basel Committee on Banking Supervision, “Basel III: A Global Regulatory Framework for more Resilient Banks and Banking Systems,” Report No. 189, Bank for International Settlements (revised, June 2011).

Buch, Claudia M., and Linda Goldberg, “Cross-Border Regulatory Spillovers: How Much? How Important?,” International Journal of Central Banking, 13 (March 2017), 505-58.

Claessens, Stijn, Giulio Cornelli, Leonardo Gambacorta, Francesco Manaresi, and Yasushi Shiina, “Do Macroprudential Policies Affect Non-bank Financial Intermediation?,” Working Paper No. 927, Bank for International Settlements (February 2021).

Fillat, José L., Stefania Garetto, and Arthur V. Smith, “What are the Consequences of Global Banking for the International Transmission of Shocks? A Quantitative Analysis,” Working Paper No. 25203, National Bureau of Economic Research (October 2018).

International Monetary Fund, Global Financial Stability Report: Potent Policies for a Successful Normalization, IMF Publications (Washington DC: 2016).

Miranda-Agrippino, Silvia, and Hélène Rey, “U.S. Monetary Policy and the Global Financial Cycle,” Review of Economic Studies, 87 (May 2020), 2754-76.

Reinhardt, Dennis, and Steven J. Riddiough, “Regulatory Arbitrage in Action: Evidence from Banking Flows and Macroprudential Policy,” Working Paper No. 546, Bank of England (January 2015).

World Bank, Bankers without Borders, Global Financial Development Report, World Bank publications (Washington DC: 2018).

––––, Bank Regulation and Supervision a Decade after the Global Financial Crisis, Global Financial Development Report, World Bank Publications (Washington DC: 2020).

Of course, regulatory arbitrage may also occur at the domestic level (as occurred prior to the global financial crisis) if banks choose to sell or securitize those assets for which the regulatory capital charge is higher than the one the regulator would impose, while keeping on the books poorer quality assets for which the regulatory capital charge is relatively low. Our focus here is on cross-border arbitrage.

See, for instance, Avdjiev et al. (2020) and Claessens et al. (2021). Cross-border arbitrage may also operate through increased lending to foreign branches or through a “rebooking” of loans, whereby loans are originated by subsidiaries but then booked on the balance sheet of the parent institution. See Reinhardt and Riddiough (2015) and Fillat et al. (2018) for a discussion of how different forms of banking organization may affect the transmission of financial shocks across countries.

Buch and Goldberg (2017) and World Bank (2018) provide a broad review of the evidence on the impact of cross-border lending by foreign banks on domestic credit.

See Agénor and Pereira da Silva (2022) for a discussion.