This commentary should not be reported as representing the views of the European Central Bank (ECB). The views expressed are those of the author and do not necessarily reflect those of the ECB.

Abstract

On 6 June 2024, Greek banks have announced that the ECB approved their dividend proposals, anticipating the first dividend payments of Greek banks since the Global Financial Crisis. This paper uses event study methodology to assess the impact of the announcement on the banks’ stock return for the date of the announcement and finds abnormal returns for all of the Greek banks, indicating financial market’s appreciation for this decision.

On 6 June 2024, Greek banks have announced that the ECB approved their dividend proposals, anticipating the first dividend payments of Greek banks since the Global Financial Crisis. The dividend announcements are part of a continued trend of positive news for the Greek economic and financial recovery which also concluded in the re-possession of investment grades by international rating agencies for the Greek government in late 2023.

In light of the above, this paper uses event study methodology to determine the impact of the dividend announcement on the stock price of Greek banks. The research question hereby is whether or not the announcements have created abnormal returns.

The methodological foundation for the event study analysis of this paper is provided by Campbell et al. (1997, pp.149) but is also supplemented by works of Brown and Warner (1980 and 1985), Armitage (1995), Bowman (1983) or Peterson (1989). According to Binder (1998, p. 111) or Campbell et al. (1997, p.149), event studies have a long history in academic research and evolved to a standard methodology to capture equity price sensibilities towards exogenous events, in this case the announcement of dividends by Greek banks.

The event date is defined for this analysis as 6 June 2024 and stock closing quotes of bank equities are regarded. The event window includes a pre- and post-event event period of, each, two days. For the entire event window of five days, abnormal returns will be calculated below. The estimation window provides information that is needed to specify the normal returns and is calibrated for a time period of 90 days.

To determine the impact of the dividend announcement on bank stock prices, a measure for abnormal returns is required. According to Campbell et al. (1997, p. 151), the abnormal return equals the observable stock return after the event minus the normal return of the stock price. Hereby, the normal return stipulates the return of the stock price that would have occurred without the event. To model normal returns there are broadly two statistical models, (i) the constant mean return model and (ii) the market model, which are most regularly used in literature, however, Brown and Warner (1980, pp.207) find that different normal return models often yield to similar results.

The main difference of the market model compared to the constant mean return model is that the former relates the stock returns to the returns of a market portfolio or market benchmark. In that sense, the market model estimates the normal returns, using a standard OLS regression in which the equity returns are the dependent variables which are explained by the index returns (independent variables). For the purpose of such market benchmark, the assessment uses the STOXX® Europe 600 Banks index, which has a variable number of components and includes a component capping mechanism that ensures that no component can dominate the index. The index is of interest for the purpose of the present study as it is an index exclusively focused on continental European banks and as it is well established in the financial world. The raw data is retrieved from Yahoo Finance.

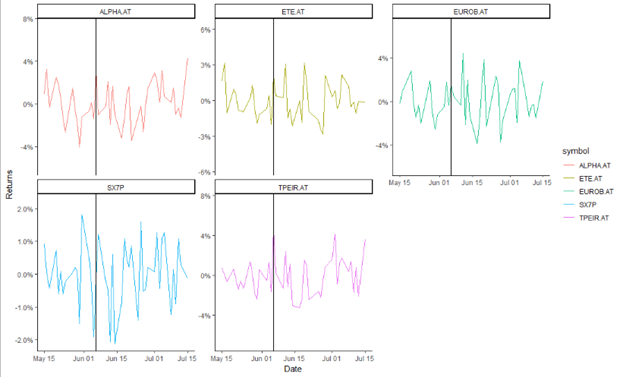

Figure 1. Overview of returns

Source: Raw data from Yahoo Finance – own manipulation and presentation.

The above Figure 1 gives a graphical overview of the returns at the event time (vertical line = 6 June 2024) and indicates that abnormal returns might be evidenced as returns for the banks exceed the returns of the benchmark index. The below Table 1 gives an overview of the main characteristics of the returns for all banks and the index and for both, the estimation window and the event window.

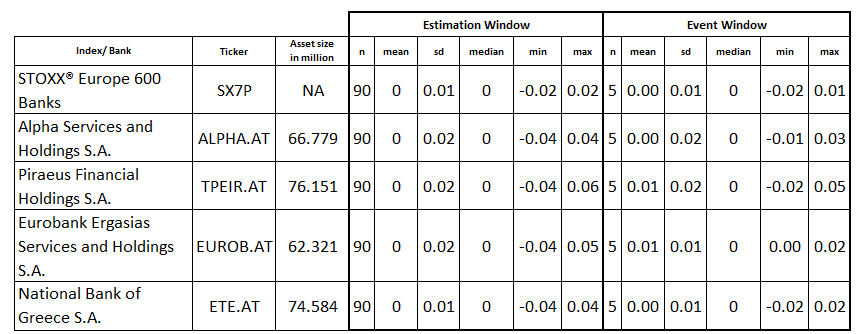

Table 1. Summary statistics of returns

Source: Raw data from Yahoo Finance – own manipulation and presentation.

