Abstract

Latin America and the Caribbean (LAC) countries are significantly exposed to climate risks and will require significant investments in adaptation and mitigation. Public development banks (PDBs) have a more prominent role in LAC than in other regions and will therefore play a key role in supporting both public and private green investments. The European Investment Bank (EIB) and the Association of Public Development Banks of Latin America and the Caribbean (ALIDE), assessed how public development banks are contributing to supporting the climate transition in Latin America and the Caribbean, what is holding them back from further scaling up green finance, and concrete policy recommendations. The analysis includes information from a survey on 28 PDBs from 15 LAC countries, representing close to 50% of total assets of PDBs in the region. The sample has a mixture of development banks at the national and regional levels. In this article, we share some key insights from the report.

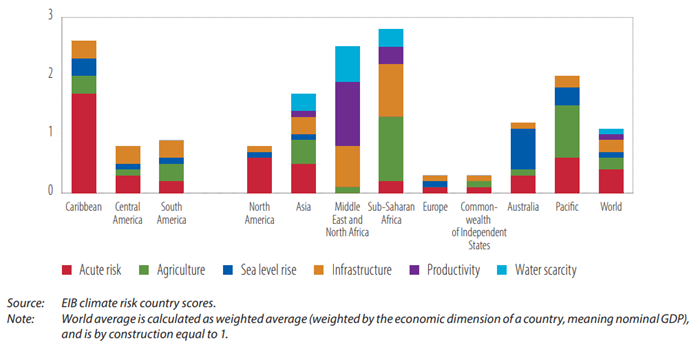

Latin America and the Caribbean (LAC) countries are disproportionately exposed to climate risks despite their low contribution to global CO2 emissions. Several countries in the region, mainly in the Caribbean, have some of the largest exposures to physical risks (Figure 1), despite the region’s total contribution to global CO2 emissions reaching only 5% (0.2% for the Caribbean). Acute risks, related to the damage associated with climate events ranging from wildfires to floods, droughts and cyclones, are particularly significant for the Caribbean and small island states more generally.

Figure 1. Economic impact of physical risk in the world, by component (world average=1)1

Against the backdrop of mounting climate risks and limited fiscal space, reaching the regions’ climate mitigation and adaptation goals will require sizeable investments, ranging between 1.9% and 4.9% of the region’s GDP per year ($110-290 billion). According to the Economic Commission for Latin America and the Caribbean. According to ECLAC, the cost of inaction against climate change could imply a decline in per capita GDP ranging from 0.8% to 6.3% by 2030. ECLAC also predicts that fulfilling climate change commitments will require a sizeable annual investment, estimated between 3.7% and 4.9% ($ 290m) of the region’s GDP until 2030. Estimates by the IMF are smaller (USD 110 bn), but still place investment needs at 1.9% of the regional GDP per year. More than 60% of these needs are related to mitigation of physical risks, but investment needs for adaptation are also significant. And what is more, these high financing needs are set against a challenging macroeconomic and fiscal backdrop. LAC countries are currently facing a combination of low growth and investment and limited fiscal capacity, raising the question of who can finance the climate transition.

With proprietary climate risk scores data on and a new survey of public development banks (PDBs) in the LAC region, a joint EIB/ALIDE report assesses how public development banks are contributing to supporting the climate transition in LAC, what is holding them back from further scaling up green finance, while also formulating concrete policy recommendations. The survey was run between January and February 2024 and included 28 PDBs from 15 LAC countries, representing close to 50% of the total assets of PDBs in the region. The sample has a mix of PDBs at the national and regional levels with a wide range of mandates (SMEs, infrastructure, agriculture, etc.).2

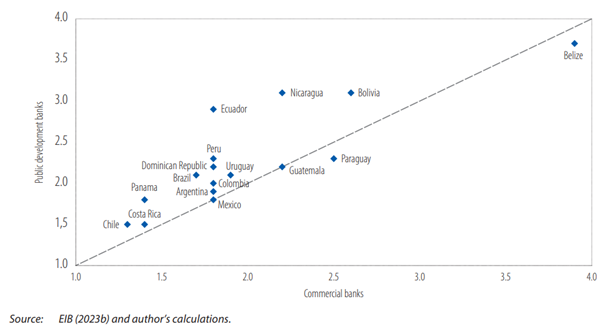

PDBs play an increasingly relevant role in leveraging public resources to address market failures and direct financial flows towards long-term sustainable investments. They play a particularly salient role in the LAC region, where they represent a much higher share of the total credit in the region – close to 50%, compared with 25% for the world. Against the background of extensive climate financing needs, limited climate flows to the region and equally limited fiscal space on the sovereigns’ side, PDBs are key in financing the green transition. These banks provide capacity-building, affordable financing and innovative financing tools. Our study shows that PBDs already lend more to the sectors of economic activity most exposed to physical risks compared to commercial banks (Figure 2) while also taking more transition risk.3

Figure 2. Public development banks’ and commercial banks’ exposure to physical risk

