Disclaimer: The views expressed in this Policy Brief represent only our own and should therefore not be reported as representing the views of the International Monetary Fund, its Executive Board, IMF management, the European Stability Mechanism, or the European Commission.

The large fall in house prices and economic activity in the United States during the Global Financial Crisis (GFC) highlights that housing boom-bust cycles can have serious consequences. Regional housing markets and economies, however, react differently to demand shocks. We study the role of housing supply for the regional transmission of monetary policy. Following interest rate increases, economic activity falls more strongly, and financial stability risks increase more sharply in states with more constrained housing supply. This calls for strengthening supervision and possibly relaxing land-use regulation, especially in inelastic areas.

Housing plays a central role for macroeconomic fluctuations globally. Real estate is the main asset for most households, and housing consumption accounts for a large share of private consumption in many countries. In addition, housing is highly sensitive to interest rate changes (Iacoviello, 2005). The sensitivity of the housing market to monetary policy, however, varies considerably not only across, but also within countries, reflecting differences in housing market attributes (Ferreira and Gyourko, 2012; Piazzesi and Schneider, 2016). In particular, tighter constraints on house building, most prominently land-use regulation and geographical restrictions, typically make house prices more responsive to monetary policy (Fischer et al., 2021; Aastveit and Anundsen, 2022; Cooper et al., 2022; Aastveit et al., 2023). Moreover, the responsiveness of house prices seems to have increased over time as housing supply elasticities in the US have declined (Herkenhoff et al., 2018; Albuquerque et al., 2020; Aastveit et al., 2023). This underscores the prominent role of housing supply in the transmission of monetary policy, which remains understudied.

In a recent paper (Albuquerque et al., 2024), we find that the regional heterogeneity in the transmission of contractionary monetary policy shocks can be partly accounted for by differences in housing supply constraints. Specifically, we document that US states in which housing supply is more constrained due to land-use regulation—supply elasticities are low—record a larger fall in house prices and economic activity. This also gives rise to more severe financial stability risks in these areas, with mortgage delinquencies and foreclosures rising considerably, ultimately spilling over to the banking sector. These findings highlight the importance of considering regional housing supply conditions when assessing the macrofinancial effects of rising interest rates.

