Global banks face an overlay of prudential regulations that shape their international operations, both from the country where they operate (host) and the country of their headquarters (home). This note discusses the home-host perspective and examines how the BIS international banking statistics can shed light on unintended international spillovers that arise from changes in home- and host-country regulations. One approach directly measures the effect on cross-border credit in a panel regression; an alternative, novel approach does so after decomposing growth in cross-border lending into separate home, host and common components. The findings suggest that prudential policies can give rise to spillovers in cross-border dollar credit, depending on who enacted policy and which instrument was used. Policies introduced by a bank’s home country are associated with larger spillovers than host-country policies.

Banks face an overlay of prudential regulation from both the country where they operate (host) and the country of their headquarters (home). For institution-specific rules, the home-country perspective is most natural: much of the Basel framework applies on a globally consolidated basis with the purpose of strengthening the resilience of the entire banking group (BCBS, 2017). More than 100 jurisdictions have adopted risk-based capital regulation and other aspects of the Basel framework.2 A country that raises capital requirements will affect the consolidated group headquartered in that country as well as its branches and subsidiaries (i.e. affiliates) abroad. Even if branches themselves issue no equity, the consolidated group must still allocate capital to the exposures its branches hold abroad.

However, countries also apply regulation on a jurisdictional basis, notably to the local subsidiaries of foreign banks. The trend toward local regulation in fact strengthened following the global financial crisis of 2007-09, e.g. in the form of ring-fencing and liquidity standards. Indeed, liquidity supervision is typically considered a host-country responsibility (BCBS, 2008).3 Some prudential measures are naturally local in scope and target particular instruments or types of borrowing (e.g. BIS, 2018, and ESRB, 2018, 2019). When a country tightens loan-to-value limits and debt-service to income caps, the scope of application is the domestic market where both domestic and foreign banks operate. This implies that subsidiaries generally face an overlay of home- and host-country regulations in the jurisdiction in which they operate. The complex array of regulation and supervision is costly for banks to manage (IIF, 2019), and a concern for regulators favouring consistent rules on a level-playing field (FSB, 2019).

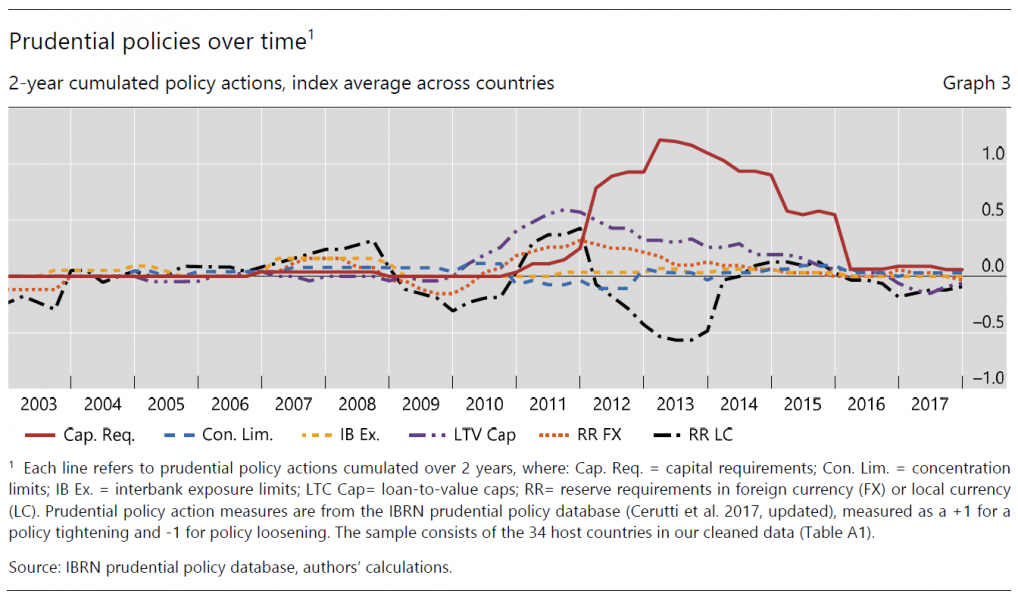

We study this issue using data on cross-border bank credit combined with prudential policy changes. The IBRN Prudential Instruments Database (Cerutti et al, 2017) covers different prudential policy changes in 64 countries for the period 2000 Q1-2017 Q4, with changes coded as a tightening (+1) and an easing (–1). The instruments include general capital requirements, interbank exposure limits and concentration ratios, as well as loan-to-value (LTV) caps and reserve requirements in local currency or in foreign currencies.

