Larger European banks have had a lower cost of overnight borrowing in the interbank market than smaller banks, but this size premium has decreased in recent years. Is this trend thanks to the implemented anti-bailout policies? Our analysis suggests that the decline in the size premium is related to actual bail-in events of failed banks but not to the implementation dates of the Bank Recovery and Resolution Directive as such. This finding is robust to controlling for the effect of the ECB’s long-term refinancing operations. Overall, the evidence suggests that the regulatory move towards bail-in rather than bailout policies to deal with financially distressed banks has reduced the too-big-to-fail expectations concerning large banks in Europe.

The issue of too-big-to-fail financial institutions has been a major research and policy question in the past years. For instance, it has been suggested that the presence of such institutions made the Global Financial Crisis (GFC) significantly worse (see Bernanke 2010).

A bank is called too-big-to-fail (henceforth, TBTF) if its failure would endanger the stability of the financial system. If a bank’s creditors expect the bank to be bailed out in a crisis, market discipline will deteriorate and as a result, the bank has fewer incentives to act prudently. As part of the reform pact agreed in the aftermath of the GFC and the European sovereign debt crisis, the EU has implemented a Bank Resolution and Recovery Directive (BRRD) that aims to ensure that a bank’s shareholders and creditors pay their share of recovery and resolution costs if the bank fails.

This policy brief is based on our recent paper “Have too-big-to-fail expectations diminished? Evidence from the European overnight interbank market”, where we investigated whether the post-crisis regulation has been effective in reducing the TBTF expectations (see Tölö, Jokivuolle and Virén 2021). We have looked for evidence of the BRRD’s effect from the pricing of loans in the overnight interbank market in Europe.

The interbank market is where banks provide each other short-term liquidity to facilitate outgoing payments and compliance with the central bank’s reserve requirement. Previous literature originating from the seminal paper by Furfine (2001) has shown that pricing of overnight loans reflects the credit risk of the borrower banks (see also Tölö, Jokivuolle and Virén 2017). Importantly, we focus on the uncollateralized market segment where pricing should more directly reflect risk differences across banks. In Europe, the interbank market transactions take place in the TARGET2 large-value payment system. We have utilized an algorithm of Arciero et al. (2016) that is able to identify interbank loans from among other payment system transactions that take place in TARGET2.

We investigated how the interbank overnight loan rates depend on bank size – used as a proxy of the TBTF status – and other bank characteristics. We found that large banks consistently obtain cheaper funding than their smaller peers, which could be an indication of their TBTF status. Since the cost differential could also be related to other factors, such as information advantages, operational efficiency possibly arising from scale advantages, and better risk-sharing opportunities, we also introduced various controls. Because the control factors are arguably relatively stable over time, we can interpret that the changes in funding cost differentials are related to the adoption of the new anti-bailout resolution regime as indications of changes in the TBTF effect.

Moreover, we utilize the implementation of the BRRD as a natural experimental setup. The idea is that the BRRD legislation was implemented in only some countries (forming a treatment group) of our multi-country data set. Such (quasi-)natural experiments can be analyzed through the difference(s)-in-differences (DiD) method. For the DiD analysis, we use panel data of the outcome (that is, changes in overnight loan prices) for the treatment group and a control group. The event, the BRRD implementation, should only affect the treatment group and should take place during a short period of time such that there are no confounding effects. The inference is based on observations just before and after the event.

