Abstract

It is interesting to note that some old patterns and regularities in household savings still hold. For instance, there is a rough equivalence between household saving and investment. The private saving rate has remained more or less constant (i.e., the so-called Denison’s law seems to hold), and household consumption continues to depend on the structure of income in a traditional way, which affects the cyclical pattern of the household saving rate. Interestingly, taxes have a very strong negative effect on consumption. Otherwise, household saving remains positively related to income growth, income uncertainty, and the real interest rate.

In the 1950s and 1960s, the assumption of a constant household and/or private saving rate was generally accepted, much like the assumptions of constant income shares (parameters of the production function), the capital-output ratio, the rate of profit on capital, the rate of productivity growth, and so on (see Herrendorf et al. 2019). Later, all these assumptions were challenged, but surprisingly little interest has been shown in investigating how much the constancy assumptions currently deviate from the data. Here, we revisit this issue, focusing only on saving behavior.

Thus, we examine the relationship between household saving and investment and the alleged constancy of the saving rate(s). Regarding the saving rates, we are interested in exploring whether there is some form of substitution effect between different sectoral components, which could offset potential sectoral shocks at the macro level. In our analysis, we focus on the determinants of household saving, paying particular attention to interest rates, income uncertainty, and income growth. We also consider the structure of income, distinguishing between wages, transfer income, taxes, and non-wage (or property) income. We use quarterly Eurostat data from 1999Q1 to 2024Q2, and annual Ameco database series from 1975 to 2023, for 25 EU countries.

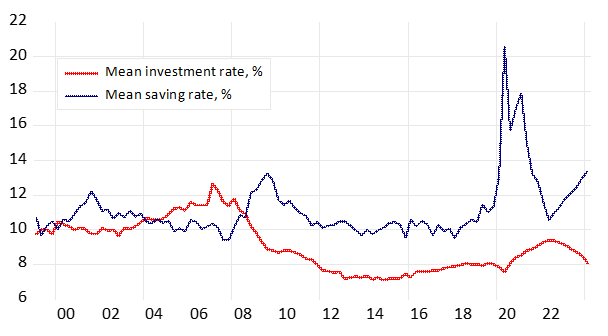

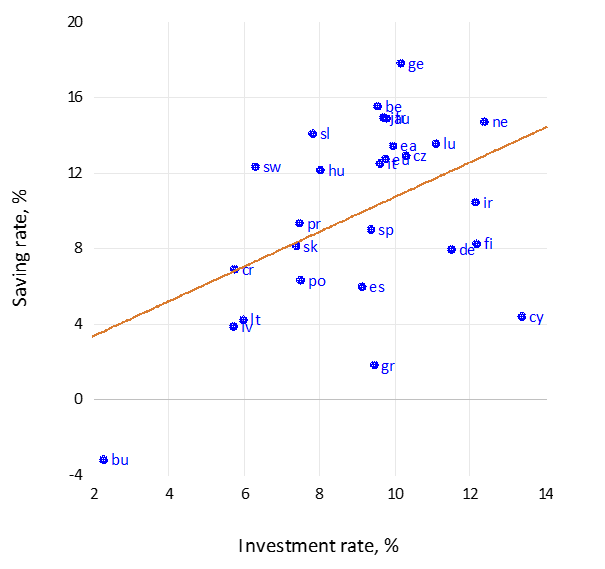

In international economics, there has been considerable debate over the puzzling finding that aggregate saving and investment are often more closely related than expected, given the differences in countries’ investment opportunities (the so-called Horioka puzzle). Obviously, within a single country, there is no reason to expect that saving in sector X should equal investment in the same sector. Regarding the household sector, we find that, on average across EU countries, the difference between the respective rates is not very large, particularly in “normal times,” typically around 1-2 percentage points (Figure 1). However, when we examine individual countries, a completely different picture emerges (Figure 2). In some cases, the saving rate can be almost double the investment rate. For instance, Germany, Greece, and Cyprus illustrate contrasting examples. For a thorough analysis of the reasons behind country-specific differences in saving rates, see e.g. Rocher and Stierle (2015).

Figure 1. Household gross investment and saving rates

Figure 2. Average of household gross saving and investment rates for 1999-2023.

