References

Bruine de Bruin, Waendi, Wilbert van der Klaauw, and Giorgio Topa (2011). “Expectations of Inflation: The Biasing Effect of Thoughts about Specific Prices.” Journal of Economic Psychology 32 (5), 834–845.

Crump, Richard K., Stefano Eusepi, Andrea Tambalotti, and Giorgio Topa (2022). “Subjective intertemporal substitution.” Journal of Monetary Economics 126, 118–133.

D’Acunto, Francesco, Daniel Hoang, Maritta Paloviita, and Michael Weber (2022). “IQ, Expectations, and Choice.” Review of Economic Studies. forthcoming.

D’Acunto, Francesco, Ulrike Malmendier, Juan Ospina, and Michael Weber (2021). “Exposure to Grocery Prices and Inflation Expectations.” Journal of Political Economy 129 (5), 1615–1639.

Dietrich, Alexander (2024). “Consumption categories, household attention, and inflation expectations: Implications for optimal monetary policy.” Journal of Monetary Economics. forthcoming.

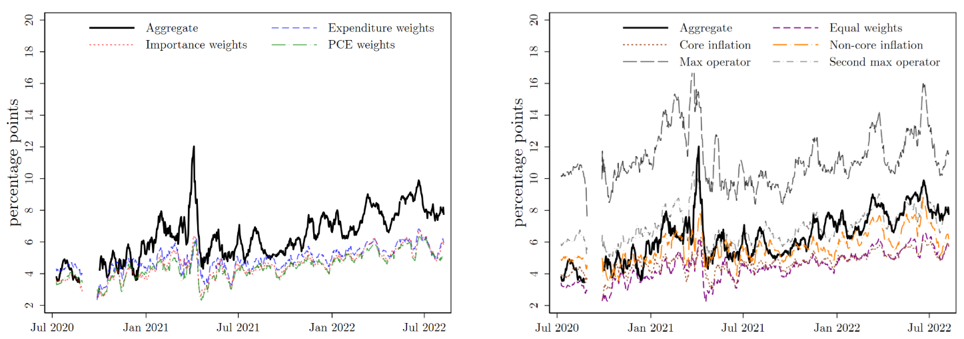

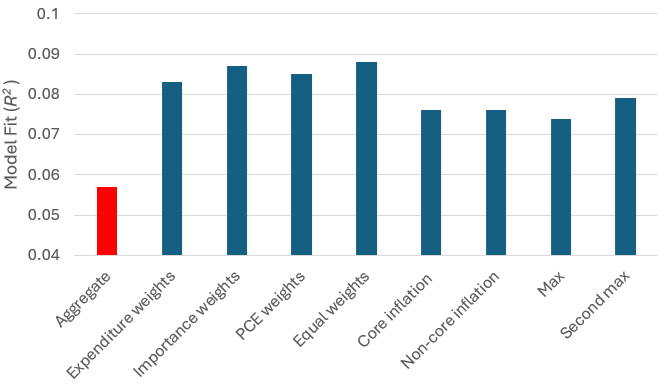

Dietrich, A., Knotek, E.S., Myrseth, K.O.R., Rich, R.W., Schoenle, R.S., Weber, M., 2023. “Greater Than the Sum of the Parts: Aggregate vs. Aggregated Inflation Expectations.” NBER Working Paper No. 31822.

Fischhoff, B. and S. B. Broomell (2020). “Judgment and Decision Making.” Annual Review of Psychology 71, 331–355.

Gabaix, Xavier and Thomas Graeber (2023). “The Complexity of Economic Decisions.” Working paper.

Knotek, E. S., R. S. Schoenle, A. M. Dietrich, K. Kuester, G. J. Mueller, K. O. R. Myrseth, and M. Weber (2020). “Consumers and COVID-19: A Real-time Survey.” Economic Commentary (2020-08).