When a country enacts a policy change, the consequences can be viewed from various angles. Domestic effectiveness is the usual focus of policymakers and of most analyses.4 We instead examine international spillovers. From a country’s perspective, we measure the response of cross-border lending following a policy change, and do so separately for the banks operating in that country (for them it is the host country), and for the banks headquartered there (for them it is home). From a bank’s perspective, any given affiliate has a home and a host regulator: for a French bank extending credit from its New York subsidiary, home-country policy is that of France and the EU, while host policy is that of the United States.

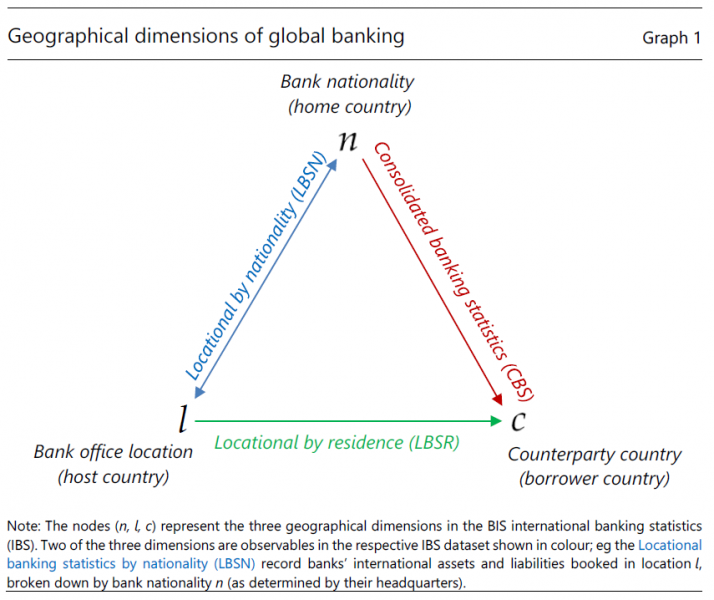

Analysing spillovers in this context thus requires data and empirics that distinguish bank nationality from the location of banking activity. That, in turn, calls for a departure from the “residency perspective” that pervades international finance thanks to the availability of balance-of-payments statistics.5 Consolidated banking groups have affiliates in host countries around the world; they borrow and lend cross-border from those affiliates, each in turn with counterparties in other countries. A full picture of this structure requires data that capture: the home country where the consolidated group is headquartered; the host countries where the affiliates of the banking group operate, and the counterparty countries where their respective borrowers reside.

The BIS international banking statistics (IBS) capture all three dimensions at the country level, but only two dimensions can be observed at a time. To illustrate, consider the example of a German bank’s cross-border claims booked by its affiliates in London on counterparties in Brazil.6 How would these claims be captured in the various IBS datasets?

