The views expressed are strictly ours and draw on NBER Working Paper 32957 “The Resilience of Central, Eastern and Southeastern Europe (CESEE) Countries During ECB’s Monetary Cycles” (September 2024).

Abstract

We investigate the resilience of CESEE countries during ECB monetary cycles after the entrance of ten countries to the EU in 2004. Undeniably, these countries have experienced a ‘miracle’ growth during the 2000s decade. However, several obstacles appeared following the global financial crisis and the euro crisis. In many CESEE countries, the quality of institutions has stalled, or even worse, has known a deterioration. Our investigation examines how fundamental and institutional variables influence cross-country resilience regarding exchange rates, interest rates, stock prices, inflation, and growth during the subsequent monetary cycles. Specifically, we focus on five ECB tightening and easing cycles observed during 2005-2023. Limiting inflation, active management of precautionary buffers of international reserves, current account surpluses, better financial development, and institution quality are important predictors of resilience in the next cycle. We also show that the US shadow rate strongly influences resilience during the ECB monetary cycles. Besides, various asymmetries are discovered for current account balances, international reserves, and fuel import shares during tightening cycles. We detect asymmetries along the distribution of the dependent variables for financial development, central bank independence, and the inflation rate preceding the cycles. These findings may provide guidelines that are useful for returning to the trajectory observed before the euro crisis by identifying the main fundamental and institutional variables that enhance the resilience of CESEE.

Three critical factors have provided ample new opportunities and challenges to the emerging Central, Eastern, and Southeastern Europe (CESEE) countries. These factors are the collapse of the Soviet Union in 1991; the growing scope and importance of the EU; and the launching of the euro by the ECB in 1999. New growth opportunities unleashed forces that challenged the old order, old borders, and the pre-1990 states’ institutions. CESEE growth patterns during 1990-2015 were concisely summarized in the IMF (International Monetary Fund, 2016) report: “From 1990 to 2008, CESEE countries made significant progress along the convergence path on the back of strong total factor productivity (TFP) growth and, to a lesser extent, capital accumulation,” raising the question “How Can CESEE Countries Get Back on the Fast Convergence Path?”

This query reflected the changing global growth trajectory propagated by the Global Financial Crisis (GFC) and its aftermath. While the GFC started in the US, the financial globalization of leverage and portfolio investment morphed the GFC into a global crisis. Consequently, the ECB was forced to adopt a sequence of tightening and easing to stabilize the Euro, testing for the first time the resilience of the Euro.

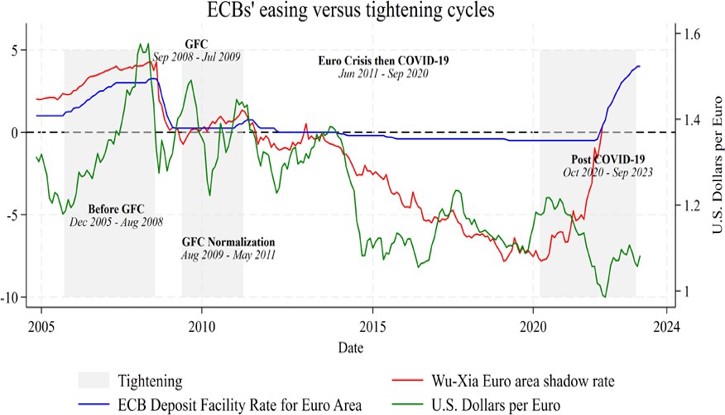

Figure 1 summarizes the timeline of these cycles, where shaded areas are tightening, and the white areas are easing. The blue line is the ECB Deposit Facility rate for the Euro Area; the red line is the Wu-Xia Euro shadow rate, both using the left percentage scale. The blue line is the US Dollar per Euro rate, using the right scale, 1 to 1.6.

Figure 1. ECB tightening and easing cycles 2005-2023

Consequently, the economic trajectory of CESEE countries during the past twenty years was dominated by the challenges associated with the Global Financial Crisis (GFC) and the subsequent Euro crisis. From the perspective of the CESEE countries, ECB policy cycles and the Euro/Dollar evolving exchange rates are exogenous shocks, testing their resilience. Our paper uses the exogeneity of ECB’s cycles to explain the performance of CESEE countries during the past five ECB cycles. Specifically, we investigate how macroeconomic conditions at the outset of each cycle influence the performance of CESEE countries during each cycle. Do ex-ante macroeconomic fundamentals explain why some CESEE countries are more resilient than others during monetary cycles? How do CESEEs’ institutions account for their resilience?

