Climate policy wants to make fossil fuels significantly more expensive and thus set in motion a climate-friendly restructuring of the German economy. We analyze the associated costs to get a sense of how climate policy could affect inflation. Accordingly, the German inflation rate could increase by half a percentage point per year during a transition phase, although this estimate is associated with a high degree of uncertainty.

Households and businesses emit far too much CO2 because they do not have to pay anything for these emissions. If politicians put a price on CO2 emissions, economic agents would take the social costs of pollution into account and the cause of the climate problem would be solved. But how much do people have to pay for climate protection and how does that increase inflation, regardless of the fact that unchecked climate change would likely cause much higher costs and thus even more inflation?

To estimate the costs of climate policy and thus its potential effect on inflation, one needs to understand what climate policy does in an economy. Climate policy puts a price on the emission of greenhouse gases. Compared to a situation without a CO2 price, the production processes change. Here is an example: Pricing emissions could make the capture and storage of CO2 emissions from power plants economically attractive. Part of the labour and capital would now be needed to produce and maintain the corresponding facilities and infrastructure. Fewer resources would be available for the production of consumer goods, so that correspondingly fewer consumer goods could be produced. Consumer goods would become scarcer. In a model world without money, workers would be paid with fewer consumer goods; the real wage would fall and the price of consumer goods would rise relative to the wage.

Whether this increase in relative goods prices also leads to an increase in goods prices expressed in euros depends on monetary policy. If it responds to a reduction in the supply of consumer goods with a corresponding reduction in money supply, the prices of goods expressed in euros would not rise, while wages would fall. In order to conceal the inevitably worse position of workers, it would be politically opportune not to react to the reduction in the goods supply with a lower money supply. Therefore, central banks would provide so much money that prices would rise to such degree that the inevitable fall in real wages would occur without a fall in nominal wages. All this suggests that climate policy will lead to higher inflation, at least for a transitional period.

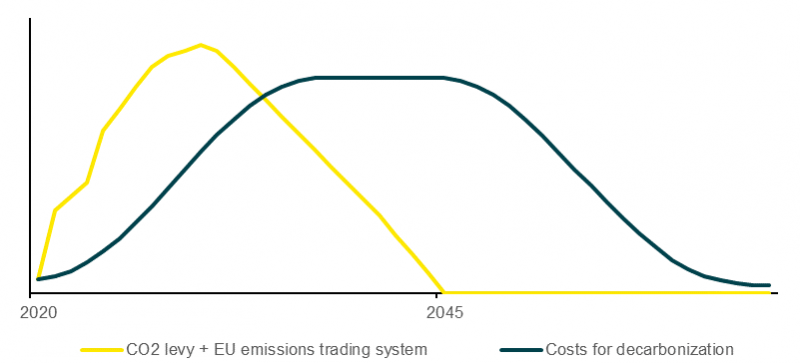

Climate policy increases inflation by triggering two waves of costs (chart 1). First, companies have to pay more for CO2 emissions. They incur further costs because the higher CO2 price leads them to reorganise their production in a climate-friendly way.

Chart 1: Two kinds of costs on the way to climate neutrality

Stylised progression of costs incurred by companies and private households in the transition to a climate-neutral economy

Sources: Commerzbank Research

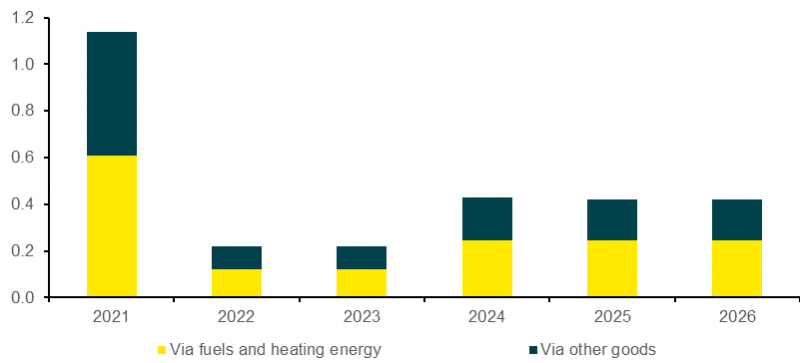

To start with we analyze the first wave of costs triggered by the CO2 levy, which companies are likely to pass on to their customers through higher prices, at least in the long run. According to calculations by the German Council of Economic Experts, the levy of 25 euros per tonne of CO2, which has been imposed since the beginning of this year, has increased consumer prices by a good 0.6% this year via more expensive fuel and heating oil (chart 2). In the coming years, the inflationary effect will be smaller, as the levy will then be raised in smaller steps according to the current legal framework.2

Chart 2: German CO2 tax will cause inflation to rise more strongly Impact of CO2 tax on y-o-y changes in consumer price index, in percentage points; assumption: businesses are in a position to directly and thoroughly pass on costs.

Sources: Sachverständigenrat, Commerzbank Research

There may be further effects from the fact that higher energy costs make the production of other goods and services more expensive (e.g. higher petrol costs for taxi rides) and the companies pass this on to their customers as well. If this were to happen in full, it would once again have a similarly large effect on consumer prices as the direct effect via higher energy costs. All in all, the CO2 levy is likely to increase consumer prices by almost 3% overall in the coming years via direct and indirect effects.

