How do aggregate conditions affect the dynamics of firm entry? Do recessions force more firms out, allowing for more firms to enter subsequently? Or does this process require other circumstances to thrive? I look into these questions using sectoral data on firm entry and exit for the main economies of the Euro Area over 2009-2019. My main finding is that expected, rather than current, GDP growth shapes the dynamics of firm entry. Specifically, I find that entry increases with past exits at the sector-level, but only at times of strong aggregate GDP growth forecast. Also, with strong growth forecasts, past entry developments weigh less on the subsequent sectoral entry dynamics. Periods of low entry and high exit can therefore be followed by strong entry subsequently, when the economy is expected to grow strongly. These findings are robust to the inclusion of several controls. This includes the quality of insolvency proceedings, firms’ ability to obtain credit or the presence of barriers to entry. Finally, breaking-down GDP into consumption, investment, and net exports, I show that expectations of private and public investment drive the impact of growth expectations on the dynamics of firm entry.

Business turnover, the process by which entrepreneurs create new firms and dissolve old ones, is a key feature of modern economies. Structural factors, such as barriers to entry or an inefficient insolvency process, play a considerable role in either slowing down or speeding up the entry and exit of firms.

In addition to structural factors, cyclical developments also matter. History would suggest that more firms are created in upturns and more liquidated in downturns. Yet the recent Covid-19 recession is an interesting case in point. On the one hand, governments around the globe took extraordinary measures to protect firms, deploying unprecedented support to corporates in their respective jurisdictions. As a consequence, firm exits almost came to a halt during the covid recession. On the other hand, while most countries suffered a deep economic contraction, firm entry followed very different patterns across countries. In Europe for instance, Spain experienced a sudden stop in new firm creation while France had a boom, even if output fell by comparable amounts in both countries.

Making sense of these diverging trends requires a proper understanding of the dynamics of entry over the business cycle, and how entry relates to past entry and exit developments. In addition, this would help shed light on how justified these massive policy interventions were.

My starting point is the observation that firms’ decision to enter largely depends on expectations of future profits, which in turn tightly depend on expectations of future economic activity. In this regard, potential new entrants are likely to take past entry and exit realisations as (imperfect) signals about future prospects and set their entry/exit decisions accordingly. For instance, a large wave of entry may signal strong prospects, leading potential new entrants to accelerate entry subsequently. Conversely, a large wave of exits may be interpreted as a signal for depressed prospects, thereby deterring potential new entrants further down the road.

In addition to past entry and exit developments, firms considering entry may also take into account the general economic outlook. When economic activity is expected to expand strongly, potential new entrants are likely to discard strong exits as a signal for weak prospects and rush to pick up the slack left by exiting firms. Similarly weak entry is less likely to carry over when the outlook looks bright. By contrast, when economic activity is expected to stay depressed, fewer firms may be willing to replace exiting ones, as running a business in such an environment would be significantly more challenging. In the same vein, low entry and weak growth expectations, are likely, taken together, to be interpreted as evidence of bad prospects, thereby negatively affecting subsequent firm entry.

In this paper, I provide empirical evidence that growth expectations are a key determinant in the dynamics of firm entry. Based on a sample of euro area countries, I show that more firms are created following more exits within a sector when the aggregate economy is expected to grow faster. Similarly, a drop in entry weighs less on subsequent entry within a sector when the aggregate economy is expected to expand quickly.

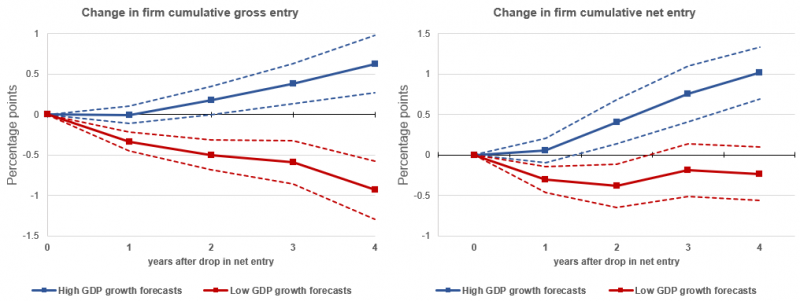

Quantitatively, the impact of growth forecasts is large. For example, in response to a one percentage point increase in exit and decrease in entry rates, gross entry drops by about 1 percentage point after 4 years, when growth forecasts are weak. Conversely, when growth forecasts are strong, gross entry increases by about 0.6 percentage point over the same period.