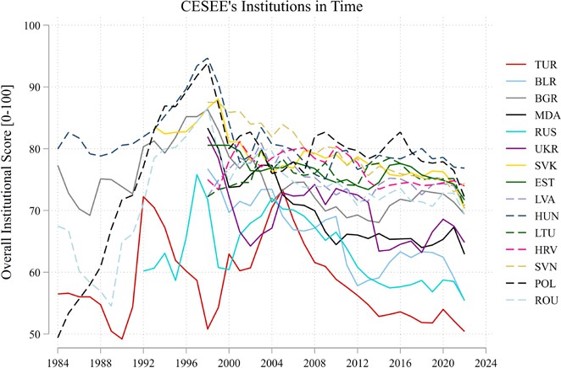

Figure 2 traces the CESEE countries’ institutional changes during the past decades. CESEE countries’ history reveals the large heterogeneity of their institutional pattern. A portion of the countries experienced an overall stable trajectory (exemplified by Slovakia, Slovenia & Estonia), while other countries experienced large volatility (exemplified by Poland, Turkey & Hungary). We will investigate how greater volatility is associated with the performance of the affected countries.

Figure 2. ICRG overall institutional Score, normalized 0-100

Motivated by the recent literature on the international spillovers of US and ECB monetary policies (Caldara et al., 2023, Ahmed et al., 2023; Georgiadis et al., 2024; Walerych and Wesołowski, 2021; Ahmed et al., 2017), Aizenman et al. (2024) investigate the determinants of emerging markets performance throughout five U.S. Federal Reserve monetary tightening and easing cycles during 2004-2023. They study how macroeconomic and institutional conditions of an Emerging Market (EM) before each cycle explain emerging markets (EM) resilience during each cycle. The baseline cross-sectional regressions examine how those conditions affect three measures of resilience — bilateral exchange rate against the USD, exchange rate market pressure, and country-specific Morgan Stanley Capital International index (MSCI). They, then, stack the five cross-sections to build a panel database to investigate potential asymmetry between tightening versus easing cycles. The evidence indicates that macroeconomic and institutional variables are associated with EM performance, determinants of resilience differ during tightening versus easing cycles, and institutions matter more during difficult times. In Aizenman and Saadaoui (2024a), we apply the methodology of Aizenman et al. (2024), focusing on the determinants of resilience in CESEE countries during the ECB’s monetary cycles.

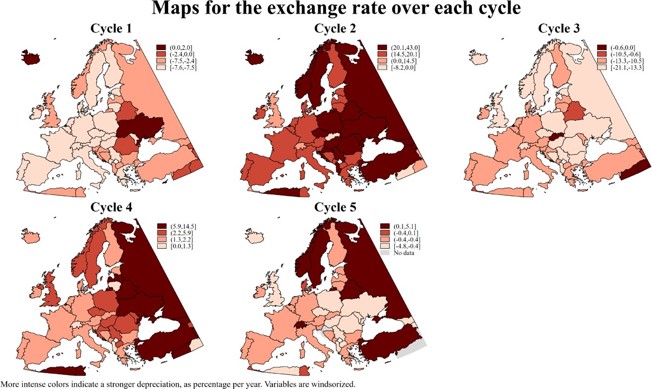

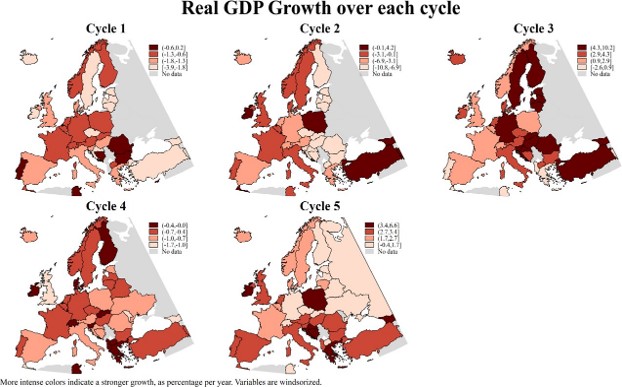

In Figure 3, we visualize the spatial dispersion of exchange rate depreciations. During ECB tightening cycles (cycles 1, 3, and 5), the exchange rate appreciates in CESEE countries (fewer red colors). In contrast, the exchange rate depreciates during ECB easing cycles (cycles 2 and 4). This notable difference may reflect the fact observation that ECB tightening cycles were associated with higher risk appetite (risk-on) for global investors in the financial market. In contrast, the easing cycles correspond to risk-off behavior, associated with financial stress and capital flights from CESEE to the core of the eurozone. Figure 4 shows the spatial dispersion of inflation rates during ECB monetary cycles. In CESEE countries, inflation was higher than in the eurozone during the GFC and after the pandemic. Figure 5 shows the spatial dispersion of growth rates. During the first cycle, the growth was slower at the first cycle’s end, in August 2008. Thereby, the slowdown of the growth rate of CESEE countries was already observable in some countries at that time. The two easing cycles were associated with slower growth. The second and the last tightening cycles (Cycles 3 and 5) were associated with faster growth in almost all CESEE countries. However, growth rate changes were slightly lower in CESEE countries during the last tightening cycle (Cycle 5).

