This policy brief is based on Cesnak, M., Cupak, A., Fessler, P., & Klacso, J. (2025). Heterogeneous Impacts of Macroprudential Policies: Financial Advisors, Regulatory Caps, and Mortgage Risk. Oesterreichische Nationalbank Working Paper No. 263.

Abstract

This policy brief examines the tightening of borrower-based macroprudential measures in Slovakia in 2018 and its effects on mortgage lending, focusing on bunching at regulatory thresholds and financial advisor mediation. Analysis of comprehensive loan-level data reveals that the regulation led to loan clustering just below introduced limits. Part of the borrowers potentially above the limits adjusted their behavior to remain compliant. On the contrary, borrowers below the thresholds pushed LTV ratios upward, bringing loans closer to riskier levels. Financial advisors played a key role in structuring loans to navigate policy constraints while maximizing borrowing capacity. Additionally, a sharp increase in mortgage approvals just before policy implementation indicates that borrowers and advisors responded swiftly to the announced changes, securing loans before the restrictions took effect. While the policy successfully curtailed excessive risk-taking, it shifted borrowing behavior toward regulatory cutoffs, effectively redistributing risk rather than only reducing it.

Macroprudential regulation serves as a key instrument for mitigating systemic financial risks, particularly in environments of increasing household indebtedness. Borrower-based measures (BBMs), including Loan-to-Value (LTV), Debt-to-Income (DTI), and Debt Service-to-Income (DSTI) limits, aim to control excessive credit expansion. However, their efficacy is closely linked to borrower responses, market dynamics, and the role of financial advisors.

Despite the increasing adoption of BBMs, there is limited evidence on their full effects due to a lack of granular data and the recent introduction of these regulations in many jurisdictions. This gap makes Slovakia’s 2018 intervention a valuable case study. The high-frequency, loan-level data available to the National Bank of Slovakia offer rare insights into borrower behavior, allowing for a detailed assessment of how regulatory thresholds shape financial decision-making.

We evaluate the impact of Slovakia’s 2018 macroprudential intervention, emphasizing two central behavioral responses: bunching at policy thresholds and financial advisor mediation in loan structuring.

Key Findings

1) Bunching Effects and Strategic Loan Structuring

The policy introduced a DTI limit of 8 and a gradual tightening of LTV to 80%, with 20% of new business allowed to exceed this limit up to 90% LTV. The regulation set stricter caps on loan eligibility, which prompted borrowers and financial advisors to strategically adjust loan applications to comply with the new rules. Many borrowers from both side of the threshold shifted their loan characteristics to stay just below the imposed limits. This resulted in a concentration of loans at 80% and 90% LTV thresholds.

Many borrowers, who previously would have taken out lower LTV loans, pushed their leverage up to the threshold to maximize borrowing potential while remaining compliant. This behavior suggests that while reducing systemic risk at the right tale of the LTV distribution, the regulation compressed risk near regulatory cutoffs. The shift also reflects the role of financial advisors, who facilitated loan restructuring to optimize eligibility under the new policy framework.

Figure 1 illustrates these effects by showing how LTV distributions changed in response to the policy announcement and implementation. The figure provides a clear visualization of the shift in LTV distributions before and after the policy, highlighting the emergence of sharp spikes at regulatory thresholds. Notably, the density of loans below 80% LTV decreased, as borrowers who previously would have taken lower LTV loans increased their leverage to the new policy limits.

This shift suggests that the policy led to strategic adjustments to maximize borrowing capacity while remaining compliant. The observed pattern is consistent with borrower behavior anticipating constraints, as well as the role of financial advisors in guiding loan structuring. The increased density at key regulatory thresholds underscores the importance of monitoring risk accumulation within constrained categories and assessing whether such policies might indirectly push higher-risk borrowers into borderline categories rather than reducing overall systemic exposure. The timing of the bunching suggests that both borrowers and lenders actively adapted their behavior as the regulatory changes took effect, reinforcing the importance of understanding how market participants respond to macroprudential policies.

Figure 1. LTV distribution before and after the policy announcement (+/- 2Q sample)

2) Financial Advisors and Credit Risk Optimization

Financial advisors played an important role in shaping loan characteristics post-regulation. The bunching effect is much stronger for mediated loans. It means advisors helped borrowers navigate the new constraints by structuring loans in ways that allowed for maximum borrowing potential while still complying with the imposed limits. This led to a concentration of loans with high LTV and DTI ratios just below the regulatory caps, reinforcing the notion that policy adjustments lead to reallocation of risk within constrained boundaries. Also, policy effectiveness depends on the presence and type of intermediaries.

