This policy brief is based on BIS Working Paper No 1190. The views expressed in this paper are those of the authors and do not necessarily reflect the position of the respective institutions.

Abstract

To become greener, firms generally must make long-term investments in eco-friendly innovation. However, when CEOs are at risk of losing their job, they may be focused more on the firm’s short-term returns. This study examines whether the likelihood of the CEO being terminated affects the firm’s environmental performance, that is, its efforts to minimize its impact on the environment. We find that a higher risk of such forced CEO turnover correlates with worse overall environmental performance by firms. More specifically, it leads to less eco-friendly innovation and higher levels of greenhouse gas emissions. Including ESG clauses in CEOs’ compensation packages only marginally offsets this effect. Overall, our results suggest that the deterioration in a firm’s environmental performance and eco-friendly innovation is at least partly driven by short-termism, a well-established friction in corporate finance.

As the number of natural disasters and days with record-high temperatures increases, so too does the macroeconomic, as well as the societal, incentive for firms to improve their environmental performance, that is, to reduce their greenhouse gas emissions and engage in other eco-friendly initiatives. Incentives are not limited to the macro dimension but are also evident at the (firm) micro level. Consistent with investors and financial intermediaries recognizing the importance of the green transition (Krueger et al. (2020)), greener firms borrow at cheaper rates (Degryse et al. (2023)), have a lower overall cost of capital (Chava (2014)), do not have to correspond a premium to investors for their exposure to carbon emission risk (Bolton and Kacperczyk (2021)), and are less financially constrained (Oliviero et al. (2024)) relative to browner firms, that is, those that are not as environmentally responsible.

Bouckaert et al. (2021) show that about 45% of the reduction in CO2 emissions by 2050 will originate from innovation, suggesting that if a firm wants to make sustainable improvements to its environmental performance it must boost its research and development (R&D) activities and shift its focus to the long term. However, if a CEO does not feel secure in their position, will they be willing to make that shift and sacrifice short-term returns for long-term investment at the risk of losing their job?

This study explores the connection between the probability of a CEO being terminated, a prominent source of risk among chief executives (Peters and Wagner (2014), Jenter and Kanaan (2015), Ellul et al. (2020)), and a firm’s environmental performance. We find that when a CEO lacks job security, short-termism takes hold, and the firm reduces investments in activities such as R&D in eco-friendly innovation that do not contribute to short-term returns. We also find that environmental, social, and governance (ESG) clauses in compensation agreements, which reward CEOs with additional pay if their firms achieve the specified ESG-related objectives, do not seem to inspire eco-friendly innovation.

We base our conclusions on environmental performance metrics or data that reflect or quantify firms’ CO2 and other greenhouse gas (GHG) emissions-, resource use, eco-friendly innovation, and overall impact on the environment. Our work contributes to a broad strand of the academic literature that studies how the threat of a CEO losing their job (Peters and Wagner (2014), Jenter and Kanaan (2015)) and short-termism (Brochet (2012), Bolton et al (2006)) affect a firm‘s financial outcomes. We complement those studies by shedding light on the relationship between such short-termism and firms’ environmental performance. Our research also complements the literature studying the effectiveness of ESG clauses in executives compensation packages.

We construct a firm-level, time-varying measure of the probability of a CEO losing their job unexpectedly—or, a forced CEO turnover—using regression analysis that involves the approach established by Peters and Wagner (2014). In their study, the authors document that episodes of forced turnover are predicted by industry volatility and market-adjusted returns, firms’ assets, Tobin’s Q, idiosyncratic stock returns, and CEO characteristics including age, tenure, and duality (ie the CEO is also the chairman of the board of directors). Specifically, our probability measure corresponds to the fitted values from a probit regression of CEO turnover episodes on the firm-level and firm-CEO-level explanatory variables listed previously.