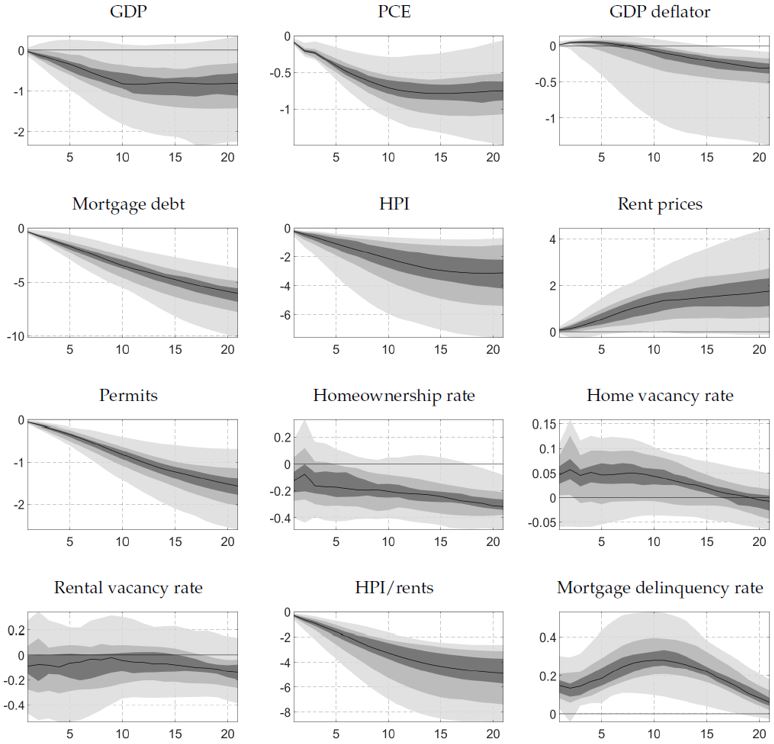

Our analysis relies on a factor-augmented VAR model (Bernanke et al., 2005), using a large quarterly dataset for the 50 US states over 1999q1–2019q4. We include state-level variables on the real economy, labor market, financial sector, public finances, and the housing market. The housing block is particularly rich, capturing information on prices and supply in both the owner-occupied and rental market segments. We identify monetary policy shocks from high-frequency financial market data, by extracting the unexpected changes in the Fed policy rate around FOMC announcements (Gürkaynak et al., 2005; Gertler and Karadi, 2015). As a first step, Figure 1 summarizes the posterior median responses of all US states to a contractionary monetary policy shock. The transmission of monetary policy is highly heterogenous across US states. Economic activity, house prices, housing supply, and the homeownership rate seem to fall in almost all states, but the magnitude of these declines varies widely.

Another finding relates to rent prices, which increase over the horizon, contrasting with the dynamics of house prices. This result suggests that housing demand shifts from the owner-occupied segment to the rental market as the cost of homeownership goes up following a contractionary monetary policy shock. The ability of monetary policy to influence the housing tenure decisions of households is in line with recent research for the US aggregate and for selected European countries (Dias and Duarte, 2019; Koeniger et al., 2022). Our contribution is to show that despite the synchronized fall in house prices and the increase in rent prices across states, monetary policy seems to exert a differential impact on households’ housing tenure decisions across states. For instance, the homeownership rate declines only marginally for some states, while falling more markedly for others. Moreover, housing market differences across states can also be seen in the responses of housing supply: home (rental) vacancy rates decrease (increase) for some states, which contrasts with the median state response. This is consistent with the reallocation of demand from the owner-occupied to the rental market evolving at a different pace across states.

Figure 1: Large heterogeneity in the state-level responses to a monetary policy shock

Notes: Distribution of the median (cumulative) IRFs across US states after a monetary policy tightening that increases the one-year treasury rate by 25bps. The black line is the median response of all state-level (median) responses. The grey areas include 30% (35–65 percentile), 60% (20–80 percentile) and 90% (5–95 percentile) of the median responses, respectively, going from dark to lighter grey.

A growing strand of the literature has focused on the relationship between monetary policy, housing supply constraints/elasticities and house prices (Gyourko et al., 2008; Saiz, 2010; Albuquerque et al., 2020; Fischer et al., 2021; Aastveit and Anundsen, 2022; Aastveit et al., 2023). This literature finds that house prices are more responsive to demand in areas with tighter land-use regulation and geographical restrictions. Our analysis goes one step further by assessing the wider macrofinancial implications of monetary policy conditional on regional differences in housing supply. Understanding these implications is particularly relevant in the current environment of higher interest rates.