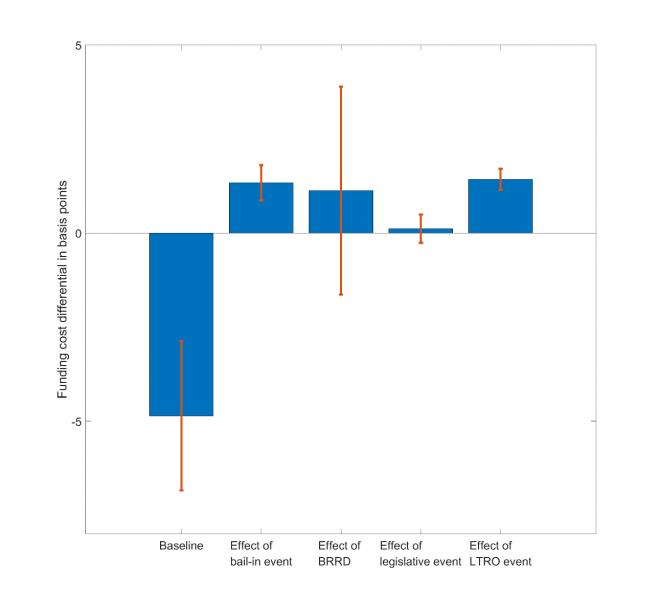

Despite the short maturity of the overnight loans, we cannot pin down a change in the funding cost at the precise implementation dates of the BRRD (which vary somewhat in different EU countries). Instead, the magnitude of the bank size premium decreases when actual bail-in events occur during the sample period (see Figure 1).1

This is in line with the findings of Schäfer, Schnabel and Weder di Mauro (2016) and suggests – using their phrase – that “actions speak louder than words” when it comes to tackling the TBTF problem. Additionally, we find some evidence of a gradual change in the funding costs that matches the timeline for the longer process of proposing and legislating the new regulation.

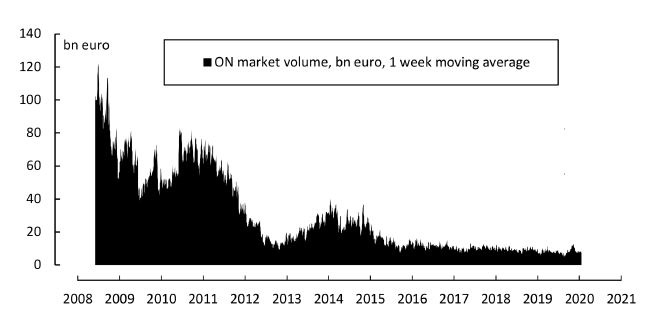

In conclusion, large banks in Europe have benefited from a consistent funding cost advantage relative to smaller ones, and especially the large banks in countries who are considered safe on the basis of their public creditworthiness seem to have been perceived as safe havens at times of market stress. However, our results suggest that the regulatory move towards bail-in rather than bailout policies to deal with financially distressed banks has reduced the too-big-to-fail expectations concerning large banks, reflected as a reduced funding cost advantage. These findings are broadly in line with those of Berndt et al. (2021) who document a decline in the too-big-to-fail expectations for globally systemically important banks. Interestingly, as Figure 2 demonstrates, volume of the (uncollateralized) interbank market in Europe has diminished considerably in the aftermath of the crises and especially in the latter half of the previous decade. Although several factors have certainly been at play, it is possible that the introduction of the BRRD has not only affected prices but also volumes by increasing the incentive for collateralized lending, which would be an interesting area of future research.

Figure 2. Development of the overnight market volume

Arciero, L., Heijmans, R., Heuver, R., Massarenti, M., Picillo, C., Vacirca, F., 2016, How to measure the unsecured money market? The Eurosystem’s implementation and validation using TARGET2 data, International Journal of Central Banking 12: 247-280. Available at: https://www.ijcb.org/journal/ijcb16q1a8.pdf.

Bernanke, B., 2010, Causes of the Recent Financial and Economic Crisis, Before the Financial Crisis Inquiry Commission, Washington, D.C., September 2, 2010. Available at: https://www.federalreserve.gov/newsevents/testimony/bernanke20100902a.htm.

Berndt, A., D. Duffie, Y. Zhu, 2021, The decline of too big to fail. Available at: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3497897.

Furfine, C.H., 2001, Banks as monitors of other banks: Evidence from the overnight Federal Funds market. Journal of Business 74(1):33–57.

Schäfer, A., I. Schnabel, B. Weder di Mauro, 2016, Bail-in expectations for European banks: Actions speak louder than words, European Systemic Risk Board Working Paper 7/2016.

Tölö, E., E. Jokivuolle, M. Virén, 2017, Do banks’ overnight borrowing rates lead their CDS price? Evidence from the Euro system. Journal of Financial Intermediation 31:93–106.

Tölö, E., E. Jokivuolle, and M. Virén, 2021, Have too-big-to-fail expectations diminished? Evidence from the European overnight interbank market, Journal of Financial Services Research, published online 18 April 2021.

As Figure 1 indicates, we controlled for the Long-Term Refinancing Operations announcements of the ECB, which also independently reduce the funding cost advantage of the large banks.