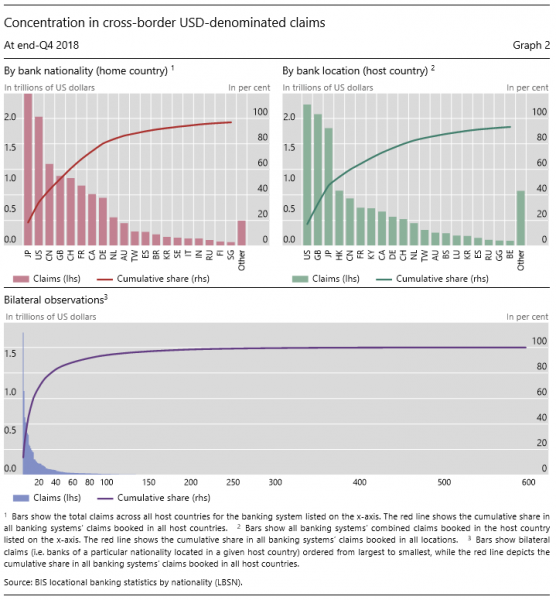

To assess whether home and/or host prudential policy leads to cross-border spillovers, we focus on nationality and location, the two dimensions captured in the LBSN. The unit of observation is the group of affiliates of nationality n located in a given host country l (e.g. German banks in the United Kingdom). The LBSN data consist of about 600 such home-host pairs.7 Most of these affiliates are small and have erratic swings in their data, which lead to volatile growth rates. We remove small affiliates with total assets below $1 billion throughout the period 2000 Q1-2018 Q4. After dropping other observations (poor data quality), the sample at end-2017 comprises 328 affiliates, covering $13 trillion (97%) of total cross-border US dollar-denominated claims in the LBSN data.8 The growth in aggregate cross-border credit is mostly driven by the larger affiliates in the sample.

Global banking is highly concentrated in a few banking systems and host countries (Graph 2). Banks headquartered in just three countries – Japan, the United States and China – accounted for over 40% of total cross-border dollar claims in 2018 Q4 (top left panel), and the top eight banking systems accounted for a full 80%. Similarly for host countries, banking affiliates located in the United States, United Kingdom and Japan booked roughly half of global cross-border claims, with the other 42 reporting countries making up the remainder. Crossing the home and host dimensions only compounds concentration: the 10 largest home-host pairs accounted for more than 50% of cross-border credit (bottom panel).

Empirical work on international banking needs to take this concentration into account. Here, we study year-on-year growth in US dollar-denominated cross-border claims. Small growth rates on large positions drive the aggregate growth rate. But the many volatile growth rates on small positions will influence standard regression estimates which, by design, capture the average observation. Since we are more interested in how aggregate lending responds to prudential policies than in the response of the average affiliate, we report results from regressions that weigh individual growth observations by the size of the underlying position.

A final point to note is the extent of correlation across policies. Within our sample, prudential policies exhibit low correlations across instruments in a given country. However, implementations of a specific prudential action can correlate across countries (Graph 3). Authorities may respond similarly to fluctuations in global liquidity, or coordinate the implementation of regulation (e.g. Basel II and Basel III). These correlations underline the value of distinguishing between home and host policies.

Our analysis makes use of two alternative empirical approaches. Both weigh the observations by the size of the position, to ensure that our empirical estimates capture the aggregate effect of policy changes, not the average effect across individual home-host country pairs. The findings on which this note draws are described more fully in Avdjiev et al (2020).

Home and host regulation. We start with a direct approach that includes both dimensions of interest: home and host countries. We regress the growth in cross-border US dollar claims booked by banks from country n located in country l on the corresponding home- and host-country policy changes (see Graph 1). One can think of this approach as a horse race, where the estimates of the separate coefficients on the home- and host-country policies will indicate which of the two has a larger effect on cross-border dollar claims. This way, we let the data speak to the spillovers from regulatory overlay. The regression also includes fixed effects for separate bank nationalities and locations, and controls for US monetary policy shocks and their interactions.

The results overall suggest that several home-country prudential policies intended to strengthen the resilience of banks can also give rise to international spillovers. A tightening in a country’s concentration limits is associated with an increase in cross-border dollar lending by banks headquartered in that country. By contrast, when the home country tightens interbank exposure limits, cross-border lending tends to contract. Both results are significant across various specifications. Home-country LTV caps, on the other hand, give rise to positive spillovers in some subsamples.9

The picture is mixed when it comes to host-country prudential policies. A tightening in a country’s LTV caps and local currency reserve requirements is associated with a decline in dollar cross-border lending of banks operating in that country. However, this effect disappears when interactions with US monetary policy are added. The estimates also suggest that US dollar cross-border lending contracts when the host country tightens capital requirements and when it eases interbank exposure limits. These effects, however, are not robust across subsamples. Host-country policies appear to be associated with weaker measured spillovers; this may reflect the diverse mix of banks from different nationalities in banking centres that receive more weight in the determination of the coefficient estimates.

