This Policy Brief is based on ECB Working Paper Series No 2881. The views expressed are those of the authors and do not necessarily reflect those of the ECB.

We estimate spillovers for different measures in the Federal Reserve’s monetary policy toolkit and find that: (i) forward guidance and large-scale asset purchases entail spillovers to the rest of the world that are as large as the domestic effects in the US; (ii) spillovers transmit predominantly through financial channels centering on global investors’ risk appetite and manifest in changes in equity prices, bond spreads, capital flows and the dollar exchange rate; (iii) large-scale asset purchases trigger immediate international portfolio re-balancing between US and advanced-economy bonds, but only limited term-premium spillovers in non-US advanced-economy sovereign bonds.

The dominant role of the dollar in global trade and finance has sparked a rich literature on the spillovers from Federal Reserve (Fed) monetary policy (see e.g. Miranda-Agrippino and Rey, 2020b). However, despite a large amount of work, important gaps in our understanding remain. In particular, analyzing the effects of Fed policy has become more complex due to attainment of the zero lower bound after the Global Financial Crisis, the use of forward guidance about the future course of policy rates, and large-scale asset purchases (LSAPs).

A case in point is the policy tightening in 2022, which involved Fed-funds rate hikes that were telegraphed well in advance by means of forward guidance as well as the unwinding of the stock of previously purchased assets on the central-bank balance sheet. Disentangling the implications of Fed policy tightening across these measures is critical as economies around the world emerge from the strains imposed by the COVID-19 pandemic while wrestling with the fallout of Russia’s war on Ukraine (IMF, 2021). It is also critical because the Fed may resort to these different measures more frequently in the future (Reis et al., 2016), and because optimal local policy responses may differ depending on the nature of spillovers (IMF, 2020).

Against this background, this article presents empirical evidence on the global financial market and macroeconomic spillovers from the different measures in the Fed’s monetary policy toolkit drawn from the analysis in Georgiadis and Jarocinski (2023). The analysis relies on novel forward guidance and LSAP shocks identified by Jarocinski (forthcoming) based on high-frequency asset-price surprises around Federal Open Market Committee (FOMC) announcements.

Estimating the causal effects of Fed policy requires the use of exogenous variation in terms of policy shocks. Since the seminal work of Kuttner (2001), Cochrane and Piazzesi (2002) and Gertler and Karadi (2015), the industry standard for identifying monetary policy shocks has been based on interest-rate surprises in narrow windows around central-bank announcements. Under the assumption that financial markets price in the entire expected endogenous response of the central bank to the state of the economy, such intra-daily interest-rate surprises reflect exogenous variation that can be exploited to estimate the causal effects of monetary policy.

This basic high-frequency identification approach has been refined in two directions. The first refinement is to distinguish between conventional policy that focuses on setting the current Fed funds rate and unconventional measures such as forward guidance and LSAPs (Gürkaynak et al., 2005a,b; Swanson, 2021). The second refinement is to purge asset-price surprises from residual endogenous policy components, such as central bank information (CBI) or Fed-response-to-news effects (Cieslak and Schrimpf, 2019; Jarocinski and Karadi, 2020; Lewis, 2023; Miranda-Agrippino and Ricco, 2021; Bauer and Swanson, 2023). We adopt the novel identification proposed by Jarocinski (forthcoming), which allows us to distinguish between conventional and unconventional policy shocks and, at the same time, account for residual endogenous policy surprise components.

Jarocinski (forthcoming)’s approach starts from the observation that asset-price surprises around Fed policy announcements are highly non-Gaussian with fat tails, i.e. that they are usually very small but occasionally very large. This non-Gaussianity exposes the characteristics of individual structural shocks, which then can be labelled ex post. Jarocinski (forthcoming) shows that his approach identifies shocks to Fed conventional rate policy, forward guidance and LSAPs, all the while accounting for residual endogenous policy surprise components. In Georgiadis and Jarocinski (2023), we focus on the effects of forward guidance and LSAPs given that since the early 2000s Fed communication about conventional rate policy has been very transparent, minimizing asset-price surprises around FOMC meetings that could be used as exogenous variation to estimate the causal effects of this particular measure in the Fed’s toolkit. This also conforms with the growing importance of forward guidance since the early 2000s (Gürkaynak et al., 2005a; Lunsford, 2020).

