We study how information frictions in the securitization market amplify the response of mortgage credit supply to house price shocks. Securitization prices and quantities endogenously result from an optimal contracting problem between investors and banks. Banks are better informed than investors about the quality of mortgages they originate, leading to adverse selection in securitization. Investors use the quantity sold as a screening device to induce banks to reveal truthful information. We find that adverse selection amplifies the response of a bank’s mortgage credit to house price shocks. The model is informative on how information frictions can induce large fluctuations in mortgage credit supply.

The mortgage securitization market in the United States is the main funding source for the housing market. However, this source of funding may experience rapid expansions and contractions, as observed during the credit cycle of the 2000s, disrupting the availability of mortgage credit to households—a key macroeconomic variable and a policymaker objective in the U.S. Hence, understanding the equilibrium relation between the securitization market and mortgage credit supply is essential to design macroprudential policies that keep a stable credit supply to households.

Garcia (2023) develops a theoretical banking model in which banks sell loans in an endogenous securitization market that is affected by information frictions. The model stresses the relevance of securitization equilibrium outcomes as a critical driver of credit supply and provides a precise mechanism by which exogenous increase (decrease) in house price growth amplifies credit expansions (contractions) through the securitization liquidity channel (Loutskina (2011), Calem et al. (2013), Vickery ad Wright (2013)). A quantitative application indicates that information frictions in securitization can amplify the response of credit supply to house price shocks by a factor between 1.5 to 2.0.

The model features banks and security investors interacting in a securitization market affected by information frictions about the quality of mortgages sold; banks are better informed about the quality of mortgages than investors leading to adverse selection in securitization (Adelino et al. (2019), Chari et al. (2014), and Downing et al. (2008)). Such information asymmetry creates incentives for banks to sell low-quality mortgages and retain high-quality ones. Investors are aware that such incentives are in place. Consequently, they design incentive-compatible contracts that induce banks to reveal their portfolio’s underlying quality. These contracts offer higher prices for mortgage pools with higher retention rates. The fraction of securitized mortgages becomes an endogenous function of the spread in mortgage returns, the differences in portfolio management costs between originators and investors, and the growth rate of house prices.

House price shocks affect securitization contracts by changing the recovery rate from the foreclosed housing collateral, a component of mortgage returns. As securitization prices and quantities are nonlinear functions of mortgage returns, a bank’s liquid funds from securitization inherit nonlinear dynamics. Consequently, mortgage lending fluctuates with the volume of mortgage securitization and may experience quick rises and falls depending on the magnitude of house price inflation. Such a mechanism, essential to account for the data, is absent in economies with complete information.

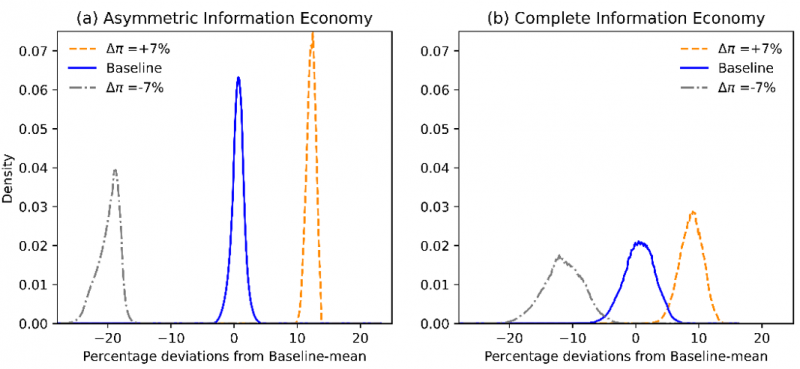

We simulate the model for a positive and a negative house price shock of 7 percent magnitude to show how the aggregate mortgage credit supply is amplified in an economy with asymmetric information. Figure 1 displays the stationary cross-sectional distribution of aggregate credit for the baseline calibration, and for a negative and positive house price shock, in the asymmetric information (left panel) and complete information (right panel) economies.

Figure 1: Simulated cross-sectional distributions of aggregate credit for positive and negative house price shocks, in the asymmetric and complete information economies

Source: Author calculations. Notes: Each density represents the simulated distribution of mortgage credit volumes across banks for different values of the house price shock, π. The Baseline (blue solid line) is the distribution in the benchmark calibration in each economy. Δπ denotes the shifted credit distributions arising from a positive and negative house price shock of 7 %, expressed as percentage deviations from the Baseline mean.

A positive house price shock changes the aggregate mortgage credit distribution in two ways; first, it shifts it to the right, implying an increase in the aggregate level of credit. Second, it reduces the dispersion of the distribution. Both changes—in level and dispersion—are larger for the asymmetric information than for the complete information economy. Negative house price shocks produce opposite effects; a contraction in the level and an increase in the cross-sectional dispersion of aggregate mortgage credit. These dynamics arise endogenously from the heterogeneity in cash holdings across bank types, which embeds the compounded nonlinear effects of shocks on securitization prices, quantities, and the contract structure—stressing the importance of modeling information frictions in securitization to account for aggregate credit dynamics.