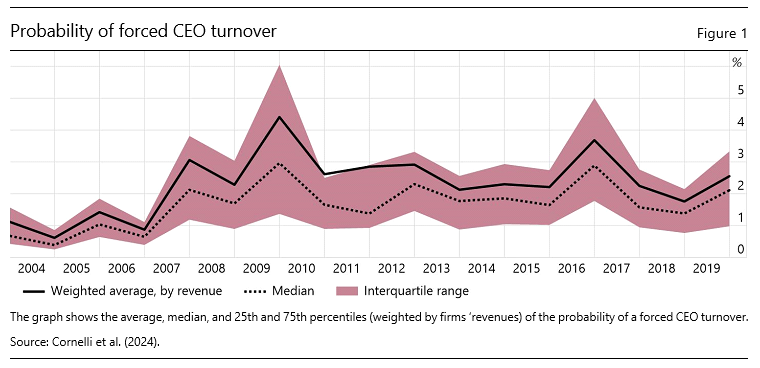

Figure 1 illustrates the distribution of our measure of the probability of forced CEO turnover over time. This probability varies from 0.25% to 6%, indicating cross-sectional variation, and notably peaks about the time of the Global Financial Crisis (GFC).

When the CEO faces the risk of termination, two outcomes are possible for the firm’s environmental performance. On one hand, the CEO could link their underperformance to the firm’s investments, including in research and development (R&D), necessary to achieve a better environmental performance. Such investments typically require immediate outlays but bear fruit only in the long term. In other words, in this scenario, a higher risk of forced turnover would correspond to better environmental performance. On the other hand, the CEO could become more short-terminist and reduce the firm’s investments in R&D and other activities that do not contribute to short-term returns.

To shed light on which hypothesis holds we regress several measures of a firm environmental performance on our derived measure of turnover risk and a wealth of firm-level and firm-CEO level controls described in the previous section. Our outcome variables correspond to the Refinitiv overall environmental score, environmental innovation score and GHG emissions (scaled by sales).

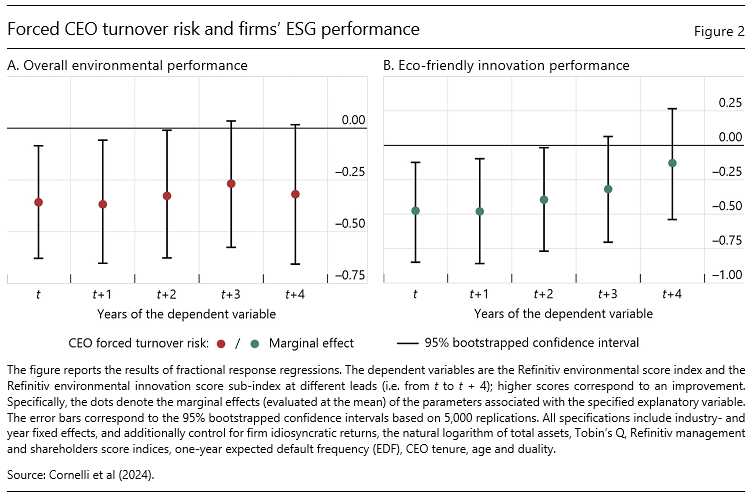

The results reported in Figure 2 support the short-termism effect. The first dot in each panel of Figure 2 shows that a higher risk of turnover is associated with worse environmental performance both overall (Panel A) and with respect to eco-friendly innovation (Panel B). Specifically, an increase of one standard deviation (ie about 3%) in the probability of a forced CEO turnover is associated with a drop of almost 1.1 percentage points in the overall environmental score and of 1.5 percentage points in the eco-friendly innovation score. Our finding that the effect is more pronounced for the latter is consistent with short-termism, because innovation typically results from a long-term process. The higher score also suggests that short-termism is particularly detrimental to eco-friendly innovation.

This result indicates that, as the risk of termination grows, CEOs could take immediate action to improve firms’ short-term returns, fearing they might not have the opportunity to do so later if they are fired. However, it is reasonable to question whether an increase in the probability of a forced CEO turnover could impact a firm’s environmental performance with a delay. To explore this possibility, we re-ran our analysis using environmental performance indicators as dependent variables for each of the ensuing four years (t+1 through t+4). The results, shown in Figure 2, suggest that the detrimental effect of short-termism is persistent—that when a CEO’s fear of being fired increases, the firm’s environmental performance continues to suffer for years.

