The behaviour of household saving and its relationship to fiscal policy has gained renewed interest at the onset of the COVID-19 crisis. In view of the strong calls for continuous fiscal support to macroeconomic stabilization, we explore the relationship between fiscal policy and household savings in the euro area within a thick modelling approach, which allows a vast number of model specifications in a dynamic panel setting. For euro area countries over the period 1999 – 2019, we find that, on average, fiscal expansions are associated with an increase in household saving rate in the euro area, which supports a partial, but not full, Ricardian equivalence channel. The relationship holds regardless of how we measure the (discretionary) fiscal policy impulse. The median saving offset across all baseline specifications is around 19% in the short run and 41% in the long run.

The behaviour of household saving and its relationship to fiscal policy has gained renewed interest at the onset of the COVID-19 crisis. In the euro area, the household saving ratio surged in the second quarter (Q2) of 2020 and again in Q1 2021 on account of both forced and precautionary reasons (see ECB 2021). The lock-down restrictions and the extreme rise in economic uncertainty are cited among the most important driving factors. The developments in fiscal policy are also linked to the increase in the household saving ratio as a high proportion of the additional income from government transfers has been saved instead of being directed to consumption. Fiscal policy, through massive net fiscal transfers to households and firms, has supported household disposable income, which has fallen less than output. At the same time, fiscal positions in the euro area countries deteriorated significantly at the onset of the Covid-crisis on account of the large stimulus measures and the worsening of macroeconomic conditions. Overall, the extraordinary stimulus measures over 2020-21, and their partial assumed unwinding as of 2022, are projected to go along with an increase, followed by a decrease, in the household saving ratio. As pointed out in ECB (2021), some of the increase in the saving rate associated with precautionary motives may be harder to reverse due to expectations of households that the strongly increased public debt burden due to the pandemic might need to be addressed via higher taxes in the future.

The recent outburst of the war in Ukraine is likely, on one hand, to increase again precautionary saving on account of the increased uncertainty and, on the other hand, to lower saving as households use them to support consumption in the face of the energy shock.2 A further deterioration in budgetary positions may also add to households building precautionary saving.

In view of the calls for fiscal support to macroeconomic stabilization, especially at the onset of the Covid-19 crisis, in our paper (Checherita-Westphal and Stechert, 2021) we seek to explore the relationship between fiscal policy and household savings in the euro area. Our paper tests the robustness of fiscal policy variables in explaining the household saving ratio by employing a thick modelling framework that allows a vast number of model specifications and controls for other relevant factors identified in the literature. In doing so, we seek to identify the most robust fiscal policy variables – if any – in explaining the household saving ratio (defined as the gross household saving as percent of gross disposable income) from both a statistical and economic perspective. To capture relevant developments, we employ standard dynamic panel estimation techniques in an annual dataset over the period 1999 – 2019 for the current euro area members.

In order to capture model uncertainty, we propose a simple thick modelling approach (Granger and Jeon, 2004) in the spirit of Ca’Zorzi et al. (2012) and De Bondt et al. (2020, 2019). This empirical method allows estimating a broad range of model specifications in a dynamic panel setting rather than relying on a single best one. For each candidate proxy of fiscal policy, we consider a limited but unique set of permutations of fourteen prior identified control variables commonly studied in the literature. Thus, we draw inference about the empirical relationship between euro area fiscal policy and the household saving ratio by utilizing thousands of fiscal elasticities conditional on various alternative fiscal-macro combinations.

Our paper fits broadly into the empirical literature testing the partial Ricardian equivalence. In this vein, an expansionary fiscal policy is generally found to be associated with a higher household (private) saving rate. This partial private saving “offset” of fiscal stimulus measures is interpreted as weak evidence of the disputed Ricardian equivalence3, according to which households fully save the additional disposable income as a result of fiscal stimulus measures in expectations of higher taxes in the future.