The estimated impact of US monetary policy on cross-border US dollar lending is negative and significant in all specifications. While it is not surprising that higher funding cost curbs cross-border dollar lending, it raises a conceptual point in our home-host context. In contrast to prudential policies, which are specific to individual home or host countries, US monetary policy acts more broadly on all dollar-denominated credit. We would not expect it to explain a significant share of the variation in growth rates across home-host pairs. This motivates an alternative and complementary approach that focuses on each dimension of interest separately.

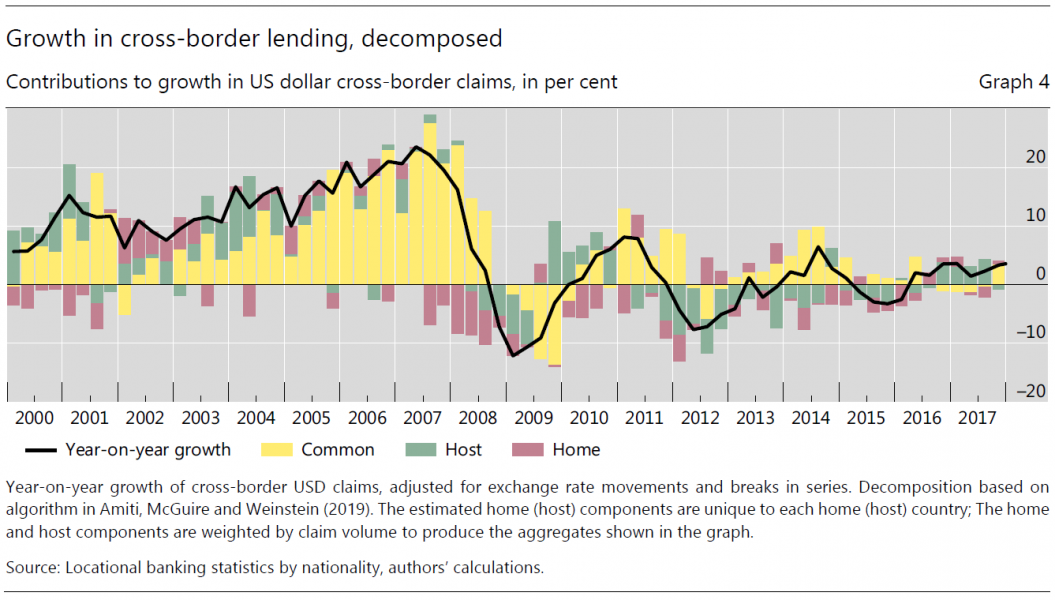

Home or host regulation. Our second approach disentangles the home and host dimensions, to estimate two separate panel regressions and examine whether home or host policy changes produce spillovers. To do so, we first decompose growth in cross-border USD credit into three components: a home-specific component, a host-specific component and a common component.10 This common component reflects overall growth, and is highly correlated with global drivers of capital flows, including US monetary policy. The home and host components are thereby purged of global factors.

The result of this decomposition is summarised in Graph 4, which aggregates the three components across all home and host countries. The common component (yellow) represents the median growth rate across all home-host pairs. It clearly dominates in the pre-crisis period up to 2008, reflecting the fact that cross-border credit grew at similarly elevated rates for all bank nationalities in all major locations. It is with the onset of the global financial crisis that the decomposition assigns greater importance to the granular home- and host-country components (as noted by Amiti et al 2019).

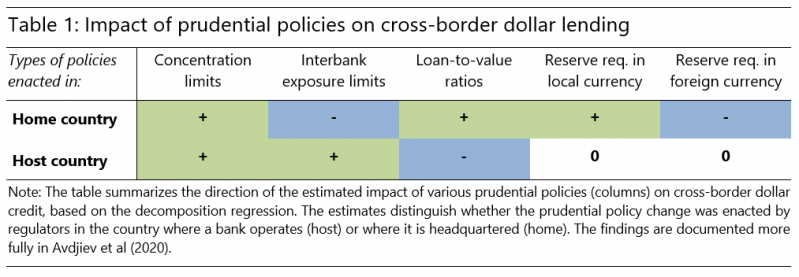

The decomposition thus allows us to match, in separate regressions, each policy with the component (home or host) that this policy is expected to affect. The results are summarised in Table 1. As before, countercyclical instruments used by the home country are associated with spillovers. A tightening of home country LTV caps is associated with an increase in cross-border dollar lending. Faced with tighter LTV limits on their domestic lending, banks are likely to re-balance their portfolios towards to cross-border dollar lending. Meanwhile, cross-border dollar lending tends to contract in response to a tightening in foreign currency reserve requirements and a loosening in local currency reserve requirements. Both policies may make cross-border dollar lending less attractive relative to local currency lending.