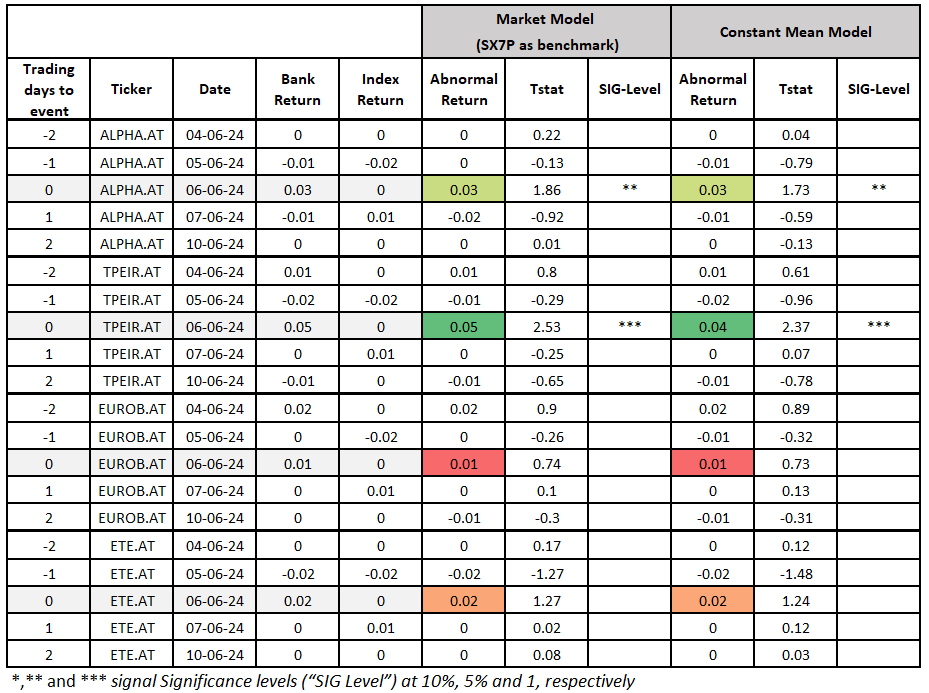

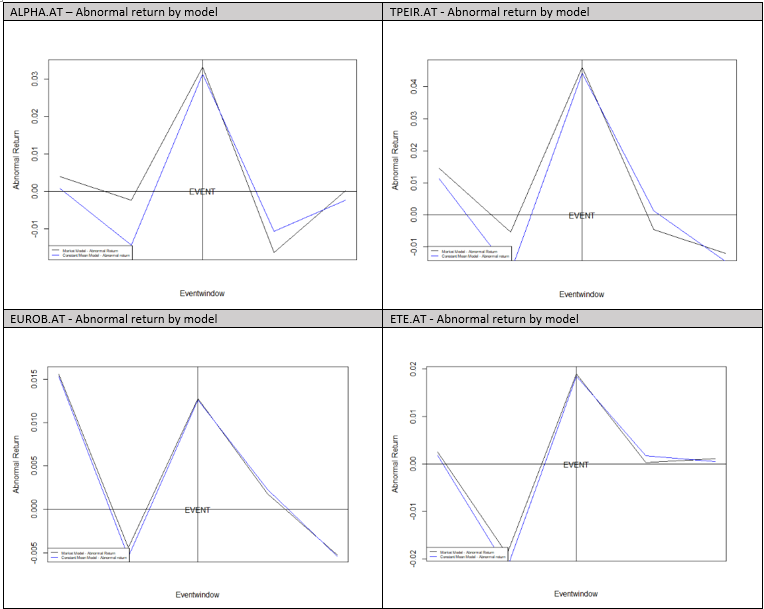

The results of the eventstudy are stipulated in Table 2 and in Figure 2 and evidence that there are positive abnormal returns for all of the four Greek banks on the date of their dividends announcements. The results also confirm that abnormal returns are highly alike for the market model and the constant mean model. Whereas for two of the banks the abnormal results are statistically significant, they are not for other two banks. In addition, there is evidence that the abnormal returns during the event window resemble the shape of a hat with the peak at the event date. As such, abnormal returns can be regarded as short termed.

Table 2. Results of the event study

Source: Raw data from Yahoo Finance – own manipulation and presentation.

Figure 2. Graphical overview of abnormal returns

Source: Raw data from Yahoo Finance – own manipulation and presentation.

The results might have several implications for various stakeholders.

First, the results imply for the Greek banks that attractiveness and international competitiveness has been further restored after the severe and restrictive measures implemented in response to the Global Financial Crisis. As such, the payout of dividends might be pull factor that attracts international investors and which allows Greek banks to access financial markets more efficiently.

Second, the results imply for policy makers and financial regulators further normalization in respect to financial markets in Greece. However, risks in the Greek banking system prevail.

Third, the results imply for the Greek economy at large that the Greek banking system is sufficiently strong to support a sustainable growth path.

On 6 June 2024, Greek significant banks have announced that the ECB approved their dividend proposals, anticipating the first dividend payments of Greek banks since the Global Financial Crisis. This brief uses event study methodology to assess the impact of the announcement on the stock return for the date of the announcement and finds abnormal returns for all of the Greek banks, indicating financial market’s appreciation for this decision. Such abnormal returns have several implica-tions for the banks, policy makers or regulators and the Greek economy at large.

Armitage, S., (1995), Event Study Methods and Evidence on Their Performance, Journal of Economic Surveys, vol 8, no 4, pp 25-52.

Binder, J., (1998), The Event Study Methodology Since 1969, Review of Quantitative Finance and Accounting, vol 11, pp 111-137.

Bowman, R. G., (1983), Understanding and Conducting Event Studies, Journal of Business Finance and Accounting, vol 10 no 4, pp 561-584.

Brown S.J. and J. B. Warner, (1985), Using daily stock returns: The case of event studies, Journal of Financial Economics, vol 14, no 1, pp 3-31.

Brown S.J., and J.B.Warner, (1980), Measuring security price performance, Journal of Financial Economics, vol 8, no 3, pp 205-258.

Campbell, J. Y., W. Lo and A. MacKinlay, (1997), “Event-Study Analysis”, Chapter 4 in The Econometrics of Financial Markets, Princeton University Press ISBN 0-691-04301-9, pp 149-180.

Peterson, P. P., (1989), Event Studies: A Review of Issues and Methodology, Quarterly Journal of Business and Economics, vol 28,pp 36-66.