This policy brief is based on Swiss National Bank Working Paper no. 02/2025. The views, opinions, findings, and conclusions or recommendations expressed in this column are strictly those of the authors. They do not necessarily reflect the views of the Swiss National Bank (SNB). The SNB takes no responsibility for any errors or omissions in, or for the correctness of, the information contained in this column.

Abstract

The world economy has become more and more globalized as firms have organized production along global value chains. But more recently, globalization has stalled. In a recent paper, we show that higher uncertainty, in combination with better automation technologies, has likely contributed to that trend reversal. We show that plausibly exogenous exposure to uncertainty in developing countries leads to reshoring to high-income countries, but only if industrial robots have made this economically feasible. In contrast, we find no strong evidence of nearshoring or diversification.

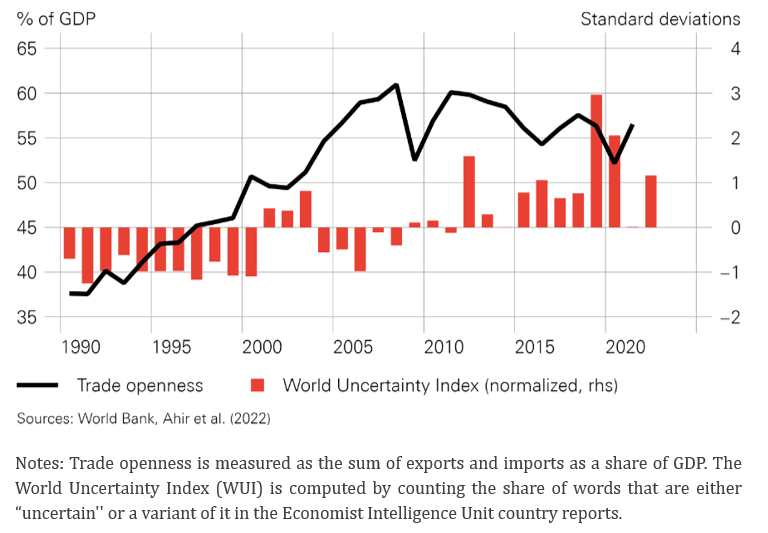

Globalization has come to a halt since the global financial crisis (GFC) in 2008 (Figure 1, black line). Trade as a share of GDP has risen by more than one percentage point per year in the period of hyper-globalization between 1990 and 2008, but has since entered a period of stagnation. This slowdown can, in large part, be attributed to a halt in the growth of intermediate goods trade between the developed and developing world. Between 2000 and 2007, the share of total inputs sourced from developing countries has almost tripled, corresponding to an average annual growth rate of about 15 percent. But with the GFC, this rapid expansion ended abruptly, being followed by a period of decline.

Figure 1. Trade openness and World Uncertainty Index (WUI) since 1990

While many factors may have been at play (Baldwin, 2022), two major developments have likely contributed to the declining globalization since the GFC: First, economic uncertainty shocks have become larger and more frequent, partly owing to stronger international trade linkages. Examples are the European debt crisis from 2011 to 2014, Brexit in 2016, the US-China trade war since 2018, and the Covid-19 crisis starting in 2020 (Figure 1, red bars). After experiencing the risks associated with high exposure to trade, firms may have started to reconsider their relationships. Second, automation technologies have made substantial advances, now having the ability to perform a range of tasks that had previously been offshored. Moreover, in their effort to fight low inflation, central banks have ensured extraordinarily favorable financing conditions after the GFC, effectively lowering the cost of capital relative to labor (Marin and Kilic, 2020). This made it especially attractive for firms to invest in ever-more-capable, domestically installed automation technologies rather than to employ foreign labor as a means of production.

While it seems plausible to assume that uncertainty and automation reduce globalization, their impacts are, in fact, theoretically ambiguous. Regarding uncertainty, the direction of the effect depends partly on whether firms view the domestic or the foreign economy as more prone to shocks (Grossman et al., 2023). Regarding automation, the direction of the effect depends largely on the relative strength of the (negative) displacement and the (positive) productivity effect (Acemoglu and Restrepo, 2020; Artuç et al., 2023).