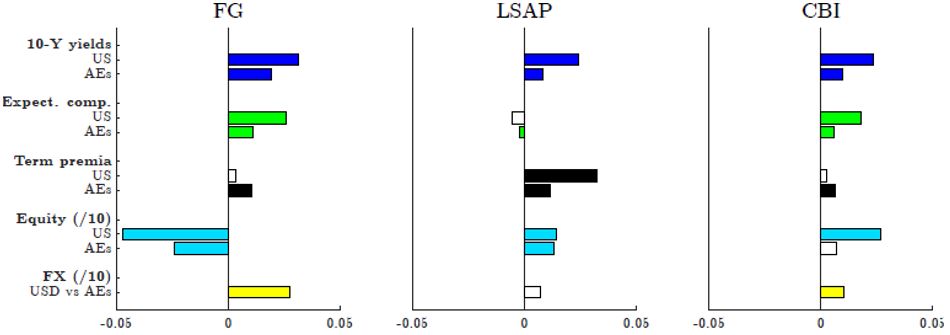

Figure 1 shows that we estimate a Fed forward guidance and LSAP tightening to raise advanced-economy interest rates on the day of the policy announcement, but only by about half as much as in the US. An LSAP tightening lifts advanced-economy term premia along with those in the US, although again only by about half as much. Advanced-economy equity prices fall together with those in the US in case of Fed forward guidance tightening. The dollar exchange rate appreciates in response to both forward guidance and LSAP tightening.

Figure 1: Impact-day global financial market effects of Fed forward guidance and LSAP shocks

Notes: Each bar depicts the daily impact response of one Fed policy shock of Jarocinski (forthcoming) estimated from ordinary least squares local projections for US variables and panel local projections for advanced-economy (United Kingdom, Germany, Sweden, Canada, Japan, Australia) variables. US expectation components and term premia pertain to 10-year US Treasury securities and are taken from Adrian et al. (2013). For advanced economies expectations components and term premia pertain to 10-year sovereign bonds and are obtained from a dynamic Nelson-Siegel model. The sample period spans 1991m1 to 2019m6. Filled bars indicate estimates that are statistically significant at the 90% confidence level. Inference is based on Newey-West standard errors robust to heteroskedasticity and serial correlation for US variables and Driscoll-Kraay standard errors robust to heteroskedasticity, serial correlation and cross-section dependence. FG stands for forward guidance, LSAP for large-scale asset purchases and CBI for central bank information effect. For additional details see Georgiadis and Jarocinski (2023).

Our findings for the announcement-day financial-market spillovers to foreign term premia and the exchange rate are consistent with theoretical predictions for the international transmission of LSAPs. In particular, in the models of Greenwood et al. (2023) and Gourinchas et al. (2022) arbitrageurs transmit the change in term premia required by domestic preferred-habitat investors in segmented markets in response to LSAPs across borders, causing an internationally synchronized increase in term premia of long-maturity sovereign bonds and an appreciation of the dollar. The larger effect on US Treasury term premia than on foreign analogues is consistent with the observation of Krishnamurthy (2022) that markets in which announced LSAPs are carried out are typically found to be affected most strongly.

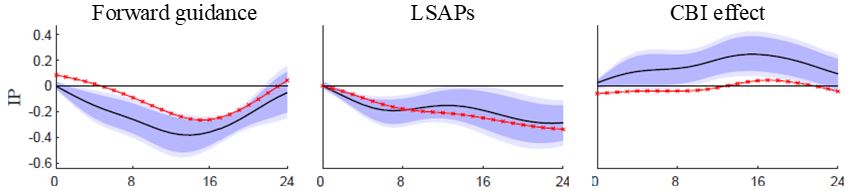

Figure 2 shows that we estimate a forward guidance and LSAP tightening to induce a strong contraction in rest-of-the-world real activity (black solid lines), with magnitudes that are similar to the domestic effects in the US (red crossed lines). A Fed tightening due to the residual endogenous policy component – such as CBI effects – are followed by an acceleration in rest-of-the-world real activity.

Figure 2: Effects of Fed policy shocks on non-US rest-of-the-world real activity (black solid lines) and the US (red lines with crosses)

Notes: Impulse responses depict deviations from baseline in percent or percentage points. Rest-of-the-world real activity measured by the logarithm of industrial production taken from the Dallas Fed Global Economic Indicators of Martinez-Garcia et al. (2015). The black solid lines depict the impulse responses of Fed policy shocks of Jarocinski (forthcoming). The red crossed lines depict the responses to the shocks of Swanson (2021). Impulse responses are estimated using the smooth local projections of Barnichon and Brownlees (2019). The sample period is 1991m1 to 2019m6. Shaded areas indicate 68% and 90% confidence bands. Panels in a given row feature the same y-axis limits. The horizontal axes display months after the shock has hit. For additional details see Georgiadis and Jarocinski (2023).