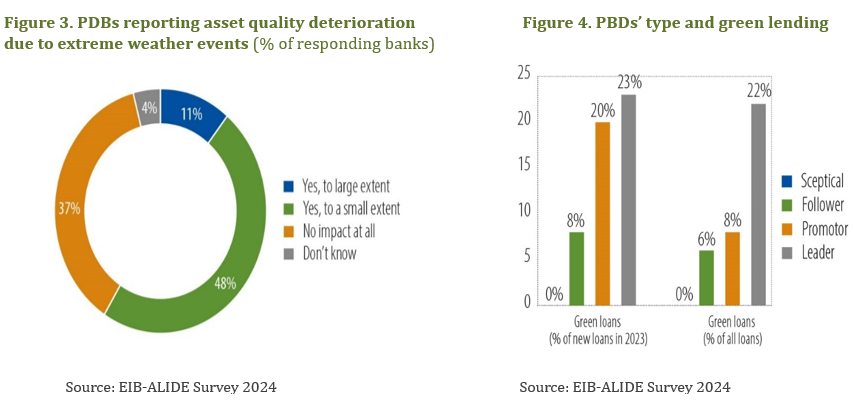

Much in line with the climate risks observed at the country level, PDBs have already experienced the damaging impacts of extreme weather events. In our survey, 40% of responding PDBs say they have experienced damage to their branches and headquarters in extreme weather events in 2023. For 59% of public development banks weather events contributed to a deterioration of the quality of their loan portfolio in the same year (Figure 3) and around 46% identify micro, small and medium-sized enterprises (MSMEs) as the most affected borrowers.

An overwhelming majority of PDBs see climate transition as an opportunity, but they are more likely to be followers than leaders when it comes to defining a climate strategy. In the survey we investigated PDB’s strategic approach to climate transition and the role that they see themselves playing in it: 93% of responding PDBs see climate transition as an opportunity rather than a risk, and 77% say that they integrate climate-related international standards – like the UN Sustainable Development Goals or the Paris Accords – into their practices. However, 7% of PDBs in our sample are reportedly sceptical about the need for the green transition, not acknowledging climate change as a significant risk and not implementing any specific policies beyond minimum regulatory requirements, if any. 46% of PDBs are followers of trends in the field, but they do so to keep the pace with competitors, not as the result of a deliberate choice/risk assessment. Encouragingly, 29% of PDBs see themselves as promoters: they are trying to address the challenged stemming from climate change at least to some extent; and 18% identify as leaders – meaning that they have climate risks fully embedded in their frameworks and strategies.

There is a clear relationship between PDB’s type and the share of green lending in their portfolios. As Figure 4 shows, as we go from the group of sceptical public development banks to that of leaders, more and more public development banks offer green loans, which represent progressively larger shares of the portfolio. Indeed, not a single bank in the “Sceptical” group is currently offering green products to customers, whereas green loans take on 23% of the total loan book of “Leaders”, on average. (Figure 4).

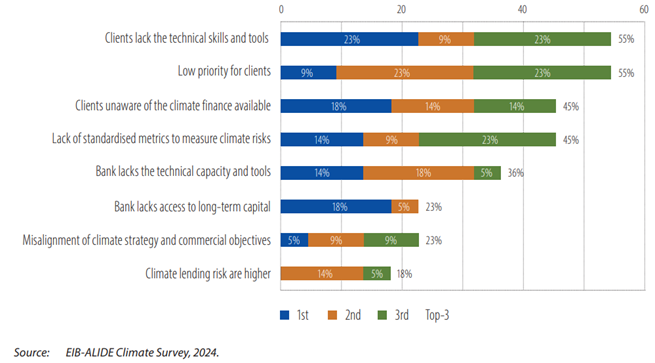

PDBs identify demand-side factors as the biggest barriers to further scaling up green lending (Figure 5). 55% of PDBs cite the clients’ lack of technical skills to make a bankable climate investment proposal, and climate adaptation being a low priority for clients as two of their top three barriers to green lending. PDBs point to clients’ unawareness of the green finance opportunities available to as the third most important constraint. PDBs also suffer from internal limitations related to the lack of standardised metrics for measuring climate risks in the industry and their own lack of technical capacity and tools while limited access to long-term capital to match the long-term horizon of climate investments is still the most significant challenge for 18% of banks. One noteworthy finding of our analysis is that sceptical PDBs attach a higher weight to internal constraints, such as lack of technical capacity (as opposed to that of clients). This seems to suggest that strengthening the capacity of PDBs could go a long way in honing their understanding of climate transition and their willingness to play a role in climate finance.

Figure 5. Share of PDBs citing each factor among the top three constraints (% of responding PDBs)

To increase climate financing in the LAC region, policy-makers should target to attract both private sector investment as the stake of the challenge is just too big. And to do so, they should aim to increase the capacity of the public sector, including PDBs, developing a more enabling institutional setup to attract private and foreign investors under clearer sustainable finance regulation. Despite already playing an important role in accommodating climate risks, PDBs will need to step up their efforts by increasing climate lending, raising awareness, catalysing private investment and building technical capacity.

Building technical capacity is indeed the main priority identified in our survey. Both clients and public development banks report that a lack of technical capacity is the main obstacle to increasing green lending. International financial institutions and multilateral development banks can play an important role here, working with PDB, providing patient capital and technical assistance programmes, identifying market failures, and designing innovative financing solutions.

For full details about the EIB climate risk country scores are please see: EIB Working Paper 2021/03 – Assessing climate change risks at the country level: the EIB scoring model

Countries (number of replies): Brazil (4), Mexico (4), Colombia (3), Ecuador (2), Costa Rica (2), Paraguay (2), El Salvador (2), Uruguay (2), Dominican Republic (1), Argentina (1), Nicaragua (1), Belize (1), Chile (1), Bolivia (1) and Suriname (1).

For more details about the methodology please see: Climate risks for Latin America and the Caribbean: are banks ready for the green transition?