References

Alfonso, Viviana, Codruta Boar, Jon Frost, Leonardo Gambacorta, and Jing Liu, “E-commerce in the pandemic and beyond,” BIS Bulletin, 2020.

Bloom, N., R. Fletcher and E. Yeh (2021), “The impact of COVID-19 on US firms”, National Bureau of Economic Research Working Paper No. w28314.

Brülhart, Marius, Rafael Lalive, Tobias Lehmann, and Michael Siegenthaler, “COVID-19 financial support to small businesses in Switzerland: evaluation and outlook,” Swiss journal of economics and statistics, 2020, 156 (1), 1–13.

Crossley, T., P. Fisher and H. Low (2021), “The heterogeneous and regressive consequences of COVID-19: Evidence from high quality panel data”, Journal of Public Economics 193: 104334.

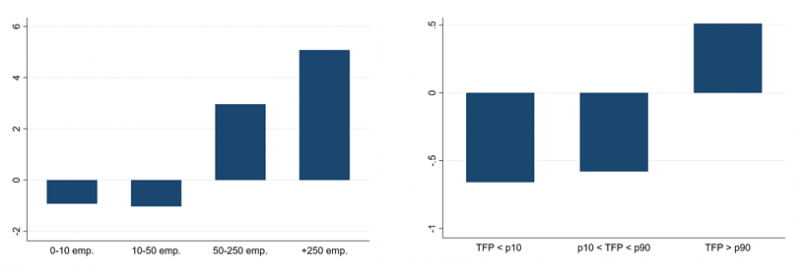

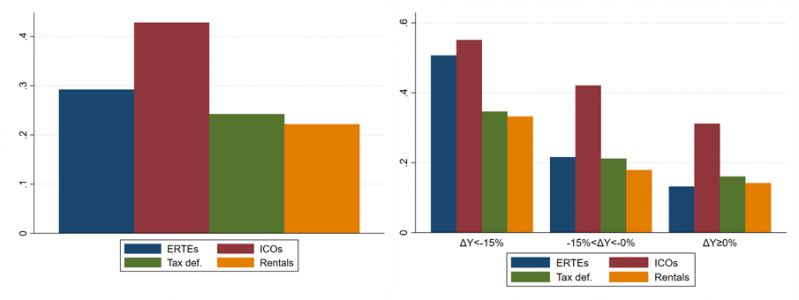

Fernández-Cerezo, A., González, B., Izquierdo, M., and Moral-Benito, E. (2021), “Firm-level heterogeneity in the impact of the COVID-19 pandemic”, Banco de España Working Paper No. 2120.

International Finance Corporation, Word Bank Group (2021), “How firms are responding and adapting during COVID-19 and recovery”.

Puy, D. and L. Rawdanowicz (2021), “Covid-19 and the corporate sector: Where we stand”, VoxEU.org, 22 June.

Thygesen, Niels (2021), “The role of fiscal policies in the Covid-19 crisis: scope and limitations”, SUERF Policy Briefs No 63, April 2021.