Several resilience-enhancing prudential tools also give rise to spillovers among banks headquartered in the country that enacts them. Cross-border dollar lending expands in response to tighter concentration limits and contracts in response to tighter interbank exposure limits. Since concentration limits may well bind for domestic lending, their tightening induces banks to substitute into cross-border US dollar lending. By contrast, since the interbank market is such a large part of cross-border USD claims, limits on interbank lending are likely to reduce cross-border dollar lending.

As in the earlier findings, the results suggest that prudential policies enacted by the host country tend to have less significant spillover effects than those enacted by the home country. The mix of nationalities across host countries does not explain this result, since the decomposition approach removes home-country variation in the host component used here. One significant policy is LTV caps, which are associated with a contraction in US dollar cross-border lending, perhaps because a tightening signals that a boom is underway. Also, a tightening of concentration limits by host countries is accompanied by an increase in cross-border dollar lending; when they bind for domestic lending, they may induce banks to substitute into cross-border dollar lending.

Global banks operate in a complex web of regulations enacted by regulators in different jurisdictions. There is a long tradition of consolidated bank regulation by home regulators, e.g. in the Basel framework. But many countries also apply local regulations on a jurisdictional basis in the host country where a bank operates, e.g. in the form of liquidity standards, subsidiarisation and ring-fencing.

This note argues that prudential regulation may produce spillovers in international credit, even if the intended scope of policy is the domestic market or the health of the banks operating there. When a country tightens loan-to-value limits, for instance, the intent is typically to restrict domestic real-estate related borrowing. Policies that aim to strengthen banks’ resilience, likewise, may induce banks to reduce leverage by shedding assets. Cross-border credit per se is generally not the target of such policies.

We report first results based on global banking data and methods that distinguish the home- and host-country dimensions. The findings suggest that certain prudential policies have significant spillover effects via cross-border dollar credit. Home-country policies are more consistently associated with spillovers, but the measured effects depend on the particular policy tool and the jurisdiction (home or host) that implements them. We find fewer spillovers for host-country policies. Such an outcome may be desirable, since prudential policy aims at the domestic market, mostly without the intention of affecting international credit.

This paper is but a first step that aims to clarify concepts around home-host regulation in international banking, and that offers a methodology to disentangle them. If banks themselves find it difficult to navigate the overlay of home and host regulations, then surely more refined data are needed to do justice to the legal and institutional complexities. Further work in this area using unconsolidated bank-level data should yield more precise insights for policymakers.

Avdjiev, S, B Hardy, P McGuire and G von Peter (2020) “Home sweet host: Prudential and monetary policy spillovers through global banks”, BIS Working Paper 853, https://www.bis.org/publ/work853.htm.

Avdjiev, S, McCauley, R, Shin, H S, (2016) “Breaking free of the triple coincidence in international finance”, Economic Policy 31(87), July, 409-51.

Amiti, M, and D Weinstein (2018) ”How Much Do Idiosyncratic Bank Shocks Affect Investment? Evidence from Matched Bank-Firm Loan Data”, Journal of Political Economy 126(2).

Amiti, M, P McGuire, and D Weinstein (2019) “International Bank Flows and the Global Financial Cycle“, IMF Economic Review 67, 61-108.

Basel Committee on Banking Supervision (BCBS) (2008) “Liquidity risk: management and supervisory challenges”.

Basel Committee on Banking Supervision (BCBS) (2017) “Basel III: Finalising post-crisis reforms”, December 2017.

Bank for International Settlements (BIS) (2018) “Moving forward with macroprudential frameworks”, BIS Annual Economic Report 2018.