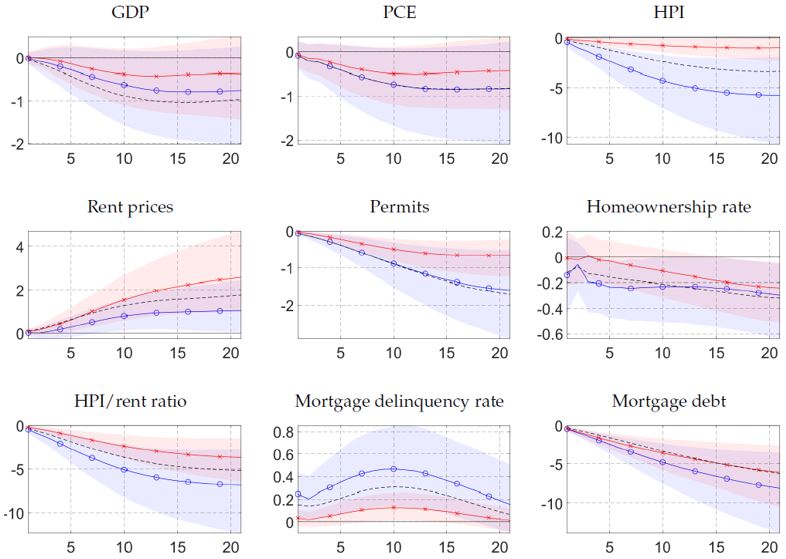

To measure the degree of housing supply constraints across states, we use the land-use restriction index (LRI) constructed by Herkenhoff et al. (2018). To compare inelastic versus elastic states, we group them according to their LRI value in 2014: Figure 2 presents the posterior distributions of the average responses both for states belonging to the highest and the lowest decile of the LRI. We find that differences in housing supply restrictions play an important role in the transmission of monetary policy: states with tighter land-use regulation (blues lines) experience a larger decline in house prices and permits after a contractionary monetary policy shock compared to states with less stringent regulation (red lines). The resulting larger decline in housing wealth for households in inelastic states seems to lead to a greater fall in economic activity (GDP and consumption).

Figure 2: Housing markets and economic activity tend to react stronger to monetary policy shocks in US states with more constrained housing supply

Notes: Posterior distributions of the average (cumulative) IRFs across US states after a monetary policy tightening that increases the one-year treasury rate by 25bps. The blue (red) line with circles (crosses) indicates the median (over all MCMC draws) of the average responses of the states belonging to the top (bottom) decile of the land-use restriction index (Herkenhoff et al. 2018). Shaded areas reflect the 68% HDI. The dashed black line is the median of the average IRFs across all the other states.

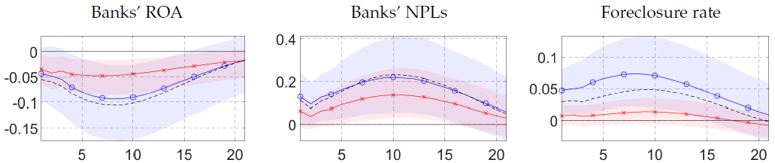

In addition, financial stability risks seem to increase by more in inelastic states: mortgage debt falls more strongly, mortgage delinquencies and foreclosures rise more sharply, and indicators proxying the health of the banking sector deteriorate more considerably (Figure 3). While our model does not allow for a general equilibrium analysis of possible channels, our results align well with the notion that financial feedback loops are key in explaining why house prices decline more in inelastic states. Areas with more inelastic housing supply tend to be more prone to boom-bust cycles in housing and credit (Huang and Tang, 2012; Anundsen and Heebøll, 2016). For instance, the stronger increase in foreclosures in inelastic states following the contractionary monetary policy shock may matter: foreclosures increase the stock of housing available for sale, further depressing prices, akin to a price-foreclosure spiral observed in more inelastic areas during the GFC (Chodorow-Reich et al., 2024).

Our main result—states with more constrained housing supply are hit harder by contractionary monetary policy shocks—does not necessarily imply that housing supply constraints are the only determinant of heterogeneity in the responses. Other characteristics, such as state-level differences in the industry composition, demography, income levels, and in the quality of institutions, may also matter. While it is arguably challenging to establish causality, our paper contains additional evidence that housing supply restrictions remain relevant for explaining the regional heterogeneity in the transmission of monetary policy, even when controlling for several other state-specific characteristics.

Figure 3: The banking sector is affected stronger by monetary policy shocks in US states with more constrained housing supply

Notes: See Figure 2.

We have shown that low housing supply elasticity areas, where land-use regulation is more stringent, record a larger fall in house prices and in economic activity after a contractionary monetary policy shock. They may also be exposed to greater financial stability risks. These effects could be related to the presence of financial-accelerator effects, and excessive borrowing, which amplify negative macrofinancial effects in areas with more inelastic housing supply. We argue that there is a case for strengthening macroprudential measures aimed at taming borrowing, such as limits on loan-to-income or/and debt-service ratios before debt imbalances start to emerge. Moreover, the relaxation of land-use restrictions should make an area less prone to boom-bust cycles in house prices as builders are less constrained to expand supply during an expansion. Smoothing the housing cycle during an expansion should help increase resilience to contractionary demand shocks.