Growth expectations and the dynamics of entry

Note: The blue line (red line) in the left-hand panel represents the change in percentage point in the cumulative gross entry rate following a one percentage point increase in the gross exit rate and one percentage decrease in the gross entry rate when the 1- to 2-year GDP growth forecast is at the 90th percentile of the sample (at the 10th percentile of the sample). The blue line (red line) in the right-hand panel represents the change in percentage point in the cumulative net entry rate following a one percentage point increase in the gross exit rate and one percentage decrease in the gross entry rate when the 1- to 2-year GDP growth forecast is at the 90th percentile of the sample (at the 10th percentile of the sample). Changes are estimated based on coefficients reported in Table 8. Dashed lines represent in each panel the corresponding 90% confidence interval.

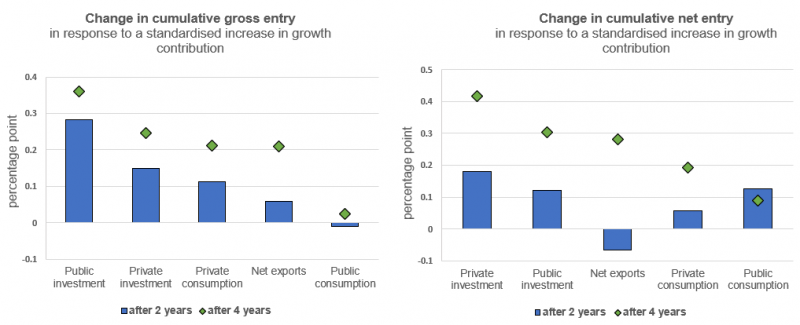

Public and private investment matter most for entry’s response to past entry and exit developments

Note: The blue bars (green diamonds) in the left-hand panel represent the relative change in cumulative gross entry after 2 years (after 4 years) in response to a combined one percentage point increase in exit and a one percentage point decrease in entry, when the contribution of each GDP component in the x-axis to future GDP growth increases by one standard deviation. The blue bars (green diamonds) in the right-hand panel represent the relative change in cumulative net entry after 2 years (after 4 years) in response to a combined one percentage point increase in exit and a one percentage point decrease in entry, when the contribution of each component in the x-axis to future GDP growth increases by one standard deviation. Future GDP growth refers to the 1- to 2-year ahead GDP growth OECD forecast. Estimates based on coefficients reported in Table 14.

The impact of growth forecasts on the dynamics of entry appears to be robust to several alternatives. For example, I do not find evidence of a similar effect for current GDP growth. Empirically, current GDP growth makes little difference to the forward path of entry once GDP growth forecasts have been considered. I also investigate the possible impact of structural factors that likely affect the dynamics of entry, e.g. regulations that capture barriers to entry, or those affecting the quality of insolvency proceedings or those influencing firms’ ability to obtain credit. Here, I find evidence that such regulations all affect – to varying degrees – the dynamics of entry. Their impact remains however marginal, relative to that of GDP growth expectations.

Last, I decompose GDP growth expectations and find that the economic outlook affects firm entry mainly through expectations of public and private investment. For example, considering the contributions of public investment and private consumption to future GDP growth, I find that the impact of the former on firm entry is about two and a half times larger than the impact of the latter after 2 years, and still about one and a half times larger after 4 years.

Altogether, this research suggests that policies focused on increasing private and public investment can often help to strengthen the economy’s supply side, by increasing firm entry and business dynamism.