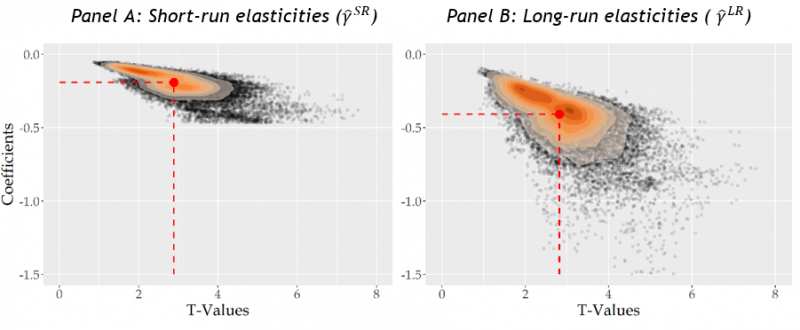

In our empirical analysis, we find evidence for a partial household saving offset of fiscal stimulus, with a median value of 19% in the short run and 41% in the long run (see Figure 1). While the magnitude of the effects varies depending on the specific fiscal policy proxy at hand, this partial offset is regardless of how we measure (discretionary) fiscal policy. Overall, we do not find empirical evidence for the existence of a strict version of the Ricardian equivalence in the euro area, i.e. a full saving offset of fiscal stimulus in the short run. Although some fiscal-macro combinations in our thick modelling approach do not rule out full saving offsets in the long-run, most of our fiscal elasticities are located well below unity. This supports the idea of learning about the relationship between fiscal policy and household saving by using many different model specifications. Our results for the euro area are broadly in line with the literature, albeit they tend to yield a somewhat weaker evidence for the saving offset of fiscal policy, particularly in relation to earlier studies or as regards the total private saving offset. This may point to an increased effectiveness of fiscal policy for short-run stabilization.

In more detail, Figure 1 presents a scatter plot of the estimated coefficients across all four baseline candidate measures for (discretionary) fiscal policy, i.e. budget balance, primary balance, cyclically adjusted primary balance and structural balance. All fiscal items, but especially cyclically adjusted or structural balances, are important indicators to gauge changes in fiscal positions. To this end, Figure 1 summarizes 23,308 trimmed models. Across all baseline fiscal variables, the estimated range of short- and long-run fiscal multipliers with respect to household saving shows that most of the elasticities are located well below zero.

Short-run elasticities are bounded between -0.09 and -0.36 (90% range) conditional on the specific fiscal-macro combination. This reflects our model uncertainty only, but points to the fact of substantial heterogeneity across different model specifications. The median short-run fiscal elasticity is around -0.19. In addition, most of the models yield fiscal elasticities with t-values greater than two, which underpins the statistical importance of fiscal items. Hence, combining information from all ‘thin’ models indicates a short-run effect of fiscal policy onto household savings, i.e. fiscal expansions in the euro area lead to an increase in the gross household saving ratio regardless of how we measure fiscal policy. This reduced-form evidence is in line with the existence of a (partial) Ricardian equivalence channel or a partial saving offset of fiscal stimulus.

The distribution of the model-implied long-run fiscal elasticities is more dispersed. The median across all models is around -0.41 (90% range between -0.21 and -0.76). Again, most of the coefficients have t-values greater than two, which indicates a high degree of statistical significance for most of the models. We document coefficient clusters at -0.24 and -0.36.

Figure 1: Distribution of fiscal elasticites and t-values across all models

Source: Authors’ calculations. Notes: This figure plots estimated coefficients (y-axis) against their corresponding t-values (x-axis), as well as their joint normalized bivariate kernel density using a Gaussian kernel and a rule-of-thumb selected bandwith parameter. All models estimated with Arellano-Bond GMM. The dependent variable is gross household saving as a percentage of disposable income. Fiscal variables (budget balance, primary balance, cyclically-adjusted primary balance and structural balance, all measured in percent of GDP) introduced one at the time in each model and treated as endogenenous. Panel A refers to estimated short run fiscal policy coefficients and corresponding t-values. Panel B plots model-implied long run fiscal policy coefficients and t-values. The number of trimmed models is 23,308 (untrimmed 25,900, τ = 0.1), i.e. 5,827 models for each fiscal variable. Red dashed lines refer to the medians.

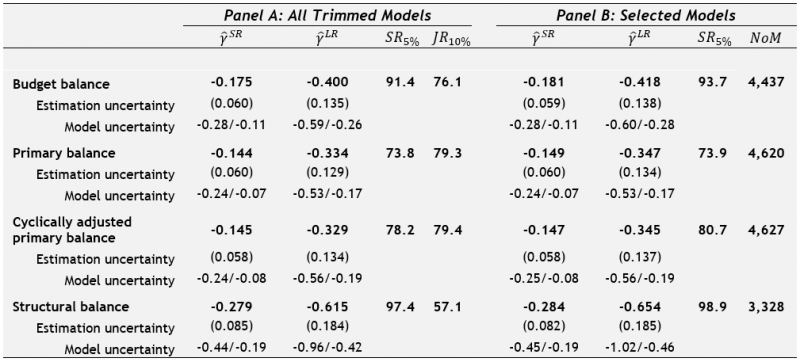

Next, we disentangle the pooled distribution into contributions from individual fiscal variables (see Table 1). For the most broadly defined fiscal policy proxy, the headline budget balance (which captures the total fiscal impulse, including automatic stabilizers), the median short-run elasticity is around -0.18 in the selected models, while the long-run effect is larger at -0.42. Selected models are required to jointly pass three common statistical model misspecification tests for dynamic panel data models. Excluding interest payments, that is, looking at the primary balance, we find similar yet slightly smaller results. The median short (long) run elasticity is around -0.15 (-0.35) in the selected models. Interestingly, when looking at the proxies for discretionary fiscal policy, we get similar estimates for the cyclically-adjusted primary balance (-0.15 and -0.35), but find larger effects when turning to the structural balance, which in addition to the business cycle also account for temporary one-offs (-0.28 and -0.65). This may imply that a permanent stimulus affects household decisions more than a temporary one.