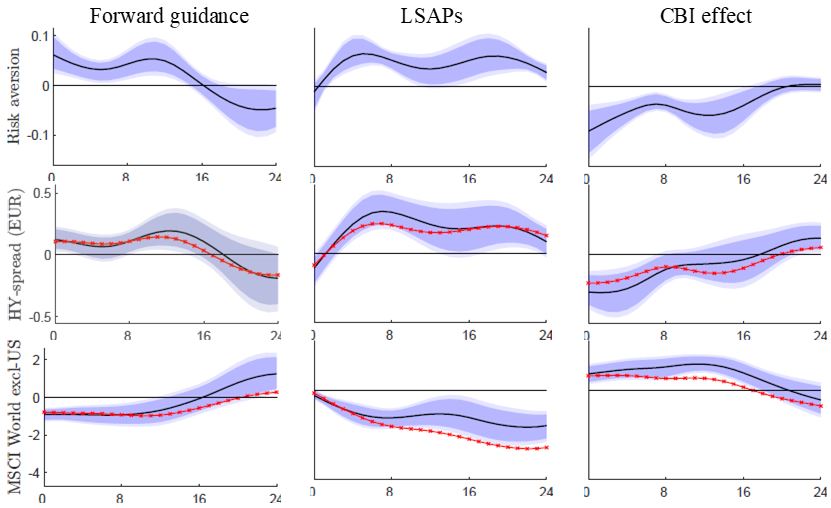

We find that financial channels play a key role in the transmission of Fed policy to the rest of the world. Figure 3 shows that a Fed forward guidance tightening triggers an immediate increase in the measure of investors’ risk aversion constructed by Bekaert et al. (2021), rest-of-the-world corporate-bond spreads, and a contraction in rest-of-the-world equity prices. A LSAP tightening also affects investors’ risk aversion and foreign risky asset prices but, as in the US, these effects build up only gradually. This is consistent with the delayed execution of LSAPs upon their announcement and the transmission mechanisms laid out in the models of Greenwood et al. (2023) and Gourinchas et al. (2022).

Figure 3: Effects of Fed policy shocks on non-US, rest-of-the-world financial variables

Notes: Impulse responses are estimated using the smooth local projections of Barnichon and Brownlees (2019). Black solid lines represent responses of rest-of-the world variables, and red crossed lines responses of US analogues. The sample period is 1991m1 to 2019m6. Shaded areas indicate 68% and 90% confidence bands. Panels in a given row feature the same y-axis limits. The horizontal axes display months after the shock has hit. For additional details see Georgiadis and Jarocinski (2023).

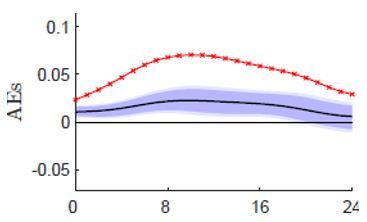

Our findings for medium-term term-premium spillovers are also consistent with theoretical predictions for the international transmission of LSAPs in terms of international portfolio re-balancing. Figure 4 shows that an LSAP tightening raises advanced-economy sovereign bond term premia. However, compared to the effects on US Treasury term premia, spillovers are muted.1 This suggests that term-premia spillovers due to investors’ international portfolio re-balancing of US sovereign-bond holdings and foreign close substitutes may not be a key transmission channel for LSAPs spillovers. Instead, our findings suggest that also for LSAPs changes in investors’ appetite for risky assets play a key role in transmitting spillovers.

Figure 4: Effects of Fed LSAP shocks on advanced-economy term premia

Notes: Impulse responses are estimated using the smooth local projections of Barnichon and Brownlees (2019). Black solid lines represent responses of rest-of-the world variables, and red crossed lines responses of US analogues. The sample period is 1991m1 to 2019m6. Shaded areas indicate 68% and 90% confidence bands. The horizontal axes display months after the shock has hit. For additional details see Georgiadis and Jarocinski (2023).