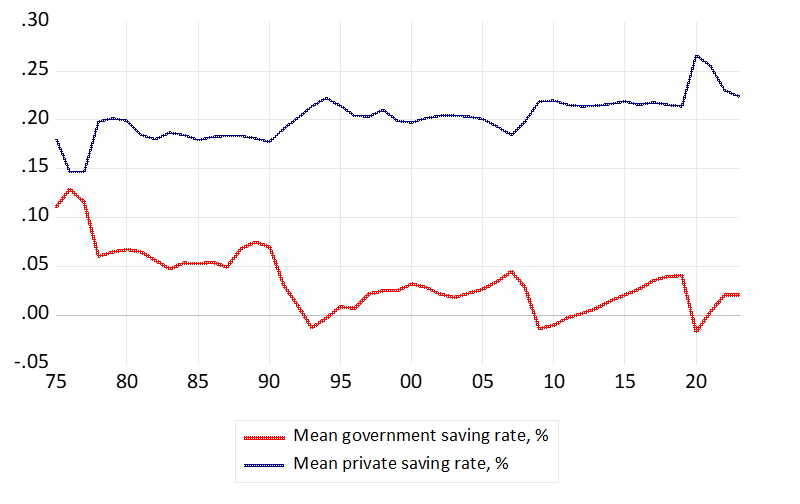

What can we say about changes in saving rates over time? Figure 3 shows that there appears to be a downward trend in the cross-country average of household net saving rates. This may be due to the fact that, over time, capital depreciation consumes a larger share of gross income. It could also be attributed to the changing composition of EU countries following the EU enlargement, particularly in the early 2000s. Interestingly, however, the overall private sector saving rate (household saving plus corporate saving over private sector income) has remained nearly constant since the early 1970s, suggesting some substitution between household and corporate saving.

As for government saving (Figure 4), a similar pattern emerges. While government saving has clearly decreased over time, there is an upward trend in private saving rather than a decline. Of course, short-run developments, such as those in the early 1990s, the 2008-2009 financial crisis, and the COVID-19 pandemic, dominate these two time series, reflecting the impact of uncertainty.

Figure 3. Household and private sector net saving rates

Figure 4. Gross public and private saving in relation gross national disposable income

A closer look at the data reveals that the observed patterns may have sound theoretical explanations. First, they align with the idea that households are rational and recognize that firms’ profits inevitably increase their current wealth, reducing their need for additional saving (see the “ultrarationality hypothesis” of David and Scadding (1974) and some critical comments on measurement issues in Holloway (1989)). The explanation may also be more practical, arising from the difficulty of distinguishing personal and corporate income within small business entities.

Regarding government saving, we must rely on debt neutrality reasoning, where households see through the “government veil” and adjust their consumption in anticipation of future higher taxes. Interestingly, Robert Barro (1988), the “father” of the debt neutrality hypothesis, suggested that a simple test for this hypothesis is to observe whether the aggregate saving rate remains relatively constant when the public saving rate drops or rises.

We can formally test these hypotheses by estimating an equation using time series data from EU countries. With this panel data, we explain the household saving rate using the following variables: household income growth, the real interest rate or the term premium, income uncertainty (measured by the VIX index), the corporate sector saving rate (corporate saving relative to private sector disposable income), and the public sector saving rate.