Boissay, F, C Cantú, S Claessens and A Villegas (2019) “Impact of financial regulations: insights from an online repository of studies”, BIS Quarterly Review, March 2019. https://stats.bis.org/frame/

Cerutti, E, R Correa, E Fiorentino, and E Segalla (2017) “Changes in Prudential Policy Instruments – A New Cross Country Database”, International Journal of Central Banking 13(1), 477-503.

European Systemic Risk Board (ESRB) (2018) “A Review of Macroprudential Policy in the EU in 2017”, April 2018.

ESRB (2019) “A Review of macroprudential policy in the EU in 2018”, European Systemic Risk Board.

Financial Services Authority (FSA) (2009) “Strengthening liquidity standards”, Policy Statement 09/16, October.

Financial Stability Board (FSB) (2019) “FSB Report on market fragmentation”, June 2019, www.fsb.org.

Hohl, S, M C Sison, T Stastny, and R Zamil (2018) “The Basel framework in 100 jurisdictions: implementation status and proportionality practices”, FSI Insights on policy implementation No 11, November 2018.

Institute of International Finance (2019) “Addressing market fragmentation: the need for enhanced global regulatory cooperation”, IIF Report, 24 January 2019.

Lane, P, and G M Milesi-Ferretti (2007) “The external wealth of nations mark II: Revised and extended estimates of foreign assets and liabilities, 1970-2004”, Journal of International Economics 73, 223-250.

McCauley, R, A Bénétrix, P McGuire and G von Peter (2019) “Financial deglobalisation in banking?” Journal of International Money and Finance 94.

This note presents background information and selected findings from BIS working paper 853 (Avdjiev et al, 2020). This research is part of a broader initiative of the International Banking Research Network (IBRN) to explore the interaction between monetary and prudential policies and their international spillovers through banks. The views expressed here are those of the authors and not necessarily those of the Bank for International Settlements or the IBRN. All errors are our own.

The scope of application goes far beyond BCBS member countries: Hohl et al (2018) survey 100 countries and jurisdictions outside the BCBS that implemented parts of the Basel framework, notably the risk-based capital regime, leverage rules, large exposures, and liquidity standards (the liquidity coverage ratio and the net stable funding ratio).

Liquidity is more local in nature than capital; for liquid assets to be judged adequate and immediately available, they need to have a local component. Separately, foreign currency risk is regarded as a source of liquidity risk. UK liquidity standards are a prominent example, which require self-sufficiency and adequacy of liquid resources for UK entities, including subsidiaries and branches of foreign banks (FSA 2009).

The BIS maintains an interactive online repository of the estimated effects of (home country) regulation on bank lending, funding costs and loan rates, as well as GDP, investment and other macroeconomic outcomes. See Boissay et al (2019), and https://stats.bis.org/frame/ .

National statistics and the balance of payments are compiled on a residency basis; accordingly, empirical work in international finance analyse data on this basis (e.g. Lane and Milesi-Ferretti, 2007). By custom or ease, theoretical work tends to follow this perspective, even as some of the limitations have become more apparent (e.g. McGuire and von Peter, 2012, and Avdjiev et al, 2016). Indeed, it can be argued that the deglobalisation apparent in cross-border banking is better understood as a problem of European banks, whose balance sheet condition led to wide-spread shedding of foreign assets (McCauley et al. 2019). This only becomes apparent in data that capture both bank residence and bank nationality.

Claims consist mostly of loans, but also include holdings of debt and equity securities, derivatives with a positive market value.

Note that the BIS data do not distinguish branches and subsidiaries. When branches reach considerable size, host country regulators typically require the branch to incorporate as a subsidiary or otherwise submit to local regulation.

Keeping only affiliates for which both home and host countries report prudential data, the sample falls to 276 affiliates, still covering $12 trillion (89%) of cross-border dollar claims.

The main sample includes 328 home-host pairs for 2000 Q1-2017 Q4. One subsamples excludes all affiliates located

in the United States and all US banks’ affiliates worldwide. Another subsample excludes all “home affiliates” – where

the home and host country are the same – to focus on foreign banks outside the United States. We report each

regression with and without the interaction with US monetary policy changes (see Avdjiev et al, 2020).

The decomposition methodology was developed by Amiti and Weinstein (2018).