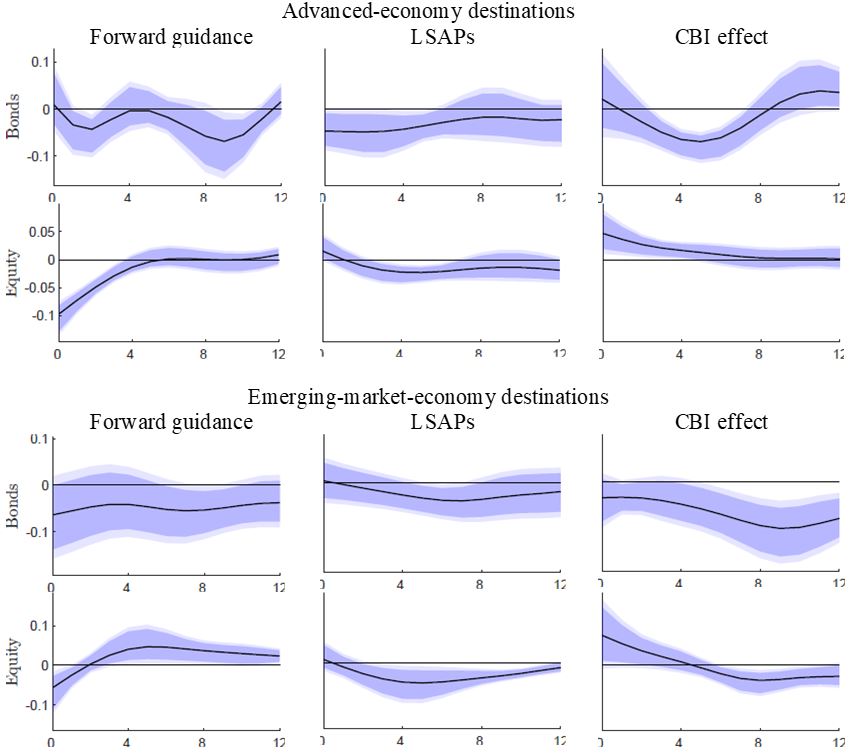

We find that Fed forward guidance and LSAPs reduce US portfolio outflows, consistent with a key role for variation in investor risk aversion. The first column in Figure 5 shows that a Fed forward guidance tightening induces US investors to reduce holdings of advanced-economy/emerging-market-economy equity and emerging-market-economy debt as opposed to arguably less risky advanced-economy debt.

The second column in Figure 5 shows that after contractionary LSAPs only US holdings of advanced-economy debt fall immediately. In contrast, holdings of emerging-market-economy debt fall with a delay. As advanced-economy debt is arguably a closer substitute for the assets purchased by the Fed under the different QE programs, these patterns are consistent with LSAPs triggering international portfolio re-balancing between US Treasury securities and foreign advanced-economy sovereign bonds by arbitrageurs across segmented markets populated by preferred-habitat investors as in the models of Greenwood et al. (2023) and Gourinchas et al. (2022): As the Fed is anticipated to shed Treasury securities after contractionary LSAP announcements, investors prepare to absorb these by shedding their holdings of foreign – especially closer advanced-economy – substitutes. As time goes by, the effects of LSAPs on US portfolio outflows become similar to those of forward guidance, consistent with these being driven by variation in investor risk aversion as well.

Finally, in contrast to a Fed tightening in the context of forward guidance and LSAPs, we find that a tightening in terms of residual endogenous policy surprise components – such as CBI effects – are followed by US capital flow responses that are consistent with a risk-on effect on US holdings of rest-of-the-world assets.

Figure 5: Effects of Fed policy shocks on US portfolio outflows by destination and instrument

Notes: Impulse responses depict deviations from baseline in percentage points of lagged stocks. Data are taken from US TIC and Bertaut and Judson (2022). Outflows are defined as net increase in US foreign financial assets (or net purchases of foreign securities by US residents). Impulse responses are estimated using the smooth local projections of Barnichon and Brownlees (2019). The sample period is 1991m1 to 2019m6. Shaded areas indicate 68% and 90% confidence bands. Panels in a given row feature the same y-axis limits. The horizontal axes display months after the shock has hit. For additional details see Georgiadis and Jarocinski (2023).

Our empirical analysis adds insights to a large empirical literature on Fed policy spillovers. We confirm previous literature finding that Fed policy spillovers are large and that they transmit especially through financial channels centering on global investors’ risk aversion (e.g. Miranda-Agrippino and Rey, 2022; Degasperi et al., 2020). Georgiadis and Jarocinski (2023) contribute to the literature by providing evidence with greater granularity across the different Fed policy measures, showing that both forward guidance and LSAPs entail large spillovers and that the variation in investor risk aversion is key for their global transmission.

Adrian, T., Crump, R., Moench, E., 2013. Pricing the Term Structure with Linear Regressions. Journal of Financial Economics 110 (1), 110–138.

Barnichon, R., Brownlees, C., 2019. Impulse Response Estimation by Smooth Local Projections. Review of Economics and Statistics 101 (3), 522–530.

