Investment costs of pension funds play a pivotal role in their returns. Consolidation in the pension fund market takes place continuously, often with cost savings as the main argument. Unused economies of scale in pension fund investment costs, however, have declined over the years to values close to zero, except for the very small pension funds. Do these economies of scale still exist? Our research investigates investment economies of scale in the Netherlands and pays special attention to the non-linear relationship between investment costs and sizes of pension funds. Furthermore, investment cost margins are disaggregated into three cost types and into six asset categories. In particular, large pension funds have to pay performance fees for complex asset categories. Such fees reduce the traditional economies of scale results for the entire portfolio. Cost savings by consolidation are still possible but very limited.

The costs of pension funds have a direct impact on their net returns. More than ever, these costs affect current and future pension benefits. Pension premiums are currently high. With pension premiums in the Netherland between 25% and 30% of salaries, little room exists to increase them further. In recent years, a large number of smaller Dutch pension funds have stopped and were taken over by other pension funds or life insurers. Annually, this concerns more than 110,000 participants and over €6 billion. A major argument for these mergers is lower costs, due to economies of scale. Research on scale effects in investment costs, the dominant component of pension fund costs, reveals a remarkable downward trend. Large unused economies of scale were found for the Netherlands of, on average, 22% during 1992-2004 (Bikker and De Dreu, 2009) and 20% in 1992 (Bikker, 2013). However, in the last decade there seems to have been an absence of any economies of scale: 0% in 2009 (Bikker, 2013) and 0% over 2002-2013 (Alserda, Bikker and Van der Lecq, 2018). This contrasts sharply with the continuing and significant economies of scale in administration costs of pension funds as observed in the same studies, even though these followed a downward trend, too: from 36% in 1992-2004 and 29% in 1992-2009, to 10% in 2002-2013. A decline in the mean economies of scale is plausible. Three quarters of the pension funds in 1992, particularly the smaller ones, have since been discontinued. But economies of scale of, on average, zero – as apparently seems to be the case with investments – would be counter-intuitive. Broeders et al. (2016) report economies of scale for investment costs over 2013. These seemingly contrary results raise the question whether scale effects on cost margins of pension fund investments still exist.

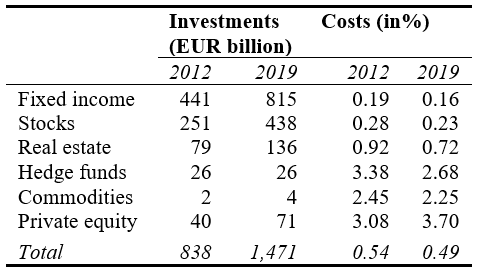

We apply new disaggregated data of 240 Dutch pension funds over 2012-2019 to a model that incorporates a number of non-linear theoretical relationships between costs and pension fund size (Bikker and Meringa, 2021). The major relationships are U-shaped unit investment costs and everlasting decline of fixed cost when pension fund size increases. Investment costs are split into three components: management (in 2019: 60%), performance fees (34%) and transactions (6%). This has been done for each of six asset classes, see Table 1. This table shows that the average cost margin has decreased from 0.54% in 2012 to 0.49% in 2019. This decrease was found for each asset class, except private equity, and is caused by, – among other factors – standardisation by external investors under pressure from competition.

Table 1. Pension funds’ investments and cost margins by asset class (2012 and 2019)

Source: DNB.

Apart from a non-linear relationship between costs and size, our model also considers asset allocation. As Table 1 explains, some assets entail higher costs and generally higher expected returns. Particularly larger pension funds invest more in complex (and costly) assets.

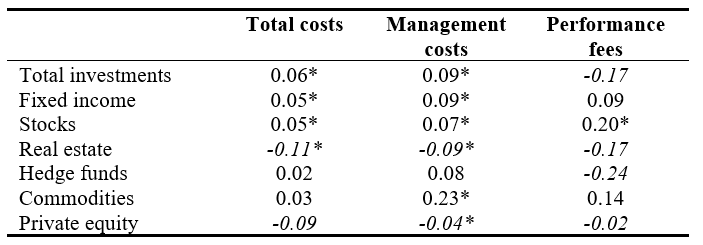

Table 2 presents the scale economies of investments costs of the average pension fund over 2012-2019 for various cost components and asset classes. Generally, we observe economies of scale. Exceptions are in italics. These are real estate and private equity, as well as performance fees for total investments and hedge funds. For the combination of total costs and total investments, the economies of scale for average-sized pension funds are rather limited at 6%.

Table 2. Economies of scale of investments costs for the average pension fund (2012-2019)

Note: Italics indicate absence of economies of scale. Asterisks point to significance of economies of scale on the 95% confidence level.

Economies of scale of management costs are substantially larger at 9%. However, for performance fees we observe no economies of scale for total investments but rather scale disadvantages, be it not statistically significant. This result is due to the categories real estate and hedge funds. Higher performance fees may be cancelled out by higher expected returns,2 so that the classical theory of economies of scale for this cost component no longer applies.