Figure 3. Maps for the exchange rates

The variation over each cycle of the year-on-year growth rate of the bilateral exchange rate (1 USD = E Domestic currency unit) is represented in the maps, expressed as percentage per year. The 21 CESEE countries are observed during the 5 monetary cycles. Tightening I: Dec 2005-Aug 2008; Easing I: Sep 2008-Jul 2009; Tightening II: Aug 2009-May 2011; Easing II: Jun 2011-Sep 2020; Tightening III: Oct 2020-Sep 2023.

Figure 4. Maps for the inflation rates

The variation over each cycle of consumer price inflation is represented in the maps, expressed as a percentage per year. The 21 CESEE countries are observed during the 5 monetary cycles. Tightening I: Dec 2005-Aug 2008; Easing I: Sep 2008-Jul 2009; Tightening II: Aug 2009-May 2011; Easing II: Jun 2011-Sep 2020; Tightening III: Oct 2020-Sep 2023.

Figure 5. Maps for the growth rates

The variation over each cycle of real GDP growth is represented in the maps, expressed as a percentage per year. The 21 CESEE countries are observed during the 5 monetary cycles. Tightening I: Dec 2005-Aug 2008; Easing I: Sep 2008-Jul 2009; Tightening II: Aug 2009-May 2011; Easing II: Jun 2011-Sep 2020; Tightening III: Oct 2020-Sep 2023.

Our empirical results identify the main fundamental and institutional variables that enhance resilience; including efficient management of international reserves, current accounts, financial institutions, and other structural factors affecting the ability to deal with the spillover effects of the ECB’s and FED’s policies. We also validated that the US shadow Federal Funds rate strongly influences CESEE performance during ECB monetary cycles. Besides, the financial development and central bank independence have asymmetrical effects between easing and tightening cycles.

We conclude by noting that CESEE’s average ‘miracle’ growth during the 2000s does not guarantee future performance and will be challenged by growing headwinds associated with growing geopolitical challenges. The high-growth rates of CESEE countries were helped substantially by the generous European Union’s Cohesion Policy. The successful convergence of most CESEE countries and the geopolitical headwinds, impacting the EU and the ECB, may reduce future allocations to CESEE.

The EU countries that have kept their currencies, and managed their monetary and exchange rate policies competently, frequently applying their own version of Inflation Targeting, may face growing headwinds from the EU to converge towards adopting the Euro. Several factors will test the cohesion of the EU and CESEE, possibly imposing negative externalities on the future growth and stability of CESEE. Among them, we can quote: the uneven trajectory of the institutional quality of CESEE countries; the growing geo-economic challenges associated with the growing frictions between the EU and Russia, China, and their allies; and the consequences of the results of the 2024 US presidential election, analyzed in Aizenman and Saadaoui (2024b).

Ahmed, R., Aizenman, J., Saadaoui, J., & Uddin, G. S. (2023). On the effectiveness of foreign exchange reserves during the 2021-22 US monetary tightening cycle. Economics Letters, 233, 111367.

Ahmed, S., Coulibaly, B., & Zlate, A. (2017). International financial spillovers to emerging market economies: How important are economic fundamentals? Journal of International Money and Finance, 76, 133-152.

Aizenman, J., Park, D., Qureshi, I. A., Saadaoui, J., & Uddin, G. S. (2024). The performance of emerging markets during the Fed’s easing and tightening cycles: a cross-country resilience analysis. Journal of International Money and Finance, 148, 103169.

Aizenman, J., & Saadaoui, J. (2024a). The Resilience of Central, Eastern and Southeastern Europe (CESEE) Countries During ECB’s Monetary Cycles (No. w32957). National Bureau of Economic Research.

Aizenman, J., & Saadaoui, J. (2024b). How Institutions Interact with Exchange Rates After the 2024 US Presidential Election: New High-Frequency Evidence (No. w33193). National Bureau of Economic Research.

Caldara, D., Ferrante, F., Iacoviello, M., Prestipino, A., & Queralto, A. (2024). The international spillovers of synchronous monetary tightening. Journal of Monetary Economics, 141, 127-152.

International Monetary Fund. European Dept. (2016). Regional Economic Issues, Central, Eastern, and Southeastern Europe. USA: International Monetary Fund. Retrieved Aug 5, 2024, from https://doi.org/10.5089/9781513590868.086.

Georgiadis, G., Müller, G. J., & Schumann, B. (2024). Global risk and the dollar. Journal of Monetary Economics, 144, 103549.

Walerych, M., & Wesołowski, G. (2021). FED and ECB monetary policy spillovers to emerging market economies. Journal of Macroeconomics, 70, 103345.

Wu, J. C., & Xia, F. D. (2016). Measuring the macroeconomic impact of monetary policy at the zero-lower bound. Journal of Money, Credit and Banking, 48(2-3), 253-291.