As noted earlier, ESG-Pay clauses do not seem capable to curb CEO’s short-terminism, particularly as it relates to eco-friendly innovation. Although this result may be surprising, it also may reflect two features about those clauses: first, compensation contracts often include governance and social targets but no specific environmental targets; and second, clauses related to the environment typically target GHG emissions or wastewater but do not cover investment in environmental R&D and eco-friendly innovation (Cohen et al. (2023).

Data on firm GHG emissions confirm our findings about the effect of CEO termination risk on firms’ environmental performance. Specifically, we find that a higher probability of forced CEO turnover is associated with an increase in emissions. When we break down GHG emissions by scope, we find that the levels of emissions from sources controlled by the firm, such as the ones coming from their production plants, do not change, and that the levels from sources indirectly controlled by the firm, such as emissions along the value chain, increase. Overall, these results suggest a tendency toward “outsourcing” emissions or “carbon leakage,” which is consistent with the objective of reducing costs (Bartram et al. (2022)) and not with improving a firm’s environmental performance.

To confirm that short-termism accounts, at least to some extent, for our findings, we use a sequential g-estimator approach in which short-termism is the mechanism mediating the effect of turnover risk (“the treatment”) on the outcome variables. The results show that the controlled direct effect of turnover risk on firm environmental performance, keeping the exposure to short-termism at a particular level, sizeably drops, thereby suggesting that the deterioration in firm overall environmental performance and environmental innovation performance is at least partly driven by short-termism. In other words, our findings are consistent with short-termism being a relevant mechanism at play.

Bartram, S. M., Hou, K., and Kim, S. (2022). Real effects of climate policy: Financial constraints and spillovers. Journal of Financial Economics, 143(2): 668–696.

Bolton, P. and Kacperczyk, M. (2023). Global pricing of carbon-transition risk. The Journal of Finance, 78(6): 3677–3754.

Bolton, P., Scheinkman, J., and Xiong, W. (2006). Executive compensation and short-termist behaviour in speculative markets. The Review of Economic Studies, 73(3): 577–610.

Bouckaert, S., Pales, A. F., McGlade, C., Remme, U., Wanner, B., Varro, L., D’Ambrosio, D., and Spencer, T. (2021). Net zero by 2050: A roadmap for the global energy sector. Technical report, International Energy Agency.

Brochet, F., Loumioti, M., and Serafeim, G. (2012). Short-termism, investor clientele, and firm risk. Harvard Business School working paper.

Chava, S. (2014). Environmental externalities and cost of capital. Management Science, 60(9): 2223–2247.

Cohen, S., Kadach, I., Ormazabal, G., and Reichelstein, S. (2023). Executive compensation tied to ESG performance: International evidence. Journal of Accounting Research, 61(3): 805–853.

Cornelli, G., M. Erdem and E. Zakrajšek (2024). CEO turnover risk and firm environmental performance. BIS Working Papers, no 1190.

Degryse, H., Goncharenko, R., Theunisz, C., and Vadasz, T. (2023). When green meets green. Journal of Corporate Finance, 78: 102355.

Ellul, A., Pagano, M., and Scognamiglio, A. (2020). Career risk and market discipline in asset management. The Review of Financial Studies, 33(2): 783–828.

Jenter, D. and Kanaan, F. (2015). CEO turnover and relative performance evaluation. The Journal of Finance, 70(5): 2155–2184.

Krueger, P., Sautner, Z., and Starks, L. T. (2020). The importance of climate risks for institutional investors. The Review of Financial Studies, 33(3): 1067–1111.

Peters, F. S. and Wagner, A. F. (2014). The executive turnover risk premium. The Journal of Finance, 69(4): 1529–1563.