These results are broadly in line with previous studies, which typically report empirical evidence for partial budget neutralisation, but fail to report evidence for full saving offsets. In addition, for our baseline we find that disposable income, real short-term interest rate, GDP deflator and household debt turn out to be the most robust determinants for household saving.4 For disposable income growth we find positive coefficients, which are relatively close across models with different fiscal policy proxies. An increase in household disposable income growth by 1 percentage point (pp) raises the household saving ratio by around 0.36 to 0.40 pp. We also find a positive effect for the short-term interest rate, indicating that the saving ratio tends to rise when the real interest rate increases, with a median coefficient of around 0.12 to 0.14 pp. When looking at inflation measured by the GDP deflator, we find that an increase in inflation is associated with lower household saving in the euro area, with a median coefficient across models of around -0.16 to -0.18. Finally, a higher household debt ratio is found to be associated with a lower household saving ratio, with a median coefficient at about -0.05 to -0.06, possibly reflecting a (lower) income effect and/or lower liquidity constraints.

Table 1: Median fiscal elasticities

Source: Authors’ calculations. Notes: The table presents the medians of estimated fiscal elasticities (short-/long-run: ![]() ) and their robust standard errors in parentheses from the trimmed coefficient distributions (fiscal balances measured as percent of GDP). The trimmed distribution results from discarding five percent at each tail of the estimated coefficient distribution. Standard errors for the model-implied long-run coefficients were computed using the Delta-method. Model uncertainty refers to 5th and 95th quantile of the estimated coefficient distribution. The dependent variable is gross household saving as a percentage of disposable income. Fiscal variables were treated as endogenous. Panel A refers to all estimated trimmed model specifications (5,827 models for each fiscal measure). Panel B discards statistically mis-specified models. It selects only those models which jointly pass both Arellano-Bond autocorrelation tests (i.e. existence of first- but no second-order autocorrelation of residuals in first differences) as well as models passing the Sargan test for overidentifying restrictions (H0: Instruments as a group are exogenous). SR5% refers to the significance ratio, i.e. the share of significant short run fiscal policy coefficients (with p-value lower than 5%). JR10% refers to the ratio of models with (i) Arellano-Bond first-, (ii) but no second-order residual autocorrelation (both at 10% p-values) as well as (iii) Sargan overidentifying test p-values greater than 10%. NoM refers to the number of models remaining after model selection. The number of total observations, across both N and T, in our regressions using an unbalanced panel varies between 292 and 358 depending on data availability.

) and their robust standard errors in parentheses from the trimmed coefficient distributions (fiscal balances measured as percent of GDP). The trimmed distribution results from discarding five percent at each tail of the estimated coefficient distribution. Standard errors for the model-implied long-run coefficients were computed using the Delta-method. Model uncertainty refers to 5th and 95th quantile of the estimated coefficient distribution. The dependent variable is gross household saving as a percentage of disposable income. Fiscal variables were treated as endogenous. Panel A refers to all estimated trimmed model specifications (5,827 models for each fiscal measure). Panel B discards statistically mis-specified models. It selects only those models which jointly pass both Arellano-Bond autocorrelation tests (i.e. existence of first- but no second-order autocorrelation of residuals in first differences) as well as models passing the Sargan test for overidentifying restrictions (H0: Instruments as a group are exogenous). SR5% refers to the significance ratio, i.e. the share of significant short run fiscal policy coefficients (with p-value lower than 5%). JR10% refers to the ratio of models with (i) Arellano-Bond first-, (ii) but no second-order residual autocorrelation (both at 10% p-values) as well as (iii) Sargan overidentifying test p-values greater than 10%. NoM refers to the number of models remaining after model selection. The number of total observations, across both N and T, in our regressions using an unbalanced panel varies between 292 and 358 depending on data availability.

In our empirical analysis, we analyze the effect of fiscal policy on household saving in the euro area, i.e. testing for Ricardian equivalence, based on a thick modelling approach. We consider multiple dynamic panel data models rather than relying only on a few possible candidate models, as typically done in the literature. This allows dealing with model and estimation uncertainty, while at the same time being agnostic about both the specific fiscal policy proxy at hand as well as the set of macro fundamentals, financial, demographic and other variables employed as controls.

Our main results can be summarized as follows. First, we find empirical evidence for a partial household saving offset of fiscal stimulus, with a median value of 19% in the short run and 41% in the long run. While the magnitude of the effects varies depending on the specific fiscal policy proxy at hand, this partial offset is regardless of how we measure fiscal policy. Overall, we do not find empirical evidence for the existence of a strict version of the Ricardian equivalence in the euro area, i.e. a full saving offset of fiscal stimulus in the short run.