Because of this theoretical ambiguity, we empirically estimate the effect of uncertainty on reshoring – and the role played by automation in facilitating it (Faber et al. 2024). We consider 18 developed countries, 17 developing countries and 19 industries in the period between 2000 and 2014. In our empirical strategy, we exploit the fact that country-industry pairs were differentially exposed to uncertainty shocks in the developing world between 2000 and 2014 because of their pre-existing trade relationships in 2000.1 We argue that our (shift-share) measure of exposure to developing countries’ uncertainty induces plausibly exogenous variation in uncertainty, as i) uncertainty shocks in developing countries are unlikely to be caused by reshoring decisions in the developed world and ii) it is based on pre-determined country-industry-level trade patterns, alleviating concerns related to simultaneity. To explore the role played by automation, we ask whether this relationship differs by the degree to which tasks in each industry are replaceable by industrial robots.2

Higher uncertainty leads to more reshoring but only in highly robotized industries. Our results show that higher uncertainty in developing countries increases the relative use of domestic inputs, but only in highly robotized industries. This suggests that reshoring in response to uncertainty in developing countries seems to become economically feasible if tasks can be performed (at relatively low cost) by a domestically installed robot. Our point estimate implies that a one standard deviation higher uncertainty shock in connected developing countries increases the relative use of domestic inputs by about seven percent.

Firms appear to move production in-house, rather than rely more on domestic suppliers. Next, we want to know whether our measure of reshoring (domestic inputs/imported inputs from developing countries) increases as a result of more domestic inputs, fewer imported inputs, or both. Results show that the reshoring response to an uncertainty shock comes entirely from fewer imported inputs from the developing world and not from more domestic inputs. This suggests that firms reorganize and move input production in-house, instead of relying on other domestic input suppliers when faced with higher uncertainty. One possible reason for this reshoring response are that firms want more control in uncertain times. Another is that it is costly to find new suppliers if firms need to invest in a supplier relationship, such that moving production in-house may be the less costly alternative (Antràs and Helpman, 2008).

Reshoring response triples after GFC. To examine whether reshoring occurred in particular after the GFC, we rerun our preferred specification but split the sample into two subperiods, the pre-GFC and post-GFC period. Results show that the reshoring response to uncertainty more than triples after the GFC. Possible reasons are higher risk aversion following the traumatic experience after the GFC, advances in automation making robots more efficient, and the low interest rate environment making investment in robots more attractive relative to hiring workers.

Reshoring response is not driven by single countries or industries. Next, we want to examine whether our results are dominated by a single hub of GVCs like the US or Germany. Our results do not change when we individually exclude each high-income country or each industry. Moreover, the results do not appear to be solely driven by the automobile sector as has been often argued (Freund, 2022).

Higher uncertainty does not lead to more diversification. In theory, it may be optimal for firms to respond to higher uncertainty also by diversification, i.e., to import inputs from a larger set of locations, to make sure that supplies are still available even if one location is shocked. To test for this possibility, we construct a Hirsch-Herfindahl measure of foreign supplier concentration. Results show, however, no significant impact of developing countries’ uncertainty on diversification, suggesting again that the costs of finding new suppliers may be quite high.

Our results are robust to several threats to identification, including reverse causality and the most important ones arising from shift-share instruments. We address concerns about reverse causality first. Reshoring by developed countries may affect uncertainty in developing countries rather than the other way around. We use two alternative identification strategies to tackle this concern. First, in a “narrative approach”, we use only locally generated spikes in uncertainty, for which the narrative for why the spikes happened suggests that the event was plausibly exogenous to reshoring decisions in developed countries. We then use only uncertainty changes for which we have identified a plausibly exogenous spike in uncertainty and set all other changes to zero when constructing the exposure to uncertainty in developing countries variable. Our estimates remain virtually unchanged, suggesting that our results are not biased by reverse causality.