It is assumed in chart 2 that the higher costs for both energy and other goods and services will be passed on to consumers without delay. In the case of energy, this can be assumed on the strength of experience with previous tax increases. In the case of other goods and services, however, this is likely to occur with a certain delay, so that the effect of the CO2 levy on the consumer price index is probably significantly smaller, especially this year, and will tend to be somewhat larger in the following years.3

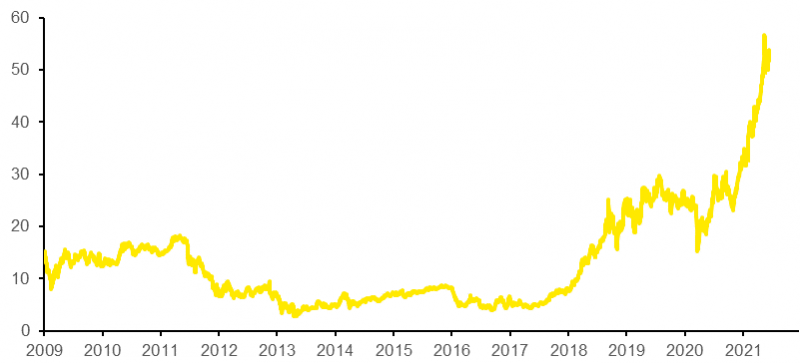

In addition to the costs of the CO2 levy, companies have to bear further burdens from the European Emissions Trading Scheme. For a long time, these were low because the companies not only received the certificates for free, but in the meantime a large amount of surplus emission allowances had accumulated, which was due to less ambitious reduction targets, crisis-related declines in production and emissions, and the extensive use of international project credits. This had put a strong downward pressure on the certificate price. But since 2017, the prices and thus the costs for the companies that need additional certificates have risen noticeably (chart 3). This is particularly noticeable in exchange-traded electricity prices, but also in the prices of intra-European air travel.

Chart 3: CO2 price has increased strongly

Price for the emission of a ton of CO2 in the EU emissions trading system

Sources: Bloomberg, Commerzbank Research

Having examined the impact of higher CO2 prices on inflation (first wave of costs), we now turn to the costs of the climate-friendly transformation of businesses triggered by higher CO2 prices and regulatory requirements. The size of this second cost wave and thus its impact on inflation depends on many factors that can hardly be predicted at present:

Because of all these open questions, the few studies that estimate the costs of decarbonising the economy can only provide an indication of the magnitude of the costs to be expected. In November 2017, for example, the German science academies estimated that a 90% reduction in greenhouse gas emissions by 2050 would incur additional costs of €3,000bn compared to a reference scenario without active climate policy. This would be just under 100 billion euros per year, or a good 2½% of current GDP.

A study commissioned by the Federation of German Industries (BDI) arrives at much lower figures. According to this study, the additional expenditure for a 95% reduction would amount to about 1,420 billion euros.4 This would be “only” just under 50 billion euros per year, or about 1¼% of GDP. The authors even point out that they have rather underestimated the positive effect of technical progress. However, it is precisely the saving of the last 5%, which is excluded in this study, that is likely to be particularly expensive. In addition, the target date for climate neutrality has been moved forward by 5 years since the study was prepared, which is likely to increase the costs. Finally, it is assumed that the most cost-efficient path to (extensive) climate neutrality will be taken. In view of the current tendency of German policy to rely on regulation rather than price signals, there is a big question mark behind this assumption, so that the costs are likely to be significantly higher.

Based on these two studies, we assume that the annual costs of a climate-friendly conversion of the economy will amount to an average of about 2 to 2½% of GDP. In the coming years, they are likely to initially be below this average, but by the end of the current decade they will increase to a value at the upper end of this range or even above it. From 2045 at the latest, however, these costs will then fall significantly.

A large part of these additional costs will be passed on by the companies to their customers, i.e. to their customers abroad as well as to the domestic buyers of investment goods, consumer goods and services. This will be possible since all suppliers are affected by this – the foreign companies either through their own national measures or through an expected CO2 border tax.

Consequently, climate policy is likely to increase consumer prices by about 2½% by the end of the decade because of the conversion costs. What has to be added to this is the effect of the CO2 levy, which is likely to be of a similar magnitude. This results in an increase in consumer prices of about 5% for the entire period; per year this means an inflation rate that is higher by about 1/2 percentage point on average. Climate policy, like de-globalisation or the great demographic shift (declining share of the working-age population), is a structural argument for higher inflation in the coming years.

This article was first published by Commerzbank Research on 18 June 2021 – © Commerzbank AG 2021.

In the next two years, the levy is to be increased in two steps of 5 and then in two steps of 10. However, this could change after the Bundestag elections, as the Greens, for example, are already calling for a CO2 levy of 65 euros per tonne for 2023.

Chart 2 does not take into account that part of the revenue from the CO2 levy was used to prevent a further sharp increase in the EEG levy. In fact, this has even fallen slightly compared to 2020. All in all, the subsidy of the EEG from the federal budget has pushed down the consumer price index by about 0.15% this year on its own. In the coming years, these payments from the federal government are to be increased further.

Here we consider the scenario that assumes largely unchanged oil prices (“$50 scenario”). This is because in the other scenarios the assumed increase in the oil price depresses the calculated (net) costs of the switch, as the savings increase due to the decrease in oil imports. However, this does not play a role for inflation.