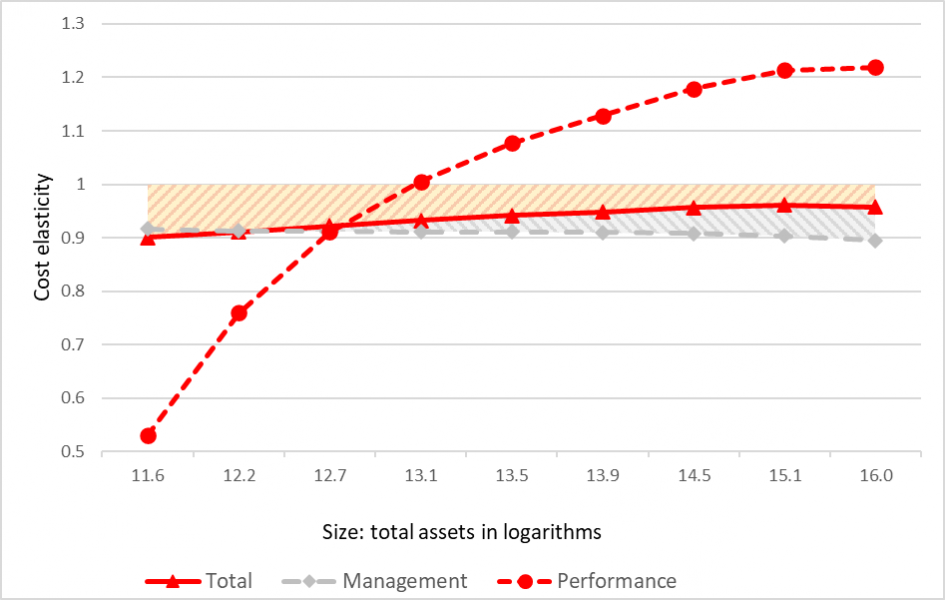

Figure 1. Cost elasticities of total investments of pension funds by size (2012-2019)

Note: This figure shows the nine percentile borders of 10% to 90%. The total investments of the 10% percentile amounts to € 110 million and that of the 90% percentile to € 8.6 billion.

Figure 1 shows how the cost-size relationship – or cost elasticity – varies with the pension fund size. The nine points on each graph represent the cost elasticity for the 10th to the 90th percentile of the size distribution. Economies of scale exist where the cost elasticity is below 1 (economies of scale = 1 – cost elasticity). For total costs and management costs, economies of scale are shaded. For total costs (shading in red), economies of scale for the smallest institutions are 10%, for larger funds 6% and for the largest pension funds 5%.

Disaggregation to cost types reveals that economies of scale for management costs (grey and red shading together) are fairly constant over pension fund sizes at around 9%. Performance fees show large economies of scale for small pension funds (47%), zero for larger funds with investments of almost a € 0.5 billion (where the cost elasticity equals 1), and diseconomies of scale up to 22% for the largest pension funds.

As a robustness test, we apply our approach to a sample without real estate, hedge funds and private equity, so that only fixed assets, stocks and commodities remain, which cover 85% of all investments. As expected, we then find economies of scale for all cost components, with values for total costs and management costs similar to those for the entire portfolio. A second robustness test applies our model to single years. The economies of scale in total costs move from 4% in 2012, via 0% in 2014, and then gradually up to 8% in 2019. Particularly, the absence of economies of scale in 2014 is remarkable.

It is possible that risk management and market analysis of larger pension funds is of a higher level, because they hire more, or more qualified, people for these activities. If this were the case, it would be more likely that their risks were lower and their returns higher. Our model does not observe such a quality effect, so that economies of scale might be underestimated. Such a relationship between costs and returns would particularly disturb economies of scale measurement of the more complex assets and could possibly explain their diseconomies of scale. This risk management costs versus returns issue is complex because it concerns expected (or longer-term) returns rather than actual returns. We were not able to deal with that in this article.

In the hypothetical case that all smaller and medium-sized pension funds would be equally large as the fifth but largest pension fund through growth, mergers or take-overs, than their investment costs in 2019 would decline by only 1.4% (or € 36 million). This is less than 0.5% of the total investment costs for all funds together. On the other hand, when two large pension funds merge, they can, mutatis mutandis, save 2.5-3% of their investment costs. Our conclusion is that some economies of scale do exist (in most years) but that they are only moderate. The argument for consolidation still exists but is limited.

Alserda, G.A.G., J.A. Bikker and S.G. van der Lecq (2018). X-efficiency and economies of scale in pension fund administration and investment, Applied Economics 50 (48), 5164-5188.

Bikker, J. A. and J. De Dreu (2009). Operating costs of pension funds: the impact of scale, governance, and plan design. Journal of Pension Economics & Finance 8(1), 63.

Bikker, J. A. (2013). Is there an optimal pension fund size? A scale-economy analysis of administrative and investment costs, DNB Working Paper nr. 376, Amsterdam.

Bikker, J. A. and J.J. Meringa (2021). Have scale effects on cost margins of pension fund investment portfolios disappeared? DNB Working Paper nr. 710, Amsterdam.

Broeders, D.W.G.A., A. van Oord and D.R. Rijsbergen (2018). Scale economies in pension fund investments: A dissection of investment costs across asset classes, Journal of International Money and Finance 67, 147-171.

Broeders, D.W.G.A., A. van Oord and D.R. Rijsbergen, 2019, Does it pay to pay performance fees? Empirical evidence from Dutch pension funds, Journal of International Money and Finance 93, 299-312.

The views expressed in this Policy Brief are solely those of the authors and do not in any way represent the views of De Nederlandsche Bank.

However, Broeders, Van Oord and Rijsbergen (2019) do not find such ‘compensation’ effect in their empirical investigation.