Aastveit, K. A., Albuquerque, B. and Anundsen, A. (2023), “Changing Supply Elasticities and Regional Housing Booms”, Journal of Money, Credit, and Banking 55(7): 1749–1783.

Aastveit, K. A. and Anundsen, A. (2022), “Asymmetric Effects of Monetary Policy in Regional Housing Markets”, American Economic Journal: Macroeconomics 14(4): 499–529.

Albuquerque, B., Iseringhausen, M. and Opitz, F. (2020), “Monetary policy and US housing expansions: The case of time-varying supply elasticities”, Economics Letters 195, 109471.

Albuquerque, B., Iseringhausen, M. and Opitz, F. (2024), “The Housing Supply Channel of Monetary Policy”, ESM Working Papers, No. 59, European Stability Mechanism.

Anundsen, A. K. and Heebøll, C. (2016), “Supply restrictions, subprime lending and regional US house prices”, Journal of Housing Economics 31(C): 54–72.

Chodorow-Reich, G., Guren, A. M. and McQuade, T. J. (2024), “The 2000s Housing Cycle with 2020 Hindsight: A Neo-Kindlebergerian View”, The Review of Economic Studies, forthcoming.

Cooper, D. H., Luengo-Prado, M. J. and Olivei, G. P. (2022), “Monetary policy and regional house-price appreciation”, International Journal of Central Banking 18(3): 173–227.

Dias, D. A. and Duarte, J. B. (2019), “Monetary policy, housing rents, and inflation dynamics”, Journal of Applied Econometrics 34(5): 673–687.

Ferreira, F. and Gyourko, J. (2012), “Heterogeneity in Neighborhood-Level Price Growth in the United States, 1993-2009”, American Economic Review 102(3): 134–140.

Fischer, M. M., Huber, F., Pfarrhofer, M. and Staufer-Steinnocher, P. (2021), “The Dynamic Impact of Monetary Policy on Regional Housing Prices in the United States”, Real Estate Economics 49(4): 1039–1068.

Gertler, M. and Karadi, P. (2015), “Monetary Policy Surprises, Credit Costs, and Economic Activity”, American Economic Journal: Macroeconomics 7(1), 44–76.

Gürkaynak, R. S., Sack, B. and Swanson, E. (2005), “Do Actions Speak Louder Than Words? The Response of Asset Prices to Monetary Policy Actions and Statements”, International Journal of Central Banking 1(1), 55–93.

Gyourko, J., A. Saiz and A. Summers (2008), “A New Measure of the Local Regulatory Environment for Housing Markets: The Wharton Residential Land Use Regulatory Index”, Urban Studies 45(3): 693–729.

Herkenhoff, K. F., L. E. Ohanian and E. C. Prescott (2018), “Tarnishing the Golden and Empire States: Land-Use Restrictions and the U.S. Economic Slowdown”, Journal of Monetary Economics 93: 89–109.

Huang, H. and Tang, Y. (2012), “Residential land use regulation and the US housing price cycle between 2000 and 2009”, Journal of Urban Economics 71(1): 93–99.

Iacoviello, M. (2005), “House prices, borrowing constraints, and monetary policy in the business cycle”, American Economic Review 95(3): 739–764.

Koeniger, W., Lennartz, B. and Ramelet, M.-A. (2022), “On the transmission of monetary policy to the housing market”, European Economic Review 145, 104107.

Piazzesi, M. and M. Schneider (2016), Housing and Macroeconomics, Vol. 2 of Handbook of Macroeconomics, Elsevier, 1547–1640.

Saiz, A. (2010), “The Geographic Determinants of Housing Supply”, The Quarterly Journal of Economics 125(3): 1253–1296.