Second, in a “small open economy approach”, we exclude the five largest developed country destinations for developing countries’ inputs (USA, Germany, South Korea, France, Italy). These account for almost 70% of all imported inputs from developing countries. The idea is that small developed countries have a lower potential to cause substantial uncertainty in developing countries than large ones. We then rerun our preferred specification with data excluding these large developed countries. Reassuringly, results remain unchanged. Overall, this reinforces our view that our results are unlikely to be driven by reverse causality.

Finally, we proceed to test for threats to identification in shift-share designs. Following Borusyak and Hull (2023) and Adão et al. (2019), we show that our uncertainty shocks are as good-as-randomly assigned and not driven by noise.

This column shows that the slowdown in globalization has been intensified by uncertainty shocks on the one hand and the option to automate production on the other. Expected cost savings from offshoring to low-wage countries have become smaller as various uncertainty shocks increased the risk of default of input delivery. Sectors able to substitute the tasks of developing countries by domestic robots reshore production to their home countries. Reshoring in-house rather than to domestic input suppliers in other industries appears to dominate among the different reshoring strategies. As it seems, having control becomes more valuable when firms realize that the world has become an ever-riskier place. An important implication of our results is that major forces weighing on globalization have already started well before the election of Donald Trump, suggesting that the slowdown of globalization is not simply due to recent geopolitical events.

Acemoglu, Daron and Pascual Restrepo, “Robots and Jobs: Evidence from US Labor Markets”, Journal of Political Economy, 128(6), p 2188-2244, June 2020.

Adão, Rodrigo, Michal Kolesár, and Eduardo Morales, “Shift-share designs: Theory and inference,” The Quarterly Journal of Economics, 2019, 134 (4), 1949–2010.

Ahir, Hites, Nicholas Bloom, and Davide Furceri, “The world uncertainty index,” NBER Working Paper 29763, 2022.

Antràs, Pol and Elhanan Helpman, “Contractual Frictions and Global Sourcing,” in “The Organization of Firms in a Global Economy (Elhanan Helpman, Dalia Marin and Thierry Verdier, Editors), Cambridge, MA and London, England: Harvard University Press, 2008, pp. 9–54.

Artuç, Erhan, Paulo Bastos, and Bob Rijkers. “Robots, tasks, and trade.” Journal of International Economics, 2023, 145, 103828.

Baldwin, Richard, “The peak globalization myth: Part 3 – How global supply chains are unwinding”, VoxEU, 2 Sep 2022, CEPR

Borusyak, Kirill and Peter Hull, “Nonrandom exposure to exogenous shocks,” Econometrica, 2023, 91 (6), 2155–2185.

Faber, Marius, Kemal Kilic, Gleb Kozliakov, and Dalia Marin. ”Global Value Chains in a World of Uncertainty and Automation”, CEPR Discussion Paper No 19615, CEPR Press, 2024, accepted at Journal of International Economics.

Freund, Caroline, “Will Covid-19 lead to reshoring?” Research Network Sustainable Global Supply Chains Report, p 42, Kiel Institute for the World Economy 2022.

Graetz, Georg and Guy Michaels, “Robots at work,” Review of Economics and Statistics, 2018, 100 (5), 753–768.

Grossman, Gene M, Elhanan Helpman, and Hugo Lhuillier, “Supply chain resilience: Should policy promote international diversification or reshoring?” Journal of Political Economy, 2023, 131 (12), 3462–3496.

Marin, Dalia and Kemal Kilic, “How Covid-19 is transforming the world economy”, VoxEU, 10 May 2020, CEPR

We measure uncertainty by the World Uncertainty Index (WUI) by Ahir et al., 2022. WUI counts the share of the word ‘uncertain’ (or its variants) in the Economist Intelligence Unit country reports.

Our measure of automation is based on robot replaceability developed by Graetz and Michaels (2018). It is defined by whether an industry can be classified as requiring tasks that may be performed by robots.