Bauer, M., Swanson, E., 2023. An Alternative Explanation for the “Fed Information Effect”. American Economic Review 113 (3), 664–700. Bekaert et al. (2021).

Bekaert, G., Engstrom, E., Xu, N. R., 2021. The Time Variation in Risk Appetite and Uncertainty. Management Science 68 (6), 3975–4004.

Bertaut, C., Judson, R., 2022. Estimating U.S. Cross-Border Securities Flows: Ten Years of the TIC SLT. FEDS Note February.

Cieslak, A., Schrimpf, A., 2019. Non-monetary News in Central Bank Communication. Journal of International Economics 118 (C), 293–315.

Cochrane, J., Piazzesi, M., 2002. The Fed and Interest Rates – A High-Frequency Identification. American Economic Review 92 (2), 90–95.

Degasperi, R., Hong, S., Ricco, G., 2020. The Global Transmission of US Monetary Policy. Warwick Economics Research Paper Series 1257.

Georgiadis, G., Jarocinski, M., (2023), Global Spillovers from Multi-dimensional US Monetary Policy, ECB Working Paper 2881.

Gertler, M., Karadi, P., 2015. Monetary Policy Surprises, Credit Costs, and Economic Activity. American Economic Journal: Macroeconomics 7 (1), 44–76.

Gourinchas, P.-O., Ray, W., Vayanos, D., 2022. A Preferred-Habitat Model of Term Premia, Exchange Rates, and Monetary Policy Spillovers. CEPR Discussion Paper 17119.

Greenwood, R., Hanson, S., Stein, J., Sunderam, A., 2023. A Quantity-driven Theory of Term Premia and Exchange Rates. Quarterly Journal of Economics 138 (4), 2327–2389. Gürkaynak, R., Sack, B., Swanson, E., 2005a. Do Actions Speak Louder Than Words? The Response of Asset Prices to Monetary Policy Actions and Statements. International Journal of Central Banking 1 (1), 55–93.

Gürkaynak, R., Sack, B., Swanson, E., 2005b. The Sensitivity of Long-term Interest Rates to Economic News: Evidence and Implications for Macroeconomic Models. American Economic Review 95 (1), 425–436.

IMF, 2020. Toward an Integrated Policy Framework. IMF Policy Paper 2020/046.

IMF, April 2021. World Economic Outlook.

Jarocinski, M., Karadi, P., 2020. Deconstructing Monetary Policy Surprises: The Role of Information Shocks. American Economic Journal: Macroeconomics 12 (2), 1–43.

Jarocinski, M., forthcoming. Estimating the Fed’s Unconventional Policy Shocks. Journal of Monetary Economics.

Krishnamurthy, A., 2022. QE: What HaveWe Learned? Presentation at the Princeton Online Seminar, Markus’ Academy, March 24, 2022, Stanford University GSB.

Kuttner, K., 2001. Monetary Policy Surprises and Interest Rates: Evidence from the Fed Funds Futures Market. Journal of Monetary Economics 47 (3), 523–544.

Lewis, D., forthcoming. Announcement-specific Decompositions of Unconventional Monetary Policy Shocks and Their Macroeconomic Effects. Review of Economics and Statistics.

Lunsford, K., 2020. Policy Language and Information Effects in the Early Days of Federal Reserve Forward Guidance. American Economic Review 110 (9), 2899–2934.

Martinez-Garcia, E., Grossman, V., Mack, A., 2015. A Contribution to the Chronology of Turning Points in Global Economic Activity (1980–2012). Journal of Macroeconomics 46, 170–185.

Miranda-Agrippino, S., Rey, H., 2020. U.S. Monetary Policy and the Global Financial Cycle. Review of Economic Studies 87 (6), 2754–2776.

Miranda-Agrippino, S., Rey, H., 2022. The Global Financial Cycle. In: Handbook of International Economics. Vol. 6. Elsevier, pp. 1–43.

Miranda-Agrippino, S., Ricco, G., 2021. The Transmission of Monetary Policy Shocks. American Economic Journal: Macroeconomics 13 (3), 74–107. Swanson, E., 2021. Measuring the Effects of Federal Reserve Forward Guidance and Asset Purchases on Financial Markets. Journal of Monetary Economics 118 (C), 32–53.

Reis, R., McMahon, M., Ellison, M., Ilzetzki, E., Den Haan, W., 2016. The Future Role of Unconventional Monetary Policy: CFM Survey Results. VoxEU Column May.

At the country level, they are large only in specific cases, such as the UK, Canada and Germany. Overall, UK term premia react the most, Japanese the least.