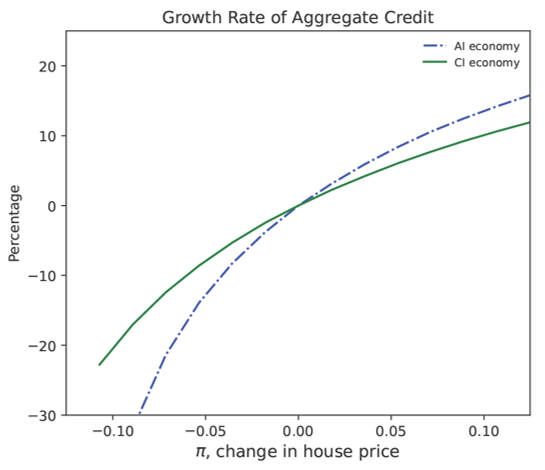

Figure 2 compares credit supply growth between economies with information asymmetries and complete information for a range of house price growth shocks. This Figure shows that an expansive (contractive) housing price shock will amplify a mortgage credit expansion (contraction). The amplification effect is not symmetric, showing larger effects on contractionary shocks. Garcia (2023) details the quantitative effects of house price shocks for various scenarios.

Figure 2: Growth rate of the aggregate credit supply for a range of house price shocks

Source: Author calculations. Notes: The growth rate is the percentage change of aggregate credit supply with respect to the benchmark calibration. The dashed and solid lines show the credit growth rate for the asymmetric information economy, labeled AI, and the complete information economy, labeled CI.

Our research provides a theoretical connection between a bank’s mortgage lending and securitization decisions. It shows that adverse selection in securitization amplifies house price shocks and their transmission to banks’ credit supply through the securitization liquidity channel. A quantitative application of the theory indicates that the response of lending to house price shocks can be amplified by a factor that ranges between 1.5 to 2.0 with respect to an economy that abstracts from modeling information frictions. These results are consistent with other studies of the aggregate effects of adverse selection in asset markets (Bigio (2015), Kurlat (2013), Krishnamurthy (2010), Bernanke and Gertler (1989)) and with the magnitudes documented for liquidity shocks at the micro-level in the mortgage market (Calem et al. (2013)). It also contributes to the macro-literature of housing by showing how lending supply forces can account for fluctuations in mortgage debt (Justiniano et al. (2015, 2019)). Furthermore, our work is relevant for designing macroprudential policies in the mortgage market that alleviate these vulnerabilities and keep a stable credit supply to households.

Adelino, M., Gerardi, K., and Hartman-Glaser, B. (2019). Are lemons sold first? dynamic signaling in the mortgage market. Journal of Financial Economics, 132(1):1–25.

Bernanke, B. and Gertler, M. (1989). Agency Costs, Net Worth, and Business Fluctuations. American Economic Review, 79(1):14–31.

Bigio, S. (2015). Endogenous liquidity and the business cycle. American Economic Review, 105(6):1883–1927.

Calem, P., Covas, F., and Wu, J. (2013). The impact of the 2007 liquidity shock on bank jumbo mortgage lending. Journal of Money, Credit and Banking, 45(s1):59–91.

Chari, V. V., Shourideh, A., and Zetlin-Jones, A. (2014). Reputation and persistence of adverse selection in secondary loan markets. American Economic Review, 104(12):4027–70.

Downing, C., Jaffee, D., and Wallace, N. (2008). Is the Market for Mortgage-Backed Securities a Market for Lemons? The Review of Financial Studies, 22(7):2457–2494.

Garcia, S. (2023). The Amplification Effects of Adverse Selection in Mortgage Credit Supply. Banco de Espana Working Paper No. 2316.

Justiniano, A., Primiceri, G. E., and Tambalotti, A. (2015). Household leveraging and deleveraging. Review of Economic Dynamics, 18(1):3–20. Money, Credit, and Financial Frictions.

Justiniano, A., Primiceri, G. E., and Tambalotti, A. (2019). Credit supply and the housing boom. Journal of Political Economy, 127(3):1317–1350.

Krishnamurthy, A. (2010). Amplification mechanisms in liquidity crises. American Economic Journal: Macroeconomics, 2(3):1–30.

Kurlat, P. (2013). Lemons markets and the transmission of aggregate shocks. American Economic Review, 103(4):1463–1489.

Loutskina, E. (2011). The role of securitization in bank liquidity and funding management. Journal of Financial Economics, 100(3):663–684.

Vickery, J. and Wright, J. (2013). TBA trading and liquidity in the agency MBS market. Working paper, Federal Reserve Bank of New York.