Moreover, the involvement of financial advisors highlights the extent to which market participants actively respond to regulatory interventions, using strategic adjustments to maintain lending volume and borrower access to credit. Instead of reducing household leverage, the regulatory caps shifted lending activity into borderline categories, where loans were structured to meet compliance thresholds. This suggests that macroprudential policies must account for intermediary behavior and market adaptation mechanisms to ensure their effectiveness in genuinely mitigating financial vulnerabilities and be prepared to adapt policies to market reaction.

3) Pre-Implementation Borrowing Surge

The announcement of the policy led to a sharp increase in mortgage approvals, as borrowers and financial advisors rushed to finalize loan agreements before the regulatory thresholds took effect. This behavior, also called as frontloading, reflects a common pattern observed in credit markets where borrowers accelerate borrowing to avoid stricter future constraints.

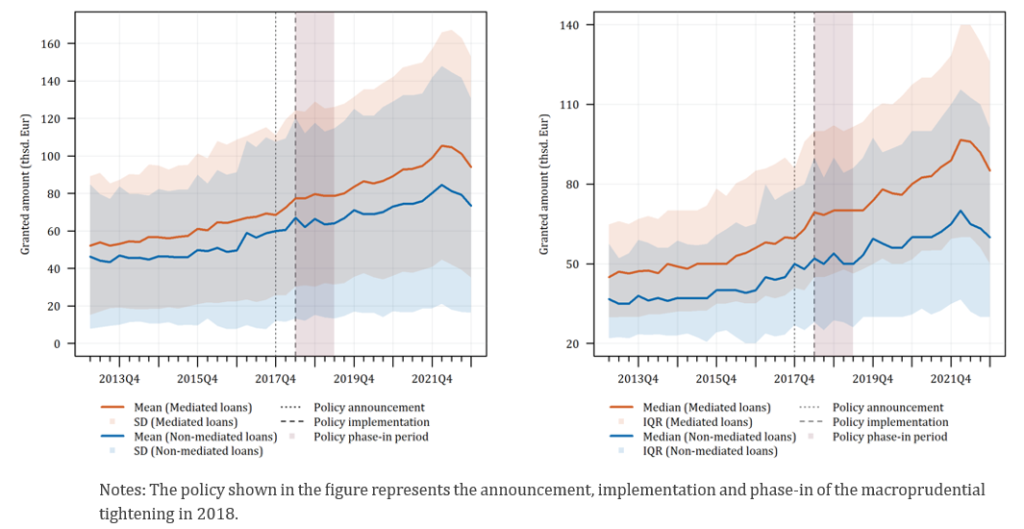

The trend is illustrated in Figure 2, which tracks the evolution of average and median granted loan amounts over time. The data reveal a significant spike in loan volumes in the quarters following the policy announcement, followed by a sharp decline once the new limits became fully binding. This pre-implementation borrowing surge underscores how expectations about future regulation can create short-term distortions in credit supply and incentivize risk-taking behavior ahead of policy enforcement. This surge reflects a behavioral response to regulatory expectations, emphasizing the need for more gradual, predictable policy transitions to prevent credit distortions.

Figure 2. Average and median granted loan amount over time

The findings suggest several important lessons for policymakers seeking to improve the effectiveness of borrower-based macroprudential measures:

Overall, these findings suggest that borrower-based macroprudential tools should be continuously evaluated and refined, with particular attention to how market participants adapt to regulations. By incorporating behavioral insights and improving the adaptability of policy frameworks, regulators can enhance financial stability while ensuring efficient credit allocation.

Slovakia’s borrower-based measures successfully reduced high-risk mortgage lending but also triggered unintended behavioral responses, reshaping the distribution of mortgage loans. The two most critical effects – bunching near regulatory thresholds and financial advisor mediation—highlight the complexity of borrower-based macroprudential measures and the potential for policy-induced distortions.

Rather than only curbing systemic risk, the regulation led to a concentration of lending at policy-imposed cutoffs, as borrowers adjusted their loan structures to stay just within permissible limits. This shift was facilitated by financial advisors, who played a key role in reallocating risk rather than only reducing it, effectively enabling borrowers to optimize loan conditions within regulatory constraints.

These findings underscore the importance of holistic policy evaluation that considers not just the direct effects of macroprudential measures but also the ways in which market participants adapt. Crucially, such evaluations require granular, loan-level microdata, as aggregated data often obscure key behavioral shifts and distributional effects. This level of detail is also necessary to analyze the joint distributions of risk measures, which is essential for understanding how different dimensions of borrower risk interact and compound under regulatory constraints. A refined regulatory approach should incorporate behavioral insights, dynamic monitoring mechanisms, and enhanced oversight of financial intermediaries to ensure that borrower-based constraints achieve their intended objectives. By integrating adaptive policy frameworks and continuously assessing market responses, regulators can better safeguard financial stability while maintaining efficient credit allocation. The two most critical effects – bunching near regulatory thresholds and financial advisor mediation – underscore the complexity of macroprudential policymaking.