Second, in terms of additional results and robustness checks, we find the following. Disposable income, real short-term interest rate, GDP deflator and household debt turn in our thick-modelling approach to be the most robust variables among a larger set of potential determinants for the household saving ratio identified in the literature. Various robustness checks – in terms of alternative data, fiscal indicators and estimators – broadly support our results with respect to household savings. On the other hand, the evidence for the relationship between fiscal policy and total private saving is weak and not robust enough in our model.

Third, our results for the euro area are broadly in line with the literature for the advanced economies, albeit they tend to yield a somewhat weaker evidence for the saving offset of fiscal policy, particularly in relation to earlier studies or as regards the total private saving offset. This may point to an increased effectiveness of fiscal policy for short-run stabilization, yet witout changing the typical conclusions that this relationship has limits. It particular, it may hold as long as public sustainability is not called into question.

Overall, based on our analysis, a deterioration in fiscal positions in the euro area is likely to contribute to an increase in the household saving rate.

Barro, Robert J. (1974). Are government bonds net wealth?. Journal of Political Economy, 82, p. 1095-1117.

Barro, Robert J. (1989). The Ricardian approach to budget deficits. Journal of Economic Perspectives, 3(2), p. 37–54.

Ca’Zorzi, Michele, Alexander Chudik, and Alistair Dieppe (2012). Thousands of models, one story: current account imbalances in the global economy. Journal of International Money and Finance, 31(6), p. 1319-1338.

Checherita-Westphal, Cristina and Marcel Stechert (2021). Household saving and fiscal policy: Evidence for the euro area from a thick modelling perspective. ECB Working Paper, No. 2633.

de Bondt, Gabe Jacob, Arne Gieseck, and Zivile Zekaite (2020). Thick modelling income and wealth effects: a forecast application to euro area private consumption. Empirical Economics, 58(1), p. 257-286.

de Bondt, Gabe Jacob, Arne Gieseck, Pablo Herrero, and Zivile Zekaite (2019). Disaggregate income and wealth effects in the largest euro area countries. ECB Working Paper, No. 2343.

ECB (2021). June 2021 ESCB staff macroeconomic projection exercise.

ECB (2022). March 2022 ECB staff macroeconomic projection exercise.

Granger, Clive and Yongil Jeon (2004). Thick modelling. Economic Modelling, 21(2), p. 323-343.

Oinonen, Sami and Matti Viren (2022). Why do households save?. SUERF Policy Brief, No. 257, January 2022.

Röhn, Oliver (2010). New evidence on the private saving offset and Ricardian equivalence. OECD Working Paper, No. 762.

According to the ECB staff macroeconomic projections (ECB 2022), where the baseline includes an initial, preliminary assessment of the impact of the war on the euro area economy based on the information available up to 2 March 2022, the increase in precautionary savings stemming from Ukraine war-related uncertainty is more than offset by households’ use of savings to cushion, at least partially, the negative effects of the energy shock on real consumption growth.

See Barro (1974, 1989) and an overview of the literature in Röhn (2010). According to Barro (1989, p. 39), the term “Ricardian equivalence” denotes the fact that budget deficits and taxation have equivalent effects on the economy (the substitution of a budget deficit for current taxes has no impact on aggregate demand). In other words, a decrease in the government’s saving (that is, a current budget deficit) leads to a fully offsetting increase in (desired) private saving. Since national saving does not change, the real interest rate does not have to rise in a closed economy to maintain the balance between desired national saving and investment demand, with no subsequent effect on investment and no burden of public debt. Barro (1989) also discusses five major theoretical objections that have been raised against the “full” Ricardian equivalence, namely, the assumptions of: (i) infinitely-lived agents; (ii) perfect capital markets; (iii) no uncertainty (surrounding future taxes and income); (iv) lump-sum taxes and (v) full employment. He concludes, however, that these assumptions apply also to other models, especially the standard view of fiscal policy, according to which budget deficits lead to an expansion of aggregate demand (or partial private saving offset). Finally, he quotes several empirical studies (natural experiments for a single country or two-country comparisons) that found a full (one-to-one) private saving offset of a budget deficit expansion, while at the same time calling for more analysis, especially in an international context.

These results are broadly in line with the findings in Oinonen and Matti (2022). Their basic model considers three main variables: household indebtedness, income growth and inflation, in a static or dynamic panel covering 34 countries over 1970-2019. As in our analysis, they find that the household saving rate depends positively on disposable income growth, real interest rate – and contrary to our results (where we find a negative effect) on inflation. The authors also control for other relevant variables and – in line with our results – they find that the “public sector surplus always decreases household saving”.