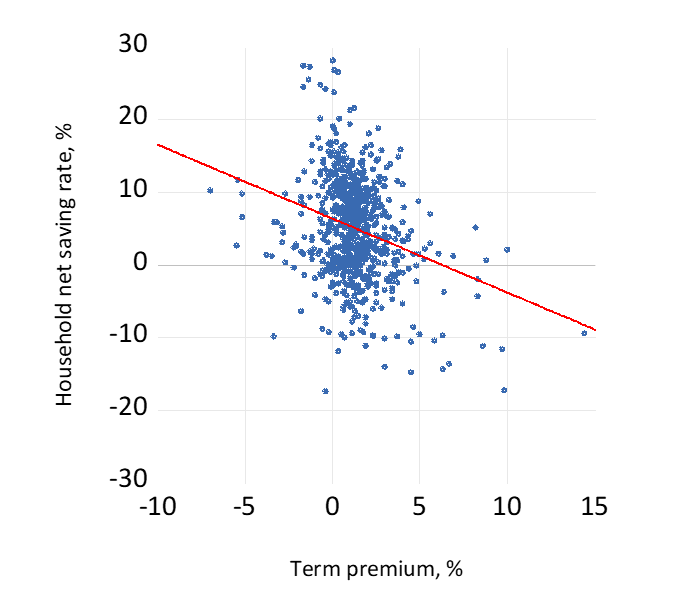

Panel data from 25 EU countries with 626 data points show that all coefficient estimates, though statistically significant, align with theoretical expectations. Income growth increases saving, as do uncertainty (measured by the VIX index) and the real interest rate. When we substitute the term premium for the real interest rate, the effect is clearly negative (Figure 5), but it becomes positive when household consumption is used as the dependent variable. This result can be interpreted through Campbell’s (1987) “saving for a rainy day” concept: when households expect future income growth to accelerate and, therefore, anticipate an increase in real wealth, they reduce saving, and vice versa1.

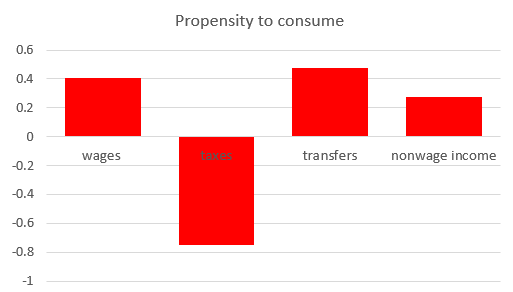

More importantly, both corporate saving and public saving reduce the household saving rate. The opposite result emerges when we reverse the perspective and explain household consumption instead. In this case, we also have the opportunity to split household disposable income into four subcategories: wages, income transfers, taxes, and non-wage income (or simply property income). The outcome of this analysis is shown in (Figure 6), where the respective short-run marginal consumption propensities (derived from the panel data) are presented.

It is no surprise that the marginal propensity to consume out of transfers is the highest, while the propensity for non-wage (or property) income is the lowest (see Koskela and Viren (1986) for similar older evidence). However, somewhat surprisingly, the largest (absolute) value is associated with income taxes (or all transfers to the general government). This result has strong implications for the effectiveness of fiscal policy. Lowering taxes could be more effective than increasing income transfers, and conversely, raising taxes might not be the best approach to balancing budget deficits.

Figure 5. Household saving rate and the term premium

Figure 6. Different short-run propensities to consume

The respective long-run parameter values can be obtained by multiplying the values presented above by 1.8.

Household saving in Europe is relatively low, particularly when focusing on net saving and its negative trend due to increased depreciation. Fortunately, these same tendencies are not evident in corporate saving, which helps ensure that overall private sector saving can offset the continuously deteriorating public sector saving. It is important to note that the growth of the public sector affects household saving in several ways beyond the substitution effects we have considered. Government transfers and taxes appear to have a significant impact on consumption, and consequently on saving, in a way that is often overlooked.

Barro, R. (1988) The Ricardian approach to public deficits. NBER Working Paper 2685.

Campbell, J. (1987) Does saving anticipate declining labor income? An alternative test of the permanent income hypothesis, Econometrica 55, 1249- 1273.

David, P and Scadding, J. (1974) Private savings, Ultrarationality, and the Denison’s Law. Aggregation and Journal of Political Economy 82, 225-249.

Herrendorf, B., R. Rogerson and Á. Valentinyi (2019) Growth and the Kaldor Facts. Federal Reserve Bank of St. Louis Review, Fourth Quarter 2019, 101(4), 259-76.

Holloway, T. (1989) Present NIPA Saving Measures: Their Characteristics and Limitations. NBER Working Paper 8117.

Koskela, E. and M. Viren (1986) Testing the direct substitutability hypotheses of saving, Applied Economics 18, 143-155,

Rocher, S. and M. Stierle (2015) Household saving rates in the EU: Why do they differ so much? European Economy Discussion Paper 005.

Our data allow us to estimate the aggregate elasticity of substitution for the panel of countries. The result was clear: the value was significantly below one, with a parameter value of 0.90.